People often ask me why they should invest in Las Vegas when they can buy much lower-cost properties in other cities. In this post, I will answer this question.

The essence is that you can not get where you want to go in low-cost locations.

What’s Your Goal

The goal of real estate investing is financial freedom. It is not owning a property somewhere that conforms to popular “advice”.

Also, financial freedom is more than replacing your existing income. It requires an income that enables you to maintain your standard of living throughout your lifetime. You need an income that increases faster than inflation to achieve this goal.

What Drives Prices and Rents

Property prices are driven by supply and demand.

Where prices are low, there has been no or limited demand for many years. Prices drive rents. Where prices are low, more people buy, so there is less demand for rental properties. The result is that rents rise slowly. Low demand is usually the result of a static or declining population, as has occurred in most cities with low-cost properties.

Where prices are higher, there has been sustained demand for many years. Where prices are high, fewer people can afford to buy and are forced to rent, driving up the demand for rental properties, thus increasing rents. This usually occurs in cities with significant and sustained population growth.

Because prices drive rents, you must buy in a city with rapidly rising prices for rents to outpace inflation.

Owning Properties in Low-Cost Locations

An example from a 1031 we completed a few years ago will show the problem with owning properties in low-cost/low-demand locations.

A client did a 1031 exchange from a Midwest city to Las Vegas. She was pleased with the performance of her Midwest investment over the eight years she owned it. She purchased the property for $100,000 and sold it for the same price. The initial rent was $1,000/Mo, and when she sold the property, the rent was $1,100/Mo. So, what was the actual result of buying and selling this property if you consider inflation?

The effects of inflation and rent growth are always relative to each other. For example, imagine watching someone attempting to walk up a descending escalator. The person walking up represents rent growth, and the downward-moving escalator represents inflation. If the person doesn’t walk up fast enough to outpace the escalator’s descent, they will move downward. So, even if rents increase, if inflation “descends” faster, your buying power, or the actual value of your money, is declining.

What happened in this situation? First, how much would the property have had to sell for to have the same value as $100,000 eight years earlier? In this example, I will assume 3% inflation.

The formula to calculate the future value (FV) equivalent of today’s value is as follows.

FV = PV x (1 + r)^n

- r: Annual inflation rate %

- n: The number of years into the future

- PV: The rent or price today

- FV: The future value in today’s dollar value

Calculating the value of $100,000 over eight years adjusted for inflation:

- FV = $100,000 x (1 + 3%)^8 ≈ $126,677

This means that $126,677, after eight years of 3% inflation, has the same purchasing power as $100,000 today. So, she sold the property for 26.6% (($126,677- $100,000)/$100,000 x 100%) less than the purchase price.

What about the rent?

- FV = $1,000 x (1 + 3%)^8 ≈ $1,267, which has the same purchasing power as $1,000 today.

So the rent decreased by 15.2% (($1267 – $1100 )/$1100 x 100%) over the same period.

Comparing Location Financial Performance

People often choose a location based on cost, cash flow, or ROI. However, cash flow and ROI metrics only predict a property’s performance under ideal conditions on the first day of a long-term hold. You need to take a much longer view than just the first day.

To illustrate this point, I will compare one property in a high appreciation and rent growth location like Las Vegas to a typical low appreciation and rent growth city.

Suppose you buy an investment property in Las Vegas for $400,000 with a rent of $2,200/Mo. And that you buy two $200,000 properties in a low-priced city that rent for $1,100/mo each.

Rents for the property segment we target in Las Vegas increased on average by over 8 %/Yr between 2013 and 2023, so I will use 8% rent growth in the example. For the slow rent growth city, I will assume rents increase by 3 %/Yr, which is high for most low-cost cities.

If we assume an inflation rate of 4%/Yr, what will be the inflation-adjusted monthly income from the properties after five, ten, and fifteen years if the same inflation and rent growth continue?

