Very reliable. Our vacancy rate is less than 2%. Even during the 2008 financial crash, our clients experienced no decline in rent and had no vacancies. COVID had almost no impact. The eviction moratorium had almost no impact. As to evictions, we’ve had seven evictions in the last 17+ years out of a tenant population >1,000.

At current interest rates (~7%), first-year returns range from -0.5% to 1% with a 30% down payment, or 4% to 5.5% with a cash purchase. Las Vegas is an investment location for lifelong financial independence rather than immediate cash flow. Since 2013, properties have averaged 10% annual appreciation and 8% annual rent growth. As rents increase, your ROI will grow. When interest rates fall, you can refinance to further boost your cash flow and ROI.

Based on client feedback, acquiring your first property typically takes 8–12 total hours, including 3–4 hours of training. Subsequent properties require significantly less time.

Of the 170+ clients we have worked with, fewer than 10 had any prior real estate investing experience. That’s why we provide training as part of our new client onboarding process. Having no prior investment experience isn’t a problem. The way we do real estate (based on commercial real estate principles) is easy to learn.

None of our clients do. Our property manager handles all maintenance and tenant interactions. If any issues arise, simply contact us—we’ll take full responsibility for resolving them.

Of our 170+ clients, over 90% are remote investors located in other states or countries. We’ve never met 60% of our clients in person, and many have never visited Las Vegas.

Due to significant property appreciation, clients use cash-out refinancing from their existing properties as down payments for new ones. This strategy allows them to expand their portfolios while keeping their total capital investment low.

We charge 2.5% of the gross sales price. Of our 560+ property transactions, sellers have paid our fee in all but 8–10 cases where clients contributed to the fee.

Yes, you can. However, properties in pristine or new condition typically cost significantly more than those needing renovation, making them less financially advantageous. Our target demographic primarily lives in specific Las Vegas areas that were developed between 1990 and 2005. Due to the age of these well-established neighborhoods, most properties will require some degree of renovation.

Every property that our clients have purchased needed some degree of renovation. There are very few occasions when our client had any active involvement in the renovation. Normally, we will handle everything for you and keep you informed through progress videos.

Yes, as outlined in our terms and conditions, you can cancel the agreement anytime by sending an email to a specified address or sending a letter to our physical address.

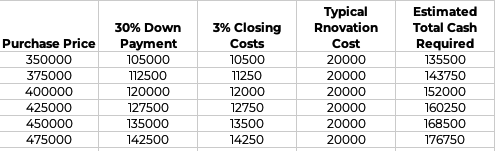

We recommend single-family homes in the $350,000–$475,000 range that attract a proven, highly reliable, tenant demographic. We’ve targeted this tenant demographic for over 17 years.

We were founded in 2005 by Eric Fernwood.

The FERNWOOD Team consists of five core team members and trusted third-party vendors who handle tasks like inspections, renovation, and property management.

For clients focused on financial goals, we typically secure a property under contract within 30 days. If you have additional requirements (such as Feng Shui considerations), the process may take longer—the more specific your requirements, the longer the search will take.

Yes. Las Vegas is an excellent investment city. There is a fixed inventory of homes that attract our target demographic, and this inventory cannot increase due to the high cost of new construction. Las Vegas’s population grows by 40,000–50,000 people annually, and the majority can only afford to rent properties in our target property segment. This ever-increasing demand for a fixed inventory of homes virtually guarantees continued appreciation and rent growth.

We select properties that attract a specific tenant segment and match your financial goals. Good properties are not like pigeons that flock, they are like eagles that fly alone.

To put this in perspective, below is the estimated annual operating costs for a $400,000 property.

Compared to a property in Nevada, properties in other states require additional cash flow to compensate for their higher operating costs.

Yes, Las Vegas is a pro-business and pro-landlord city. For example, the time to evict a non-paying tenant is typically 17–35 days, depending on court backlog. Thanks to strict eviction regulations, we’ve only had seven evictions in 17+ years with a tenant population of over 1,000.

New around here ? Start With the Basics

New around here ? Start With the Basics

New around here ? Start With the Basics