- Should You Invest Now?

- Potential Investment Properties

- Market Trend

- About the Fernwood Real Estate Investment Group

- Schedule a discovery call with Eric Fernwood

Before I Get into This Month’s Article…

Data Corruption

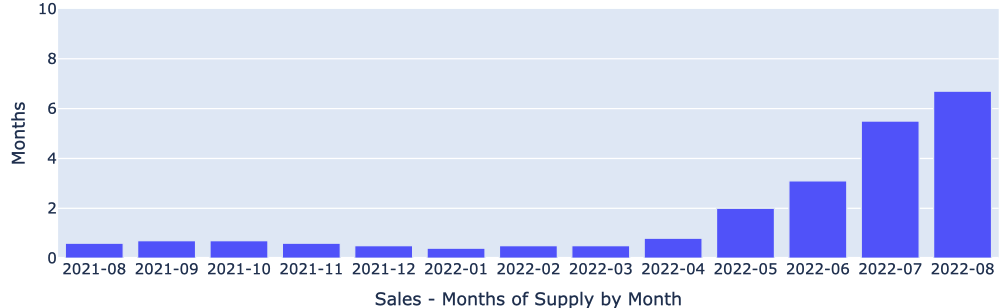

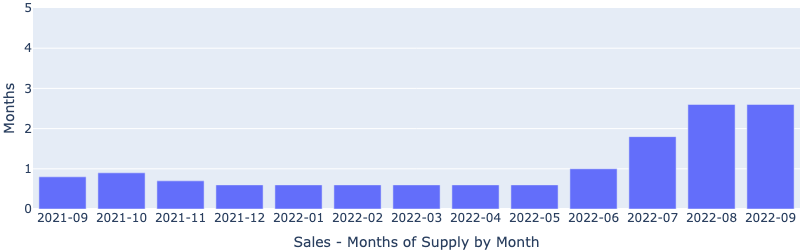

Below is last month’s Sales – Months of Supply chart. It showed inventory was over six months. This did not make sense because the overall MLS inventory remained at about three months. We suspected a problem, but I never considered a problem with our historical data until a few days ago.

I discovered that there was corrupted data. I believe the cause was the MLS changing a data label about three months ago. The result was invalid inventory data. The adage “garbage in, garbage out” applies.

We corrected the data corruption and reran the statistics on the same data. Inventory was now between two and three months, in line with the MLS inventory charts.

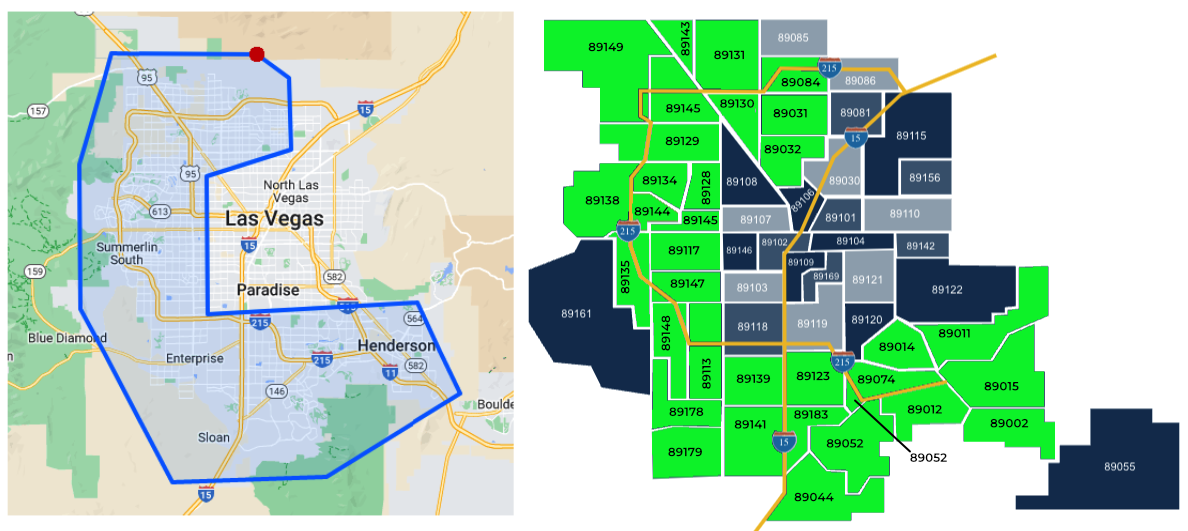

While digging through the code, I discovered another potential issue. See the two maps below.

