In This Report

- How Much Cash and Time Are Required to Invest with Us?

- Potential Investment Properties

- Market Trends

- About the FERNWOOD Team

How Much Cash and Time Are Required to Invest with Us?

During new client meetings, the two questions I hear most frequently are, “How much will it cost?” and “How much of my time will be required?” These are important, fundamental questions any investor should consider. In this post, I will provide a detailed rundown on the cash and time required to acquire a good Las Vegas investment property with us.

How Much Do You Need to Invest in a Good Las Vegas Investment Property

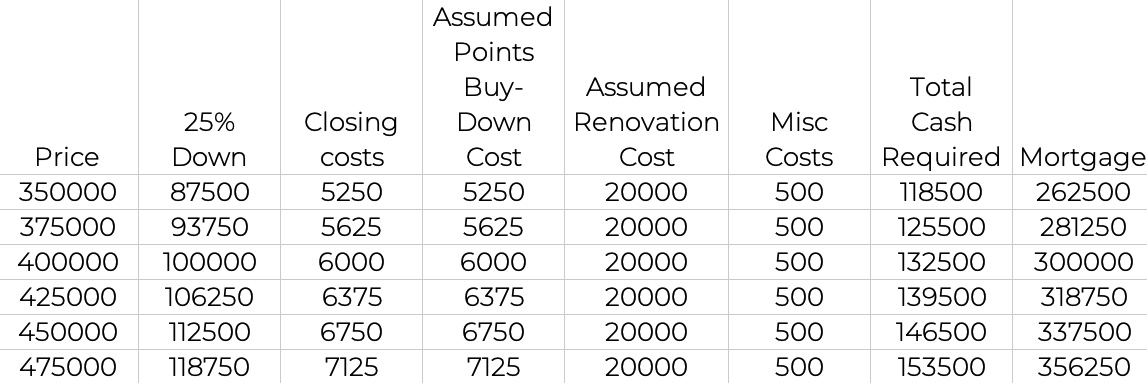

Many people only consider the down payment when they’re estimating the cost. There are many additional costs, and below is a reasonable estimate of how much cash you will need to close and bring to (rental) market a $400,000 rental property. Note that some items are property-specific, for example, renovation cost.

- Purchase price: $400,000

- Down payment (25%): $100,000. I used 25% down because this is the most common amount our clients put down.

- Closing cost (financed, not a cash purchase): 1.5% x $400,000 = $6,000. This includes the cost of obtaining a loan, title and escrow fees, home inspection, etc.

- Typical interest rate buy-down cost: 1.5% x $400,000 = $6,000

- Typical renovation cost: $20,000

- Miscellaneous additional costs: $500

Total estimated cash required: $132,500 with a 25% down payment. This investment will also require a $300,000 mortgage. Below is a table showing how much cash and mortgage for different price points.

Notes:

- Property price: Obviously, higher-priced properties will cost more to acquire. However, the narrow property segment we target (to maximize chances of high performance) costs between $320,000 and $475,000 today.

- Our Fees: As outlined in our terms and conditions, we charge 2.5% of the gross sales price. What’s important to understand is that the seller, not you, almost always pays this fee. Out of 560+ properties, our clients have contributed to our fee only six to eight times or, about 1.4% of cases. If a seller refuses to pay our fees, we recommend finding another property.

- Renovation: I used $20,000 as an estimate, but actual costs depend on the property and market. We don’t use a standard upgrade list—just what’s needed to make the property competitive. We start with a full list of possible upgrades in the Property Report, then, during due diligence, narrow it down to only what’s needed to meet the rental goals.

- Buy Down Cost: I estimated the interest rate buy-down at 1.5% of the purchase price for simplicity, though the actual cost depends on your loan amount, down payment, and credit score, and is usually based on the loan amount, not the sales price. I used the sales price to be conservative. The buy-down lasts for the life of the loan, but I expect you’ll refinance to a lower rate if the interest rates drop significantly at some point.

- Down Payment: With the current high interest rates, you may need to put down more than 25% to have a neutral cash flow the first year. How much you need to actually put down depends on the cost to buy down the interest rate and the current interest rate at the time you buy. So there’s no simple answer. I just assumed 25% and 1.5% of the purchase price to buy down the interest rate.

- Miscellaneous Costs: I included a $500 buffer to cover unexpected minor expenses that may arise.

How Much of My Time Will Be Required?

Due to our one-stop, done-for-you services, the typical amount of time that clients need to invest with us is very reasonable. I’ve asked multiple clients what the total amount of time is that they invested, including the first introductory call through getting their first rent check. The answers ranged between 8 and 12 hours total time. What does the amount of time include?

- Initial discovery call: 1 Hour. The purpose of this call is to understand your situation and goals and determine whether Las Vegas and our services are a good match for you. One-on-one with Eric Fernwood or Cleo Li.

