In This Report

- Successful Real Estate Investing Is Not About Properties

- Potential Investment Properties

- Market Trends

- About the Fernwood Real Estate Investment Group

Successful Real Estate Investing Is Not About Properties

Almost everything I read online is about buying properties and getting a “deal.” However, this is the wrong focus if your goal is to achieve financial independence through real estate, and I can easily prove it.

Properties do not pay rent; the tenant who occupies the property pays the rent. The purpose of the property is to attract reliable tenants. A reliable tenant stays many years, takes good care of the property, and pays the rent on schedule. You will not achieve a reliable income unless a reliable tenant continuously occupies your property.

Tenant Segment and Properties

The renter population is not homogeneous; it consists of various segments with unique housing requirements. For example, single people are more likely to rent one-bedroom condos, whereas a family of four is more likely to rent a single-family home in the suburbs and not one-bedroom condos.

It is important to understand that a person is unlikely to rent a property unless it meets all their housing requirements. For example, below is a segment with a specific housing requirement, and on the right are four properties for rent. However, only one of the four properties will be considered by this tenant segment; the others will be eliminated and not be considered.

The takeaway is that a tenant segment will only rent properties that match all their requirements. The corollary is also true: every property matches the housing requirement of a single tenant segment, and you can not change this. So, before you buy a property, you need to understand the tenant segment who will occupy it.

The Right Approach

The property is just a tool to attract a reliable tenant, so the property type doesn’t matter. To maximize your chances of always having a reliable tenant, identify a tenant segment with a high percentage of reliable individuals. You can easily determine the best property for income reliability in Cleveland, Kathmandu, Bangkok, Las Vegas, or Atlanta. How?

Ask multiple local property managers the following question: If you wanted to buy a property with the highest probability of attracting tenants who stay many years, pay the rent on schedule, and take good care of the property, what would you buy? Chances are most will point to the same properties. This is my experience.

When I first moved to Las Vegas, I studied ten years of MLS rental data. From this data, I identified subdivisions where the average tenant stay was over five years. To verify these were the right properties, I asked several property managers what they would buy. Almost all pointed to the same properties I found through my research.

Once I knew which properties attracted this tenant segment, I bought properties similar to what they were renting.

I did not presume to know the property type, configuration, location, or rent range. None of this matters; what matters is what your target tenant segment is willing and able to rent. Also, this process will likely result in different property types, configurations, and locations in each city. In one city, it could be multi-family. In another, it could be townhomes or condos. In another, it could be single-family homes. My point is that since the only purpose of buying a rental property is the income it produces, you only care about income reliability.

Summary

If you buy properties based on others’ recommendations, your chances of having a reliable income are much lower than if you first identify the tenant segment you want and buy what they are willing and able to rent. Do you think a national chain selects store locations based on the opinion of someone on the internet? No. They know their target customer’s demographics and buy in a location where that demographic is located.

Follow what national retail store chains do: buy what your “customer” wants, not what you want.

Potential Investment Properties

Below is a link to this month’s list of candidate investment properties. Our proprietary data mining software selected these candidate properties from thousands of available properties, and this is just the first step in our multi-step validation process, as shown below.

