Hello,

I’m sending our weekly blog a few days late because I spent last week on vacation in Yellowstone. I’m back now and ready to get things back on track.

Many people I talk to have preconceived ideas about investing in real estate, usually from reading or attending seminars by “experts” or “gurus.” Most self-professed gurus provide advice on purchasing properties such as:

- Buy low-cost properties

- Buy multi-family

- Buy properties at a discount

However, where this advice falls down is that properties do not pay rent; the tenants occupying them do. So, if your tenant stops paying rent or frequently causes damages, you lose money no matter how cheap you bought the properties or how good the numbers are on paper.

Thus, if your investment goal is financial independence, the key is having tenants who stay for many years, consistently pay rent on time, and take good care of the property, not the type of property.

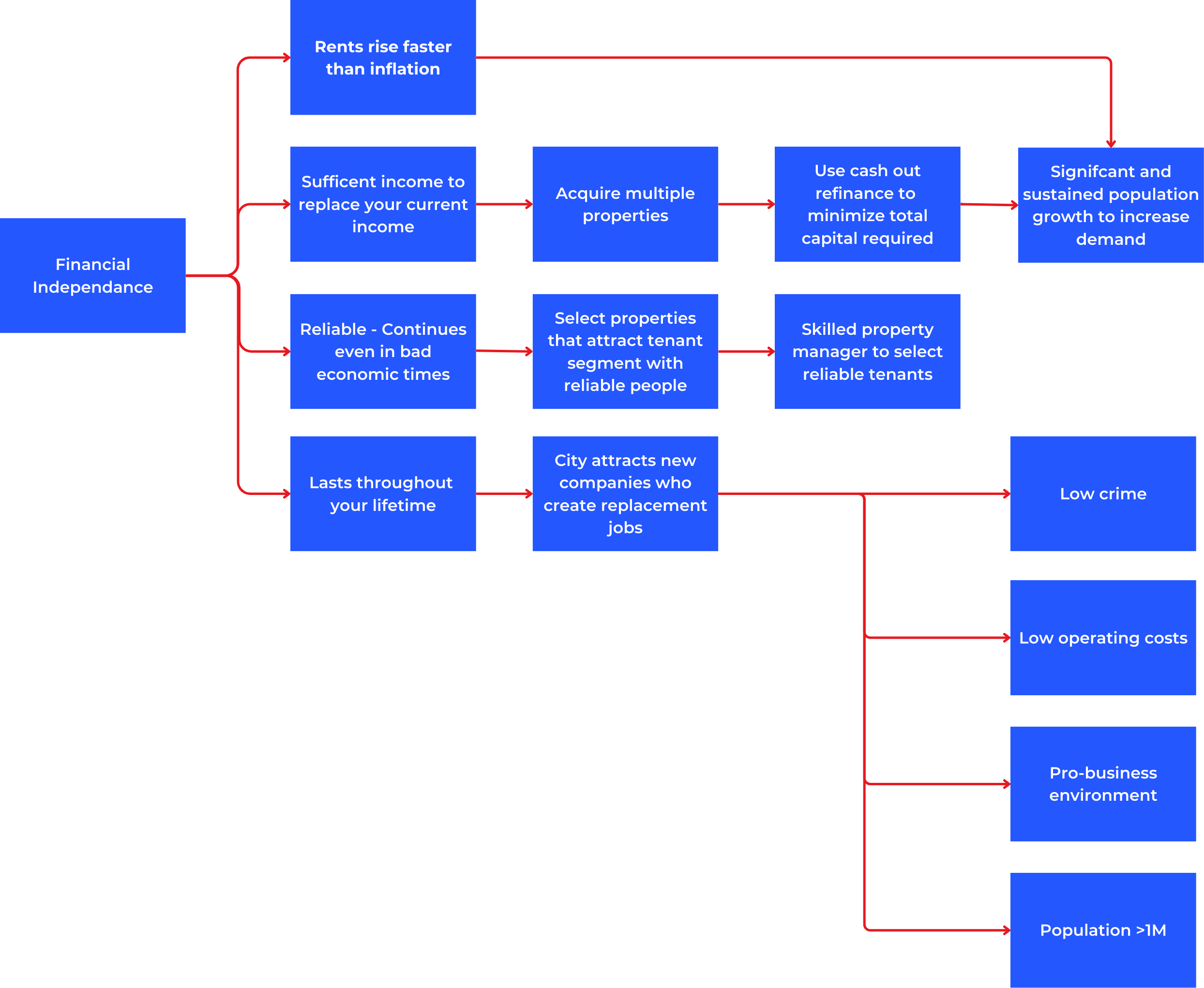

Financial independence requires a rental income that meets four criteria:

