In This Report

- Stability and Growth: A Guide for Uncertain Times

- Potential Investment Properties

- Market Trends

- About the FERNWOOD Team

Stability and Growth in Uncertain Times

In our April and May market reports, I mentioned that we are living in a time when “there are weeks where decades happen.” June seems to intensify that trend. Just as temporary tariff reductions have offered some relief and hopes for stability, the world was thrown into even more chaos.

While I admire the audacity and ingenuity of the Ukrainians and Israelis in triumphing over much larger adversaries by rewriting modern warfare playbooks, these conflicts, especially the increasing likelihood of war between Israel and Iran escalating, do pose potential disruptions to global shipping routes and energy supplies, affecting economies and financial markets. We also still face uncertainty around the future trade framework.

In times like these, how should investors position themselves for security, stability, income, and even growth?

I see residential real estate as an obvious choice.

Why Real Estate Stands Out

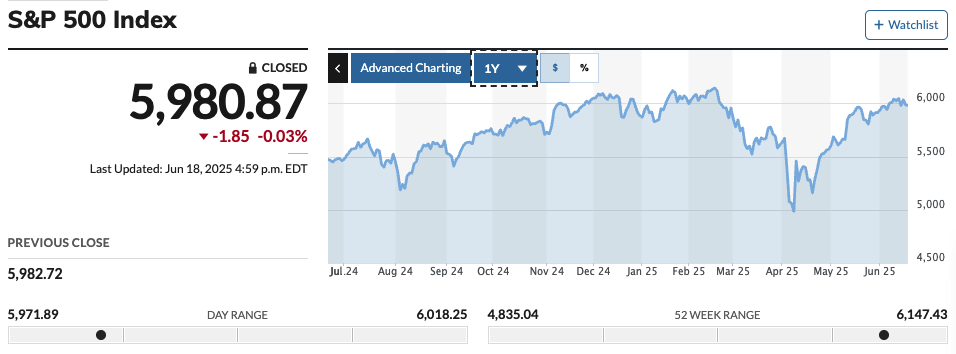

Below is a chart showing the S&P 500 Index (supposed to be a more stable segment of the stock market) over the last year.

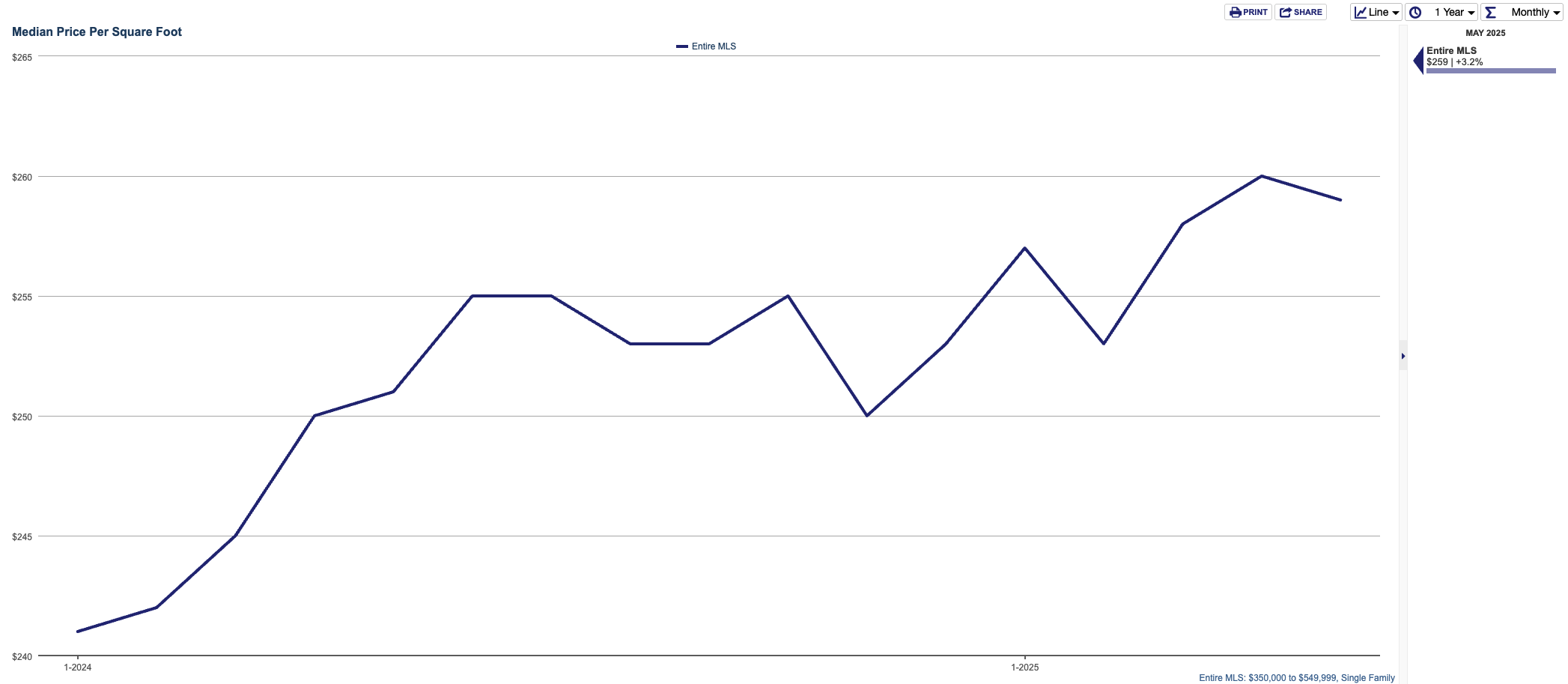

Here is a chart from the Las Vegas Realtor MLS showing the price per square foot for all single-family homes (including new construction) priced between $350,000 and $550,000 in the last year. (I chose this broader market range, rather than just our target property profile, to better show overall market trends.)

