In This Report

- 2024 Las Vegas Investor Outlook

- Potential Investment Properties

- About the Fernwood Real Estate Investment Group

2024 Las Vegas Investor Outlook

Welcome to 2024.

I hope you are having a good start to the new year.

Every January, we publish our Las Vegas investment forecast for the upcoming year. Predicting what will happen in the future is hard; so many factors can impact the market – inflation, interest rates, economic performance, geopolitical events, unexpected events, etc. However, forecasts are still useful as they provide guidelines for investment planning.

I will start by reviewing what happened in 2023.

Looking Back at 2023

At the beginning of 2023, most economists and financial analysts expected a recession in 2023. There were fears that Las Vegas housing prices would crash and foreclosure waves would return.

In my 2023 Outlook, I stated:

In the near term, interest rates will be the key factor.

- If interest rates rise significantly, buyers will be choked off, and prices will fall slightly.

- If interest rates remain relatively stable, I believe prices will remain relatively static.

- If interest rates fall even slightly, the demand for homes will surge, and prices and rents will rise.

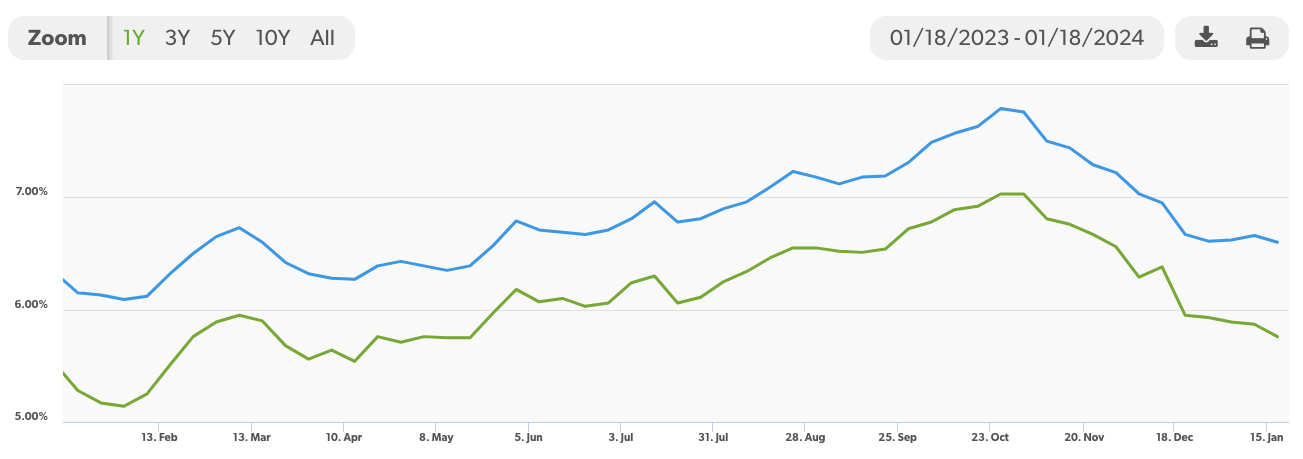

As it turns out, mortgage rates rose sharply from about 6.15% in Jan 2023 to 7.79% in Oct before coming down to 6.65% at the end of the year (source: Freddie Mac). In the chart below, the green line represents the 15-year fixed interest rates, while blue signifies the 30-year fixed interest rates.

Here’s what happened to the prices (note: this is only for the segment we target, not metro Las Vegas or other property types).

Sales – Median $/SF by Month

Despite significant interest rate hikes, $/SF increased in 2023. YoY is up 7.5%; YTD is up 9.5%.

It turns out that I was conservative about the Las Vegas housing market strength. I attribute the price increases to the persistently low inventory.

Sales – Availability by Month

Sales – Closings by Month

Sales – Months of Supply

Inventory remained at or just above one month for much of 2023. In Las Vegas, six months of supply indicates a balanced market where you can expect prices to be stable. Low inventory pushed up the prices despite rising interest rates.

