2021 – Las Vegas Investment Outlook

Photo by Ameer Basheer on Unsplash

At the beginning of each year we publish our outlook for the coming year. This year’s report is divided into the following sections, so you can easily navigate to section(s) of interest.

- 2020 Summary – An executive review of 2020. More detail and charts in other sections.

- What I expect to happen in 2021

- 2021 Concerns – Possible changes that may negatively impact the Las Vegas real estate market or the nation.

- New Developments in Las Vegas – We are in a pandemic but companies continue to announce new projects. This is a strong indicator that companies believe Las Vegas will recover and prosper in the foreseeable future.

- Other Items of Interest – Interesting data points that are noteworthy.

- What About the News? – There is a lot of misinformation in the press concerning the Las Vegas market.

- Background – A recap of what is our target tenant pool and how they have performed.

- Looking Back at 2020 – Here you will find the detailed market statistics so you can see how the market performed in 2020.

- Summary – A brief summary of what I see for 2021.

- References – Some of the many articles I read in preparation for this report.

2020 Summary

There is a traditional Chinese curse: “May you live in interesting times.” 2020 has certainly been an interesting time.

2020 was a year like no other. For the first time, the casinos in the international gaming mecca closed their doors for more than 2 months. You would think that the local economy, along with its real estate market, would be decimated. The “experts” did issue dire predictions of the housing prices crashing 50%; rents dropping 20%, etc.

So, how did the real estate market turn out in 2020? Below are some highlights from the charts you will find in the Looking Back at 2020 section in this report. Note that the data is based on the narrow property profile we target; this is not an assessment of the general Las Vegas market.

Rentals:

- Rents increased by about 9% YoY.

- Days from list to contract fell from 27 days in December 2019 to 7 days in December 2020.

- Inventory fell from an already low of 1,000 units in November of 2019 to about 400 units in December 2020. To put this in perspective, “normal” inventory at this time of year is around 2,500 units.

- Most properties in good condition receive multiple applications. Many applicants are from California and are signing a lease sight unseen due to very limited inventory.

Sales:

- Prices increased about 8% YoY

- Days from list to contract fell from 35 days in December of 2019 to 13 days in December 2020.

- The average daily inventory fell from 1,700 units in December 2019 to just over 1,000 today.

- In Las Vegas, 6 months of supply is considered a balanced market. Today we have under 1 month’s supply.

What I Expect in 2021

Once again, time to gaze into the crystal ball (not).

Before I continue, two statements on predictions:

“Trying to predict the future is like trying to drive down a country road at night with no lights while looking out the back window.” …Peter Drucker

“Predicting anything beyond yesterday is guessing.” …Eric Fernwood

I dislike the normal weaselly content-free statements most “experts” issue and did not take that approach. Consequently, I run the risk of being wrong to some degree on most statements.

- By the end of the first half, a sufficient number of people will have had the COVID vaccination that people will feel “safe” and the Las Vegas’ tourism sector will start to rebound. There are various articles[^15] about the pent up demand in the US for a vacation. Since Europe, Canada, and many other international tourist destinations are likely to remain restricted due to COVID, US destinations should do well.

- In the third quarter of 2021, the convention business in Las Vegas will start to recover. I do not expect big conventions but these will pave the way for the convention business to return in 2022.

- More companies will relocate infrastructure to Las Vegas. I believe the rate will increase throughout 2021. See the section titled Why Companies Choose Las Vegas for specifics.

- “Digital nomads” will continue to relocate to Las Vegas. Las Vegas is close enough to LA and SFO, which enables these digital nomads to stay in touch with family and friends. Their positive experiences will encourage friends and family to also relocate to Las Vegas. Over time, I believe this will increase the rate of people moving to Las Vegas.

- Construction will continue on the $24B projects under development and more (like the new Google data center) will be announced.

- Low-interest rates will likely remain through the first half. After that, I expect interest rates to rise. See the section titled Concerns for 2021 for specifics.