While the S&P Index fluctuated more than 25% during the last year, the Las Vegas single-family homes (in our general price range) prices ($/SF) increased 7.5% YoY.

I gave some thought to why real estate is stable.

Unlike stocks or other financial assets, which can experience dramatic swings due to changes in expectations, human psychology, or trading algorithms, real estate offers stability rooted in a simple truth: housing is always a necessity. Regardless of economic conditions, people need places to live. This consistent and reliable demand helps shield real estate from the volatility seen in other markets. Cities like Las Vegas, where land is limited, population is growing steadily, and job creation is strong, demonstrate this stability even more clearly.

While the stock and bond markets can fluctuate wildly in a single day, real estate values change (more) gradually and predictably (supply and demand). This slower pace of change, combined with less speculative trading, makes real estate particularly appealing to long-term investors seeking growth and security.

Real estate also acts as a natural hedge against inflation. As living costs rise, property values and rents typically increase alongside them. This helps investors maintain their purchasing power over time. While no investment is entirely risk-free, properties with stable tenants and strong fundamentals reduce exposure to economic uncertainty. In the face of today’s global challenges, real estate offers a unique blend of security and growth potential.

Building Generational Wealth

Beyond its stability, real estate is one of the most effective tools for building and preserving generational wealth. It offers tax advantages that other investments simply can’t match.

I am witnessing a fine example of this unfolding right now.

A client inherited a portfolio of rental properties from a grandparent who had enjoyed a secure, long, and comfortable retirement from these investments. When the client inherited the properties, they benefited from a stepped-up basis reset to the current market value and reset depreciation. This demonstrates why real estate is such an efficient and powerful vehicle for transferring and preserving generational wealth.

The inherited properties came with significant maintenance and tenant challenges. The client decided to execute a 1031 exchange, reinvesting the proceeds into multiple single-family homes. This strategy allowed them to diversify and grow their portfolio, improve cash flow, and increase appreciation potential—all while deferring capital gains taxes and resetting depreciation. Rather than just preserving wealth, this approach positioned them for substantial long-term growth.

I will write more about this project once everything is complete, as this is a good case study on how to execute a complex 1031 exchange when multiple relinquished properties and even more replacement properties are involved. This project illustrates how 1031 exchanges enable families to grow their portfolios while minimizing tax burdens. With strategies like these, real estate becomes a pathway to financial security for generations.

The Bottom Line

In a world marked by geopolitical uncertainty, strained trade relations, and economic volatility, real estate remains a dependable investment. Its core strengths —consistent demand, steady appreciation, reliable income, low volatility, and inflation protection —make it uniquely stable and rewarding. Combined with powerful tax advantages like the inheritance step-up in basis and 1031 exchanges, real estate stands as one of the most effective tools for building and transferring wealth.

In today’s uncertain world, if you want to pursue growth, security, and a proven path to financial independence, real estate remains an indispensable option.

If you’re interested in exploring how the current Las Vegas market conditions could align with your goals, please use the link below to schedule a time that works best for you.

Potential Investment Properties

Below is a link to this month’s list of candidate investment properties. Our proprietary data mining software selected these candidate properties from thousands of available properties, and this is just the first step in our multi-step validation process, as shown below.

This Month’s List of Candidate Properties

Market Trend

Below are charts from our latest trailing 13-month market report, which includes May data. Remember that this data is only for our target property profile, not the entire metro area. To see all the charts, please click here.

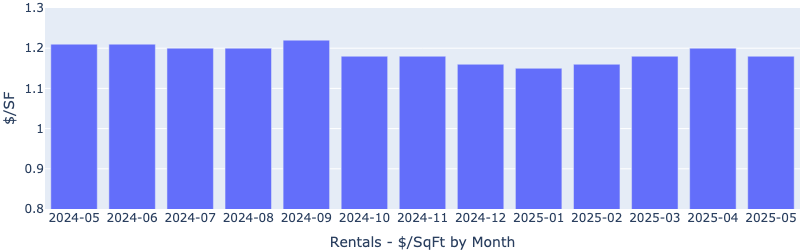

Rentals – Median $/SF by Month

Rents had a slight decrease MoM. Despite global tensions, rents remained reasonably stable.

Rentals – Median Time to Rent by Month

As expected with all the volatility, time to rent increased slightly MoM but still at a healthy 22 days.