Let’s look at how the rental market did in 2023.

Rentals – Median $/SF by Month

Despite a year-end typical holiday season dip, rents rose 3.5% YoY.

Rentals – List to Contract Days by Month

The median time to rent ranged between 20-30 days, back to pre-COVID trend.

Rentals – Availability by Month

This chart shows the average daily number of properties that were for rent in a particular month. Notice the sharp decrease in both MoM and YoY (down ~19%).

Rentals – Closings by Month

Rentals – Months of Supply

Inventory stayed under 1.4 months for much of 2023. Demand is still greater than supply.

In summary, 2023 was a (lot) better year than I thought.

Looking Forward to 2024 and Beyond

Much of the fear of an imminent recession has dissipated. The Fed even indicated possible rate cuts in 2024. What do I think will happen to the Las Vegas investment real estate in 2024 and beyond?

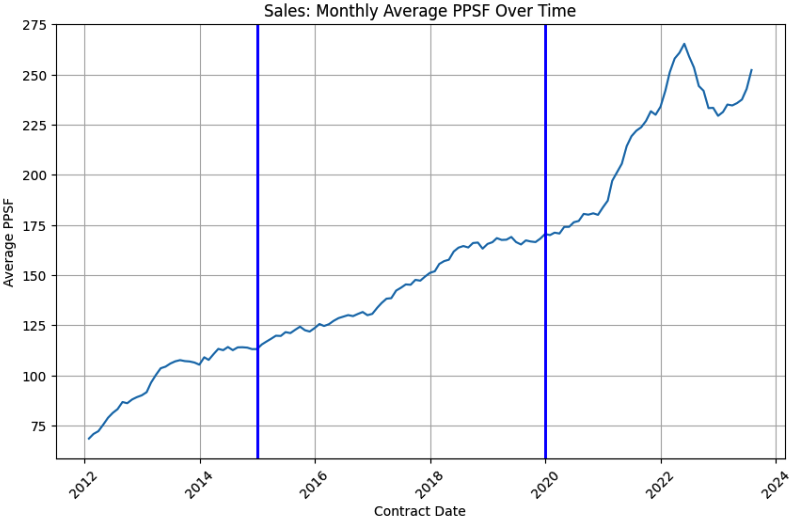

While past performance doesn’t guarantee future results, it’s typically the best indicator. In my opinion, the period from 2015 to 2020 is the most comparable to conditions today. It took place after the effects of the 2008 financial crash had subsided and before COVID-19 and the subsequent unprecedented rate hikes by the Federal Reserve. This period closely mirrors our starting point in 2024, though it’s not identical.

Appreciation

Below is a chart showing the $/SF for our property segment from 2012 through November 2023. Please note that these numbers are only for the segment we target, not the general Las Vegas market. The compound annual growth rate from 2015 to 2020 was 10.81%.

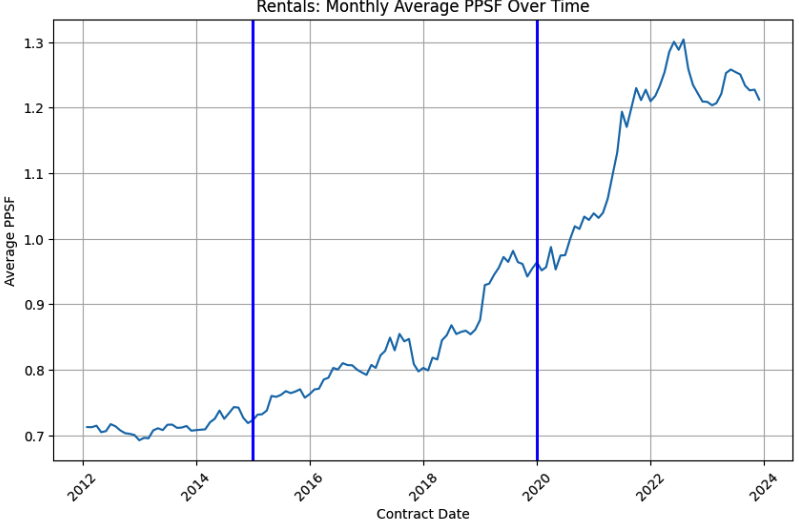

Rent Growth

See the chart below. The compound annual growth rate from 2015 to 2020 was 7.45%.

