In This Report

- Q1 2024 Las Vegas Market Update

- Potential Investment Properties

- Market Trends

- About the Fernwood Real Estate Investment Group

Q1 2024 Las Vegas Market Update

Please note that the following applies only to our target property segment, not the entire Las Vegas metro. Click here to see the property profile we target.

How’s the Market Doing?

It is hot and getting hotter

The market is heating up, evidenced by shrinking days on the market for both sales and rentals. See the graphs below. Notice the significant decrease of days on the market YoY, 15% for rentals and 47% for sales!

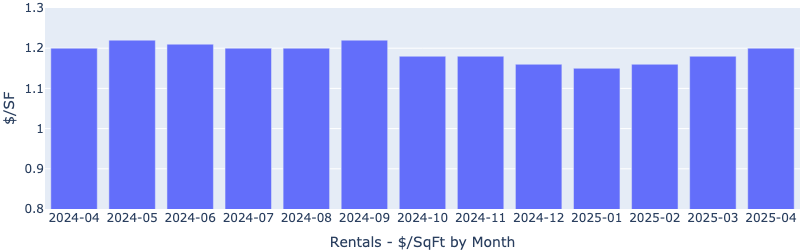

Sales – List to Contract Days by Month

The number of days on the market is decreasing rapidly in 2024, driven by limited inventory and strong demand.

Rentals – List to Contract Days by Month

The same trend is true for rentals. Rental trends tend to follow sales. When prices are high, more people are forced to rent, which results in increased demand and rising rents.

The above charts show data through March 2024. Our participation in the market in April tells us that April is hotter than March. Our clients currently hunting in the market know how fast good properties are selling and how competitive they are. Those who recently put their properties on the rental market were delighted with how quickly they rented out. So when next month’s stats are out, I expect to see a continuing decrease in the days on the market for both sales and rentals.

Inventory has been frustratingly low and is getting worse

Sales inventory had stayed low throughout 2023 and has plummeted in 2024.

Inventory in March dropped to only 0.5 months, less than half of that a year ago! The last time we saw a 0.5-month inventory was during the crazed COVID days.

Even the rental inventory is decreasing rapidly in 2024.

The rapidly shrinking inventory for both sales and rentals can only mean one thing—rising prices and rents. This is already showing in March data, and I expect to see more price and rent increases in next month’s stats.

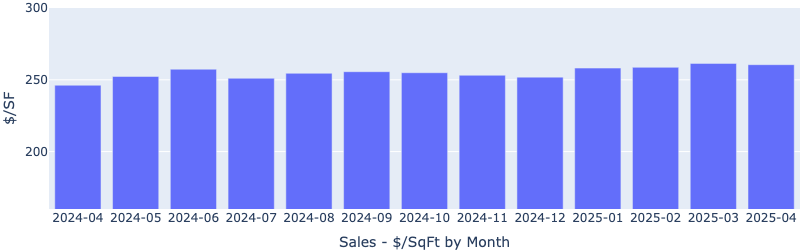

Sales – $/SqFt by Month

Rentals – $/SqFt by Month

For landlords, this is wonderful – rising property values and increasing monthly cash flow. Good time to expand your portfolio. If you don’t own an investment property in Las Vegas yet and have been thinking about it, now would be a good time to act, as the longer you wait, the higher the prices you will need to pay. Las Vegas properties will remain excellent investments for the foreseeable future due to the sustained economic and population growth. Still, it is always better to acquire an asset at a lower price.

Where Will the Market Go for the Remainder of the Year?

Where the market goes from here depends on two words:

Interest rates

If interest rates increase by 1% or more, I expect the market to cool down correspondingly. The number of homes available will likely remain stable, but the pool of buyers will shrink in line with the rise in interest rates. This could result in moderate to negligible increases in prices and rents, depending on the exact interest rate levels. However, given the recent announcement by the Fed to cut interest rates by a total of 0.75% in 2024 and the stable state of inflation, it seems unlikely that interest rates will see a significant increase for the remainder of 2024.

