In This Report

-

Get Ready to Buy in the Best Time of the Year

-

Potential Investment Properties

-

Market Trends

-

About the FERNWOOD Team

Get Ready to Buy in the Best Time of the Year

It’s October. The holiday season will be here before we know it. Traditionally, Q4 has been a great time for investors to purchase. Since fewer people want to move during the holidays, the sellers that remain on the market are likely motivated. This has traditionally allowed us to secure good deals during this time.

This year, a rare convergence of factors in Las Vegas makes this buying season even better. Let me explain.

The (Possible) Perception

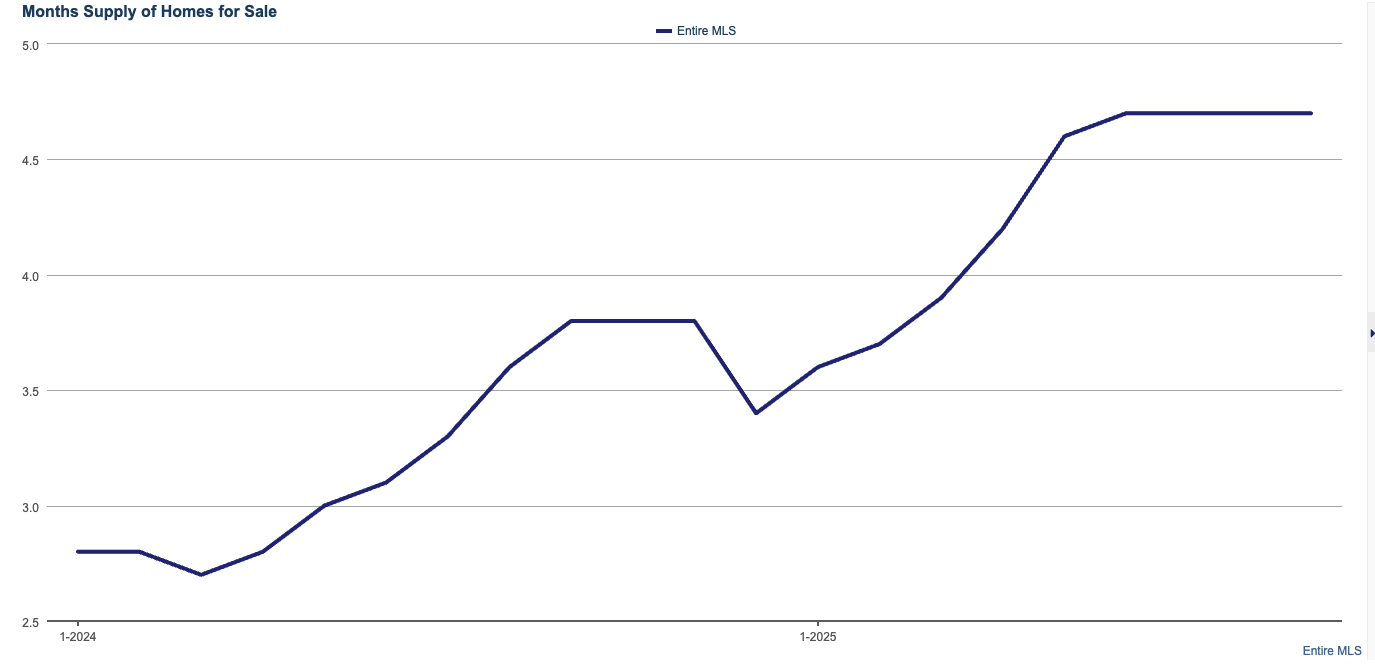

The Las Vegas housing market experienced an unusual slowdown since early summer 2025. The chart below shows the months of supply for ALL property types and all price ranges. It started climbing much earlier in the year than usual.

[]

If you follow the news, it’s probably easy to understand why the buyer’s confidence may be shaken:

-

Kinetic wars – every day there seems to be news about the Ukraine war, the war in the Middle East and Iran, the India/Pakistan war, the Thailand/Cambodia conflict, the pending conflict in Venezuela… on and on.

-

Trade wars, especially between the two largest economies, can have significant potential effects if not resolved.

-

The shutdown of the US government due to the budget conflict in Congress.

Conflicts cause uncertainty and anxiety. People naturally tend to hesitate at making significant financial decisions when there is uncertainty.

I don’t know why but there also seems to be negative media coverage that targeted Las Vegas.

-

News articles about the decline in tourism, ranting anger towards casinos charging high fees.