However, I anticipate stronger appreciation and rent growth from 2024 to 2029 compared to 2015 to 2020 due to the following reasons.

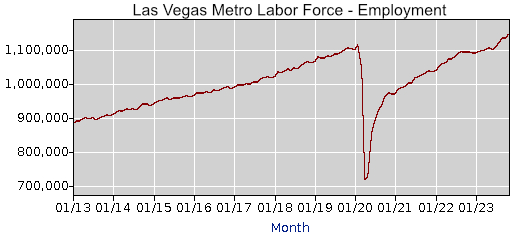

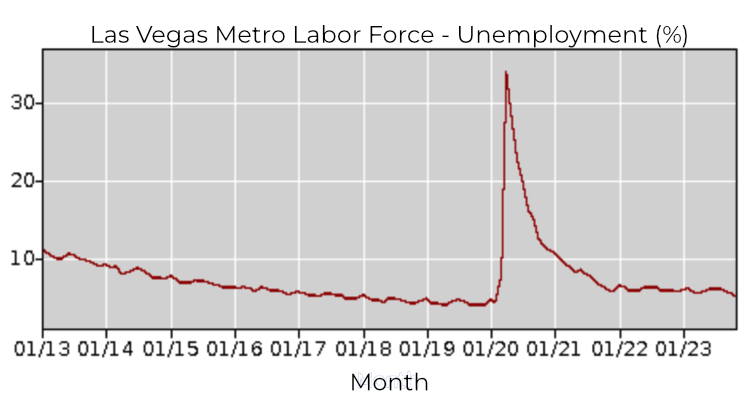

Stronger Economy

The chart below is from the Bureau of Labor Statistics. Employment has now surpassed the previous peak in January 2020, much higher than in 2015.

The unemployment rate was 7.7% in January 2015 and 5.1% in November 2023.

Growing employment and declining unemployment mean more people could buy a home, increasing demand for purchases.

Tighter Housing Market

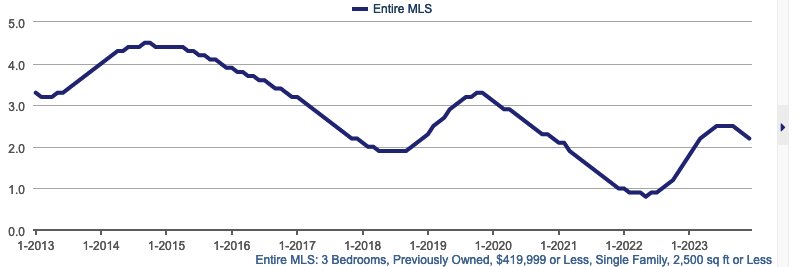

Below is a chart from the Las Vegas Realtor Association MLS showing the historic supply levels for single-family homes. These levels roughly resemble our target property segment but include the entire metro area.

Inventories have been on a long-term downward trend. They were 4.8 months in January 2015 and 2.2 months in December 2023. The housing market has much more upward pressure on prices now than in 2015.

Las Vegas Growth Drivers

Job Growth

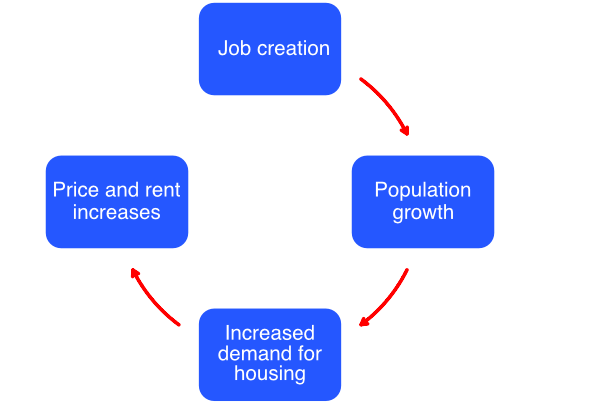

There is a direct relationship between jobs and price and rent growth. See the image below.