If interest rates drop by 1% or more, I KNOW the market will switch to hypergear. Although more homes may enter the market, even more buyers will emerge, driving up prices, similar to what we saw during the COVID frenzy. However, with inflation still exceeding the Fed’s target and the GDP and unemployment rate showing positive signs, there’s little incentive for the Fed to cut interest rates aggressively. Doing so could risk letting inflation spiral out of control again. Therefore, I believe the chance of a significant interest rate drop in 2024 is low.

The most likely scenario is that the interest rates will remain stable at their current levels throughout 2024, with minor fluctuations. In this scenario, I expect the current inventory level to be the main price and rent driver. At 0.5 months for sales and 0.8 months for rentals, I expect a strong, but not extreme, growth in prices and rents, which means a 10-15% increase in prices and a 6-8% rise in rents for the year, inline with our 2024 Investor Outlook.

Summary

The investment market in Las Vegas is experiencing strong growth and is expected to continue the trend as long as the interest rate does not increase significantly.

Potential Investment Properties

Below is a link to this month’s list of candidate investment properties. Our proprietary data mining software selected these candidate properties from thousands of available properties, and this is just the first step in our multi-step validation process, as shown below.

This Month’s List of Candidate Properties

Market Trend

Below are charts from our latest trailing 13-month market report, which includes March data. Remember that this data is only for our target property profile, not the entire metro area. To see all the charts, please click here.

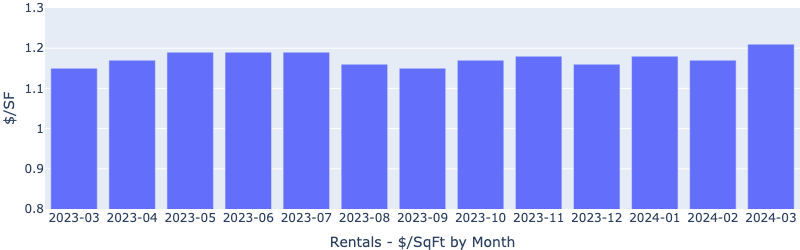

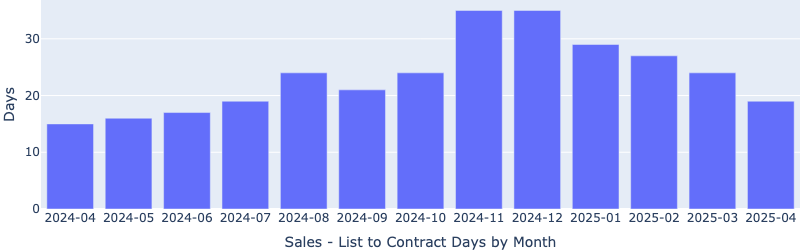

Rentals – Median $/SF by Month

$/SF jumped up in March, now at the highest level in the last 13 months. YoY is up 5.2%.

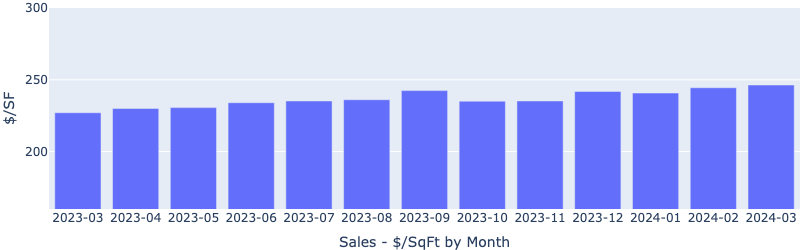

Sales – Median $/SF by Month

Despite persistently high interest rates, the $/SF continued to climb, up 10.3% Year over Year.

Rentals – Median Time to Rent by Month

Median time to rent continued to fall after the holiday season, now at 21 days, showing a heating up rental market. YoY is down 12.5%.

Sales – List to Contract Days by Month

Median days on the market continued to drop rapidly, showing a heating-up market. YoY is down more than 46.7%!