The map on the left is the area our statistics software searches. On the right is the area our mining software searches (for potential investment properties). I changed the statistics search area to match the data mining software search area.

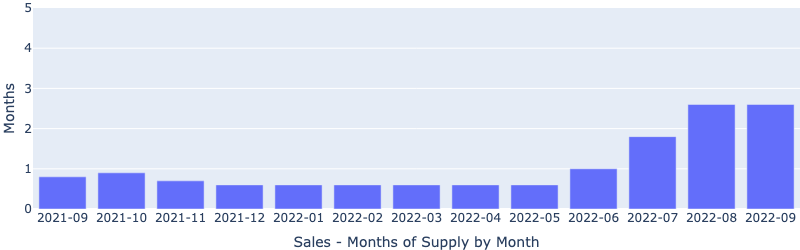

Below is the corrected Sales – Months of Supply chart.

My apologies for not finding the error sooner.

State of the Las Vegas investment market

Note that the following includes only the narrow segment of single-family properties we target.

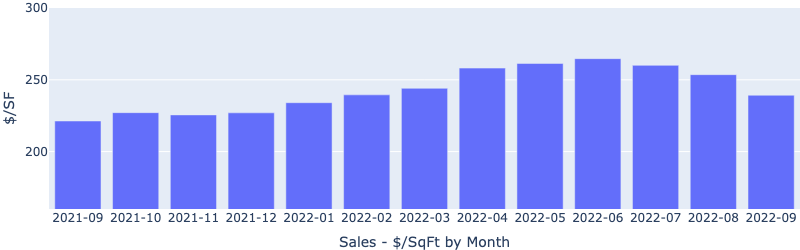

Median $/SF declined 4% from August. YoY prices are up 9%.

The number of properties for sale continues to increase. I expect it to level off in the next few months. More about that later.

After declines since June, the number of buyers appears to have stabilized.

Supply remained below three months, indicating a seller’s market. Six months of supply is considered a balanced market.

Where do I see the market going from here?

Below is a chart from the MLS showing the number of new listings by month in the price range of $300k-$500k. New listings have declined since July, and I expect this to continue. This is why I believe the number of properties for sale will level off within the next 2-3 months. And stabilize at 2-3 months of supply, which was the state before COVID. Before COVID (2018 and 2019), prices and rents increased by about +5% per year; supply ranged between 2 and 3 months.

Why do I believe prices will continue to increase?

Because the market drivers for Las Vegas haven’t changed.

- Population growth – Population increases by 2.5% to 3% per year.

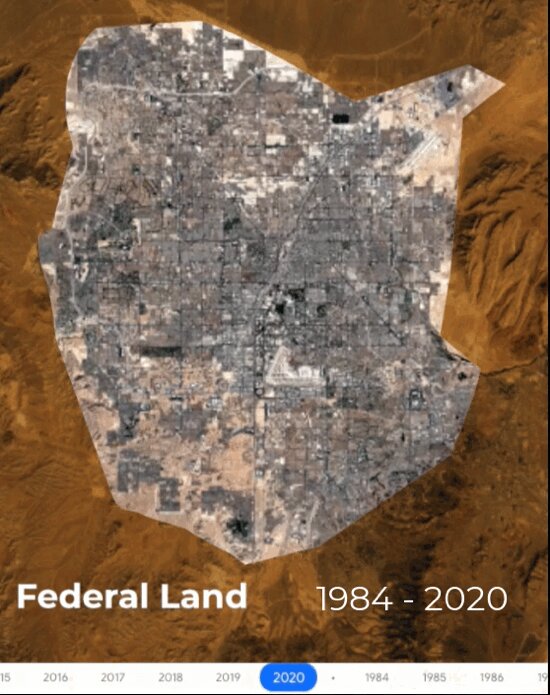

- Land shortage – Below is a map showing vacant land at the end of 2020.