- Rents will increase in 2021 by approximately 7 to 10%

- Prices $/SF will rise in 2021 by approximately 7 to 10%

- The California exodus will continue through 2021, with Las Vegas getting a similar portion of this fleeing population as it did in 2020.

- Companies like HP, Oracle, Tesla, Toyota, Comcast, Charles Schwab, and others will continue leaving California and Las Vegas will get the infrastructure, and Austin (et al) will get the R&D.

- The EU will continue to have negative interest rates on deposits.[^14] This leaves the US one of the few safe places to invest for a reasonable return. This will continue to push up the stock market.

- California commercial electricity will continue to be the 5th most expensive electricity and Nevada will continue to have the 11th least expensive commercial electricity in the country. Also, the rolling blackouts in California will continue or get worse causing business uncertainty. This will drive more infrastructure companies to relocate to Las Vegas.

Concerns for 2021

-

If the COVID virus cannot be brought under control, we will be in uncharted territory.

-

Changes by the Biden administration may result in inflation, rising interest rates, and delayed recovery. For example, the Biden administration intends to increase corporate tax rates from the current 21% to 28%. Corporations have no option other than to raise prices and the result will be inflation. The fed stated that they will keep rates low, but inflation may force their hand. This likely means:

- Higher interest rates will decrease return rates on newly acquired properties.

- Higher interest rates will reduce home affordability. This will likely decrease the rate of appreciation for properties. On the other hand, since fewer people will be able to purchase homes, more will be forced to rent. This will tend to drive up rental rates and will benefit people who already own investment properties or who buy them before interest rates rise.

- Fewer companies will set up operations in the US since the EU will have lower tax rates (if corporate taxes are increased to 28%), so fewer jobs will be created which will slow the recovery. Today Europe has an average corporate tax rate at just under 20%.[^20] A 28% corporate tax rate may force companies to move operations to Europe or other countries with a more pro-business environment. This may reverse the trend of the last few years where companies were setting up new operations in the US.

-

People moving from California and other high-cost states could bring the types of social/anti-business legislation that has hurt California and now Austin.

-

The rate of people moving to Las Vegas increases significantly. While rapid growth sounds good, infrastructure can only expand so fast. If you exceed the growth rate the city can manage, you get the types of problems Boise is having.

New Developments

Below are two of the more interesting recent announcements:

- Google Data Center – Google is in the process of building a $600M data center in Henderson. They also announced that they will add a second $600M data center on the same site[^1]. Las Vegas will be one of 11 data centers worldwide. Even though they will not employ many people (100 to 150 employees at an average salary of $65,000), the presence of Google is huge. I believe that where Google goes, others will follow. And, it will be infrastructure, which is what I want for Las Vegas. I’ve seen companies lay off thousands of engineers and programmers at a time, but no one walks away from infrastructure.

- Amazon announced that it will open three more centers in Las Vegas. Of special interest are two facilities: Merch by Amazon and Print on Demand. “Merch by Amazon allows brands and independent artists to create custom-printed apparel and electronics products. Print on Demand helps authors and publishers with on-demand publishing, helping to reduce upfront costs of printing for inventory.”[^3] Amazon selecting Las Vegas for this type of infrastructure will bring others to Las Vegas as well.

The hospitality industry is still expanding:

- Virgin Hotels is opening a new hotel/casino this month (January 2021

- The First Atari Hotel Looks Like a Gamer’s Fantasy — and It’s Opening in Las Vegas

-

The Boring Company plans to expand the existing underground transit system in Las Vegas.

Other Items of Interest

- Las Vegas was the second fastest-growing city in the US for 2020[^4] – according to updater. “Most people migrated [to Las Vegas] from cities like San Fransisco, Los Angeles, and Sacramento, Updater said.”

- According to Newsweek, Nevada is the third fastest-growing state[^11].

- California fuels Las Vegas growth – As California continues to make the state less desirable for both individuals and businesses, many are leaving the state. Leaving California has actually become a significant business.[^6][^7] A portion of these companies and people will choose Las Vegas. Hopefully, the number of people moving to Las Vegas will not become the torrent that Boise is attempting to deal with.