Jobs are what attract people to Las Vegas, and 2023 was a particularly good year. Las Vegas employment increased by 4,800 jobs (0.4%) since October, an increase of 42,600 jobs (3.8%) since November 2022.

Future Job Growth

Depending on the study you refer to, there is currently between $26B and $30B either under construction or slated to begin. These large projects will create thousands more jobs in the future. Some highlights:

- The impending relocation of the Oakland A’s and the construction of its future home stadium on the Strip.

- 11,000 workers will soon be hired to build high-speed Brightline rail from Las Vegas to California – While the hiring of employees to build the line is noteworthy, the impact of people from LA coming to Las Vegas will be even more significant. I believe Brightline will have a similar effect as the professional sports teams have had on Las Vegas’ desirability. While Las Vegas was once known as “Sin City,” it is now perceived as a great place to live and work.

- Amazon buys 300 acres near Boulder City for $48 million. – Amazon continues to expand in Las Vegas.

- The first F1 race in Las Vegas was in 2023 and plans to occur annually. Like the sports teams, this will expose more people to Las Vegas, which will bring more people and businesses to Las Vegas.

- NOVVA Data Center – Data centers continue to move into Las Vegas. In addition to no state income taxes and pro-business government, the cost of electricity is relatively low. For example, California’s commercial energy rate in November 2023 was $.2314/KwH, while in Las Vegas, it was $.1128/KwH.

- California – The exodus of people and businesses from California is another factor to consider. See the infographic below showing where California companies are moving to (Source: Applied Analysis).

Population Growth

What’s the current status of population growth?

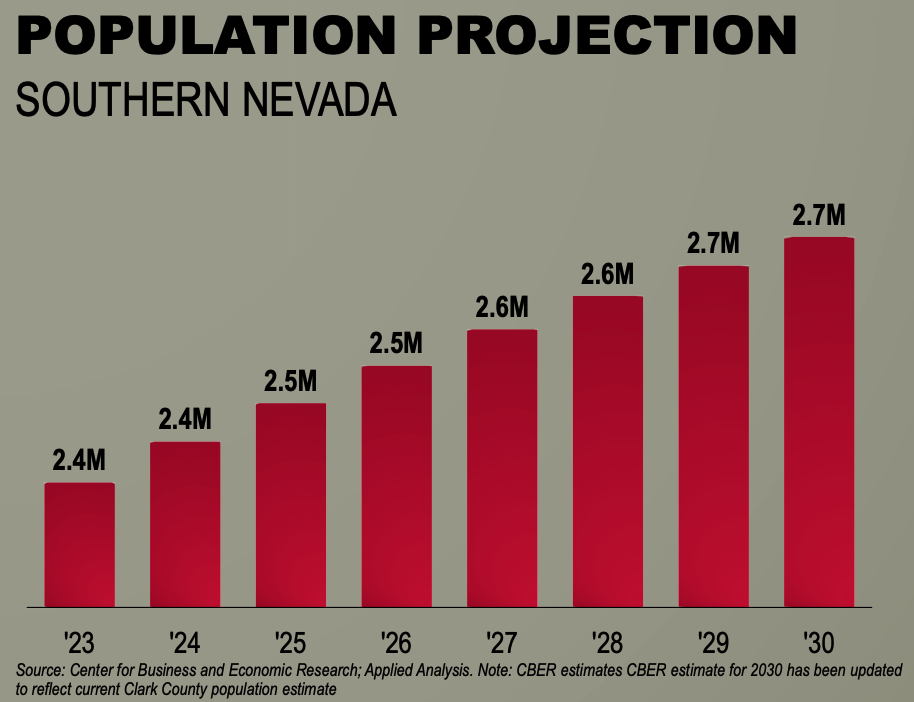

The population continues to increase at an average rate of about 2.3% per year and is projected to continue growing for the foreseeable future.

