[Image generated with Dall-E]

In last week’s blog article, I explained the limitations and value of popular metrics like cash flow and ROI. In this post, I will explain how to estimate a specific zip code’s probable price and rent growth rate using Zillow Research data. Before I do, you need to understand what determines prices and the relationship between prices and rents.

What Determines Prices and Rents

Prices fluctuate based on supply and demand. Although significant interest rate fluctuations can affect demand and supply in the short term, but population changes in the long term determine demand. In cities with growing populations, the current housing supply is insufficient, causing prices to rise until inventory and demand reach equilibrium. The current inventory is sufficient if the city has a static or declining population, so prices remain static or decline.

Rents follow price trends. When prices rise, fewer people can afford to buy, so more people rent. This increases the demand for rentals and rents. When prices fall, more people can buy, so the demand for rentals decreases, and so does rent. The takeaway is that price trends are a reliable indicator of future rent trends.

Prices and rents don’t move in perfect sync. For instance, a 10% increase in property prices might lead to only an 8% increase in rents. In the long run, rent increases tend to mirror price increases. That’s why I’ve found that the price growth rate is the most reliable way to project future rent growth rates.

Markets Change Slowly

Property prices are driven by population change, and prices drive rents. So, current population trends strongly predict future real estate prices and rents. The reason is population trends in cities have significant momentum and change slowly. Today’s declining population resulted from deep-rooted economic and social issues that developed over decades. Reversing these issues demands substantial and sustained effort over decades—and sometimes, it’s simply not feasible. When residents leave, they seldom return, which further compounds the problem. Consequently, today’s population trends will likely persist well into the future.

The same principle applies to cities experiencing strong population growth. Jobs are the primary driver of attracting people to a city. The economic and social conditions that draw new employers typically take decades to establish. Factors that make a city an appealing place to work and live are unlikely to change quickly. As a result, current population trends are likely to continue for the foreseeable future.

The key takeaway is that a city’s population trend, whether growth or decline, will likely persist for decades. Consequently, today’s real estate trend is likely to continue into the foreseeable future.

Projecting Future Performance

As discussed earlier, prices and rents are driven influenced by population changes. These demographic shifts stem from deep-rooted economic and social factors that evolve slowly. Therefore, we can use recent appreciation trends to project future appreciation and rent growth.

However, you can’t just use any historical time period for a city because major anomalies like COVID-19 or the 2008 financial crash distorted the real estate market. For analysis, I’ve chosen to base future appreciation and rent growth on 2013 through 2020. Why?

By 2013, markets had largely recovered from the 2008 crash, and the COVID-19 pandemic effect had yet to begin (it started in 2021). As a result, these years represent the most “normal” period in recent history. The price trends during this time serve as a good indicator of future trends, assuming we don’t encounter unforeseen significant events like COVID-19.

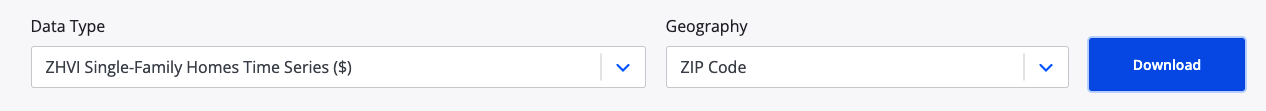

Since a city or metropolitan area is too broad for our analysis, we’ll focus on a specific zip code. For historical single-family home price data, I relied on Zillow Research. Specifically, I used the “ZHVI Single-Family Homes Time Series ($)” dataset.

After downloading the Excel file, I randomly selected zip code 91733 from this example’s “RegionName” column. The row contains data for many years, but I’ll focus on the period from 2013 through 2020. The steps I followed are below.

-

Identify the start and end prices for this range of years:

- Start value (1/31/13): $115,866

- End value (12/31/20): $205,380

-

Determine the number of years between the start and end dates: From 1/31/13 to 12/31/20 is approximately 7.92 years

-

Use the compound annual growth rate (CAGR) formula: CAGR = (Ending Value / Beginning Value)^(1/n) – 1, where n is the years between the start and end dates.

CAGR = ($205,380/$115,866)^(1/7.92) – 1 ≈ 0.075 or 7.54%

Because rents typically follow property prices, you can use the 7.54% appreciation rate to project rent growth. In last week’s email, you learned how to calculate the present value of future rent based on an assumed rent growth rate and inflation rate.

For example, if a property is rented today for $2,000/month and the average inflation is 5%/year in the future, what will be the inflation-adjusted rent in 5 years in today’s dollars?

- $2,000 x (1 + 7.54%)^5 / (1 + 5%)^5 ≈ $2,254 in present value buying power.

The formula I used is:

FV = PV x (1 + r)^y / (1 + R)^y

Where:

- FV: The future value in terms of current buying power

- PV: The current rent. The current buying power

- r: The annual rate of rent or price growth

- R: The average annual inflation

- y: The number of years into the future

This formula enables you to project rent and price growth into the future.

Summary

Predicting anything beyond yesterday is guessing. There is no accurate way to predict future events. However, we must have a reasonable projection of probable future performance to guide our investment decisions today. The method described in this post is the best I know of. If you have another approach, I would love to learn about it.