Appreciation or Initial Cash Flow?

Image by Janine Bolon from Pixabay

Appreciation and initial cash flow are opposing forces. You can choose a location to maximize one or the other, but not both. In this article, I will describe the market forces, why they are opposing, and the long-term effects of buying into each type of market.

Note: I am only talking about initial cash flow. In all cases, return in an appreciating market will surpass markets with a high initial return over time.

It’s All About Demand

The two properties below are similar in size, age, bedrooms, and baths. One has an asking price of $2.5M and the other $137,000. Demand is why one is worth so much more than the other.

Demand not only drives property prices, it also drives rent. Depending on the market, rental rates lag property prices by 2 to 10 years. So, when property prices are static or falling, the return will be higher since property prices were higher in the past than they are today (in inflation-adjusted dollars). Where property prices are rising, the return will be lower since the current rent reflects lower property prices in the past.

Before I continue, I want to talk about return metrics.

Limitations of ROI

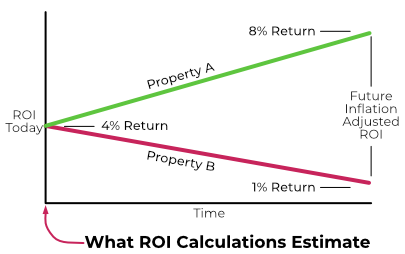

Return metrics, like ROI, are only a snapshot in time. ROI estimates how the property is likely to perform on day one of a lifetime hold. ROI tells you nothing about how the property will perform in the future.

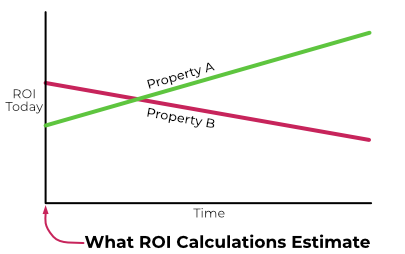

For example, suppose you were comparing two properties with the same ROI. One property is in an appreciating market and the other is in a static or declining market (in inflation adjusted dollars). Suppose both properties have the same return today (4%). Over time, cash flow for the property in the appreciating market will increase because rents are rising faster than inflation. Over the same period, inflation adjusted cash flow will decline in the static or declining market because rent increases are not keeping up with inflation.

Below is another example showing the problem with selecting properties based only on ROI. In this example, property A is in an appreciating market while property B is in a static or declining market. Within a few years, Property A’s return will exceed that of property B.

However, it’s not as simple as just declining rents in inflation-adjusted dollars. The problem is what is causing demand to decline. The two primary reasons markets decline are:

- Undesirable location – When a sufficient portion of the population finds the location undesirable, they will move to a location they perceive to be better. The most common reasons people leave a location include high taxes, crime, poor schools, and oppressive government regulation.

- Declining job quality or quantity – The average lifespan of a private company is about ten years. An S&P 500 company only has an average lifespan of 18 years. Unless new companies move into the area, create jobs with similar pay, and require similar skills, the area will spiral into economic decline. The result is that people with sufficient income and employers with viable businesses will leave the area.

No matter the reason, as an area declines, people and money leave the area. The primary source of revenue for cities are property taxes and sales taxes. With falling property prices, declining population, and declining median income, city revenues fall. As income falls, the city has no option but to decrease funding for city services, including schools. As the area continues to decline, families with sufficient income will leave. The people remaining in the area tend to be lower-income individuals. As the downward spiral continues, more people leave the area. At some point, the jobs that remain are primarily low-paying service sector jobs. Declining incomes not only force down rents, but tenant quality also falls. The result is shorter tenant stays (more turns) and higher repair/maintenance costs. Falling inflation-adjusted income and increasing costs are a bad combination for investors.

In Conclusion

Appreciating or declining property prices and rents are only a symptom of area conditions. Where there is high demand for properties, rents rise and property prices rise, but initial cash flow is lower. Where there is limited demand for properties, initial return will be higher but inflation adjusted income falls because rents do not keep pace with inflation.