In This Report

- Is Multi-Family a Better Investment Than Single-Family?

- Potential Investment Properties

- Market Trend

- About the Fernwood Real Estate Investment Group

Is Multi-Family a Better Investment Than Single-Family?

A question I frequently receive is, “Is multi-family a better investment than single-family?” In this article, you will learn why my answer is, “It depends.”

What’s the Goal?

What is the goal of real estate investing?

It’s financial freedom; it is not to own a specific property type to meet someone else’s opinion.

Financial freedom is more than just replacing your existing income. It’s about maintaining your current lifestyle for as long as you live. To achieve this, you need passive income that meets three requirements:

- Rents must outpace inflation: If rents do not outpace inflation, no matter how many properties you own, you cannot achieve financial freedom because inflation is continuously eroding purchasing power. This depends on the housing supply and demand trend of the city where you invest.

- Income persistence: Financial freedom requires that your income lasts throughout your life. This is dependent on the economic health of the city where you invest.

- Income reliability: Income reliability depends on the tenant who occupies the property.

The Property Defines Its Tenant Segment

The population of people who rent is comprised of many different segments. Each segment has different behavioral characteristics and housing requirements. You target a specific segment by buying properties that match the housing requirements of the segment you want to occupy your property. For example, below is an illustration showing the housing requirements of a tenant segment (for example, families with elementary school children) and a property that matches their housing requirements.

The opposite is also true. Each property matches the housing requirement of only a single tenant segment. Thus, when you purchase a property, the segment of tenants that will occupy your property is predetermined and cannot be altered. This is why identifying the segment you want to occupy your property and buying properties that match their housing requirements is critical for income reliability.

To show the difference the tenant segment makes on net income, I will compare the financial performance of a typical 4-plex in Las Vegas to the typical properties we target over a ten-year period.

Typical 4-Plex Characteristics

Note: The property cost and rent came from averaging the 36 4-plexes for sale on 01/31/2024. The typical in-between tenant renovation costs came from property managers who specialize in multi-family properties.

Almost all multi-family properties in Las Vegas were built before 1986 and are located in distressed areas. The typical tenant stays less than one year, and the time to renovate and re-rent is three months. The typical cost for the in-between tenant renovation is $2,000. The typical unit rent is $800/Mo to $900/Mo. The typical price for a 4-plex in reasonable condition is $650,000 to $700,000.

Assuming a one-year tenant stay, the unit is vacant three months out of every fifteen months. Assuming a higher-end $900/Mo rent:

- Gross 10-year rent: $900 x 4 units x 12 Mo x 10 Yrs = $432,000

- Lost Rent due to vacancy: Gross 10-year rent x (3 Mo Vacant / 15 Mos) ≈ $86,400

- Number of tenant turns per unit over 10 years: 10 Yrs / 15 Mos = 8 turns

- The number of tenant turns over 10 years for the 4-plex: 8 turns x 4 units ≈ 32 turns

- Renovation cost for 32 turns: $2,000/turn x 32 turns = $64,000

- I will ignore all other costs to keep the example simple.

- Net 10-year rent: $432,000 – $86,400 – $64,000 = $281,600

Despite the 4-plex having a much higher paper cash flow ($432,000), the actual cash flow ($281,600) is significantly less due to the frequent tenant turns.

Our Single Family Target Property Characteristics

Out of our population of over 500 properties, the average tenant stays for more than five years. The typical in-between tenant renovation cost is $500. The time to renovate and re-rent is one month. For the property segment we target, $700,000 can get you two properties. The typical rent for such a property is $1,800-$1900/Mo; I will assume an average of $1850/Mo rent:

- Gross 10-year rent: $1,850 x 2 units x 12 Mo x 10 Yrs = $444,000

- Lost Rent due to vacancy: Gross 10-year rent x (1 Mo Vacant / (5 Yrs x 12 Mos)) ≈ $7,400

- The number of tenant turns over ten years for the two units: 2 turns x 2 units = 4 turns

- Renovation cost for 4 turns: ≈ 4 turns x $500/turn = $2,000

- I will ignore all other costs to keep the example simple.

- Net 10-year rent: $444,000 – $7,400 – $2,000 = $434,600

The net rent from the two properties is significantly higher due to long tenant stays.

Here’s why adhering to the dogma of people on websites can be costly. Real estate is a local matter, not a national one. There are no “one-size-fits-all” recommendations applicable to all cities. It’s your money, so you need to conduct your own due diligence.