- Zillow is predicting a +10% increase in Las Vegas housing prices in 2021.[^16] Interestingly, in the summer of 2020 they predicted a 7% decrease for 2021.

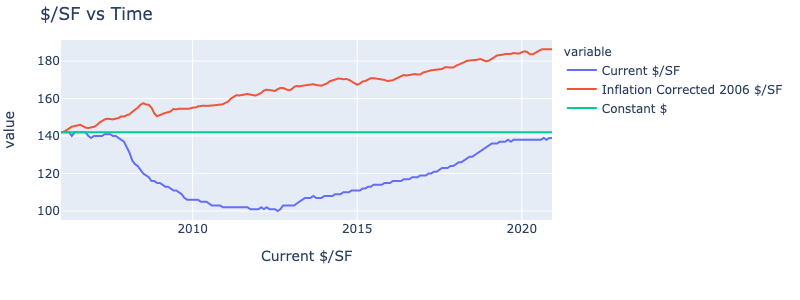

- Housing prices for Las Vegas are still well below 2006 peak prices. See the chart below. If you ignore inflation, prices have almost reached the 2006/2007 peak. However, inflation is real and must be considered. $143/SF in 2008 dollars is the same as $174/SF in 2020 dollars so there is still a long way to go.

- The median sales price for new single-family homes is $415,000[^2]. The current price range for our target property profile is between $250,000 and $350,000. What this means is that new homes will not compete with resales as investments. The quantity of conforming rental properties is virtually capped. This will tend to drive up rents and prices.

- Land shortage – The available land for development continues to dwindle. At the end of 2019, the amount of vacant buildable land in the Las Vegas Valley was less than 28,000 acres, of which 5,000 to 7,000 acres is not viable for residential development. (87.5% of Clark County is federally owned. 85% of the entire state is federally owned. ) Consumption rate is about 5,000 acres/year. See the animated GIF below. The areas in brown are federal land. The time-lapse only goes through 2018 and there was a large amount of development in 2019 and 2020. The southwest part of the city is now the least developed and construction in the area is relentless.

Why Companies Choose Las Vegas

- Low operating cost – No state income taxes, pro-business environment, low property taxes and low energy costs will continue to attract companies to Las Vegas.

- Energy cost – The average cost of commercial energy in Nevada is $0.0459/kWh, which is the 11th lowest cost in the US. California is $.1839/kWh, which is the 5th most expensive in the US.[^12] A major cost for many infrastructure companies is energy, so these companies will be attracted to Nevada and Las Vegas due to energy costs. In addition to low energy costs, Las Vegas has another huge advantage. Las Vegas is one of the few cities in the US with dual sources of electric power (California and Hoover dam). Uninterrupted power is critical for modern manufacturing and computer centers.

- Data bandwidth – The fiber optic bundle connecting Southern California to the East Coast runs under Las Vegas Boulevard, which is why Switch Company[^13], one of the largest data centers in the world is located in Las Vegas. Google is building two data centers here as well.

- Location – Las Vegas is within 16 hours driving distance to 20% of the US population.

- Image change – Las Vegas image is changing. Once only thought of as Sin City, today many people see that life beyond the Strip is very desirable. This is important because at the end of the day, if the location is not a desirable place to live it will be difficult to attract companies and people. Las Vegas meets these requirements today and will do even better in the future as the city builds out.

What About the “News”?

There are a lot of confusing messages in the “news”. Note that I quoted “news”. Most of the articles I read in preparation for this outlook seemed more like content-free text promoting the political views of the reporter and/or organization. Also, there were many obvious errors, even from publications you would expect to have performed at least basic research. Below is one example of the quality of the “news”:

“Nearly a third of U.S. apartment renters didn’t pay any of their April rent during the first week of the month, according to new data to be released Wednesday by the National Multifamily Housing Council and a consortium of real-estate data providers.”