High rent growth city:

- Year 0: $2,200, buying power: $2,200

- Year 5: $2,200 x (1 + 8%)^5/(1 + 4%)^5 ≈ buying power: $2,657

- Year 10: $2,200 x (1 + 8%)^10/(1 + 4%)^10 ≈ buying power: $3,209

- Year 15: $2,200 x (1 + 8%)^15/(1 + 4%)^15 ≈ buying power: $3,875

Because rents increased faster than inflation, your buying power and the amount of goods and services you can buy increased yearly.

Low rent growth city:

Note: For simplicity, I combined the income from the two properties ($1,100/month x 2 = $2,200/month).

- Year 0: $2,200, buying power: $2,200

- Year 5: $2,200 x (1 + 3%)^5/(1 + 4%)^5 ≈ buying power: $2,096

- Year 10: $2,200 x (1 + 3%)^10/(1 + 4%)^10 ≈ buying power: $1,997

- Year 15: $2,200 x (1 + 3%)^15/(1 + 4%)^15 ≈ buying power: $1,903

Because rent didn’t keep pace with inflation, your purchasing power, which is the quantity of goods and services you can buy, decreased annually.

You can never be financially independent if you buy properties in locations where rents do not outpace inflation.

There is another problem with low appreciation and rent growth cities.

How Much Capital You Need to Reach Your Goal

Most people will need to purchase multiple properties to meet their financial goals. A drawback of low-cost locations is that acquiring multiple properties requires much more capital than in high-growth/higher-cost locations. I will show why this is the case by comparing properties in two locations. I will start by estimating how many properties you will need to purchase.

For example, if you need $5,000/Mo to maintain your standard of living, and each property generates $350/Mo, you will need to buy ($5,000/$350) 15 properties.

If I assume that each property in a low-cost, low-appreciation location costs $200,000 and your only acquisition cost is a 25% down payment, how much capital from your savings will you need to purchase 15 properties?

- 15 x $200,000 x 25% ≈ $750,000, which is a lot of after-tax dollars.

What if you invested in a higher-cost, higher-appreciation location instead of a low-appreciation location?

So, I have numbers to work with, I will assume each property costs $400,000 and that the appreciation rate is 10 %/Yr. (Note: The average appreciation rate in Las Vegas for the property segment we’ve targeted was 15 %/Yr between 2013 and 2023.) Also, like the previous example, I will assume that the only acquisition cost is the 25% down payment.

The cash from savings to acquire the first property:

- $400,000 x 25% = $100,000

Due to rapid appreciation, we can use cash-out refinancing for the down payment for all additional properties. How does this work?

You can refinance a property and withdraw cash. The amount of cash you can withdraw depends on your property’s value relative to the outstanding loan balance. Generally, you can withdraw 75% of the market value minus the payoff balance of the existing mortgage. Assuming the property appreciates at 10% /Yr, how long must you wait to withdraw $100,000 for the downpayment on your next property? (Note: To simplify things, I assume there is no principal paydown.)

- Year 1: $400,000 x (1+10%)^1 x 75% – $300,000 (existing loan) ≈ $30,000

- Year 2: $400,000 x (1+10%)^2 x 75% – $300,000 ≈ $63,000

- Year 3: $400,000 x (1+10%)^3 x 75% – $300,000 ≈ $99,300

- Year 4: $400,000 x (1+10%)^4 x 75% – $300,000 ≈ $139,230

So, after three years, a 75% cash-out refinance provides the down payment for your next property.

