In This Report

- How Our Clients Are Dealing With High Interest Rates

- Potential Investment Properties

- Market Trend

- About the Fernwood Real Estate Investment Group

How Our Clients Are Dealing With High Interest Rates

I’m very fortunate to work with an incredibly smart group of investors. I learn a lot from their analytical skills and insights into the economy and markets.

Recently, I’ve talked to multiple clients about their investment strategies. The dominant approach today is to buy the property (or multiple properties) now instead of waiting, even if the cash flow is initially negative. When interest rates fall, refinance.

Prices and Rents Will Rise

As you may have read in our 2024 Las Vegas Investor Outlook, we expect rents and prices to increase significantly. Rising demand for housing is driven by land shortage and population growth. Jobs drive population growth. Some recent examples of job growth in Las Vegas:

- The last job fair had over 20,000 open positions.

- $1.8B Sony movie studio backed by Mark Wahlberg approved for Summerlin – Projected to create thousands of new jobs.

- How North Las Vegas is becoming an industrial powerhouse

- Depending on the study, there is between $26B and $30B in new construction or planning. This will create thousands of future jobs.

Every new job will result in additional demand for housing, and there is little room to add more housing.

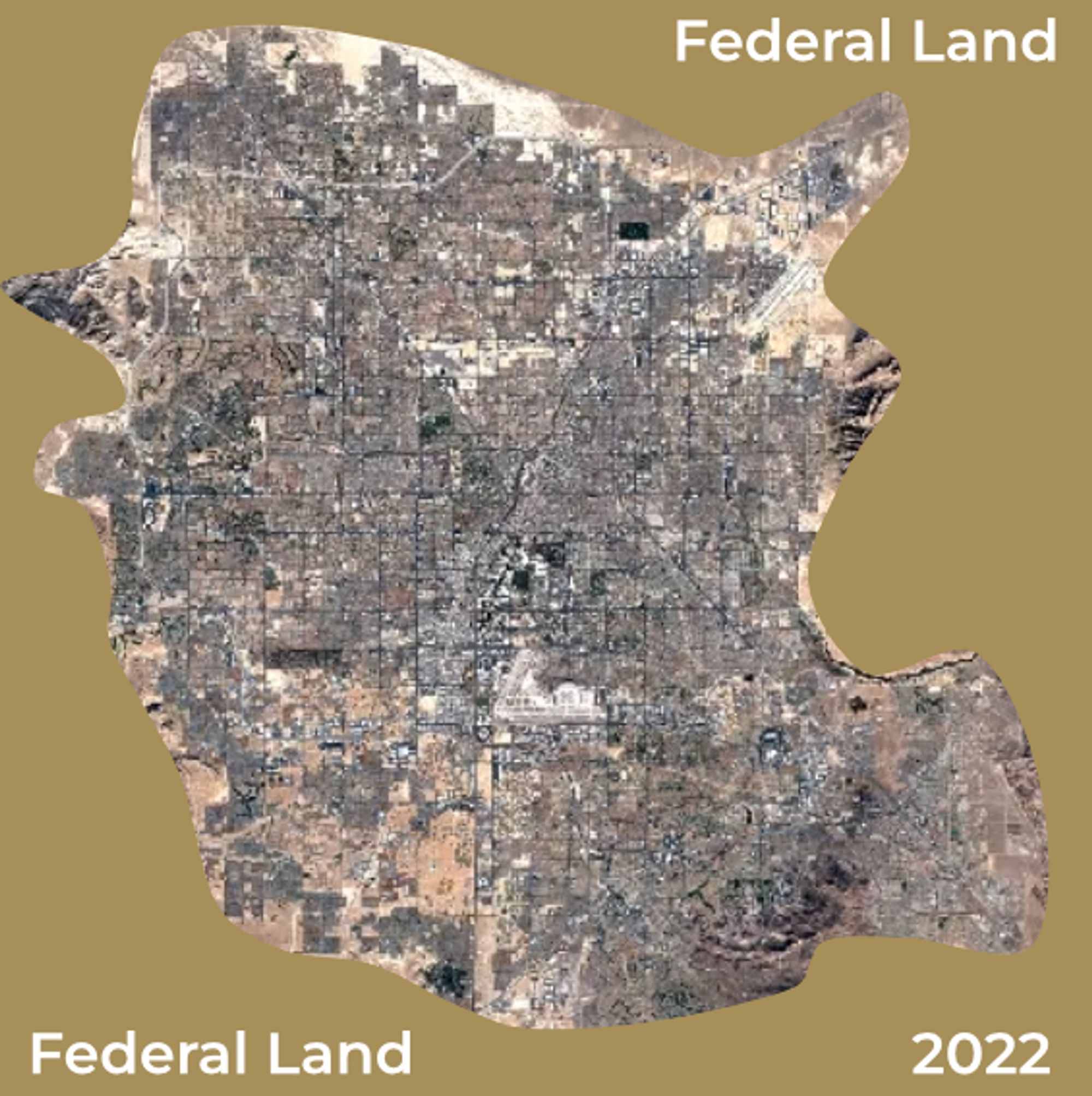

Below is a map showing available land in the Las Vegas Valley. As you can see, there is very little undeveloped land available.