This is from the Wall Street Journal

The following is a statement by Scott Trench, CEO of Biggerpockets:

Does anyone reading remember when, in early April, a bunch of big time news outlets reported how “NEARLY A THIRD” of American renters didn’t pay April rent? Well, those headlines got a lot of clicks and some good discussion going on BiggerPockets, but the fact of the matter is that the biggest reason for that drop in April rent collections was that we were comparing rents collected April 1-5, 2019, with rents collected April 1-5, 2020. April 4th and 5th were Saturday and Sunday in 2020. Banks are closed on Sunday.

Oops. False alarm. The real estate market didn’t crash, and doomsday did not materialize.

Below are my responses to the three most common “news” reports we are asked about.

“Large Number of Foreclosures in Las Vegas” – While there may be a significant number of foreclosures in other parts of the country, at this time it is not true for Las Vegas. According to the UNLV Lied Center For Real Estate Research[^5]:

“Most regions in Nevada are seeing a distress share lower than their pre-recession value. The distress share was less than 3 percent in the Las Vegas metropolitan area and less than 1 percent in Washoe County.”

Note, Reno is in Washoe County.

There has been no significant increase in the number of distressed residences in Las Vegas because the home buyer population has had limited economic impact due to COVID. Note that this does not mean no impact, just not enough to prevent most from staying current with their mortgage.

Borrowing the truth rating icon from the Washington Post Fact Checker, this gets

“The Coming Wave of Evictions in Las Vegas” – As usual, the “experts” got it wrong. Their mistake was that they grouped all tenants into one basket and made their “prediction”. As an engineer, I can tell you that their approach is invalid. You cannot combine disparate tenant populations into a single group and produce any meaningful information. They also made an even bigger error.

When the eviction restrictions end, some C and B Class tenants may be evicted. However, what the “experts” seemed to forget is that all these people will still need a place to live. And, all the owners of the C and B Class properties will still need tenants. What I believe will happen is closer to musical chairs than a huge wave of vacancies. Evicted tenants will move to the next C or B Class property down the street. And, the people from that unit will move to another recently vacated property. Most C Class tenants and many B Class tenants are cash-based, they have no or very limited credit so an eviction does not have any impact on their future. One property manager who handles a lot of such properties told me that their C Class tenant screening criteria consist of: “A heartbeat, 2 paycheck stubs and enough money to pay the first month’s rent.” Whether they just got evicted, skipped or have a damage judgement against them does not matter. So, in the short term, I see the potential for a lot of people shuffling around, but not a lot of vacancies.

For the tenant pool we target – To date, out of the 160+ client properties we track (out of a total of > 200 properties), at some point during the last 9 months 10 tenants have had trouble paying the full rent on schedule. In December that number dropped to 5. For example, one of the 10 tenants just paid close to $9,000 to bring their rent current. Paying $9,000 to catch up on the rent is a lot more expensive than moving. However, moving is not the issue, a bad credit report is their fear. If our tenant pool has a bad credit rating, they will not be able to rent another A Class property. More than likely, they will end up in B- or C Class properties with the resulting change in safety and school quality.

This gets:

“The Las Vegas Economy is Crashing – Basically, I believe none of these articles when it comes to Las Vegas and likely the nation. The US has the most stable economy in the world at this time. Also, almost all international transactions (oil, food, trade, etc. are dollar-denominated). The EU central bank has had a negative (yes, negative) interest rate for some time.[^14] The only market where Europeans are likely to get a good return is the US. Low-interest rates also force fixed-income investments such as giant pension funds to seek higher returns from the stock market. So, the US securities market is likely to remain strong.

