[Image generated with Dall-E]

Investors commonly rely on cash flow and ROI to evaluate investment properties. However, these metrics have significant limitations when investing for long-term success, to achieve financial independence. Allow me to elaborate.

Cash Flow and ROI Limitations

Cash flow and ROI only estimate a property’s likely performance on day one under ideal conditions. They provide no insight into future performance. Cash flow and ROI are helpful when comparing similar properties in the same area, as these properties are likely to have comparable appreciation and rent growth rates.

However, if your goal is to reach and maintain financial freedom, cash flow, and ROI are insufficient because you must consider probable future performance over the next 20 to 30 years.

For example, suppose you are considering two properties:

Property A

- Cash flow: $1,000/Mo

- Annual rent growth: 2%/Yr

- Purchase price: $250,000

Property B:

- Cash flow: $1,000/Mo

- Annual rent growth: 8%/Yr

- Purchase price: $400,000

Inflation:

- 5%/Yr

Based on day-one performance, Property A appears to be the better option. It provides the same cash flow as Property B but at a lower purchase price. However, if your goal is financial freedom, then you need to look beyond day-one returns.

To demonstrate the value of long-term performance compared to day-one performance, let’s estimate the present value of the rental income after 10, 15, and 20 years for both properties.

Property A:

- Today: $1,000 x (1 + 2%)^0/(1 + 5%)^0 ≈ $1,000

- After 10 years: $1,000 x (1 + 2%)^10/(1 + 5%)^10 ≈ $748

- After 15 years: $1,000 x (1 + 2%)^15/(1 + 5%)^15 ≈ $647

- After 20 years: $1,000 x (1 + 2%)^20/(1 + 5%)^20 ≈ $560

Property B:

- Today: $1,000 x (1 + 8%)^0/(1 + 5%)^0 ≈ $1,000

- After 10 years: $1,000 x (1 + 8%)^10/(1 + 5%)^10 ≈ $1,325

- After 15 years: $1,000 x (1 + 8%)^15/(1 + 5%)^15 ≈ $1,526

- After 20 years: $1,000 x (1 + 8%)^20/(1 + 5%)^20 ≈ $1,757

As evident from the calculations, if your goal is financial freedom, purchasing Property A would be a disastrous decision.

Rent Growth and Inflation

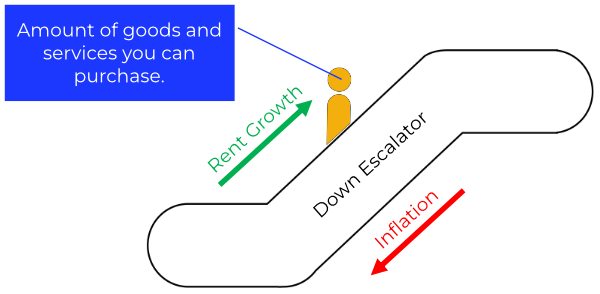

The best physical analogy I have for the interaction between rent increases and inflation is walking up a “down” escalator.

The speed at which the stairs are moving down represents the effects of inflation. The speed at which you’re walking up the escalator represents rent growth. If you are not walking up the stairs faster (rent growth) than the stairs are moving down (inflation), the amount of goods and services you can buy declines every year.

You Can Only Count on Today?

I once spoke with someone who claimed that basing decisions on future possibilities made no sense. He insisted we should only rely on current circumstances. This perspective struck me as odd, given that with any investment, you must consider its likely performance over your intended holding period. Real estate, in particular, offers more predictability compared to the stock market. While stock values can fluctuate rapidly, real estate changes occur at a much slower, almost glacial pace.

In real estate, prices are driven by supply and demand. When buyers outnumber sellers, prices rise until the market reaches equilibrium. Conversely, when sellers outnumber buyers, prices fall until supply and demand balance out. This dynamic shifts gradually over time, making it relatively straightforward to predict future trends.

Prices drive rents. If prices are high, more people are forced to rent, so increased demand causes rent to rise. If prices are low, more people will buy, leading to decreased demand for rentals, so rents fall.

What drives changes in demand? Population shifts.

In cities with declining or stagnant populations, existing housing inventory typically matches (or exceeds) demand, causing prices to remain low or even decrease. Conversely, in cities with growing populations, the demand exceeds supply, leading to rising prices and rents.

Summary

Cash flow and ROI are good tools for comparing properties, provided they are similar and in the same environment. However, because these metrics do not provide any insight into future performance, they have limited value when selecting properties for financial independence.

In next week’s blog, I will show you how to evaluate future appreciation and rent growth for a given zip code.