Other Considerations

- Low-income reliability: The tenant segment that occupies multi-family housing in Las Vegas primarily consists of near-minimum-wage workers. They are typically the first to be laid off and the last to be rehired during economic downturns. During the 2008 financial crash, many multi-family properties were vacant and boarded up. Many were foreclosed upon. In comparison, our clients had zero decrease in rent and zero vacancies during the same period. The difference was due to the different tenant segments the properties attracted.

- Rent growth: Rents are tied to income. The income of low-income workers is linked to the minimum wage. Therefore, unless the minimum wage rises, it’s unlikely that rents in multi-family properties can be increased. For the segment we’ve targeted, rents have increased by >8%/Yr since 2013.

- Inability to screen out bad tenants: The people who occupy multi-family homes in Las Vegas typically live cash-based lives. Because they live cash-based lives, there is little financial history to evaluate them for payment performance. According to one property manager, any financial history they have is likely to be bad. She described her screening process for multi-family properties as: “If they have two pay stubs and enough cash to pay one month’s rent, they are in.”

- Leases mean little to cash-based tenants: Minimum wage workers tend to have few possessions, so if there is an issue, they put their possessions on the back of a pickup and go down the street to the next property.

Few minimum-wage workers have credit cards or even a checking account. So, if they skip on a lease or get a damage judgment against them, there is little you can do to collect. The tenant segment we target is credit-based, and they understand that even a late rent payment will show up on their credit and will have long-term negative effects. This is part of the reason we’ve had only six evictions out of a tenant population of over 1,000 in the last 16 years.

Summary

Is multi-family always the right answer? It depends on your goal and the tenant segment the property attracts.

My first investment property was a multi-family in Houston. On paper, it was a cash cow. In reality, due to non-performing tenants, evictions, damage, and other costs, I lost money every year. My cash cow was actually a money pit.

I next bought two 4-plexes in a suburb of Atlanta. They performed well, and there were few issues.

The difference was the tenant segments the properties attracted. The Houston property was a C (D?) Class with near minimum wage cash-based tenants. The Atlanta properties were B+ Class, and the tenant segment was credit-based and earned significantly more than minimum wage.

The type of property is irrelevant. Choose one that attracts a tenant segment with a high concentration of reliable tenants. In Las Vegas, the properties that attract the tenant segment with the highest concentration of reliable people are single-family homes with specific characteristics.

Buy the type of property that helps you reach your financial goals; don’t follow others’ opinions.

We’ve helped more than 180 clients on their path to financial freedom. Many have already made it. If you would like to discuss what we can do for you, please schedule a Zoom chat. I promise not to try to sell you anything.

Potential Investment Properties

Below is a link to this month’s list of candidate investment properties. Our proprietary data mining software selected these candidate properties from thousands of available properties, and this is just the first step in our multi-step validation process, as shown below.

Market Trend

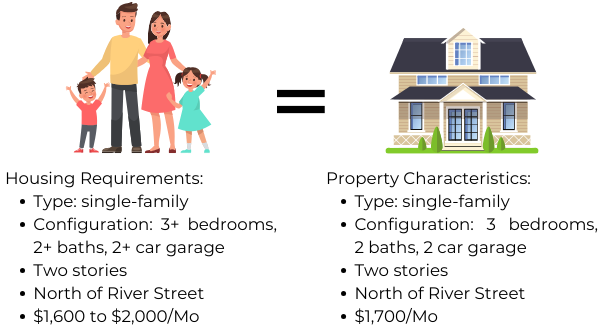

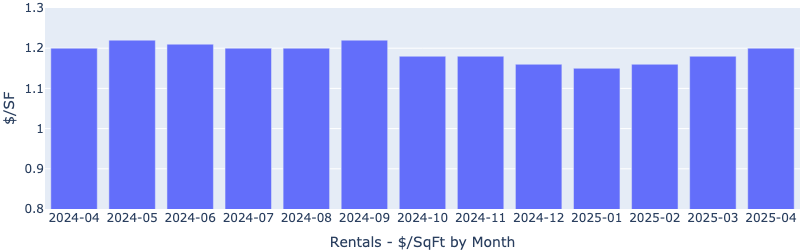

Below are charts from our latest trailing 13-month market report, which includes January data. Remember that this data is only for our target property profile, not the entire metro area. To see all the charts, please click here.

Rentals – Median $/SF by Month

Rents started to rise after the holiday season. YoY is up 5.4%.

Sales – Median $/SF by Month

Despite rising interest rates, $/SF climbed up throughout 2023. MoM is almost unchanged, but YoY is up 8.1%.