While nothing is guaranteed, the combination of population growth and limited land for expansion virtually assures that prices and rents will continue to increase.

Buying Now

With current interest rates, it isn’t easy to find an initially positive cash flow property. However, our clients are buying today to take advantage of rising prices and rents and refinancing in the future when interest rates fall. To put this into perspective, I will compare the cost of waiting for one or two years instead of buying now.

Assumptions

- Interest rates remain at 7.5% over the next two years with a 30% down payment.

- The appreciation rate will be 8%/Yr, which I believe to be conservative. In addition to prices being driven by population growth, people waiting to buy a home for the last two years will enter the market as soon as interest rates start to decrease, resulting in prices rising even more rapidly.

- Rent will increase by 8%/Yr. I believe this to be a conservative rate because as prices rise, rents follow.

- I assumed an initial rent of $2,000/Mo for the example.

Purchasing today:

- I assumed a $400,000 purchase price, and a 30% down payment ($120,000.) So, the debt service will be $1,958/Mo.

If you wait one year:

- Purchase price: $430,000

- 30% down payment: $129,000, an increase of $9,600.

- The interest rate will need to decline to 6.7% to have the same debt service as buying in the initial year. Will it be at 6.7% in one year? It’s possible, but no one knows.

- Regardless of the interest rate in one year, you will have paid $9,600 more for the down payment (or $800/Mo., likely more than any negative cash flow if you purchased it in the initial year) and lost $30,000 in equity growth.

If you wait two years:

- Purchase price: $466,560

- 30% down payment: $139,968, an increase of $19,968

- To have the same debt service as the initial year, the interest rate will need to decline to 6.0%.

- Regardless of the interest rate in two years, you will have paid $19,968 more for the down payment (or the equivalent of $832/Mo. for two years, likely much more than any negative cash flow if you purchased it in the initial year) and lost $66,560 in equity growth.

In summary, waiting to buy will cost you more.

What happens if interest rates remain high indefinitely? Inventory (supply) will remain suppressed, and the imbalance between demand and supply will persist, resulting in prices and rents continuing to increase. Therefore, it’s not a question of if but when the property turns cash flow positive. Additionally, you will continue to build your equity.

Can I Buy in a Location That Can Cash Flow in the Initial Year?

Absolutely. There are places where prices have been stagnant or fallen for years. You will likely find cash flow-positive properties in declining cities (Detroit, Birmingham, Cleveland, etc.). However, rents and prices have been and will likely remain almost stagnant. There are no growth drivers due to the declining population.

If you hold properties in these stagnant or minimal growth markets, you can not expect equity or rent growth. Your only return would be the monthly cash flow. Due to inflation, the buying power of the cash flow you receive will decrease every month. Over the course of just 3-5 years, the performance of your capital deployed in these markets will significantly lag behind if it was deployed in a high-growth but still reasonably priced city such as Las Vegas.

When you invest in real estate in a city, you tie your financial future to that city’s economic prospect and the land supply. Select a growing city with a diminishing land supply, like Las Vegas, if you want your real estate investment to flourish.

As always, I welcome and appreciate your feedback.

Potential Investment Properties

Below is a link to this month’s list of candidate investment properties. Our proprietary data mining software selected these candidate properties from thousands of available properties, and this is just the first step in our multi-step validation process, as shown below.

Market Trend

Below are charts from our latest trailing 13-month market report, which includes February data. Remember that this data is only for our target property profile, not the entire metro area. To see all the charts, please click here.

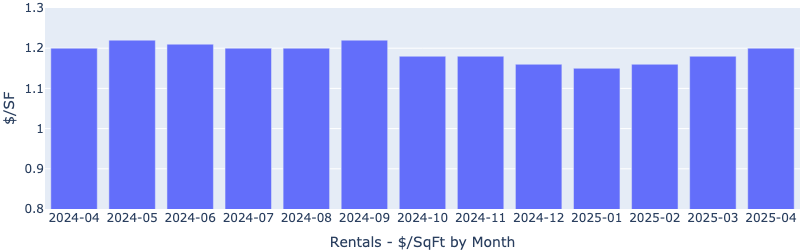

Rentals – Median $/SF by Month

$/SF showed a slight drop MoM, which is surprising considering the decreasing rental inventory and time to rent. YoY is up 4.5%.

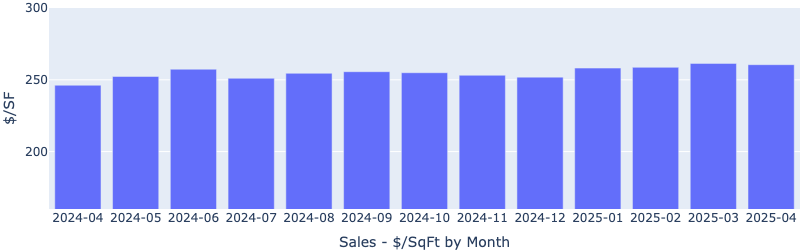

Sales – Median $/SF by Month

Despite persistently high interest rates, the $/SF continued to climb, up 7.1% Year over Year.

