- Hedging Against Inflation

- Potential Investment Properties

- Market Trend

- About the Fernwood Real Estate Investment Group

- Schedule a discovery call with Eric Fernwood

What do people fear the most as they approach retirement? The following list of retirement fears is from a 2020 study.

- Running out of money.

- Skyrocketing inflation.

- High health care costs.

- Stock market crashes.

- Children moving back home.

- Taking Social Security at the wrong time.

- No one takes care of finances.

- Too much debt.

In the current high inflation and turbulent economic environment, most people can check off numbers 1, 2, and 4 as a done deal.

Whether you are approaching retirement or have a long ways to go, consistently growing your equity and income is essential. It’s just that inflation and stock market crashes are not making this easy.

Many analysts expect high inflation and turbulent markets to continue for the foreseeable future. The question to ask is, where do we go from here?

Select single-family rental homes are a premier choice for hedging against inflation and a volatile bear stock market. Don’t take our word for it.

- Why Wall Street May Be in the Single-family Rental Market for Keeps

- Investors buying large numbers of homes in Las Vegas

Why is real estate the best hedge? I will answer this question by comparing conventional investments (stocks, mutual funds, bonds, etc.) with real estate.

Conventional Investments

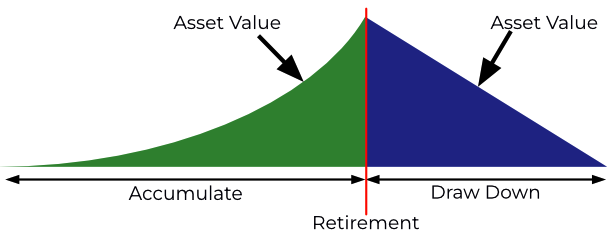

Suppose you have only been invested in stocks, mutual funds, bonds, and other similar instruments for your retirement, and your goal is to accumulate sufficient capital so you can draw over retirement. See the illustration below.

There are several problems with this approach.

- You need to accumulate a large amount of capital to have enough to periodically draw down even a small amount over time.

- You have to accurately predict how long you and your spouse will live. The draw-down period and the monthly withdrawal determine the amount of initial capital required. If you or your spouse live longer than expected or have unexpected major expenses, you will run out of money. A brutal way to end a life.

- You have to accurately predict inflation for the entire draw-down period.

- Accurately predict future market crashes and the strategy to maintain your capital. Even the best fund managers cannot do this over 20 or 30 years.

How much capital will you need to accumulate if the draw-down period is 20 years and the monthly draw-down is $10,000? If we assume:

- No inflation.

- No taxes.

- Perfect stock selection over the draw-down period.

- No market crashes.

Calculating the total capital needed is easy:

20 Years x $10,000 / Month x 12 Month / Year = $2,400,000

You must accumulate $2,400,000 in after-tax dollars to draw down pre-tax $10,000/Mo.

However, inflation is always with us, so you need to accumulate more to compensate. Below is a table showing how much you will need to accumulate at various inflation rates to draw down $10,000/Mo., in present value dollars, with no taxes, perfect stock selection over the draw-down period, and no market crashes.

| 20-Year Average Inflation Rate | Initial Funds Required |

|---|---|

| 5% | $3,967,914 |

| 7% | $4,919,459 |

| 9% | $6,139,214 |

| 11% | $7,704,340 |

The inflation rate in 1980 was 13.50%, and we are over 8% today, so the above inflation rates are not unprecedented.

Another consideration is that there will be one or more market crashes over any extended period. The chart below reflects when you hope to sell vs. when you have to sell. Remember that you will need a continuous income stream during good economic times or bad. Your expenses never stop. You reduce your working capital disproportionately faster when you have to liquidate during a market downturn.

In summary, there are many uncertainties with capital accumulation investments. Also, the draw-down method assumes zero dollars left in the account at the end of the draw-down period. There is no “pad” for someone living longer than anticipated, medical emergencies, higher inflation than expected, or market crashes. Also, the above assumes that you made perfect stock selections for 20 years, something no money manager has achieved.

Real Estate – Income Streams

Real estate investing is more about accumulating income streams than equity accumulation (although it is an excellent way to accumulate equity). Let’s look at achieving the same goal of $10,000/Mo. income, but using real estate this time.

Assumptions:

- Each property costs $400,000, and you acquire the property using a 25% down, 30-year fixed loan.

- In a good location, rents rise rapidly so I will assume an average cash flow of $500 per property.

