In This Report

- The One Big Beautiful Bill: What We Should Know About

- Potential Investment Properties

- Market Trends

- About the FERNWOOD Team

The One Big Beautiful Bill: What We Should Know About

The One Big Beautiful Bill Act (OBBBA) has now been signed into law. The bill contains more than 800 pages. Here, I will attempt to summarize what it means for (individual) real estate investors.

Before I continue, I want to make it clear that I do not have any formal training in taxes, law, finance, or legislation. I’m an engineer. The following are simply my personal interpretations, along with links to sources where you can find the official information. Please note that new articles and expert analyses are being published regularly with more in-depth evaluations of this legislation.

We Will Pay Less Taxes

The act makes permanent the provisions of the 2017 Tax Cuts and Jobs Act (TCJA).

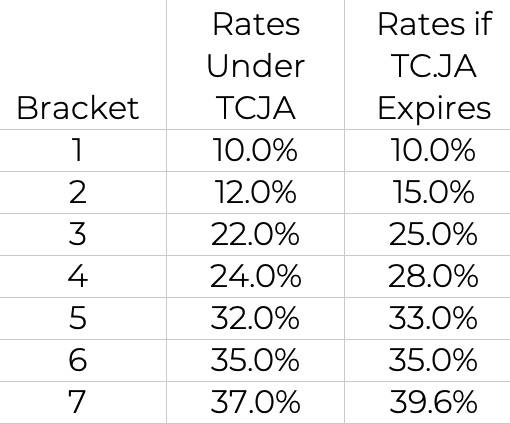

The chart below shows the tax rates for all income brackets. The right column displays the rates that would have applied had the bill not passed, while the middle column shows the extended rates now in effect. As you can see, most income brackets will benefit from these changes, except for Bracket 1 (the lowest income) and Bracket 6. I believe most, if not all, readers of my blog fall within the benefiting brackets.

*Yahoo Finance April 9, 2024 / The Bahnsen Group

Lower taxes mean more money to invest.

Investment Real Estate Receives More Tax Benefits

The act maintains the current like-kind exchange (1031 exchange) rules, allowing investors to continue deferring taxes when reinvesting real estate gains. This relieved the fear of a major (real estate) tax benefit going away.

The incremental benefit the OBBBA brings is the 100% full deduction of equipment and capital investment (and making this bonus depreciation permanent). This includes qualified properties placed in service after January 19, 2025. Based on my research, this means that components identified in a cost segregation study that have a recovery period of 20 years or less can be fully expensed in the first year using bonus depreciation.

This used to be an exclusive tax benefit for real estate professionals, but is now available to general investment property owners. It provides a much larger upfront deduction, reducing your taxable income right away. If you want to venture into researching which components in a property qualify for bonus depreciation, this IRS publication page is a good starting point. Personally, I think your CPA is a much more efficient and reliable source:).

Potential Impact on the Las Vegas Real Estate Market

President Trump campaigned on “no tax on tips” and “no tax on overtime.” These promises were addressed in the bill via deductions up to a cap on income received via tips ($25,000) and overtime ($12,500), though only for the years 2025-2028.

To me, it seemed that Trump wanted to appease Nevada voters, as a large percentage of the workforce in Nevada (or, essentially, Las Vegas, which has the lion’s share of Nevada’s population and economy) earns a significant portion of their income through tips or overtime. Whatever the motive, the net effect is that a large portion of workers in Las Vegas are poised to have a pay raise for at least the next 4 years.

As I pointed out in my last blog (Which U.S. Market Offers Maximum Capital Appreciation Over Next Decade?), rising personal income is a critical factor in a market’s appreciation potential – higher income means more purchasing power for homes and rentals. Rising personal income means more people can qualify to buy a home, thus increasing demand for homes.

So it seems to me that this provision in OBBBA is a tailwind for the Las Vegas housing and rental market, at least for the segment we target.

Conclusion

Based on my research, the OBBBA has positive effects on us individual real estate investors and the Las Vegas housing market. Again, I’m not a licensed tax, financial, or legal professional, so if you find any mistakes or omissions, please let me know so I can correct them.

If you’re interested in exploring how the current Las Vegas market conditions could align with your goals, please use the link below to schedule a time that works best for you.

Potential Investment Properties

Below is a link to this month’s list of candidate investment properties. Our proprietary data mining software selected these candidate properties from thousands of available properties, and this is just the first step in our multi-step validation process, as shown below.

This Month’s List of Candidate Properties

Market Trend

Below are charts from our latest trailing 13-month market report, which includes June data. Remember that this data is only for our target property profile, not the entire metro area. To see all the charts, please click here.

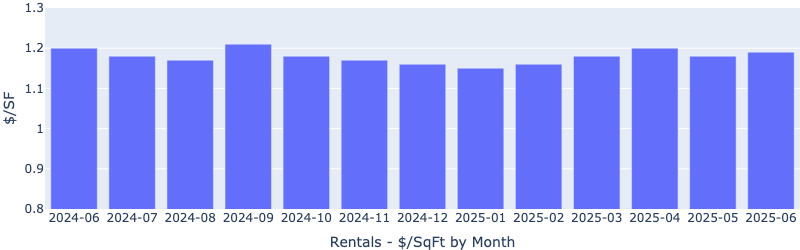

Rentals – Median $/SF by Month

Rents increased slightly MoM. Despite global tensions, rents remained reasonably stable.