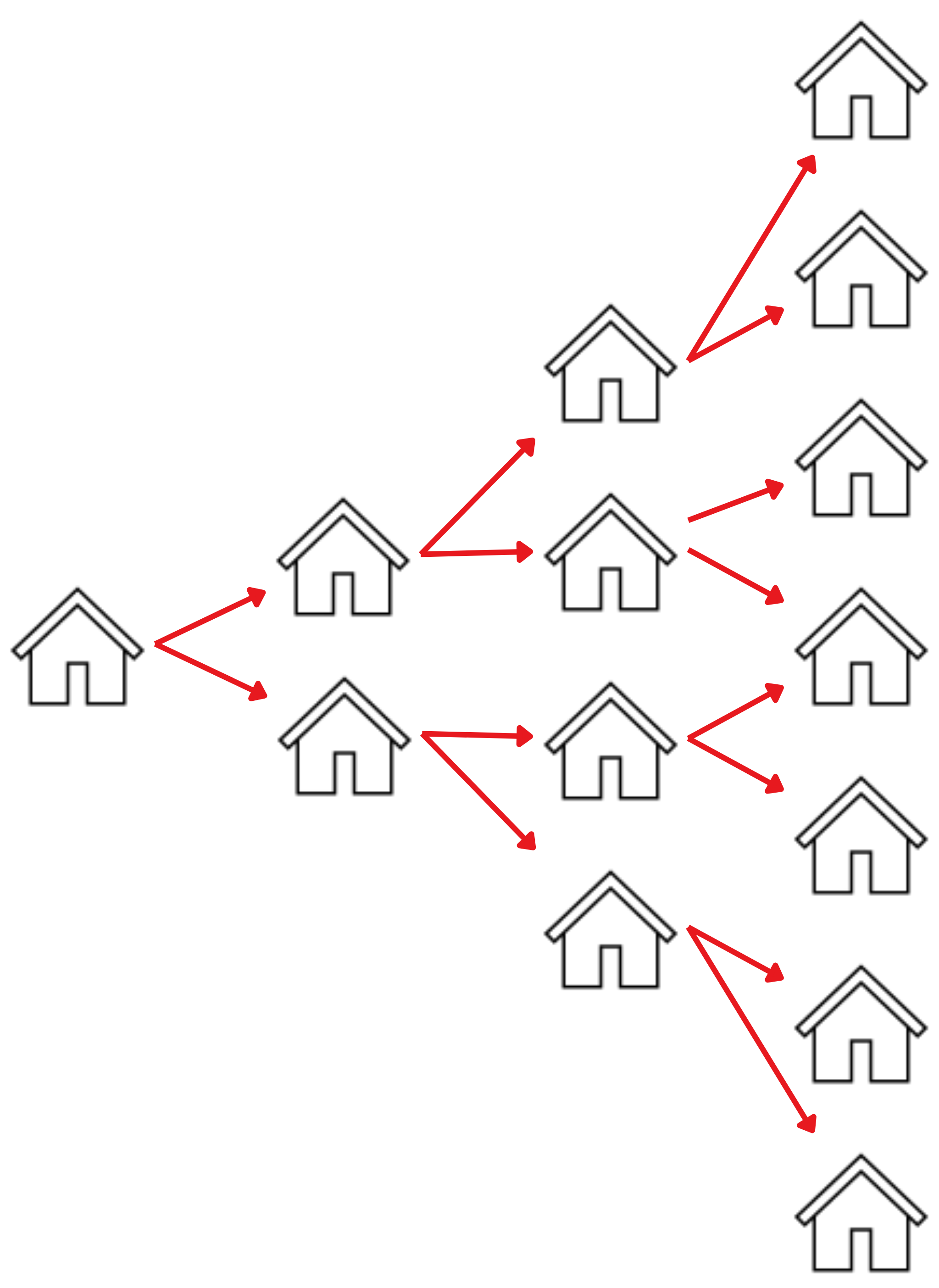

The property you refinanced and the property you acquired will continue to increase in value, enabling you to repeat the process every few years. This enables you to continue growing your portfolio with limited additional capital from your savings, as illustrated below.

Although properties in high-appreciation cities are more expensive, acquiring multiple properties requires significantly less capital than in low-cost locations. This is because you can expand your portfolio using accumulated equity via cash-out refinancing.

You Need Fewer Properties in High-Appreciation Locations

Another benefit of investing in high-appreciation cities is rapid rent growth. As shown previously, when rents rise faster than inflation, so does your inflation-adjusted income. As a result, you may need to acquire fewer properties as the inflation-adjusted cash flow from each property is growing.

Summary

At first glance, low-cost locations seem attractive for real estate purchases (notice I did not say real estate investing). However, the goal of real estate investing is to maintain your current lifestyle throughout your lifetime. Low-cost locations cannot achieve this because rents do not outpace inflation. Also, low-cost locations require far more capital because you can not use cash-out refinancing to grow your portfolio.