In This Report

- Are You an Investor or a Consumer?

- Potential Investment Properties

- Market Trends

- About the Fernwood Real Estate Investment Group

Notes

Our first Las Vegas REI Group virtual meetup was held on Friday, December 13, and received positive feedback. We’re planning the next meeting for late January or early February 2025, focusing on market expectations for the coming year. Once we have a confirmed date, we’ll share the date and registration link.

I will be on vacation from Christmas Day through January 5, returning to the office on January 6, 2025. I’ll have limited email access and no cell phone coverage during this period. Also, I won’t be publishing blog articles for the next two Sundays. If you need to get in contact with Cleo or me before we return, don’t hesitate to contact either Taylor Koki at Taylor@Fernwood.Team / 702-513-8688 or Daniel Buckle at Dan@Fernwood.Team / 702-904-0011.

I wish you a happy and healthy holiday season and a prosperous new year!

Now, onto this week’s article.

Are You an Investor or a Consumer?

Real estate investors take two distinct approaches to property selection. Some prioritize long-term financial performance, while others rely on personal feelings and aesthetic preferences. These contrasting strategies lead to significantly different financial outcomes. In this post, I’ll examine how these approaches compare.

The Performance-Driven Investor

For many investors, the guiding principle is straightforward: invest in properties that deliver strong, long-term, reliable income with rents and prices increasing faster than inflation. These investors maintain a laser focus on building an income stream that meets the following requirements:

- Rent growth outpaces inflation: Inflation steadily erodes the purchasing power of money over time. For example, with a 5% inflation rate, $100 worth of goods today will cost $162 in 10 years. To achieve financial freedom, your rental income must grow faster than inflation.

- Rapid appreciation: You will need the income from multiple properties to replace your current income. If you buy in a location with rapid appreciation, you can grow your portfolio by reinvesting accumulated equity through cash-out refinancing.

- The income must last throughout your lifetime: Your property’s value depends on your tenants’ job security. Non-government jobs tend to be short-lived—companies last only 10 years on average, and even S&P 500 companies typically survive just 18 years. Unless new companies continually create replacement jobs, your rental income will not last.

- Reliable income: Select properties that attract a tenant segment with a high percentage of reliable tenants. Reliable tenants stay for many years, pay rent on schedule, and take good care of the property.

By focusing on financial goals, you focus on the tenant. The process becomes identifying a tenant segment with a high concentration of reliable people and buying properties similar to what they rent today. This removes luck and feelings from property selection.

The Emotionally-Driven Investor

In contrast, some investors take a more personal approach to real estate. They choose properties based on their preferences and where they want to live. They might consider the charm of a neighborhood, its visual appeal, the property’s floor plan, school ratings, or nearby lifestyle amenities.

When you select properties based on where and what you would like to live, you assume a significant population of people share your feelings and tastes. This may not be true. For example, a potential client wouldn’t consider a property without a pool. I explained that we target a highly reliable tenant segment unlikely to rent properties with pools or hot tubs. I believe this is because our demographic typically has young children and is concerned about drowning risks. However, the client could not accept that anyone would rent a property in Las Vegas without a pool because if they were looking for a home to rent, they would only consider pool homes.

Emotion-driven investors often overlook crucial market dynamics, tenant preferences, and economic trends that drive property performance. By letting personal taste override market demand, they risk acquiring properties that don’t appeal to potential tenants. This disconnect often results in extended vacancies, inconsistent rental income, and lower profits.

The Tenant-Centric Mindset

To succeed in real estate investing, you must focus on what your tenants want, not what you want. It doesn’t matter if you like or dislike a property – what matters is whether your target segment will want to live there.

Think about it this way: when you focus on making tenants happy, you make better investment choices. Tenants who love their rental home are more likely to:

- Stay longer

- Pay rent on time

- Take good care of the property

- Help you save money on repairs and maintenance

This leads to a more stable and profitable investment.

Summary

A consumer buys what he/she loves. An investor buys what reliable tenants love. Invest like an investor, not a consumer, to maximize the financial performance of your real estate investments.

If you’re interested in exploring how the current Las Vegas market conditions could align with your goals, please use the link below to schedule a time that works best for you.

Best regards,

…Eric

Potential Investment Properties

Below is a link to this month’s list of candidate investment properties. Our proprietary data mining software selected these candidate properties from thousands of available properties, and this is just the first step in our multi-step validation process, as shown below.

This Month’s List of Candidate Properties

Market Trend

Below are charts from our latest trailing 13-month market report, which includes October data. Remember that this data is only for our target property profile, not the entire metro area. To see all the charts, please click here.

We’re observing the typical seasonal slowdown in prices and rents because fewer people are buying properties and moving during the holiday season.