- Processes and Fundamentals: 1 Hour. There are no secrets in real estate investing. In this session, we walk you through every step of our process. By the end, you’ll know exactly how we work and can decide if we’re the right fit for your goals. One-on-one with Eric Fernwood or Cleo Li.

- Review and Sign Terms and Conditions: 30 Minutes. Before we share property information, you’ll need to sign a buyer broker agreement. Because the standard agreement can be unclear, we add an addendum to spell out key points—like your right to cancel anytime by email or letter. If we’re not a good fit, you can walk away easily. Our terms and conditions cover several other important topics.

- Analytics and Portfolio Growth: 1 Hour. We show you how we analyze the property so that you understand the information we provide. Also, we explain how you can grow your portfolio with minimal incremental capital. One-on-one with Eric Fernwood or Cleo Li.

- Kickoff Call: in the kickoff call, you will meet with Cleo Li and the account manager. 1 Hour. The topics are typically about current market conditions and understanding your long-term goals so we can make informed property recommendations. One-on-one with Cleo Li and your assigned account manager.

- Property Report Review and Property Selection: Total: 30 minutes. On every property we evaluate that we believe matches your situation and goals, we create a detailed assessment. Initially, these could take a few minutes for you to read. Soon, you’ll be able to evaluate a property in about five minutes with the information we provide. On average, you will look at about six properties before we get one under contract.

- Review and eSign various documents: 30 minutes to an hour.

- Principal Forms of Ownership and Risk Reduction: Optional 1 hour meeting. In this meeting we will discuss what I have learned from sitting in on client attorney meetings. The goal is to be aware of the pros and cons of the various forms of ownership. Also, you will learn why we remove certain things from rental properties during renovation.

- Meet the Property Manager: 1 Hour. In this session, you’ll learn about being a landlord in Las Vegas, fees, tenant selection, maintenance, when rent is deposited, and more. This is a one-on-one meeting with Angela Valdez, owner of Lantana Property Management.

- Final closing signing: 1 hour if financing, 15 – 30 minutes if cash.

The total time is about 7.5 to 9 hours, but most clients will spend 8 to 12 hours in total, including additional questions and meetings. This covers everything up to your first rent check. (For a more detailed description of our processes and services, click here.)

Other related questions:

- Do you need to come to Las Vegas to buy a property? No. If you’re in the U.S., the title company can send a mobile notary to you. This can also be arranged for clients in other countries (although some lenders may not allow this).

- What if I want to visit my property? I recommend seeing your first property in person. We’ll pick you up at the airport and take you to the property, where you’ll usually meet Selena (renovation manager), the property manager, and your account manager. We want you to know the team, since most clients buy multiple properties with us.

- How long does it take to buy additional properties? Usually much less time than the first. If it’s been a while, we’ll do a one-hour market update. Expect about two to three hours total per additional property.

- How much time will I spend each month? Most clients spend about 10 minutes a month reviewing their online portal. For any issues, contact the property manager first. If it’s not resolved quickly, email Cleo Li (Cleo@Fernwood.Team) and me (Eric@Fernwood.Team), and we’ll make sure it gets handled.

Summary

By focusing on a narrow property segment, we can provide you with a fairly accurate cash requirement. And due to our done-for-your services and heavy reliance on processes, your total time requirement to invest with us is minimal.

If you’re interested in exploring how the current Las Vegas market conditions could align with your goals, please use the link below to schedule a time that works best for you.

Potential Investment Properties

Below is a link to this month’s list of candidate investment properties. Our proprietary data mining software selected these candidate properties from thousands of available properties, and this is just the first step in our multi-step validation process, as shown below.

This Month’s List of Candidate Properties

Market Trend

Below are charts from our latest trailing 13-month market report, which includes July data. Remember that this data is only for our target property profile, not the entire metro area. To see all the charts, please click here.

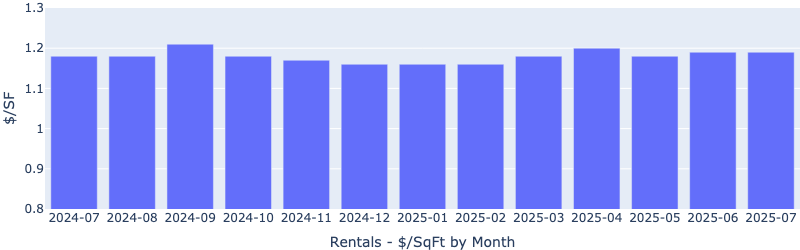

Rentals – Median $/SF by Month

Rents remained flat in June and July. Despite global tensions, rents remained reasonably stable.