-

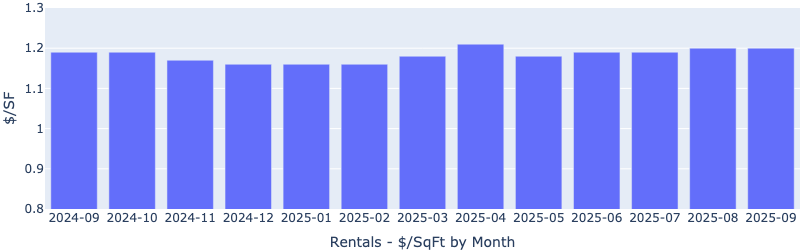

Headlines pointing to declining rents. When I clicked into the article, it was about the one and two-bedroom apartments. A large number of mega apartment complexes were built over the past two years, and it is no surprise that the apartment market is saturated, leading owners to lower rents to fill units. However, our target (families) do not rent apartments (or condos) so what happens in the apartment market has no real relevance for us. What has happened to rental rates for the segment we target? Rents have actually ticked up.

If you follow these news coverage, it seems like the sky is falling in Las Vegas. The market is going to crash worse than 2008, bla bla bla… With the market “crashing,” you would expect a lot of distressed single family homes. Below is the actual data for single-family homes:

-

Short sales: 38, about 0.0084% of all single-family homes

-

Bank owned (REO): 37, about 0.0082%

-

Foreclosures started: 33, about 0.0073%

The Reality

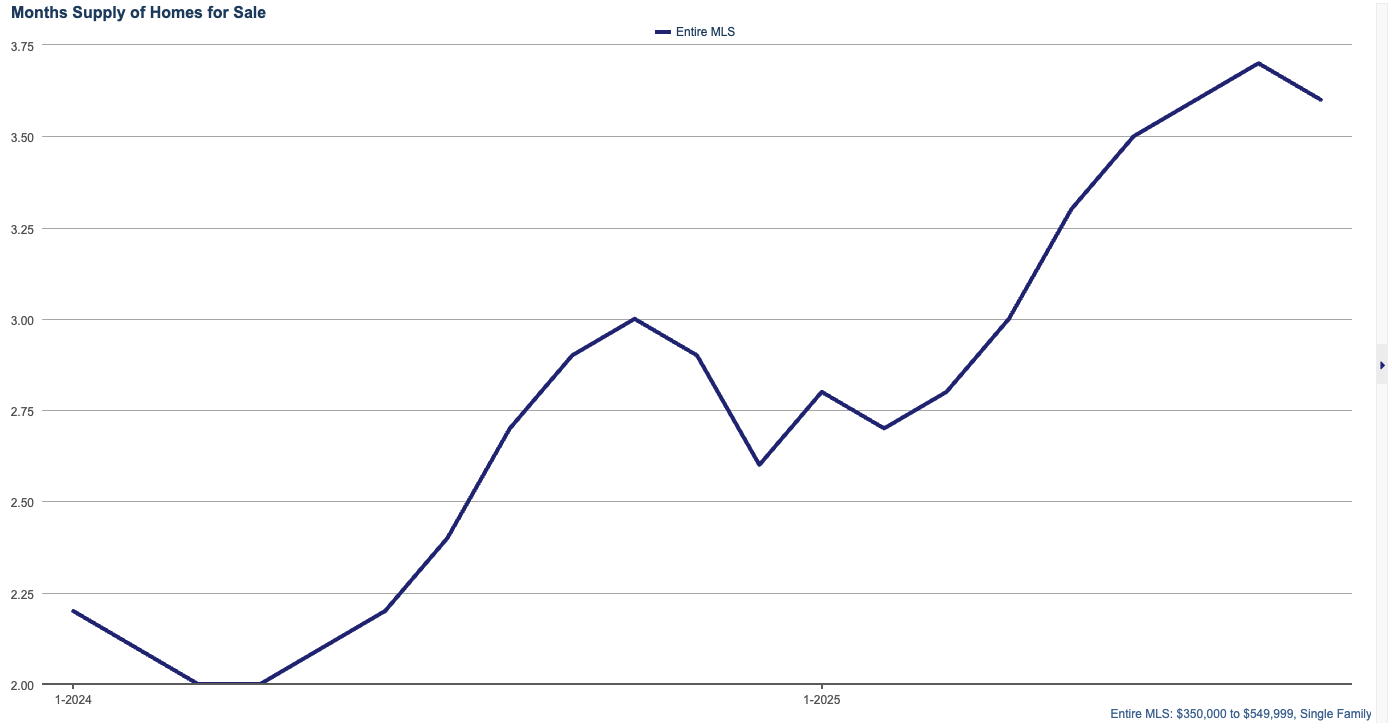

The chart below shows the months of supply for single-family homes priced between $350,000 – $550,000 for all MLS. This is roughly in our target segment price range, but for all areas.

[]

Inventory has actually decreased in September. This is unusual, as inventory typically rises in the fall as the peak spring/summer sale season ends. This is also true for our specific target segment.

