Is Buying a Property in Las Vegas a Good Investment? (2023)

In This Report

- Is Buying a Property in Las Vegas a Good Investment?

- Potential Investment Properties

- Market Trend

- About the Fernwood Real Estate Investment Group

Is Buying a Property in Las Vegas a Good Investment?

Whether Las Vegas is a good investment location for you depends on your goals. If your goal is financial independence, Las Vegas is one of the best investment locations in the nation.

Financial Freedom

Financial freedom is more than just replacing your current income; it’s about maintaining your current lifestyle for life. To have lifelong financial freedom, you need a passive income that meets three requirements:

- Rents must outpace the cost of living: Inflation consistently erodes the purchasing power of a fixed amount of money. For instance, if the inflation rate is 5%, what you can buy today for $100 will cost $155 in 10 years. If rents fail to pace with the cost of living, your financial independence will be short-lived.

- Dependable: You will receive the rental income every month, even when the economy is doing badly.

- Lifelong: You will not outlive the income.

Whether rental income can outpace the cost of living, as well as how long the rental income will last, depends on the city in which the property is located. The reliability of your income is dependent on the tenant, their value in the eyes of their employer, and the resilience of their employers during economic downturns.

In this post, I will only discuss how Las Vegas meets the requirements for rental income that outpaces the cost of living and why it will provide an income that will last.

Rapid Appreciation and Rent Growth

Property prices are driven by the imbalance between sellers and buyers. If there are more sellers than buyers, prices will fall until the number of sellers is roughly in equilibrium with the number of buyers. Conversely, if there are more buyers than sellers, prices will rise until the number of sellers is roughly in equilibrium with the number of buyers. How fast prices rise is dependent on how imbalanced the number of buyers vs. sellers is.

How do rising property prices affect rent prices?

- Higher property prices reduce the number of people who can afford to buy a home, forcing them to rent. This, in turn, increases demand for rental properties and drives up rent prices.

- Lower property prices make it possible for more people to purchase a home, reducing the demand for rental properties and causing rents to decrease.

In order for prices (and rents) to increase at a rate faster than the cost of living, there must be significantly more buyers than sellers. This is the result of sustained and significant population growth. What is the current population growth situation in the Las Vegas Valley?

Las Vegas has an average annual population growth rate of 2-3%, which may increase due to recent news that Las Vegas is now the top city in the US for people relocating due to job opportunities.

Why are so many people moving to Las Vegas? Jobs. The Las Vegas Valley spring job fair had over 20,000 open jobs with an average wage of $65,000. This is a large number for a city the size of Las Vegas. These jobs will attract more people to move to Las Vegas, all of whom will require housing. This will increase demand for housing and will drive up prices and rents.

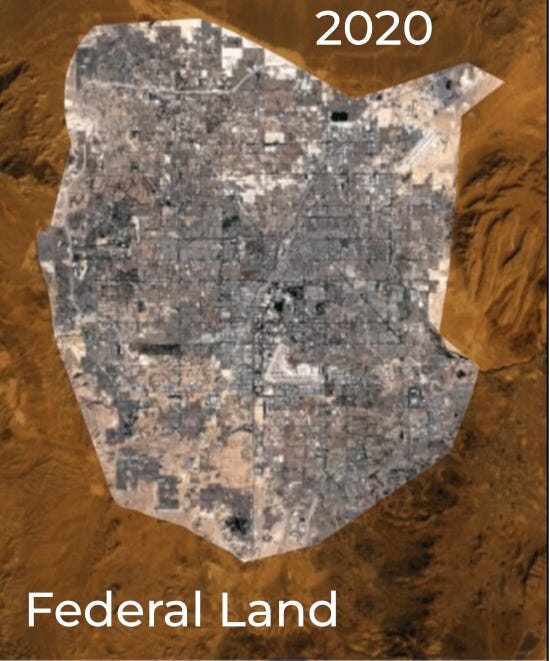

Why can’t Las Vegas build more homes to meet the demand for housing? Limited private land for expansion. About 90% of Clark County is federal land. In a study I did in 2019, I determined that Las Vegas only had about 22,000 acres of undeveloped land. The average rate of raw land consumption exceeds 4,000 acres per year. Consequently, available raw land is being rapidly depleted, and soon the only option for expansion will be redevelopment. This has already begun in certain areas of the Las Vegas Valley.