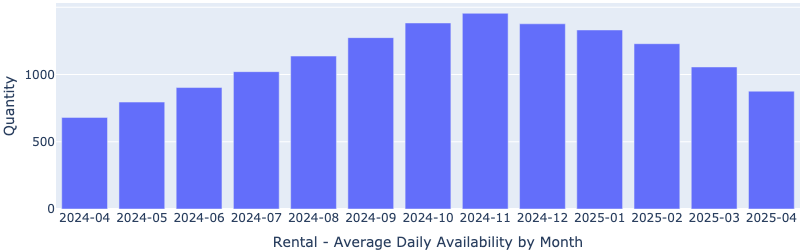

Rentals – Availability by Month

The number of homes for rent continued the downward trend. YoY is down 12.5%.

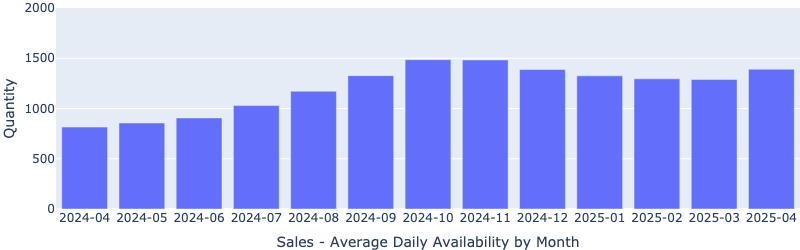

Sales – Availability by Month

This chart shows the average daily number of properties for sale in a particular month. YoY is down 45%!

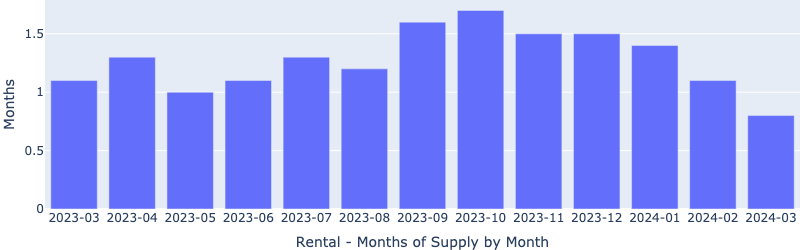

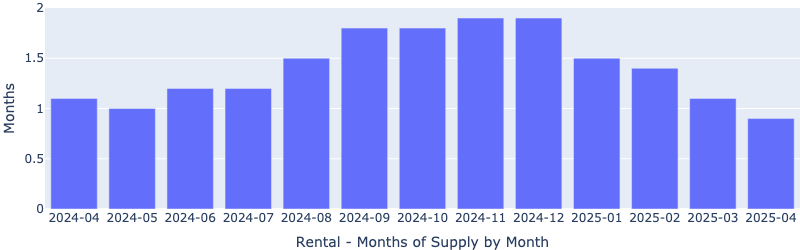

Rentals – Months of Supply

Only about 0.8 months of supply for our target rental property profile. YoY is down 27%! Demand is greater than supply. This will pressure up the rents.

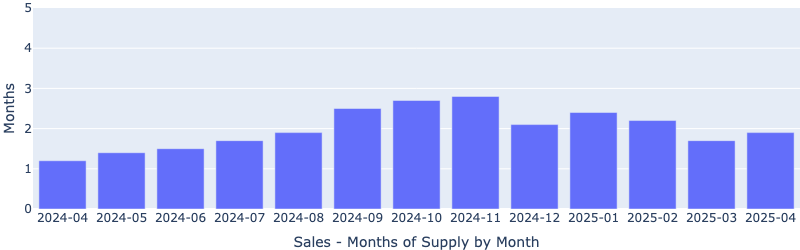

Sales – Months of Supply

There are just 0.5 months of supply for our target property profile. YoY is down 54.5%! A 6 months supply is considered a balanced market. This will continue to drive up the prices.

About the Fernwood Real Estate Investment Group

We Help Clients Acquire Highly Reliable Passive Income Streams

For the last 16+ years, we’ve helped clients build highly reliable, passive income streams through real estate that they will not outlive. Several are now retired and living entirely on their rental income. Most never invested in real estate before they started working with us, and most live in other states or countries. Below is a two-minute video of the services we provide.

Want to know what we can do for you?

© 2005-2024 Cleo Li and Eric Fernwood, all rights reserved.