In This Report

- Why Rents Are Falling in These Cities

- Potential Investment Properties

- Market Trends

- About the Fernwood Real Estate Investment Group

Why Rents Are Falling in These Cities

[Fort Meyers image generated with Dall-E]

A recent Biggerpockets blog (After Analyzing the Largest Rental Markets—Here’s Where Prices Could Fall) identified several cities where rents are expected to fall. In this post, I’ll explore what I believe to be the common thread linking these cities.

Before I continue, I want to explain what drives prices and rents.

Prices and rents are a function of supply and demand. With more buyers than sellers, prices rise until the number of buyers and sellers reaches equilibrium. Conversely, when more sellers than buyers exist, prices fall until they balance out.

Rents follow property prices. When prices or interest rates are high, fewer people are willing or able to buy homes, forcing them to rent. The increased demand for rentals drives rents up. Conversely, more people buy rather than rent when property prices are low. This decrease in demand results in decreasing rents.

What Do Cities with Falling Rents Share

The primary reasons for stagnant or declining prices and rents are stagnant or shrinking populations (soft demand) and or urban sprawl (unlimited supply). Urban sprawl—the unrestricted expansion of cities—leads to new properties competing with existing ones. Existing homes have only a slight price advantage when undeveloped land is cheap. Given a choice between old and new properties, most people opt for new ones, even at a higher cost.

Below are time-lapse aerial views of five cities mentioned in the article. These views demonstrate how these cities can continue to expand, adding excessive supplies and resulting in decreased rent.

- Fort Myers, FL −6.25% rent growth

- Phoenix, AZ −2.25% rent growth

- Atlanta, GA −1.36% rent growth

- San Antonio, TX −1.26% rent growth

- Jacksonville, FL −2.26% rent growth

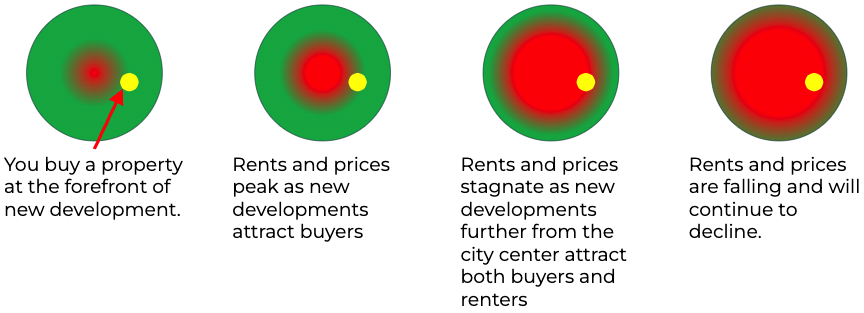

Due to the lack of geographical constraints on expansion in these cities, properties purchased in newly developing areas today may become part of secondary markets in the future. This cycle is illustrated below.

- The first image on the left shows a new property purchased in an up-and-coming area.

- The second image illustrates how rents and prices increase as development reaches the property.

- The third image depicts how the property becomes less desirable as the wave of development passes, causing rents and prices to stagnate compared to newer developments.

- In the fourth image, the wave of development has moved far beyond the property, leading to further declines in rents and prices. At this stage, the owner’s main option is to sell the existing property, acquire another in the path of new developments, and begin the cycle anew.

A more effective strategy is investing in cities with substantial, sustained population growth and limited expansion potential. Las Vegas exemplifies such a city, as illustrated below. Today, there is about 16,000 acres of undeveloped land in the entire valley. Historically, Las Vegas consumes 4,000 to 5,000 acres per year. And, with between $26B and $30B in development, the available land will soon be consumed.

With limited raw land for expansion, new developments will primarily involve redeveloping existing areas. As a result, rents and prices of properties you purchase today will likely continue increasing due to increasing demand from population growth while the housing supply remains relatively static.

Take the Long View

Demand drives prices and rents, primarily influenced by population changes and a city’s expansion potential. In cities with abundant, cheap land on the outskirts, newer properties cannibalize demand for existing ones. This scenario creates a challenging cycle for investors: they must either continually sell their current properties and reinvest in new development areas or face the prospect of stagnating—and eventually falling—rents and prices.

Potential Investment Properties

Below is a link to this month’s list of candidate investment properties. Our proprietary data mining software selected these candidate properties from thousands of available properties, and this is just the first step in our multi-step validation process, as shown below.

This Month’s List of Candidate Properties

Market Trend

Below are charts from our latest trailing 13-month market report, which includes August data. Remember that this data is only for our target property profile, not the entire metro area. To see all the charts, please click here.