- No other costs (closing costs, renovation, etc.) will be considered.

- No need to consider inflation because, in a good location, rents rise faster than inflation. Yes, the concept is as simple as this, to hedge against inflation, invest in a market where rents and prices rise faster than inflation! For example, Las Vegas. To learn more about selecting a good investment location, click here.

To have $10,000 per month:

- $10,000/Month / $500/Property = 20 Properties.

Using the above assumptions, the total cash required for down payments would be:

- 20 properties x ($400,000 x 25%) = $2,000,000

Remember that this $10,000/Mo. is near perpetual, and rises with inflation, so you will never need to worry about running out of money. You can pass this income stream to your children and their children.

The above is oversimplified, and the numbers vary greatly in the real world. However, the concept is valid. And don’t forget that:

- When invested in a good location, your income will increase even after the inflation.

- As mortgages are paid off, the net rent from each property will increase significantly.

- You can greatly reduce the total capital required if you leverage accumulated equity.

- Investment real estate provides significant tax advantages.

What happens if there is a market downturn?

Las Vegas was the poster child of the 2008 housing crash. However, our clients had zero decreases in rent and zero vacancies. The key? Select the right tenant pool.

To be fair, I want to mention the disadvantages of real estate.

- Not a Liquid Asset – Stocks and similar instruments can be quickly converted to cash, while real estate can take months to sell. However, the lack of liquidity is also a strength because real estate is not susceptible to the knee-jerk reactions of the stock market.

- Location is Critical – The most important decision you make is the investment location, not the property.

- Capital Intensive – With stocks, you can start for less than $100. With real estate, significant initial capital and credit are required.

In summary, stocks and other financial instruments accumulate equity and are susceptible to market volatility and inflation. You draw down a portion of your equity each month when you need the money. You have zero dollars remaining on the last day of the planned drawdown period. There is no pad for errors, market crashes, unplanned expenses, or living longer than expected.

Real estate provides an income stream in addition to equity accumulation. If you buy in a location where rents increase faster than inflation, you will have a dependable passive income you will not outlive. And the income increases over time.

Summary

In uncertain economic times, smart money is moving from volatile investments to safe havens that provide a dependable income stream and equity growth.

If you want to learn more about our processes that have delivered consistent performances, check out our training videos.

Thank you for your time. And, as aways, I welcome your feedback.

…Eric

Eric Fernwood

Eric@Fernwood.Team

702-358-8884

www.Fernwood.Team

Below is a link to this month’s list of candidate investment properties. Our proprietary data mining software selected these candidate properties from thousands of available properties, and this is just the first step in our multi-step validation process, as shown below.

Note: Due to the rapid increase in interest rates, first-year returns are low. However, the return increases significantly even with a conservative 8% annual rent increase. The typical rent increase range is 8% to 12%. Contact me if you’d like detailed analysis for this subject.

Below are charts from our latest trailing 13 month market report, which includes August data. Remember that this data is only for the property profile that we target, not for the entire metro area. To see all the charts please click here.

|

Rental Statistics

|

Sales Statistics

|

|

Rentals – Median $/SF by Month

As expected, August rents had a drop from July and June levels.

|

Sales – Median $/SF by Month

Due to the rising inventory, prices dropped again MoM in August. YoY is still at an impressive 16%!

|

|

Rentals – List to Contract Days by Month

Median time to rent is about 17 days for August. No change from July.

|

Sales – List to Contract Days by Month

Median days on market is just under 30 days for August. A much more rational market (for the moment).

|

|

Rentals – Availability by Month

This chart shows the average daily number of properties that were for rent in a particular month. We are at about the pre-pandemic level.

|

Sales – Availability by Month

This chart shows the average daily number of properties that were for sale in a particular month. We are approaching the pre-pandemic level.

|

|

Rentals – Months of Supply

Just a little over one month of supply for our target rental property profile. Demand is still greather than supply.

|

Sales – Months of Supply

Inventory is now above 6 months for our target property profile, even though it’s 3.5 months for the entire MLS in this price range. We can look into our data sets for possible errors but for now we will assume that they are accurate. We are starting to see some sellers willing to work with buyers.

|

For the last 15+ years, we’ve helped clients build highly reliable, passive income streams through real estate that they will not outlive. Several are now retired and living entirely on their rental income. Most never invested in real estate before they started working with us, and the vast majority live in other states or countries. Below is a two-minute video of the services we provide.

© Cleo Li and Eric Fernwood, all rights reserved.