Below is an aerial view of the Las Vegas Valley from 2020. The brown-colored areas on the map indicate federal land, and as you can see, there is little undeveloped land left. Additionally, significant growth has occurred between 2020 and the present day, which means that even less land is currently available for development.

Raw land in desirable areas costs over $1 million per acre. Due to the high cost of land, new homes in these areas start at $550,000. The properties that attract our target segment cost between $320,000 and $475,000. So, no matter how many new homes are built, the number of homes in the $320,000 to $475,000 price range will not increase. Therefore, the number of properties that attract our target tenant segment is almost fixed.

### Lifelong Income

Your financial independence depends on the long-term economic growth of the city where you invest, with jobs being the critical factor. However, it’s not just about the jobs your tenants have today because all non-government jobs have a limited lifespan. The average lifespan of a company is 10 years. Even an S&P 500 company has an average lifespan of only 18 years. This means that every non-government job your tenants have today will eventually come to an end. Without new companies moving into the city and creating replacement jobs, only low-paying service sector jobs will remain.

What is the future job outlook for Las Vegas? Today, there are new projects worth approximately $30 billion that are either under construction or planned. These projects will create thousands of additional jobs in the future.

Another major source of future jobs is companies moving out of California. Below is a chart showing the top 10 destinations for companies leaving California. I see no reason why the trend of employers leaving California will change in the future.

The rapid pace of job creation is expected to continue for the foreseeable future, resulting in a bright long-term job outlook for the Las Vegas Valley. Sustained economic growth will ensure that your rental income lasts for a long time.

Summary

So, the answer is yes. Buying a rental property in Las Vegas in 2023 is a good investment, and it is likely to remain so for the foreseeable future. Las Vegas offers unique advantages for investors due to its combination of a land shortage, sustained and significant population growth, and a rapidly expanding economy. This combination almost guarantees:

- Your rental income will outpace the cost of living.

- You will not outlive your rental income.

- Your equity increases rapidly, allowing you to reinvest it into additional properties. This significantly reduces the total capital needed to acquire the multiple properties needed to replace your current income.

However, not all properties in Las Vegas will be good investments. If you would like to find out which Las Vegas properties can best help you achieve financial independence, please get in touch:

As always, I welcome your comments.

…Eric

Eric@Fernwood.Team

702-358-8884

Potential Investment Properties

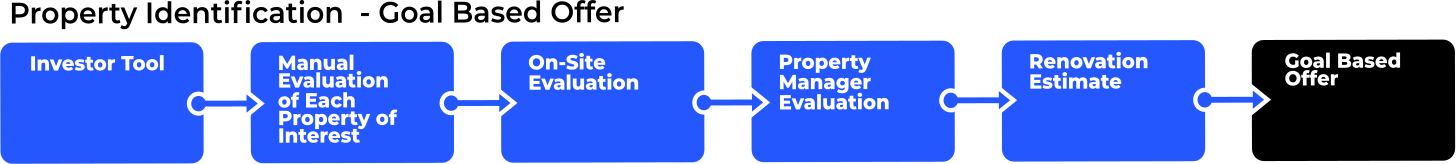

Below is a link to this month’s list of candidate investment properties. Our proprietary data mining software selected these candidate properties from thousands of available properties, and this is just the first step in our multi-step validation process, as shown below.

This Month’s List of Candidate Properties

Market Trend

Below are charts from our latest trailing 13-month market report, which includes July data. Remember that this data is only for our target property profile, not the entire metro area. To see all the charts, please click here.

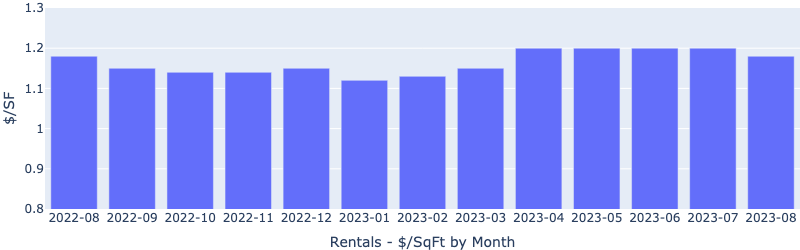

Rentals – Median $/SF by Month

August saw rents drop slightly, conforming to past seasonal trends. YoY is flat.