- Rents rise faster than inflation: Inflation continuously reduces the dollar’s purchasing power, causing the same goods and services to cost more each day. If rents don’t increase faster than inflation, you will soon need a job to make up the difference between your rental income and inflated prices.

- Sufficient rental income to replace your current income: You likely must purchase multiple properties to achieve this. If you buy in a city with significant and sustained appreciation, you can use the accrued equity via cash-out refinancing for the down payment on additional properties, reducing the total cash required from your savings.

- Reliable: You must be able to rely on rental income every month, even during tough economic periods. This requires a tenant whose job is less likely to disappear during an economic downturn.

- Lasts throughout your lifetime: This depends on your tenants maintaining their income throughout your lifetime, which relies on the city’s economic growth. Private sector jobs typically only last 10-20 years; without consistent creation of replacement jobs, tenants will not be able to pay the current level of rent.

Below is a diagram illustrating the four rental income requirements and what is needed to meet them.

Below are steps to achieve financial freedom.

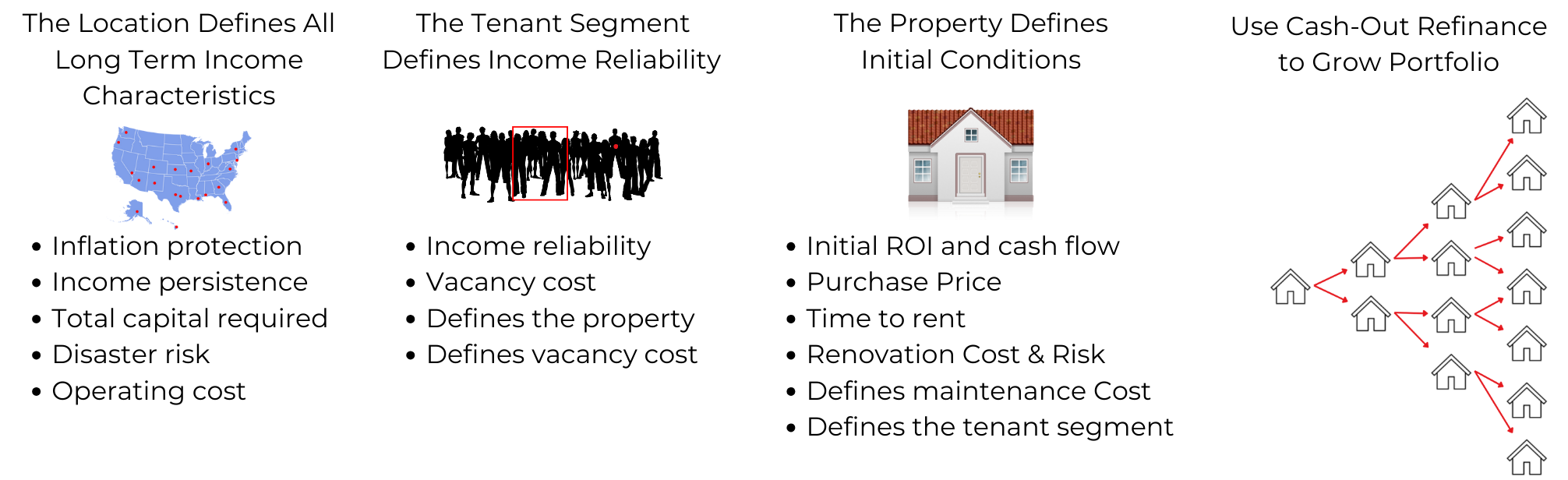

If your goal is financial freedom, selecting properties is not the most important decision. After the investment location, the most important decision is choosing a tenant segment with the right behaviors to provide reliable income. Next, buy properties similar to what this segment already rents, not based on the advice of so-called experts.