Las Vegas Real Estate Investment Update - November 2024 Market Report

In This Report

- High ROI or High Growth?

- Potential Investment Properties

- Market Trends

- About the Fernwood Real Estate Investment Group

Our first Las Vegas REI Group virtual meetup will be held on Friday, December 13, 2024, 12:00 PM - 1:00 PM PST. The topic is:

Journey to financial freedom - What’s your strategy and why? Your successes and lessons learned.

There will be no sales pitches. But each attendee will be expected to participate. If you are interested in attending, please follow this link to register.

Now, onto this week's article.

High ROI or High Growth?

As I wrote a few weeks ago, popular metrics like ROI and cash flow only predict a property's day-one performance. They offer no insight into long-term performance.

As this article will explain, ROI can be misleading. Higher ROIs often appear in cities with declining populations and low-rent properties. Consequently, you face a choice: invest in a property with a higher initial ROI but declining buying power or accept a lower initial ROI for a property with increasing buying power over time. It's impossible to have both; you must choose.

Higher Initial ROI

If you opt for a higher initial ROI, invest in locations with declining populations like Birmingham, Cleveland, Memphis, or Detroit. Due to population losses, there is little demand for homes, so prices do not keep pace with inflation, resulting in declining inflation-adjusted prices.

Property prices determine rents. In areas with high property prices, fewer people can afford to buy and are forced to rent. This increased demand for rental properties drives up rents. Conversely, in areas with low property prices, more people can afford to buy homes, reducing the demand for rental properties. This results in declining inflation-adjusted rents.

Due to year-long leases and other factors, there is a two to five-year time lag between changes in property prices and rents. So, the rents today reflect property prices from two to five years ago. The result is a higher initial ROI in cities with declining prices. However, you cannot achieve financial independence in such cities because financial freedom is about having a rental income that will sustain your lifestyle for life. Unless rents outpace inflation, it does not matter how many properties you own; the buying power, which is what you live on, will continuously decline over time.

For example, you buy a property with a net cash flow of $500/Mo. If the rent growth rate averages 2%/Yr and inflation averages 4%/Yr, what will be the inflation-corrected buying power (the equivalent amount of goods and services you can buy today with the future rent) in 5, 10, and 15 years?

- Year 5: $500 x (1 + 2%)^5 / (1 + 4%)^5 ≈ $454

- Year 10: $500 x (1 + 2%)^10 / (1 + 4%)^10 ≈ $412

- Year 15: $500 x (1 + 2%)^15 / (1 + 4%)^15 ≈ $374

Therefore, achieving financial freedom is impossible due to the continual decline in the buying power of the rental income, even though rent increases by 2 %/Yr.

Markets With Significant and Sustained Population Growth

If you opt for long-term rent and price growth, invest in cities with significant and sustained population growth. However, the initial ROI will be lower because rents reflect lower property prices from two to five years ago. However, despite the lower initial ROI, you can achieve financial independence because rent growth outpaces inflation.

For example, suppose you buy a property with a net cash flow of $500 per month. If the rent growth rate averages 8%/Yr and inflation averages 4%/Yr, what will be the buying power in 5, 10, and 15 years?

- Year 5: $500 x (1 + 8%)^5 / (1 + 4%)^5 ≈ $604

- Year 10: $500 x (1 + 8%)^10 / (1 + 4%)^10 ≈ $729

- Year 15: $500 x (1 + 8%)^15 / (1 + 4%)^15 ≈ $881

Because your inflation-adjusted buying power continuously increases faster than inflation, you can achieve financial freedom.

In summary, you can opt for a higher initial ROI with declining buying power over time or accept a lower initial ROI with increasing buying power. It's impossible to have both simultaneously.

If you're interested in exploring how the current Las Vegas market conditions could align with your goals, please use the link below to schedule a time that works best for you.

Best regards,

...Eric

Potential Investment Properties

Below is a link to this month's list of candidate investment properties. Our proprietary data mining software selected these candidate properties from thousands of available properties, and this is just the first step in our multi-step validation process, as shown below.

This Month’s List of Candidate Properties

Market Trend

Below are charts from our latest trailing 13-month market report, which includes October data. Remember that this data is only for our target property profile, not the entire metro area. To see all the charts, please click here.

Rentals - Median $/SF by Month

Rents held steady from September to October. YoY is up marginally.