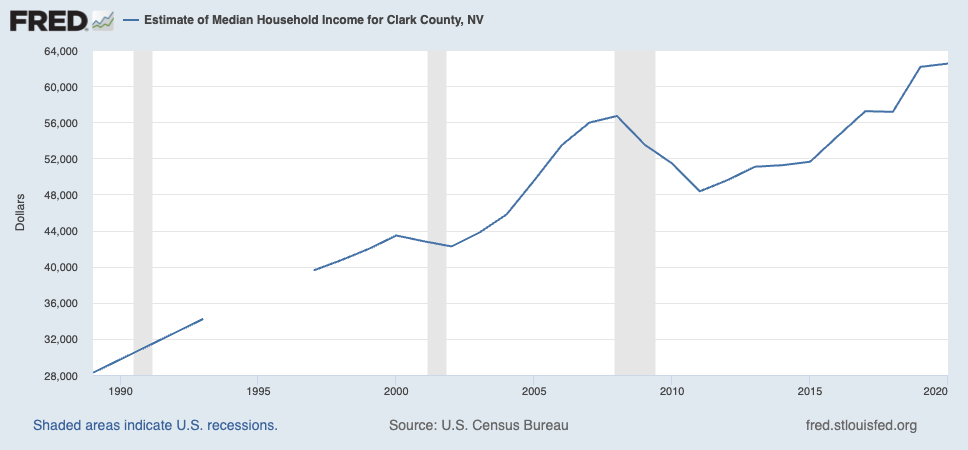

- Jobs – Jobs bring people. Today, there are between 26,000 and 31,000 available jobs in Las Vegas, depending on which job board you check. And over $22B is under development. These developments will create thousands more jobs, better-paying jobs. See below the median household income for Clark County from the St Louis Federal Reserve.

Increasing population and decreasing land supply almost guarantees future rent and price increases.

Should You Invest Now?

Waiting makes sense if one of two things occurs:

- Interest rates fall significantly. This is not likely. The Fed will keep raising interest rates until inflation is under control.

- Prices fall at least enough to compensate for rising interest rates.

How much do prices need to fall to offset interest rate hikes? Below is a table showing how much prices must decrease to offset interest rate hikes.

| % Decrease from $400,000 | Purchase Price to Compensate for Increased Interest Rate | Interest Rate | Constant Payment @ 25% Down |

|---|---|---|---|

| 400000 | 6.00% | -1800 | |

| 5% | 379706 | 6.50% | -1800 |

| 10% | 360738 | 7.00% | -1800 |

| 14% | 343242 | 7.50% | -1800 |

| 18% | 327080 | 8.00% | -1800 |

| 22% | 312129 | 8.50% | -1800 |

| 25% | 298276 | 9.00% | -1800 |

So, if the interest rate is 6.0% and increases to 7.5%, prices must decrease by 14% to have the same monthly payment. Our target segment is stabilizing, so I do not see any significant decreases.

If you want a dependable passive income, the longer you wait, the longer it will take to generate the cash flow you need.

The time to invest is when there are good opportunities

Good opportunities exist in any market. You just have to find them, which is what we do for our clients. Usually, there are more good opportunities when few are looking.