How has new home construction kept pace with population growth?

The current Clark County (Las Vegas metro) population is about 2.3M. The average population growth over the last 20+ years is 2.3%/Yr. If each residence accommodates 2.5 people, and 80% opts to buy or rent a single-family residence, the additional new homes needed in 2023 can be calculated as follows: 2.3M x 2.3% x 80% / 2.5, which is approximately 16,928. According to LVRdata.com, the number of new homes built in 2023 was 11,374. So, in 2023, metro Las Vegas fell further behind by 5,554 homes. The imbalance between the number of available residences and population growth is driving up prices and rents, a trend likely to continue for the foreseeable future.

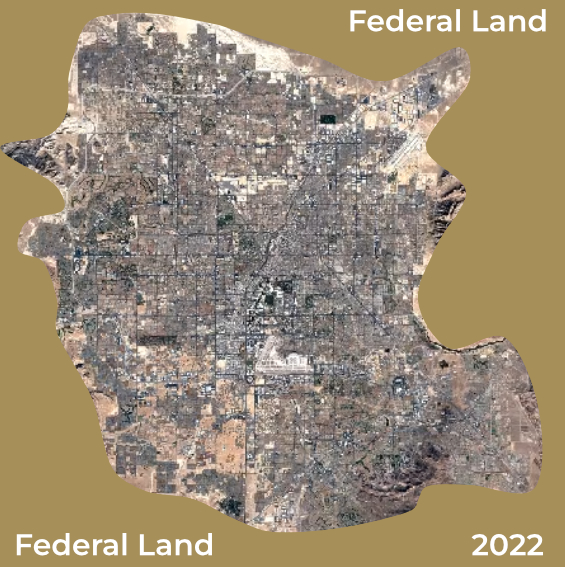

Constraints to Expansion

The scarcity of available raw land for expansion is a contributing factor to the continued increase in prices and rents. As you can see in the aerial view below, Las Vegas is a small island of private land surrounded by a vast expanse of federal land; 90% of Clark County and 85% of the entire state of Nevada is federally owned.

Most of the remaining undeveloped land is situated on the metro area’s outskirts and is less desirable. In more appealing areas, undeveloped land is above $1M per acre, resulting in the starting price of new homes over $550,000. Our target property segment lies between $320,000 and $475,000. As such, regardless of how many new homes are built, the inventory of homes within this price range remains largely unchanged.

Perfect Storm

Las Vegas presents an ideal situation for residential investors. The availability of jobs continues to attract people to the city, resulting in a rising population. Most jobs in Las Vegas are in infrastructure, paying between $60,000 to $85,000 per year. Many of these workers find the housing market too expensive and opt to rent instead. As such, the demand for rental properties continues to increase while the supply remains limited. I foresee continuous increases in prices and rents for the foreseeable future.

My Predictions

I believe the critical drivers for price and rent growth in 2024 will be interest rates and population growth.

I’ve discussed the population growth, which I anticipate will remain strong for the foreseeable future. Population growth will drive up prices and rents, and how fast prices and rents rise depends on interest rates.

Assuming interest rates remain stable, based on historical data plus my assessment of the current market and economic conditions, I expect the next 5-year average appreciation rate to be over 11% and the rent growth rate to be ~8%. Note that this is a five-year average. The appreciation and the rent growth rate could be higher or lower each year.

If interest rates drop meaningfully, I expect price and rent growth to accelerate.

If interest rates increase (as in 2023), based on how our segment performed in 2023, I expect modest to moderate appreciation and rent growth.

What About the Interest Rates?