Rentals – List to Contract Days by Month

Median time to rent was down significantly MoM, showing a heating up rental market. YoY is down 20%.

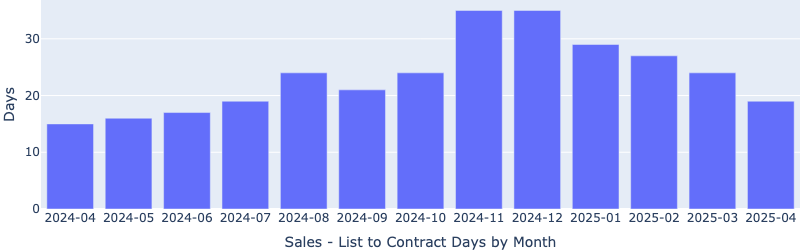

Sales – List to Contract Days by Month

Median days on the market dropped to about 25 days for January, following the seasonal trend.

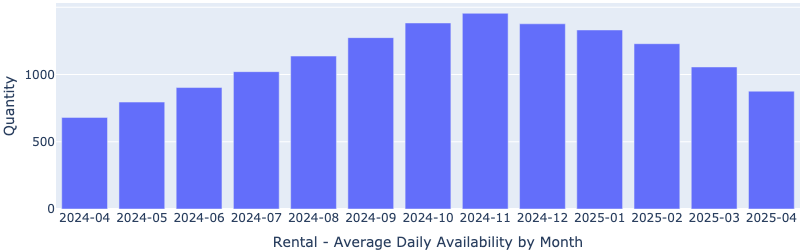

Rentals – Availability by Month

The number of homes for rent continued the downward trend. YoY is down 12%.

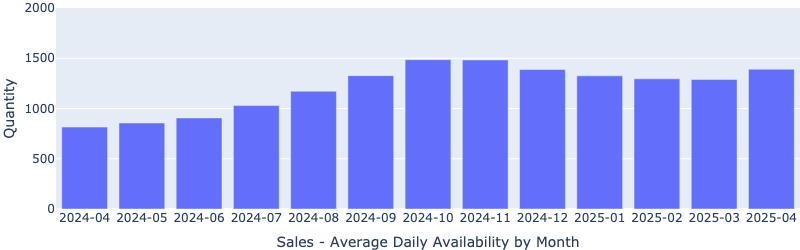

Sales – Availability by Month

This chart shows the average daily number of properties that were for sale in a particular month. January saw a big decline. YoY is down 54%!

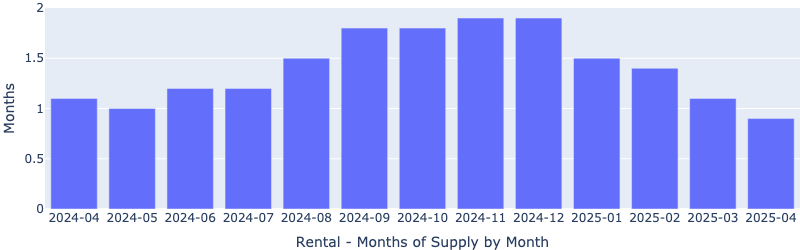

Rentals – Months of Supply

Only about 1.1 months of supply for our target rental property profile. Demand is greater than supply.

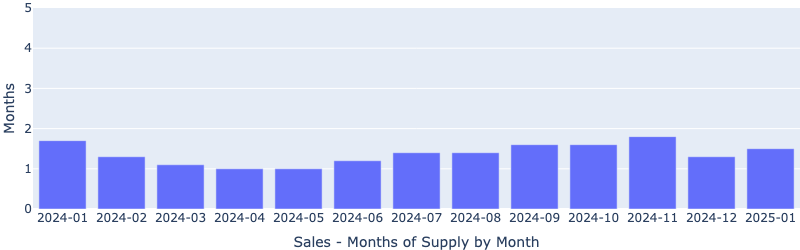

Sales – Months of Supply

Just about one month of supply for our target property profile. A 6 months supply is considered a balanced market. This will continue to drive up the prices.

About the Fernwood Real Estate Investment Group

We Help Clients Acquire Highly Reliable Passive Income Streams

For the last 16+ years, we’ve helped clients build highly reliable, passive income streams through real estate that they will not outlive. Several are now retired and living entirely on their rental income. Most never invested in real estate before they started working with us, and most live in other states or countries. Below is a two-minute video of the services we provide.

Want to know what we can do for you?

© 2005-2024 Cleo Li and Eric Fernwood, all rights reserved.