Locally, the underlying economy is comparatively strong. At the end of 2019, Las Vegas had approximately $24B under construction. Some of these developments recently came on-line (Circa Casino, Project Neon, Raiders Stadium, etc.). Others are still under construction (Google’s $1.2B data center, Amazon opening 3 more centers which brings the total to 6 in Las Vegas, etc.) and more new projects have been announced. And, it is not just the jobs, it is the type of jobs. No one walks away from billions of dollars of infrastructure so the vast majority of these projects will be completed creating secure jobs. In some cases, openings may be delayed but they will open. When they do, they will create thousands of new jobs, the majority of which will match our target tenant pool. These jobs will bring more people to Las Vegas, which increases the demand for rentals and sales, which will drive up prices and rents.

This gets

Background

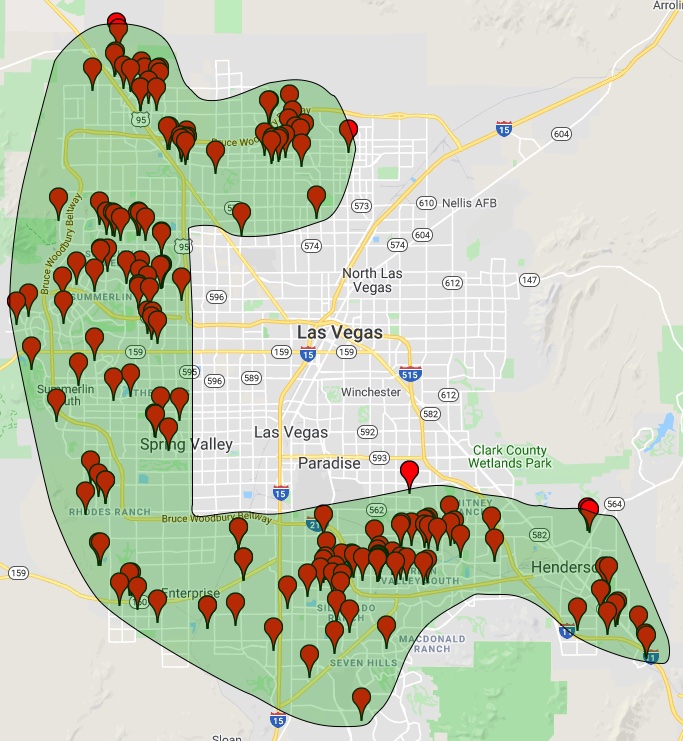

The information in this document primarily concerns properties that match our property profile, not the general Las Vegas real estate market. Our data does not include condos, townhomes, C Class, B Class properties, high rises, or properties costing over $400,000 or less than $250,000. Our focus is very narrow since we target a very specific tenant pool that has proven very reliable and resilient to economic instability. What is our target tenant pool? I put together the following diagram to illustrate where they fit in the overall income range.

In the above diagram, I subdivided the entire range of workers into three general categories based on income.

- Low Skilled Workers – These are the near minimum wage workers. They are easy to replace and are the first to be laid off in times of economic stress and the last to be rehired. They typically rent C Class and some B Class properties. They have an average tenant stay of about 1 year. Turn costs are high and there are frequent skips, evictions and significant property damage. When you read about all the coming evictions, the vast majority are residents of C Class and some B Class properties.

- Mission Critical Workers – This is our target tenant pool. These are the line people, the individuals that generate income for their employers. Compared to their cost, they generate a large amount of income. These people are laid off only if the company is closing its doors. They typically rent Class A and Class B+ properties. This tenant pool’s average stay is about 5 years and the average turn cost is about $500. How reliable is this tenant pool? We had no rent decreases or vacancies during the 2008 crash and have had very few issues during the COVID epidemic. This tenant pool stays and pays. What they fear is not a physical eviction but a credit hit. They know that if they have a negative report on their credit, everything they finance will cost more plus, no property manager will rent an A Class property to them. So, they tend to be very good tenants, whether there is an eviction moratorium or not.

- Salaried Professionals – Very few of this population rents, they are home buyers, The few that rent primarily do so due to life changes like a divorce or the death of a spouse. As soon as they get their lives sorted out, they buy a home. Typical tenant stay is about 2 years and turn costs tend to be high because the properties they rent are larger and the expectations of tenants in this price range are high.