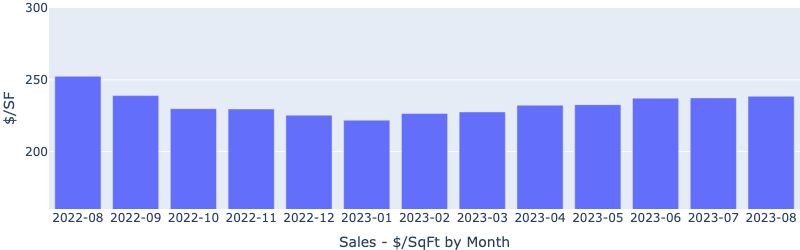

Sales – Median $/SF by Month

Despite increasing interest rates, $/SF is climbing up. This is due to the shrinking supply and steady demand.

Rentals – List to Contract Days by Month

Median time to rent maintained at ~20 days, indicating steady demand.

Sales – List to Contract Days by Month

Median days on the market continued to drop, indicating increasing demand.

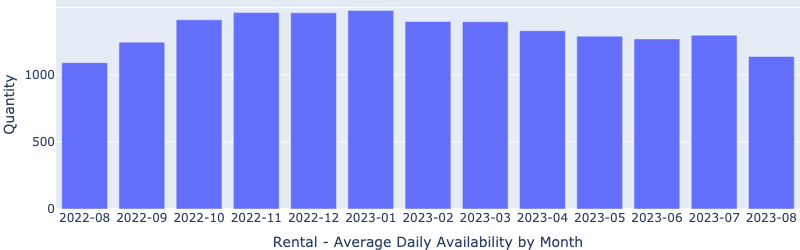

Rentals – Availability by Month

The number of homes for rent continued the downward trend.

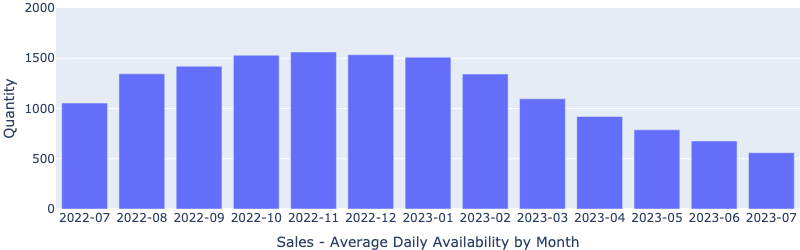

Sales – Availability by Month

This chart shows the average daily number of properties that were for sale in a particular month. The number of homes on the market continues to decrease rapidly. This is going to push up the price.

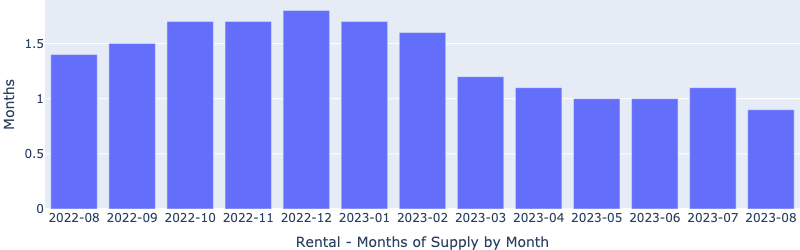

Rentals – Months of Supply

Only about 0.8 months of supply for our target rental property profile. Demand is greater than supply.

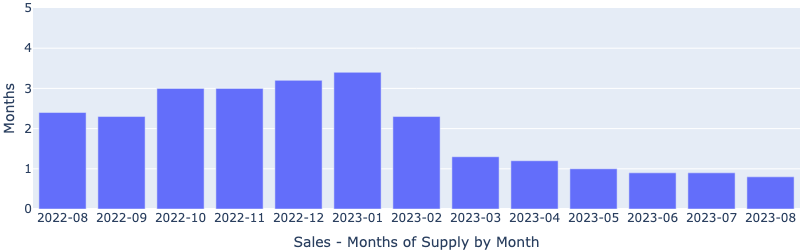

Sales – Months of Supply

Inventory is now at only 0.7 months. 6 months’ supply is considered a balanced market. This will push up the prices.

About the Fernwood Real Estate Investment Group

We Help Clients Acquire Highly Reliable Passive Income Streams

For the last 15+ years, we’ve helped clients build highly reliable, passive income streams through real estate that they will not outlive. Several are now retired and living entirely on their rental income. Most never invested in real estate before they started working with us, and most live in other states or countries. Below is a two-minute video of the services we provide.

Want to know what we can do for you?

© 2005-2022 Cleo Li and Eric Fernwood, all rights reserved.