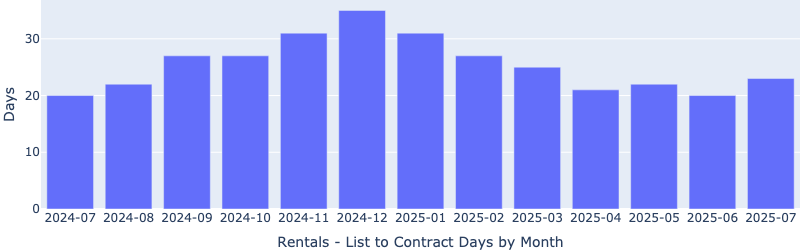

Rentals – Median Time to Rent by Month

Time to rent increased MoM (from 20 days to 23 days), but remained healthy.

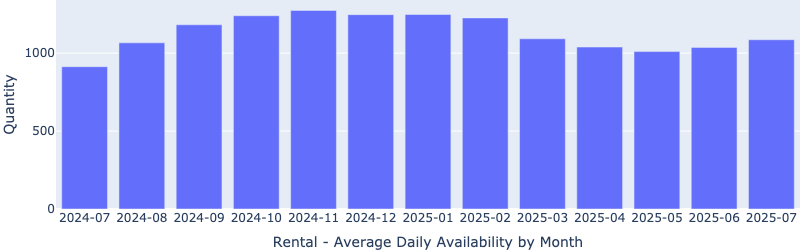

Rentals – Availability by Month

The number of homes for rent increased MoM in July, conforming to seasonal trend.

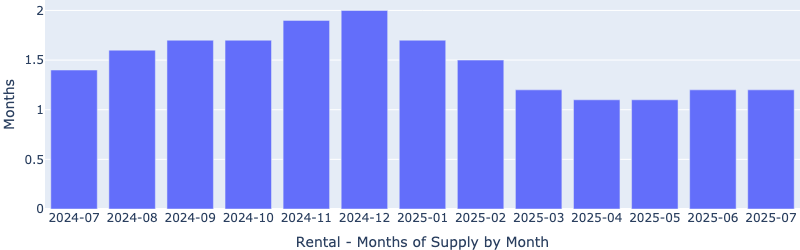

Rentals – Months of Supply

There are only 1.2 months of supply for our target rental property profile. This low inventory will continue to pressure up rents.

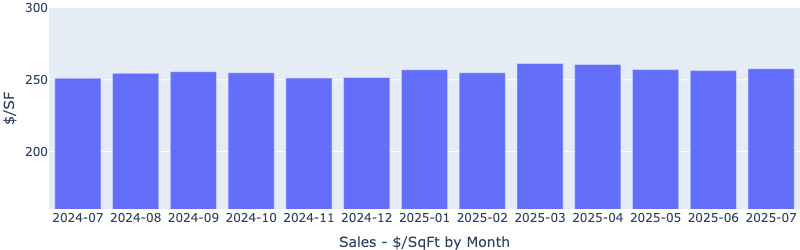

Sales – Median $/SF by Month

Despite all the volatility and alarming media headlines, the $/SF had a slight increase MoM. YoY is up 3%.

Sales – List to Contract Days by Month

Median days on the market increased MoM, indicating that sellers and buyers are in a “stand-off” waiting to see which side blinks first. Based on the price increase in July, it doesn’t look the sellers have caved in.

Sales – Availability by Month

The number of properties for sale increased MoM, inline with what we are seeing in the market. This has enabled us to secure more good deals.

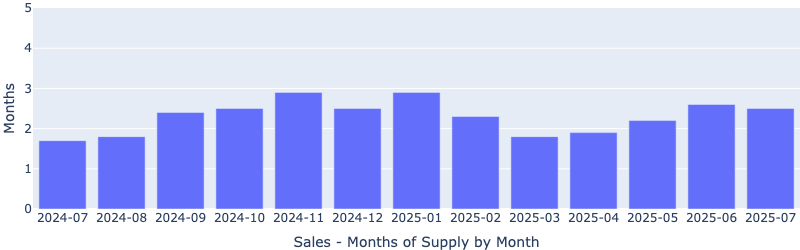

Sales – Months of Supply

Despite increasing number of homes on the market, the inventory decreased MoM, to about 2.5 months. This indicates that more buyers have entered the market. Six months is considered a balanced market where the number of buyers and sellers are roughly equal, and prices remain stable. This is still a seller’s market, despite the soundbites or clickbait you might hear or see in the media.

About the FERNWOOD Team

We Help Investors Build Wealth through Strategic, Data-driven Real Estate Investments in Las Vegas.

Here is what our clients have to say about us:

For the last 17+ years, we’ve helped clients build highly reliable, passive income streams through real estate that they will not outlive. Several are now retired and living entirely on their rental income. Most never invested in real estate before they started working with us, and most live in other states or countries. Below is a two-minute video of the services we provide.

Want to know what we can do for you?

© 2005-2025 Cleo Li and Eric Fernwood, all rights reserved.

Join the newsletter. Subscribe to receive our latest post in email.