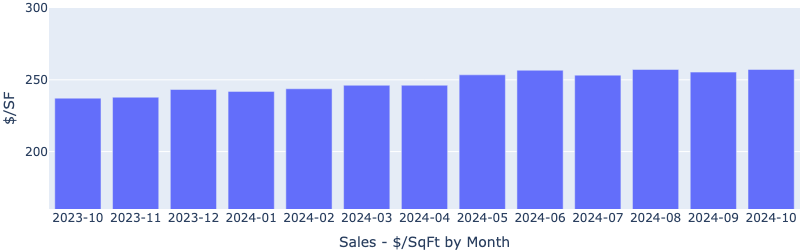

Sales - Median $/SF by Month

The $/SF increased slightly MoM, bucking the seasonal trend. YoY is up 8.6%.

Rentals - Median Time to Rent by Month

Median time to rent increased slightly MoM, now at around 28 days (vs 27 days in September). This conforms to the traditional seasonal trend.

Sales - List to Contract Days by Month

Median days on the market also increased MoM, now at 24 days, conforming to the seasonal trend.

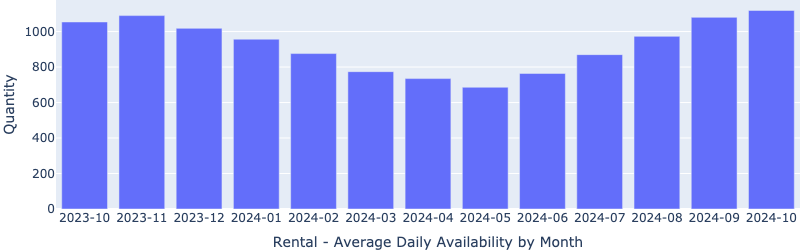

Rentals - Availability by Month

The number of homes for rent increased MoM, conforming to the seasonal trend.

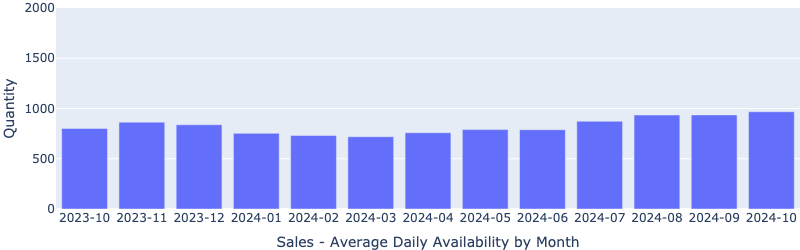

Sales - Availability by Month

This chart shows the average daily number of properties for sale in a particular month. We are also seeing a slight increase MoM in October.

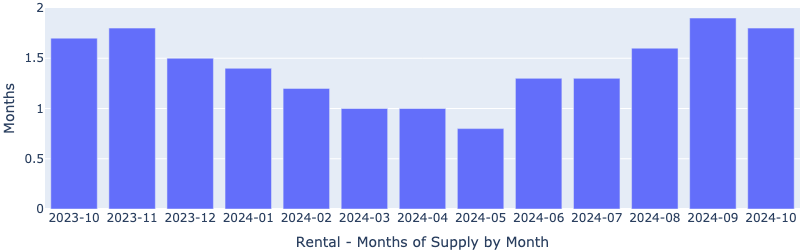

Rentals - Months of Supply

About 1.8 months of supply for our target rental property profile. This low inventory will continue to pressure up rents.

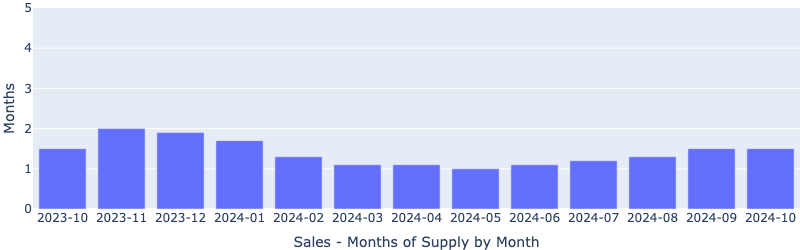

Sales - Months of Supply

There are about 1.5 months of supply for our target property profile. YoY is flat. A 6 months supply is considered a balanced market. This will continue to drive up the prices.

Rents and prices held steady in October, which is a bit surprising given the time of the year. However, time on the market increased slightly, which is expected for the season.

About the Fernwood Real Estate Investment Group

We Help Clients Acquire Highly Reliable Passive Income Streams

Here is what our clients have to say about us:

For the last 17+ years, we've helped clients build highly reliable, passive income streams through real estate that they will not outlive. Several are now retired and living entirely on their rental income. Most never invested in real estate before they started working with us, and most live in other states or countries. Below is a two-minute video of the services we provide.

Want to know what we can do for you?

© 2005-2024 Cleo Li and Eric Fernwood, all rights reserved.