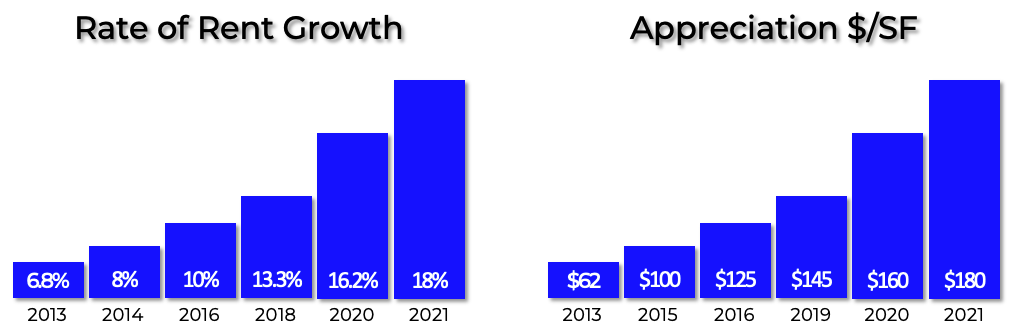

Real estate is a long-term investment. Prices and rents will continue to rise if the location fundamentals are right. Below is how our client’s properties have performed since 2013 (when I started collecting such data).

In 2018, prices, rents, and interest rates all had a large run-up. Many were worried that the market would correct or even crash. In my 2019 investment outlook, I wrote about why I believed prices and rents would continue to rise due to the Las Vegas market drivers (which are still relevant today) and recommended investing sooner rather than later. Looking back today, those investments made in 2018 and 2019 have become big winners. I see a similarity between the market conditions today and late 2018.

But what about market turbulence?

Market turbulence WILL happen. However, it has not impacted our clients. Specifically,

- 2008 crash – Zero decline in rent and zero vacancies.

- COVID – Almost no impact

- Eviction moratorium – One property was impacted (out of 400+).

I attribute the above results to the dependable tenant pool that we target.

Real estate is a long-term investment. Market timing will not make any meaningful difference over the long term. Waiting will reduce your return because prices and interest rates will continue rising.

What about the current high-interest rates?

Inflation and high interest rates are not to politicians’ advantage. In a year or two, I expect interest rates and inflation to come down. When they do, refinance at a lower rate and use the accumulated equity as the down payment on your next property.

Next Step

Ready for us to help you invest? Book a discovery call.

I wish everyone (investing) success.

If you want to learn more about our processes that have delivered consistent performances, check out our training videos.

Thank you for your time. And, as aways, I welcome your feedback.

…Eric

Eric Fernwood

Eric@Fernwood.Team

702-358-8884

www.Fernwood.Team

Below is a link to this month’s list of candidate investment properties. Our proprietary data mining software selected these candidate properties from thousands of available properties, and this is just the first step in our multi-step validation process, as shown below.

Note: Due to the rapid increase in interest rates, first-year returns are low. However, the return increases significantly even with a conservative 8% annual rent increase. The typical rent increase range is 8% to 12%. Contact me if you’d like detailed analysis for this subject.

Below are charts from our latest trailing 13 month market report, which includes August data. Remember that this data is only for the property profile that we target, not for the entire metro area. To see all the charts please click here.

|

Rental Statistics

|

Sales Statistics

|

|

Rentals – Median $/SF by Month

September rents declined 3% from August. Up 4% YoY. I expect it to drop a bit further as we enter the holiday season.

|

Sales – Median $/SF by Month

Median $/SF declined 4% from August. YoY prices are up 9%.

|

|

Rentals – List to Contract Days by Month

Median time to rent is about 25 days for September.

|

Sales – List to Contract Days by Month

Median days on market is just over 30 days for September.

|

|

Rentals – Availability by Month

This chart shows the average daily number of properties that were for rent in a particular month. The number of units for rent declined in September.

|

Sales – Availability by Month

This chart shows the average daily number of properties that were for sale in a particular month. The number of properties for sale continues to increase. I expect it to level off in the next few months.

|

|

Rentals – Months of Supply

Still just one month of supply for our target rental property profile. Demand is still greather than supply.

|

Sales – Months of Supply

2-3 months of supply is still a seller’s market.

|

For the last 15+ years, we’ve helped clients build highly reliable, passive income streams through real estate that they will not outlive. Several are now retired and living entirely on their rental income. Most never invested in real estate before they started working with us, and the vast majority live in other states or countries. Below is a two-minute video of the services we provide.

© Cleo Li and Eric Fernwood, all rights reserved.