This Month’s List of Candidate Properties

Market Trend

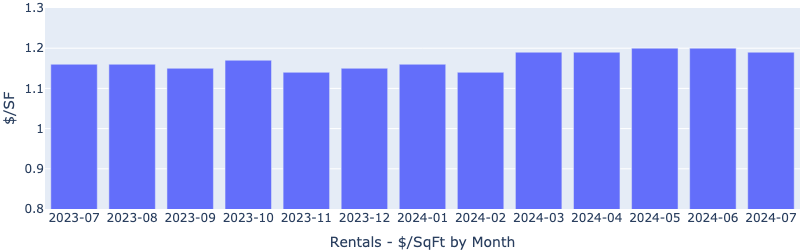

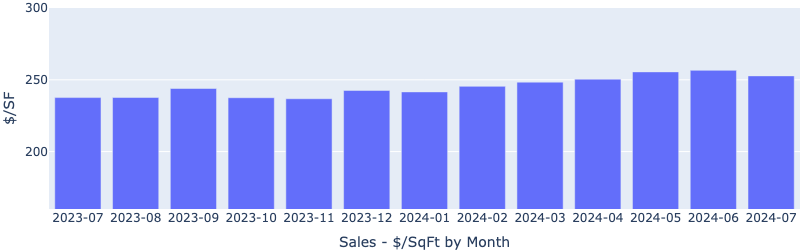

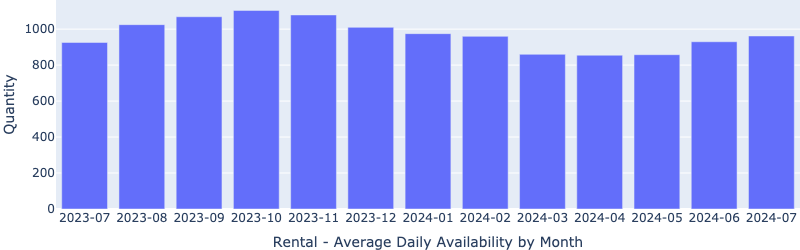

Below are charts from our latest trailing 13-month market report, which includes July data. Remember that this data is only for our target property profile, not the entire metro area. To see all the charts, please click here.

We’re observing the typical seasonal slowdown in prices and rents that starts in July because fewer people are buying properties and moving as school resumes in mid-August.

Rentals – Median $/SF by Month

Rents had a slight drop MoM ($1.19/SF vs $1.20/SF). YoY is up 2.6%.

Sales – Median $/SF by Month

The $/SF also had a slight drop MoM. YoY is up 6.7%.

Rentals – Median Time to Rent by Month

Median time to rent increased compared to April, May, and June, but is still at 20 days. YoY is flat.

Sales – List to Contract Days by Month

Median days on the market is also showing a slow uptrend, indicating the market is slowing down slightly compared to the peak home sale season of Q1 and Q2.

Rentals – Availability by Month

The number of homes for rent increased slightly MoM, conforming to the seasonal trend (school starting).

Sales – Availability by Month

This chart shows the average daily number of properties for sale in a particular month. We are also seeing a slight increase MoM.

Rentals – Months of Supply

About one month of supply for our target rental property profile. YoY is down 23%. Demand is greater than supply. This will pressure up the rents.

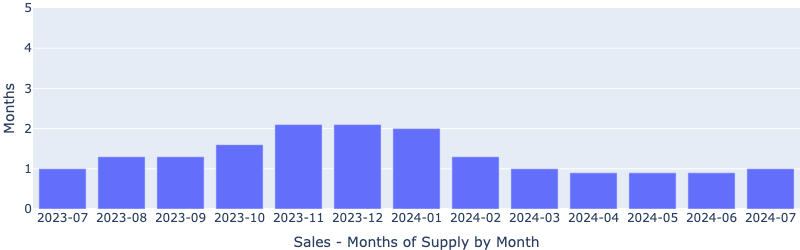

Sales – Months of Supply

There is one month of supply for our target property profile. YoY is flat. A 6 months supply is considered a balanced market. This will continue to drive up the prices.

As we suspected in our mid-year market check-in last month, July did see a slight slowdown of the market compared to the hot Q2. However, given the low inventory level (one month), we do not expect prices and rents to fall on a year-over-year level, although we may see a traditional seasonal slowdown.

About the Fernwood Real Estate Investment Group

We Help Clients Acquire Highly Reliable Passive Income Streams

Here is what some of our clients have to say about us:

For the last 16+ years, we’ve helped clients build highly reliable, passive income streams through real estate that they will not outlive. Several are now retired and living entirely on their rental income. Most never invested in real estate before they started working with us, and most live in other states or countries. Below is a two-minute video of the services we provide.

Want to know what we can do for you?

© 2005-2024 Cleo Li and Eric Fernwood, all rights reserved.