We’re observing the typical seasonal slowdown in prices and rents that starts in July because fewer people are buying properties and moving as school resumes in mid-August.

Rentals – Median $/SF by Month

Rents had another slight drop MoM ($1.18/SF vs $1.19/SF). YoY is up 3.5%.

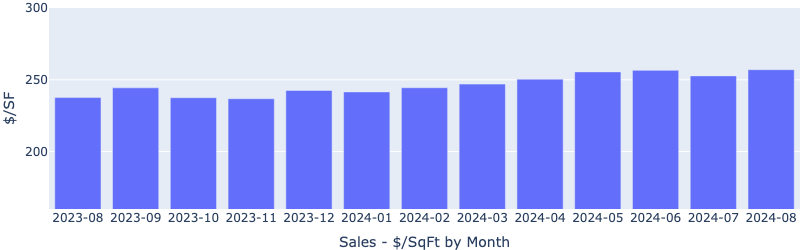

Sales – Median $/SF by Month

The $/SF increased MoM. YoY is up 8.5%.

Rentals – Median Time to Rent by Month

Median time to rent continued to increase MoM but still at a very reasonable 22 days. This conforms to the traditional seasonal trend.

Sales – List to Contract Days by Month

Median days on the market also increased MoM, now at 23 days, conforming to the seasonal trend.

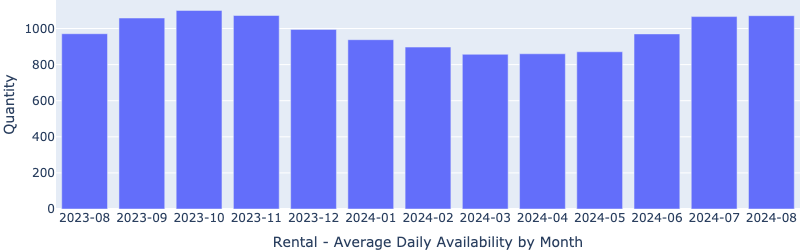

Rentals – Availability by Month

The number of homes for rent remained flat MoM, YoY increased ~8%.

Sales – Availability by Month

This chart shows the average daily number of properties for sale in a particular month. We are also seeing a slight increase MoM.

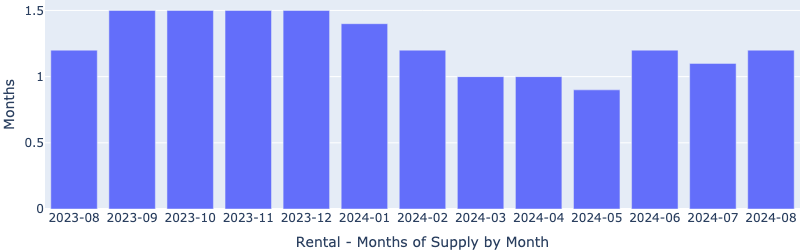

Rentals – Months of Supply

About 1.2 months of supply for our target rental property profile. YoY is flat. Demand is greater than supply. This will pressure up the rents.

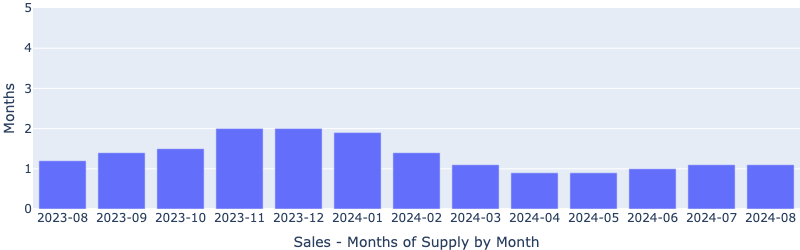

Sales – Months of Supply

There is just above one month of supply for our target property profile. YoY has a slight drop. A 6 months supply is considered a balanced market. This will continue to drive up the prices.

The sales and rental markets in Q3 slowed down compared to the hot Q2. However, given the low inventory level (about one month), we do not expect prices and rents to start a downward trajectory; rather, we are seeing a traditional seasonal slowdown.

About the Fernwood Real Estate Investment Group

We Help Clients Acquire Highly Reliable Passive Income Streams

Here is what our clients have to say about us:

For the last 17+ years, we’ve helped clients build highly reliable, passive income streams through real estate that they will not outlive. Several are now retired and living entirely on their rental income. Most never invested in real estate before they started working with us, and most live in other states or countries. Below is a two-minute video of the services we provide.

Want to know what we can do for you?

© 2005-2024 Cleo Li and Eric Fernwood, all rights reserved.