[Image generated with Dall-E]

A client recently asked me how many properties they’d need to achieve financial independence. The answer depends on the rent growth rate of your properties. Let me explain.

What Drives Rents and Prices

Prices and rents are driven by supply and demand. What determines the level of demand? Population change. When the population is declining or stagnant, there is low demand and, consequently, prices and rents are low. The problem in low-cost, low-demand locations is inflation. Below is an example property that illustrates the low rent growth rate problem.

Investing in Low-Cost Markets

Suppose you are considering a property in a city where the rent growth rate is 2%/Yr, the initial rent is $1,000/Mo, and inflation is 5%/Yr. What will the buying power of the rent be in 5, 10, and 15 years?

- 5 years: $1,000 x (1 + 2%)^5 / (1 + 5%)^5 ≈ $865

- 10 years: $1,000 x (1 + 2%)^10 / (1 + 5%)^10 ≈ $748

- 15 years: $1,000 x (1 + 2%)^15 / (1 + 5%)^15 ≈ $647

So, in 10 years, even though rents increased 2% per year, the rent will only buy what $748 purchases today. This means that no matter how many properties you buy in low-cost markets, you can never achieve financial freedom because your income’s buying power declines continuously. Financial freedom requires rents to outpace inflation to provide the additional dollars needed to cover ever-increasing prices over your lifetime.

There’s another problem: appreciation is also driven by demand. With limited appreciation, every investment dollar must come from your savings. If your income requirement is $5,000/Mo and each property initially generates $300/Mo, you’ll need to acquire:

- $5,000 / $300 = 17 properties

How much savings will you need to buy 17 properties if each costs $250,000 and the only cost is the 25% down payment?

- 17 x $250,000 x 25% = $1,062,500

For most people, this is an unattainable amount of after-tax savings.

Investing in Higher-Cost Appreciating Markets

In the low-cost market, you needed 17 properties, and over time, you must keep adding properties because rents did not outpace inflation. In high-appreciation markets, you will need fewer properties, and the total capital required will be a fraction of what was needed in the low-cost market. Before I continue, I need to explain the connection between prices and rents.

Prices are driven by demand, which is determined by population growth. As demand increases, prices rise until the number of people who can afford to purchase roughly matches the available supply. This price increase forces more people to rent, causing rental demand to increase. Consequently, rents rise until demand roughly matches supply. Because rents follow prices, you can estimate future rents using price growth.

Let’s consider a scenario where you need $5,000 per month in present value dollars. Each property initially generates $300 monthly with a starting rent of $1,000 per month. The properties cost $400,000 each, appreciate at 10% annually, and have an 8% yearly rent growth. Inflation is set at 5% per year, and the acquisition cost is a 25% down payment.

Cost to buy the first property:

- 25% x $400,000 = $100,000

How long will you have to let the property appreciate in order to use a 75% cash-out refinance to yield $100,000, assuming that the mortgage principal remains at $300,000?

- One year: $400,000 x (1 + 10%)^1 x 75% – $300,000 ≈ $30,000

- Two years: $400,000 x (1 + 10%)^2 x 75% – $300,000 ≈ $63,000

- Three years: $400,000 x (1 + 10%)^3 x 75% – $300,000 ≈ $99,300

So, after three years, a cash-out refinance will yield the money needed for the down payment on the next property.

This was an oversimplified example because I did not consider appreciation of the additional property and other costs, but the concept is valid.

In the next simplified example, I’ll make the following assumptions: • All properties cost $400,000 • Rents increase by 8% annually • The initial cash flow from the first property is $300 per month • Expenses total $700 per property and remain constant • A new property is added every three years, based on the previous calculation

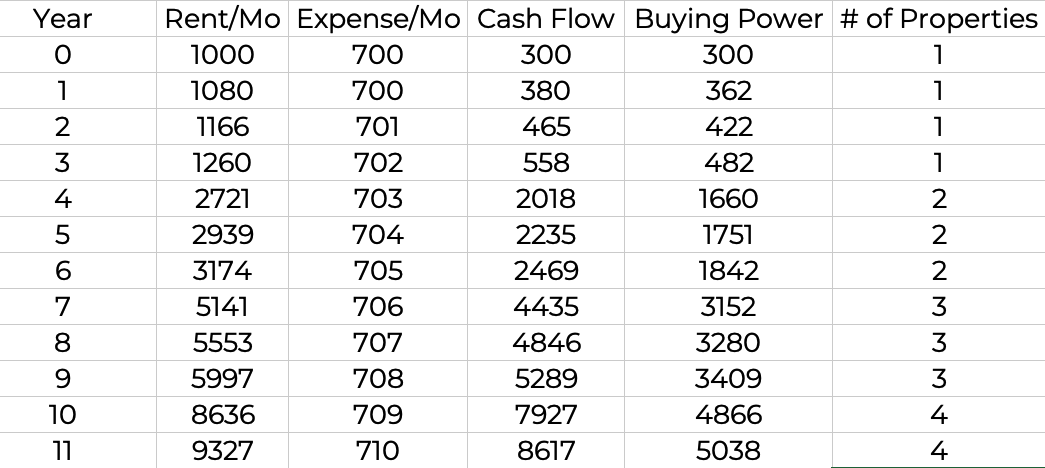

How many properties will it take to achieve a $5,000/month cash flow in present value (inflation-adjusted buying power)? The table below illustrates this scenario.

This example demonstrates that just 4 properties over 11 years can achieve the goal. While simplified, the concept holds true: in a high-rent-growth city, you’ll need fewer properties to reach a present value buying power of $5,000 per month. This illustrates the power of investing in appreciating markets.

Even though properties cost more in a high-appreciation, high rent-growth market, the advantages are twofold:

- The total capital required is only a fraction of the cost to acquire multiple properties in a low-cost market.

- Because rents outpace inflation, you can achieve and maintain financial freedom with fewer properties—something that’s not possible in a low-cost city.

Summary

The number of properties needed to achieve financial independence varies depending on your chosen investment location. Cities with faster property appreciation and rent increases require fewer properties and less capital investment. By strategically leveraging rapid appreciation over time, you’ll likely need far fewer properties than you might initially expect to reach your financial goals.