[Image generated with Dall-E]

The goal of real estate investing is financial independence, a life free from the daily grind. To achieve financial independence, you need an income that meets four requirements.

-

Rents increase faster than inflation: Inflation erodes the value of money over time, causing prices for goods and services to rise. To maintain your current standard of living, your rental income must increase faster than inflation. If rents don’t outpace inflation, you can’t achieve financial freedom—no matter how many properties you own.

-

Lasts throughout your lifetime: Your rental income depends on tenants maintaining similar wages throughout your lifetime. However, non-government jobs are inherently temporary. On average, companies last about ten years, with even large S&P 500 corporations lasting only 18 years on average. This means every non-government job your tenants currently hold will eventually end. For tenants to continue paying comparable rent, new companies must move into the city, creating replacement jobs with similar wages and skill requirements. Consequently, the location must possess the right characteristics to attract new businesses.

If replacement jobs are not created, only low-paying service sector jobs will remain. As average incomes decline, city revenues fall, forcing cities to reduce services. This results in increased crime and an exodus of those who can afford to leave. This creates a downward spiral of population loss, falling average incomes, and further cuts to city services—a financial death spiral from which few cities recover.

-

Rental income reliability: Your income must continue uninterrupted, even during economic downturns. This requires purchasing properties that attract a tenant segment with a high proportion of reliable individuals and working with a property manager who can consistently select reliable tenants. Reliable tenants stay many years, pay rent on schedule, and take good care of the property.

-

Sufficient income to replace your current income: You’ll need income from multiple properties to replace your current income. It’s unlikely you can buy all these properties with your savings. However, by investing in areas with rapid and sustained appreciation, you can grow your portfolio through cash-out refinancing. This strategy allows you to acquire the properties you need at a fraction of the cost of buying with your savings.

In this post, I will focus solely on acquiring multiple properties.

Growing Your Portfolio

There are two methods of acquiring multiple properties. The first is to purchase all the properties you need from your savings.

For example, suppose each property costs $200,000, your only acquisition cost is the 25% down payment, and you need 30 properties to replace your current income. How much cash will you need from your savings?

- 30 x $200,000 x 25% = $1,500,000

If your combined state and federal tax rate is 40%, you must earn $2,500,000 in pre-tax income to have $1,500,000 in post-tax income. This is out of reach of most people.

The second method requires only a fraction of the savings but only works in cities with significant and sustained property appreciation.

Suppose you purchase in a location where the appreciation rate averages 8% per year, each property costs $400,000, and your only acquisition cost is the 25% down payment. Also, assume that you still need 30 properties to have sufficient income to replace your current income. How much money from savings will you need?

For the first property:

- 25% x $400,000 = $100,000

With an 8% annual appreciation rate, you can leverage the accumulated equity through cash-out refinancing to acquire additional properties. How long must you hold the first property to pay off the existing $300,000 mortgage and net $100,000 for the next down payment using a 75% cash-out refinance?

Calculating the net proceeds for the first four years:

- After year 1: $400,000 x (1 + 8%)^1 x 75% – $300,000 ≈ $24,000

- After year 2: $400,000 x (1 + 8%)^2 x 75% – $300,000 ≈ $49,920

- After year 3: $400,000 x (1 + 8%)^3 x 75% – $300,000 ≈ $77,914

- After year 4: $400,000 x (1 + 8%)^4 x 75% – $300,000 ≈ $108,147

So, between three and four years, your net from the 75% cash-out refinance will yield enough to pay for your next property’s $100,000 down payment. Now, you’ll have two properties increasing in value.

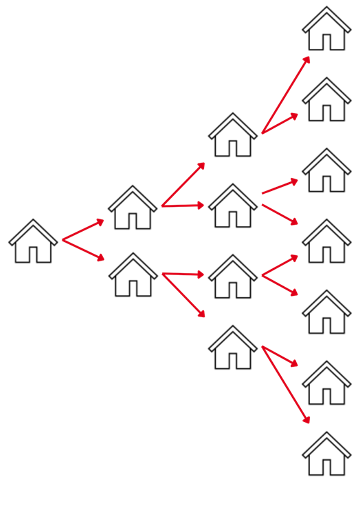

In three to four years, both properties will have appreciated enough to enable you to use cash-out refinancing to double your portfolio. The number of properties acquired grows exponentially over time. Consequently, as illustrated below, you can build a substantial portfolio with minimal additional capital from savings.

Summary

Although properties in high-appreciation areas are more expensive, investing in these locations requires less overall capital to build a multi-property portfolio. This is because you can grow your holdings by reinvesting the accumulated equity. Buying in high-appreciation locations enables you to achieve financial freedom with far less capital than investing in low-cost, low-appreciation locations.