Below is a chart showing household income vs the number of households in Clark County. (Note, this chart is from Wolfram Alpha.)

The tenant pool we target is the middle band. Our tenant pool has an average household income of between $45,000 and $65,000 per year. Above this income range, the people are primarily home buyers, not renters. Below this income range, you largely have lower skilled cash based workers whose employment is subject to economic turbulence. During the 2008 crash, many of the C class properties in town were boarded up and/or the banks foreclosed on them.

Looking Back at 2020

The information below only concerns the narrow property profile/tenant pool we target. No data for any other property type is included. The typical property we target has the following characteristics:

- Single family

- Sale price < $400,000

- Bedrooms: 3 to 4

- Garage: 2 to 3

- Stories: 1 or 2

- Note that while the green area appears homogeneous, in actuality it is more like Swiss cheese.

Below you will find the statistics we generate each month.

Note: The charts below are based on data from the Greater Las Vegas Association of REALTORS (GLVAR) MLS.

Rental Statistics

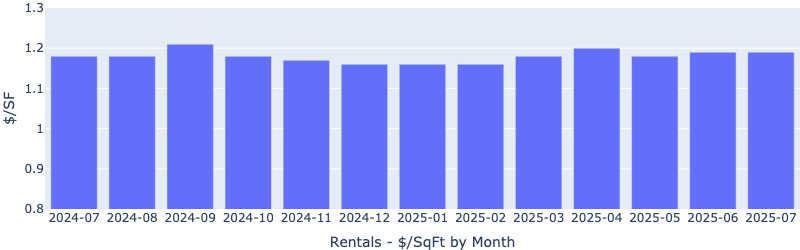

Rentals – Median $/SF by Month

Rents rose by approximately 9% in 2020.

Rentals – List to Contract Days by Month

There is very little rental inventory and what is available goes under contract in days.

Rentals – Availability by Month

Inventory was low in December 2019, today it is down to the lowest I’ve seen in the last 15 years.

Rentals – Months of Supply

2 to 3 months is typical. Today we are just over 0.5 months of supply.

Sales Statistics

Median $/SF by Month

YoY $/SF increased by about 8%

Sales – List to Contract Days by Month

Due to the limited supply and the high levels of demand, properties went under contract in days, not weeks or months.

Sales – Availability by Month

There is very little inventory, which continues to drive up prices.

Sales – Closings by Month

Sales – Months of Supply

6 months of supply is considered a “balanced” market. Today there is about 0.5 months of supply.

Summary

Las Vegas is in a unique position. There is little land for expansion, a growing job market, and an influx of people. Unless there is another “COVID Event”, prices and rents will continue to increase at a rapid rate through 2021 and beyond. So, unless California suddenly turns business and people-friendly, Las Vegas will have a long run of prosperity.

As always, I wecome your feedback.

Eric Fernwood

EricFernwood@gmail.com

702-358-8884

01/23/2021

References

[1]: Google to Invest Additional $600M at Henderson Data Center Site

[2]: Prices for new Las Vegas homes set another record

[3]: Amazon details Nevada plans for 8 buildings, 2K more jobs_

[4]: Las Vegas ranked 2nd fastest growing city in 2020, study says

[5]: Nevada Housing Market Update

[6]: Companies Join People in Fleeing California

[7 ]: From Elon Musk to Oracle — the coronavirus accelerates California exodus

[8]: A look at Nevada’s exploding housing market

[9]: Fed will keep interest rates low until economy recovers

[10]: Las Vegas Home Values

[11]: America’s Fastest-Growing States

[12]: Electricity rates by state

[13]: Switch

[14]: Key ECB interest rates

[15]: Pent Up Travel Demand At An All-Time High, Says ASTA

[16]: Zillow – Las Vegas Home Values

[17]: Here’s how land is used by the federal government in Nevada

[18]: Public Lands and General Natural Resource Issues

[19]: Biden’s First 100 Days: Here’s What To Expect

[20]: Corporate Tax Rates around the World, 2020