Rentals – Median Time to Rent by Month

Despite all the volatility, time to rent decreased MoM (from 22 days to 20 days), more aligned with the expected seasonal trend.

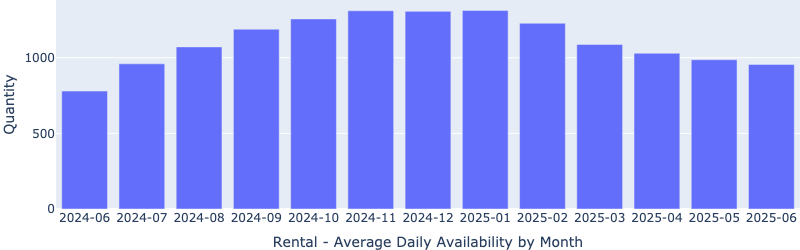

Rentals – Availability by Month

The number of homes for rent continued to decrease MoM, in line with our expectations.

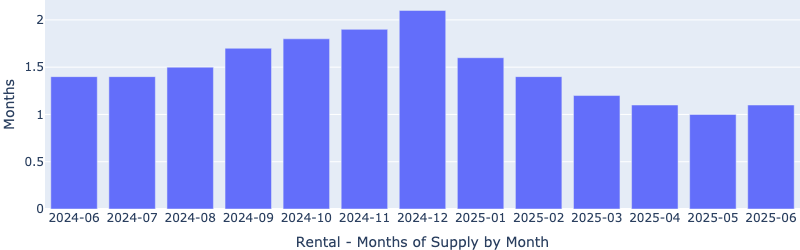

Rentals – Months of Supply

There are only 1.1 months of supply for our target rental property profile. This low inventory will continue to pressure up rents.

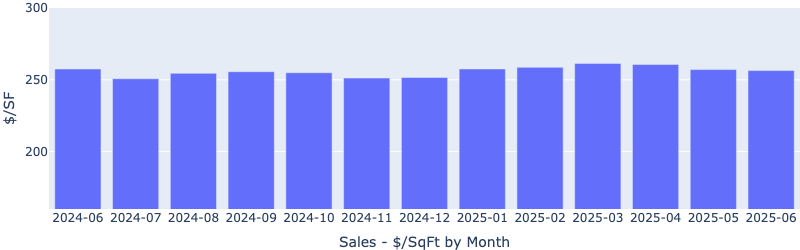

Sales – Median $/SF by Month

As expected with all the volatility, the $/SF had a marginal decline MoM. This has enabled us to secure better deals.

Sales – List to Contract Days by Month

As expected with all the volatility, median days on the market increased MoM but is still at a healthy 23 days.

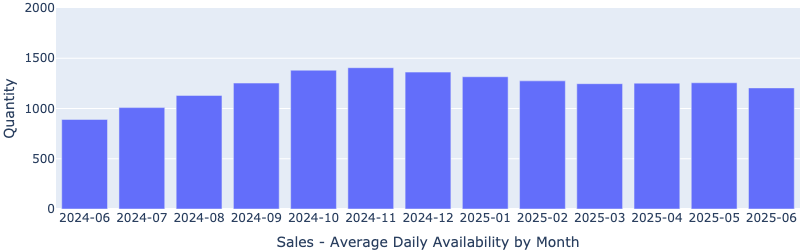

Sales – Availability by Month

The number of properties for sale decreased MoM, inline with our expectations.

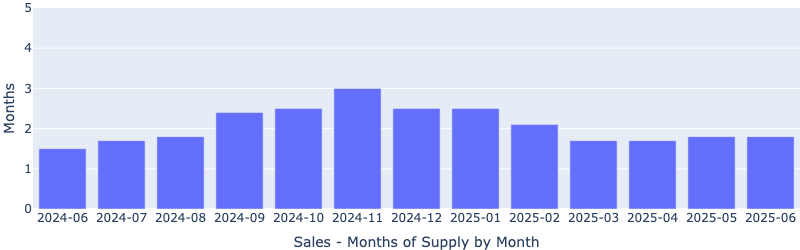

Sales – Months of Supply

Inventory remained unchanged MoM, at about 1.8 months. Six months is considered a balanced market where the number of buyers and sellers are roughly equal and prices remain stable. This is still a sellers market, despite the soundbites or clickbaits you might hear or see in the media.

About the FERNWOOD Team

We Help Investors Build Wealth through Strategic, Data-driven Real Estate Investments in Las Vegas.

Here is what our clients have to say about us:

For the last 17+ years, we’ve helped clients build highly reliable, passive income streams through real estate that they will not outlive. Several are now retired and living entirely on their rental income. Most never invested in real estate before they started working with us, and most live in other states or countries. Below is a two-minute video of the services we provide.

Want to know what we can do for you?

© 2005-2025 Cleo Li and Eric Fernwood, all rights reserved.

Join the newsletter. Subscribe to receive our latest post in email.