November 2022 Market Report

- A 4-Step Process for Getting Off and Staying Off the Daily Worker Treadmill.

- Potential Investment Properties

- Market Trend

- About the Fernwood Real Estate Investment Group

- Schedule a discovery call with Eric Fernwood

When I talk to new clients, I hear how much they've lost in 2022. They wish they diversified with real estate sooner so that their capital and income were (more) secure. This month's article describes a 4-step process for investing in real estate so that you can get off (and stay off) the daily worker treadmill no matter the financial market condition. It starts with clarifying your specific goals.

Goals

Write down your goals. For example, if $10,000/Mo. will allow you to get off the treadmill today, write that down. Clear goals give you a yardstick by which you can evaluate decisions. If your goal is a dependable passive income that will get you off and keep you off the daily worker treadmill, the income must meet three requirements.

- Reliable - You continuously receive income in good and bad economic times.

- Inflation Compensating - Your rental income grows faster than inflation, compensating for rising prices.

- Persistent – The income continues for a long time; you and your spouse will not outlive the income.

All of the above are long-term passive income characteristics. All long-term income characteristics are determined by the location.

Location

The location determines all long-term income characteristics. The top location selection criteria are:

- Pre-COVID rents and prices rose faster than inflation. Dollar bills have no value by themselves. Dollar bills are only worth what you can get in exchange for them. Every time you go to the store, buying the same basket of goods takes more and more dollars. Unless rents increase faster than inflation, you won't have the additional dollars you need and will soon be back on the treadmill.

- Metro population greater than 1 million. Small towns may rely too much on a single business or market segment.

- Both state and city populations are increasing. Do not buy where state or city populations are static or decreasing.

- Low crime. People with sufficient income will move away from cities with high crime levels. Companies will not choose high-crime locations for new operations. Eliminate any city on Neighborhood Scout’s 100 most dangerous cities.

- Low operating costs. The two most obvious are property tax and insurance. High property taxes and insurance are a direct hit on cash flow.

Tenant Pool Segment

The only way to have a dependable passive income is if a dependable tenant continuously occupies the property. A dependable tenant is someone who:

- Has stable employment in a market segment that is very likely to be stable or improve over time

- Pays all the rent on schedule

- Takes care of the property

- Does not cause problems with neighbors

- Does not engage in illegal activities while on the property

- Stays for many years

Such tenants are the exception, not the norm. Most tenants in Las Vegas that meet all the above requirements are found in a single segment. This is probably true everywhere. We’ve targeted this segment for 15+ years. The results are -

- Our average tenant stays over five years.

- We've had five evictions in the last 15 years (over a thousand tenants).

- 2008 crash - Zero decline in rent and zero vacancies.

- COVID - Almost no impact

- Eviction moratorium - No impact

How do you target a specific segment? Through property manager interviews and other sources, determine the following for your target segment.

- Type - Condo, high rise, single-family, etc.

- Configuration - For example, 2,000SF, two bedrooms, three-car garage, large back yard, single-story, two stories, etc.

- Location - Where the target tenant pool wants to live.

- Rent Range - What your segment can afford. Usually, about 1/3 of the gross monthly household income of the median segment income.

- Wants - Attributes the segment values.

Once you define these property characteristics, searching for conforming properties is a straightforward task.

Important - Let the tenant segment you want to occupy your property define all property characteristics. You have no say in the property type or anything else if you want this segment to occupy your property.

Property

You determined all property characteristics when you selected a tenant pool segment. You can give this property description to any realtor, and they can find conforming properties.