In my blog post last week, I discussed my expectations for interest rates in 2024. I recommend reading the article for a detailed understanding, but here is a summary:

Uncertainty surrounds the interest rate trend for 2024. The Federal Reserve aims for a neutral policy with long-term interest rates much lower than the current 5.25%-5.5%. But despite decreasing inflation, there’s ambiguity about rate cuts due to strong GDP growth and stable low unemployment. Minimal interest rate changes in 2024 are likely. In Las Vegas, if mortgage rates drop, property prices will rise.

Risk Mitigation

Our clients invest in real estate to achieve financial freedom. Financial freedom is more than just replacing your existing income. It’s about maintaining your current lifestyle for as long as you live. To achieve this, you need a passive income source that meets three requirements to mitigate long-term risk:

-

Rents must outpace inflation. You will only have the necessary funds to maintain your standard of living throughout your life if rents outpace inflation.

Rents for our segment have increased on average by >8%/Yr since 2013.

-

Income persistence: Financial freedom requires that your income lasts throughout your life. Income persistence is dependent on not just current jobs but also future jobs.

How long your income will persist depends on the current and future jobs. As shown earlier in this paper, the number of jobs in Las Vegas continues to increase and will continue to do so for the foreseeable future.

-

Income dependability: The rental income must continue, even in bad economic times. Income dependability depends on the tenants who occupy your property.

The tenant segment we’ve targeted for 16+ years has proven to be very dependable.

- 2008 crash – Zero decline in rent and zero vacancies.

- COVID – Almost no impact

- Eviction moratorium – Almost no impact

- The average tenant stays over five years.

- Only six evictions in 16+ years out of a tenant population >1,000.

Summary

The perfect storm of rapid population growth and land shortage almost guarantees that Las Vegas prices and rents will continue to increase for the foreseeable future.

Many people remain concerned about interest rates. If you’re planning on purchasing investment properties in 2024 with financing, my advice is not to wait for potential future interest rate reductions. Instead, set a target interest rate, such as 6.25% or 6.5%, and aim to buy down the rate to meet your goal. In this scenario, changes in mortgage rates will only impact your rate buy-down cost. If you come across a property that offers good returns at your target interest rate, don’t hesitate to secure it. Later, if the interest rates decrease, you can refinance to improve cash flow. Waiting could result in higher costs for the same property.

A personal note:

Our goal is to provide you with the best information we can and be level-headed in our investor outlooks. We would appreciate it if you could let us know if you have corrections or recommendations.

Thank you for your time,

Eric Fernwood & Cleo Li

Potential Investment Properties

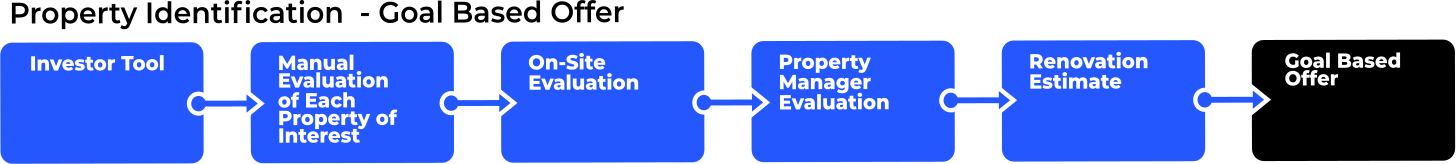

Below is a link to this month’s list of candidate investment properties. Our proprietary data mining software selected these candidate properties from thousands of available properties, and this is just the first step in our multi-step validation process, as shown below.

About the Fernwood Real Estate Investment Group

We Help Clients Acquire Highly Reliable Passive Income Streams

For the last 16+ years, we’ve helped clients build highly reliable, passive income streams through real estate that they will not outlive. Several are now retired and living entirely on their rental income. Most never invested in real estate before they started working with us, and most live in other states or countries. Below is a two-minute video of the services we provide.

Want to know what we can do for you?

© 2005-2023 Cleo Li and Eric Fernwood, all rights reserved.