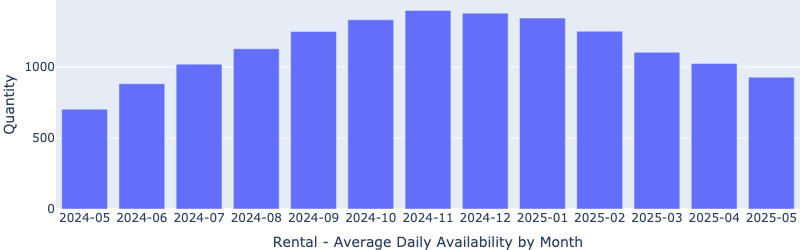

Rentals – Availability by Month

The number of homes for rent continued to decrease MoM, in line with our expectations.

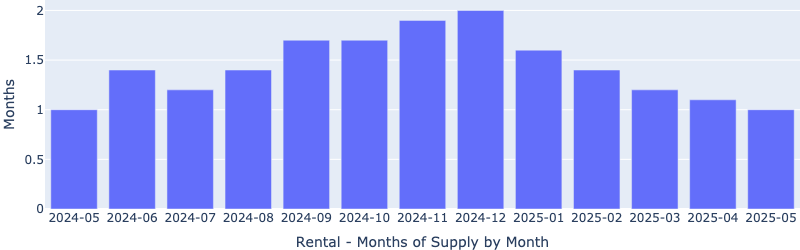

Rentals – Months of Supply

There is only one month of supply for our target rental property profile. This low inventory will continue to pressure up rents.

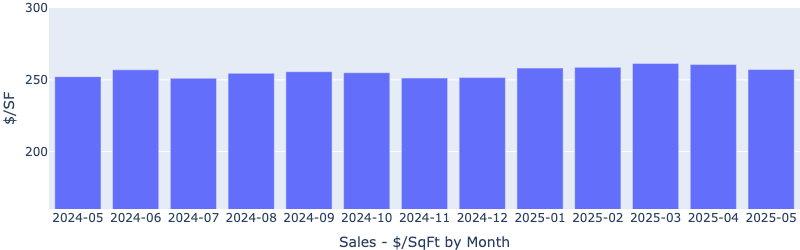

Sales – Median $/SF by Month

As expected with all the volatility, the $/SF had a slight decline MoM. This has enabled us to secure better deals.

Sales – List to Contract Days by Month

Despite all the volatility and a slightly increased inventory, median days on the market remain unchanged MoM. Remember that this is only for the segment we target, not the overall market.

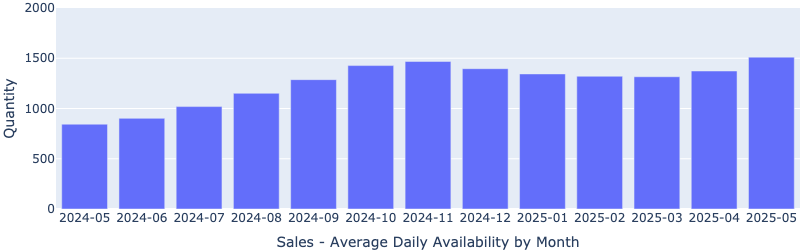

Sales – Availability by Month

The number of properties for sale increased moderately MoM.

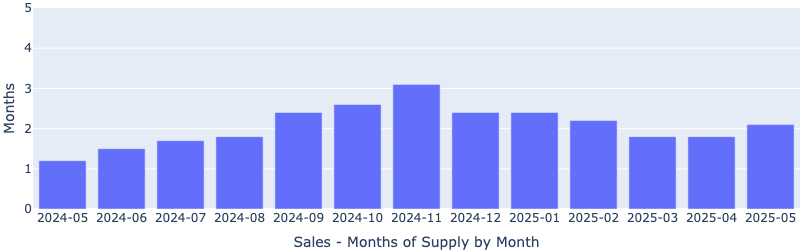

Sales – Months of Supply

Inventory increased slightly as well MoM. There are about two months of supply in our segment. Six months is considered a balanced market where the number of buyers and sellers are roughly equal. This is still a sellers market but we are seeing better deals.

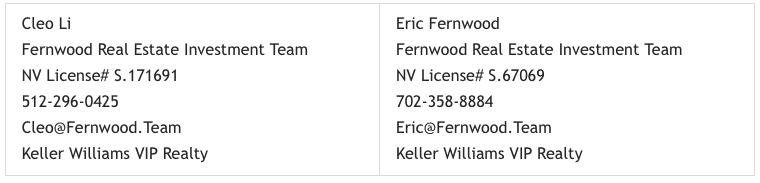

About the FERNWOOD Team

We Help Investors Build Wealth through Strategic, Data-driven Real Estate Investments in Las Vegas.

Here is what our clients have to say about us:

For the last 17+ years, we’ve helped clients build highly reliable, passive income streams through real estate that they will not outlive. Several are now retired and living entirely on their rental income. Most never invested in real estate before they started working with us, and most live in other states or countries. Below is a two-minute video of the services we provide.

Want to know what we can do for you?

© 2005-2025 Cleo Li and Eric Fernwood, all rights reserved.

Join the newsletter. Subscribe to receive our latest post in email.