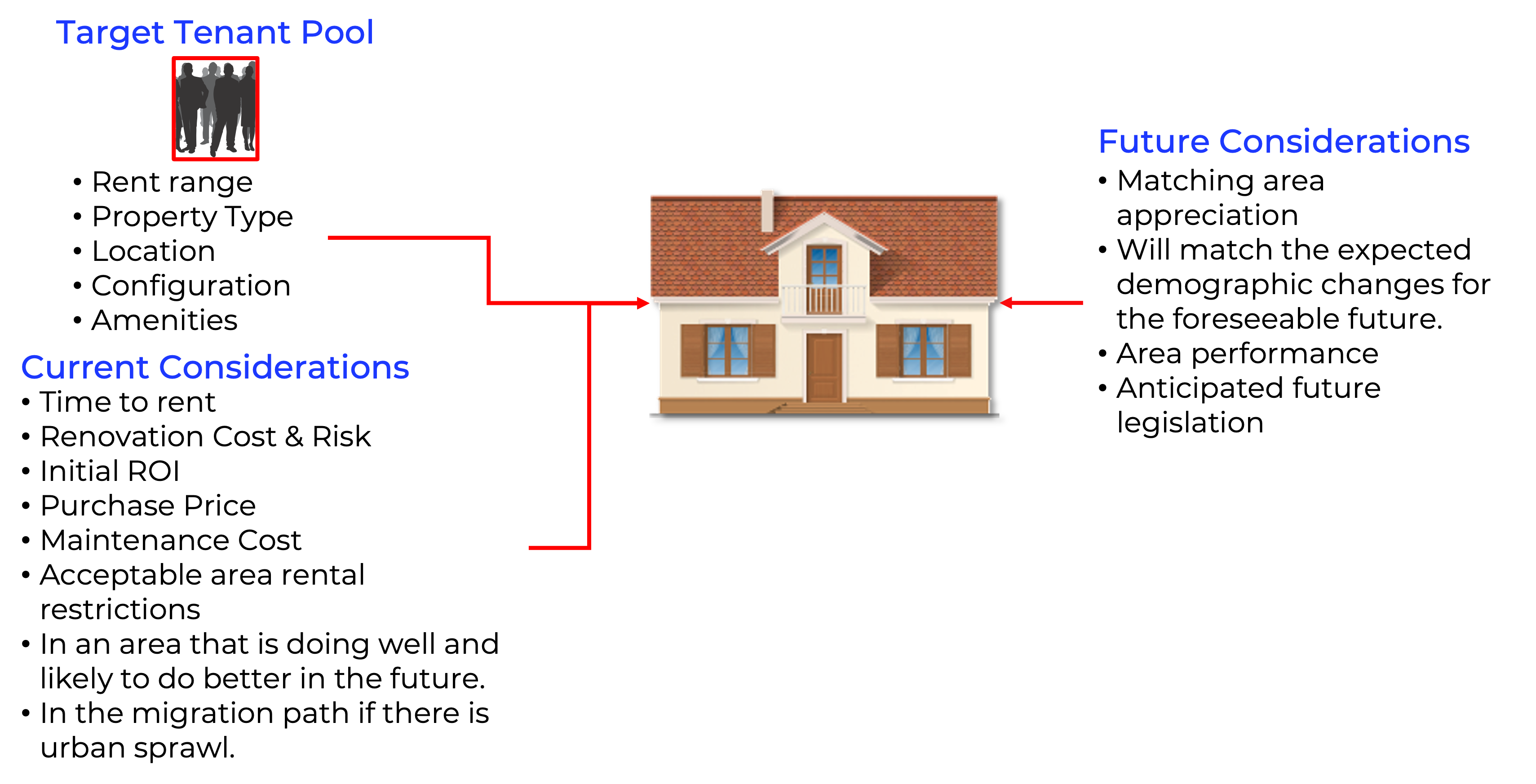

However, there are additional considerations, as illustrated below.

You will likely hold the property for as long as you live and then pass it to your children. Keep the long-term nature of real estate investing in mind when you make selection and renovation decisions.

This is the process that I followed to help multiple clients reach and maintain financial independence and many others on their way.

What do you think of this guide? As always, I welcome and appreciate your feedback.

To find out if my services are a fit for you, book a discovery Zoom call with me.

Below is a link to this month's list of candidate investment properties. Our proprietary data mining software selected these candidate properties from thousands of available properties, and this is just the first step in our multi-step validation process, as shown below.

> Note: Due to the rapid increase in interest rates, first-year returns are low. However, the return increases significantly even with a conservative 8% annual rent increase. The typical rent increase range is 8% to 12%. Contact me if you'd like detailed analysis for this subject.

Below are charts from our latest trailing 13 month market report, which includes October data. Remember that this data is only for the property profile that we target, not for the entire metro area. To see all the charts please click here.

|

Rental Statistics

|

Sales Statistics

|

|

Rentals - Median $/SF by Month

October rents were up from September. YoY rents are up 5%. We are in the slowest rental season of the year, and I expect rents to remain soft for the remainder of the year until after the first.

|

Sales - Median $/SF by Month

Prices saw another drop from September.

|

|

Rentals - List to Contract Days by Month

Median time to rent is about 24 days for October, still below pre-COVID days especially considering the season.

|

Sales - List to Contract Days by Month

Median days on market dropped from September. I attribute that to sellers cutting prices.

|

|

Rentals - Availability by Month

This chart shows the average daily number of properties that were for rent in a particular month. We are at about the pre-pandemic level.

|

Sales - Availability by Month

This chart shows the average daily number of properties that were for sale in a particular month. We are approaching the pre-pandemic level.

|

|

Rentals - Months of Supply

Still just a little over one month of supply for our target rental property profile. Demand is still greater than supply. This will push up the rent.

|

Sales - Months of Supply

Inventory is a little over 3 months for October. 6 months supply is considered a balanced market.

|

© Cleo Li and Eric Fernwood, all rights reserved.