Rentals – Median Time to Rent by Month

Median time to rent continued to fall after the holiday season, now at 24 days, showing a heating up rental market. YoY is down 4%.

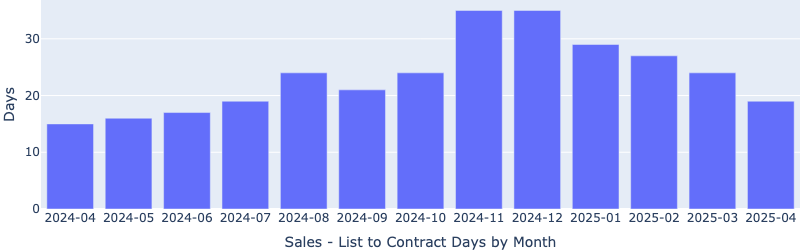

Sales – List to Contract Days by Month

Median days on the market dropped to 20 days for February, showing a heating-up market. YoY is down more than 40%!

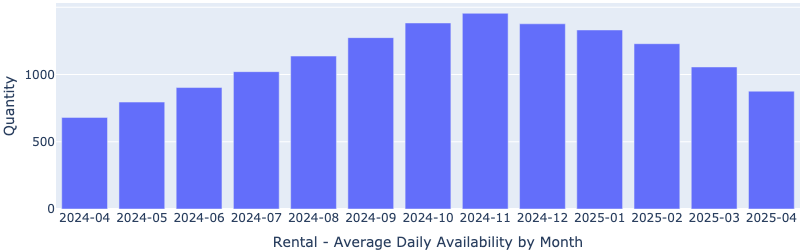

Rentals – Availability by Month

The number of homes for rent continued the downward trend. YoY is down 16.7%.

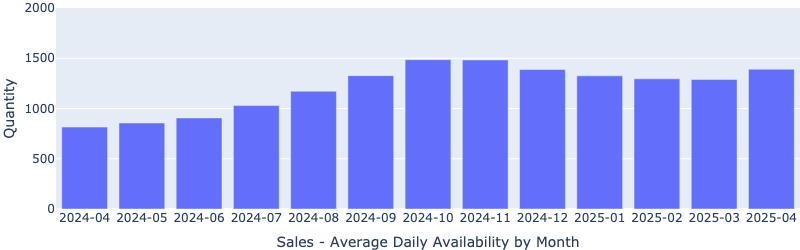

Sales – Availability by Month

This chart shows the average daily number of properties for sale in a particular month. February saw another big drop. YoY is down 58%!

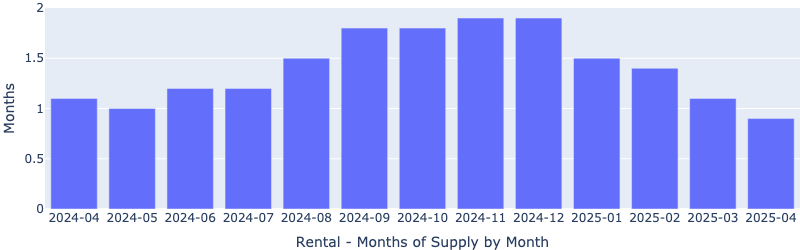

Rentals – Months of Supply

Only one month of supply for our target rental property profile. YoY is down 33%! Demand is greater than supply. This will pressure up the rents.

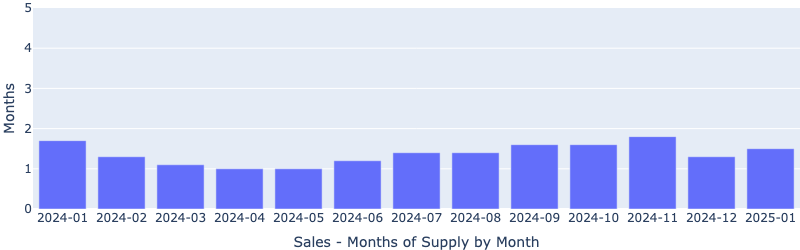

Sales – Months of Supply

There are just about 0.9 months of supply for our target property profile. A 6 months supply is considered a balanced market. This will continue to drive up the prices.

About the Fernwood Real Estate Investment Group

We Help Clients Acquire Highly Reliable Passive Income Streams

For the last 16+ years, we’ve helped clients build highly reliable, passive income streams through real estate that they will not outlive. Several are now retired and living entirely on their rental income. Most never invested in real estate before they started working with us, and most live in other states or countries. Below is a two-minute video of the services we provide.

Want to know what we can do for you?

© 2005-2024 Cleo Li and Eric Fernwood, all rights reserved.