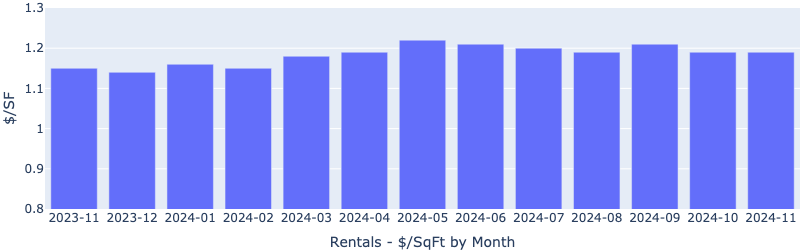

Rentals – Median $/SF by Month

Rents held steady from October to November, bucking the seasonal trend. YoY is up 3.5%.

Rentals – Median Time to Rent by Month

Median time to rent increased in November to 30 days. This is expected for the time of the year, and especially since the rents held steady.

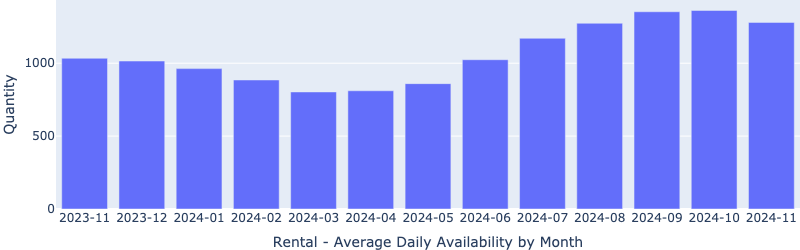

Rentals – Availability by Month

The number of homes for rent had a moderate decrease MoM, a drop earlier than the usual seasonal trend.

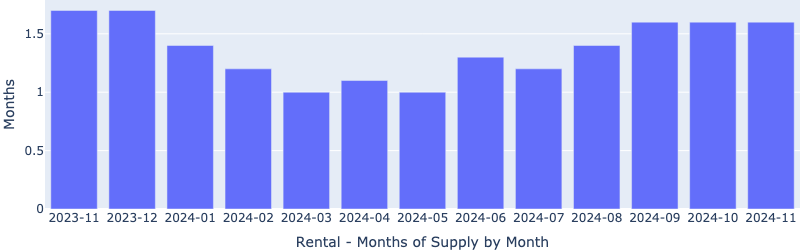

Rentals – Months of Supply

About 1.6 months of supply for our target rental property profile. This low inventory will continue to pressure up rents.

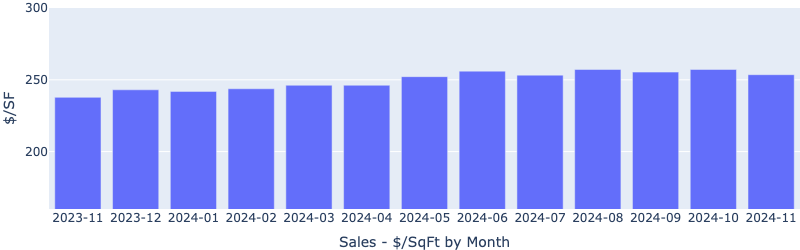

Sales – Median $/SF by Month

The $/SF decreased slightly MoM, conforming to the seasonal trend. YoY is up 7.6%.

Sales – List to Contract Days by Month

Median days on the market had a large increase from October to November, which is surprising since we observed an uptick of buyer activities in November after the election. We will monitor this piece of November data in the coming months to see if this was some sort of data glitch from MLS.

Sales – Availability by Month

This chart shows the average daily number of properties for sale in a particular month. There is also a slight decrease MoM in November.

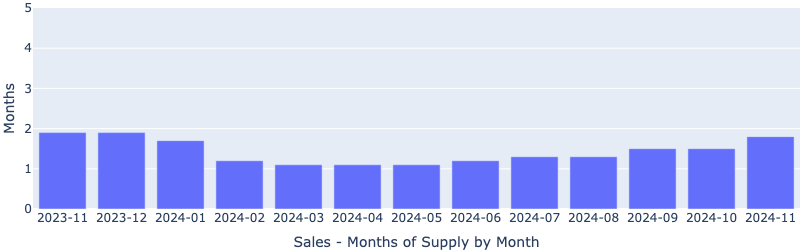

Sales – Months of Supply

There are about 1.8 months of supply for our target property profile. A 6 months supply is considered a balanced market. This limited inventory (even during the holiday season) will likely continue to drive up prices.

About the Fernwood Real Estate Investment Group

We Help Clients Acquire Highly Reliable Passive Income Streams

Here is what our clients have to say about us:

For the last 17+ years, we’ve helped clients build highly reliable, passive income streams through real estate that they will not outlive. Several are now retired and living entirely on their rental income. Most never invested in real estate before they started working with us, and most live in other states or countries. Below is a two-minute video of the services we provide.

Want to know what we can do for you?

© 2005-2024 Cleo Li and Eric Fernwood, all rights reserved.