Las Vegas Real Estate Investment Update - June 2024 Market Report

In This Report

- Frustrated by High Interest Rates? Review Your Options

- Potential Investment Properties

- Market Trends

- About the Fernwood Real Estate Investment Group

Frustrated by High Interest Rates? Review Your Options

Investing in real estate during the current high interest rates can be frustrating, but delaying your investment might cost you more in the long run. Here’s why:

Financial Impact of Waiting

If you bought a $400,000 property today with 30% down, your down payment would be $120,000. Assuming a 7.5% interest rate, your principal and interest (P&I) payment would be $1,958/Mo.

What happens if you wait three years for interest rates to drop to, say, 5%? Let’s look at potential property appreciation:

(In our 2024 Las Vegas Investor Outlook, I stated that I expect our next 5-year average appreciation rate to be over 11% and the rent growth rate to be ~8%, and why.)

Market Value After 8% Annual Appreciation:

- After one year: $432,000

- After two years: $466,560

- After three years: $503,885

Market Value After 10% Annual Appreciation:

- After one year: $440,000

- After two years: $484,000

- After three years: $532,400

If you wait three years and interest rates drop to 5%, your 30% down payment would be:

- 8% appreciation: $151,166

- 10% appreciation: $159,720

Note: When interest rates decrease in the future, you can make a smaller down payment, such as 25%. However, your loan amount will be larger, and obtaining a loan at that time may involve points or other costs that we cannot predict. Therefore, I used a 30% future down payment to simplify things.

Principal and Interest Payments After Three Years:

- At 8% appreciation at 5% interest: $1,895 per month

- At 10% appreciation at 5% interest: $2,001 per month

Loss of Equity by Waiting:

- If 8% appreciation: $103,885

- If 10% appreciation: $132,400

Buy Now, Refinance in the Future

If you purchase the property today for $400,000 and refinance after three years at 5%, your P&I would be $1,503/Mo. The result would be significantly higher cash flow. Additionally, you would have accumulated equity, cash flow, and tax savings.

Rent Growth:

Assuming an initial rent of $2,000 per month with an 8% annual increase:

- After one year: $2,160

- After two years: $2,333

- After three years: $2,519

Summary of Financial Impact:

Waiting three years for lower interest rates means:

- At 8% appreciation:

- Equity loss: $103,885

- Increased down payment: $31,166

- Loss of rent (as rent rises, properties have increased cash flow.)

- Loss of tax savings

- At 10% appreciation:

- Equity loss: $132,400

- Increased down payment: $39,720

- Loss of rent (as rent rises, properties have increased cash flow.)

- Loss of tax savings

Options

Here are what I believe to be the available options for investors.

- Do not buy real estate: This means missing out on the most proven method of financial freedom. I’ve discussed alternatives to real estate with many clients, but none have found a good alternative.

- Buy real estate in low-cost locations: These areas may offer initial positive cash flow and cheaper properties. However, appreciation and rent increases in these areas are around 1%. If (real) inflation is 5%, the buying power of your rent and the equity you invested in these properties will decrease by about 4% per year. See “The Allure of Low-cost Markets” and “Why Low-Cost Properties Are the Most Expensive.”

- Buy real estate today and accept initial negative cash flow: Many clients are adopting this strategy. They believe that with rising rents and property prices, they will achieve positive cash flow within one or two years.

- Buy real estate today and put more money down: Most clients are putting down between 30% and 35%, depending on the property and interest rate, to achieve positive or zero cash flow.

- Wait until interest rates fall: Property prices are rising, so waiting might cost you more even after interest rates decrease.

Keep in mind that if you do not have sufficient funds to acquire and renovate a property, plus a comfortable reserve in case of an emergency, do not do it.

Conclusion:

Investing in real estate during high interest rates can be frustrating, especially compared to the investing environment before the interest rate hikes. But we are now in a new era, and waiting can lead to a significant loss of returns. By taking action now, you will benefit from property appreciation, rent growth, and tax savings, setting yourself up for future financial success.

Potential Investment Properties

Below is a link to this month's list of candidate investment properties. Our proprietary data mining software selected these candidate properties from thousands of available properties, and this is just the first step in our multi-step validation process, as shown below.

This Month’s List of Candidate Properties

Market Trend

Below are charts from our latest trailing 13-month market report, which includes May data. Remember that this data is only for our target property profile, not the entire metro area. To see all the charts, please click here.

Rentals - Median $/SF by Month

Rents continued the up trend as expected. It is up 3% YoY and 7.96% since November.

Sales - Median $/SF by Month

Despite persistently high interest rates, the $/SF continued to climb, up 10% Year over Year.

Rentals - Median Time to Rent by Month

Median time to rent had a slight increase from April, but is still below 20 days. YoY is flat.

Sales - List to Contract Days by Month

Median days on the market continued to drop, showing a heating-up market. YoY is down more than 22%.

Rentals - Availability by Month

The number of homes for rent continued the downward trend. YoY is down 11%.

Sales - Availability by Month

This chart shows the average daily number of properties for sale in a particular month. YoY is down 21%!

Rentals - Months of Supply

Only about 0.7 months of supply for our target rental property profile. YoY is down 36%! Demand is greater than supply. This will pressure up the rents.

Sales - Months of Supply

There are just 0.6 months of supply for our target property profile. YoY is down 45%! A 6 months supply is considered a balanced market. This will continue to drive up the prices.

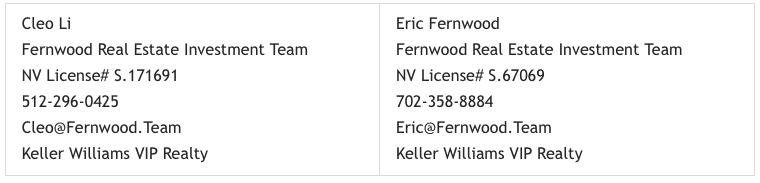

About the Fernwood Real Estate Investment Group

We Help Clients Acquire Highly Reliable Passive Income Streams

Here is what some of our clients have to say about us:

For the last 16+ years, we've helped clients build highly reliable, passive income streams through real estate that they will not outlive. Several are now retired and living entirely on their rental income. Most never invested in real estate before they started working with us, and most live in other states or countries. Below is a two-minute video of the services we provide.

Want to know what we can do for you?

© 2005-2024 Cleo Li and Eric Fernwood, all rights reserved.