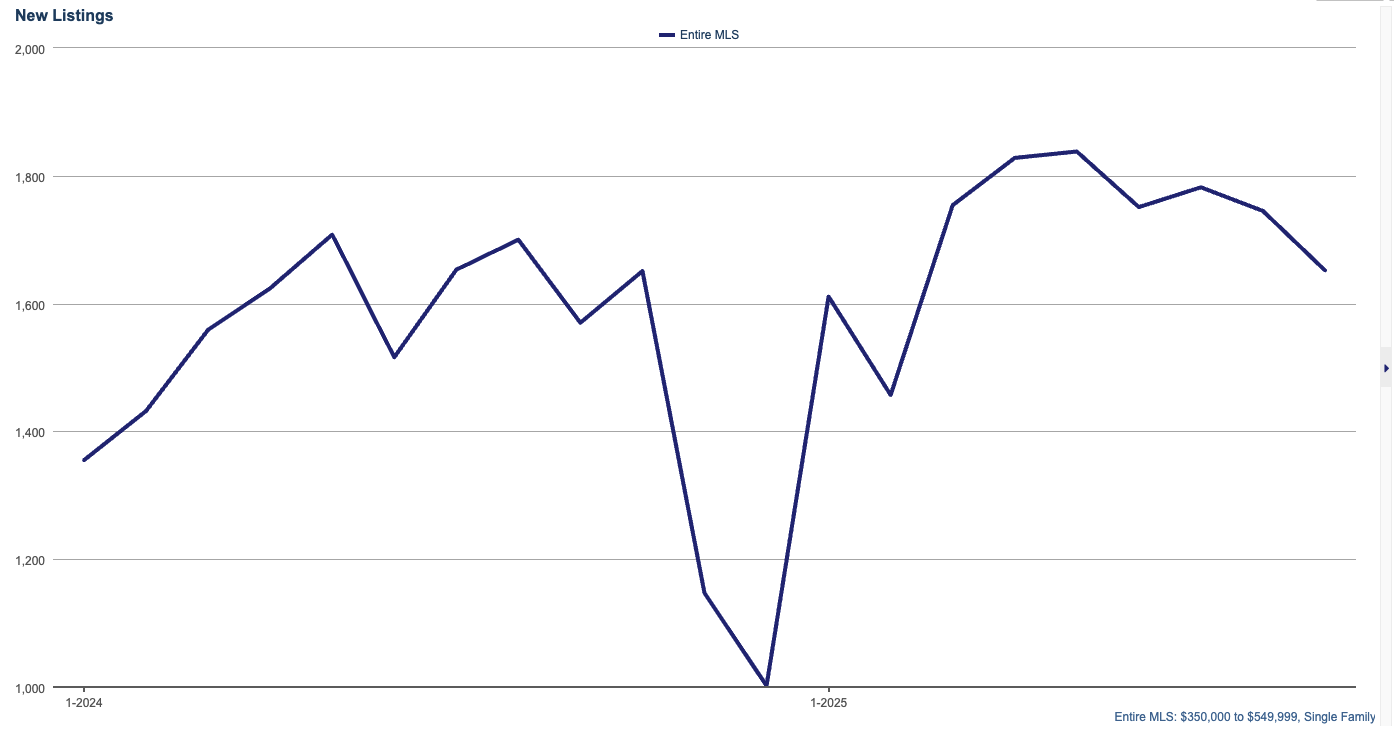

The next chart shows the number of new listings coming onto the market for the same single-family price band.

[]

It has been decreasing since July.

This tells me that inventory will likely stabilize, if not decrease, between now and the end of the year.

When inventory stabilizes or decreases, prices will stabilize or increase. This is already showing up in our target segment. It is very unusual to see prices ticking up from August to September.

The Opportunity

There seems to be a disconnect between news portraits and the reality of the market which we can exploit it to our advantage.

Many sellers who’ve been waiting to sell their homes may feel stressed by all the negative news. They may be more inclined to accept lower offers just to move on with the sale.

However, the fundamentals for Las Vegas have not changed. Population growth remains strong due to , and

If you’ve been wanting to buy a good investment property in a growing market with solid fundamentals at a value price, now may be the time. to see if the current Las Vegas market conditions align with your goals.

Potential Investment Properties

Below is a link to this month’s list of candidate investment properties. Our proprietary data mining software selected these candidate properties from thousands of available properties, and this is just the first step in our multi-step validation process, as shown below.

Market Trend

Below are charts from our latest trailing 13-month market report, which includes August data. Remember that this data is only for our target property profile, not the entire metro area.

Rentals – Median $/SF by Month

Rents remained stable MoM and marginally up YoY. This is unusual as rents typically dip in this time of year.

Rentals – Median Time to Rent by Month

Time to rent increased MoM from 24 days to 28 days, but remained healthy especially for the season.

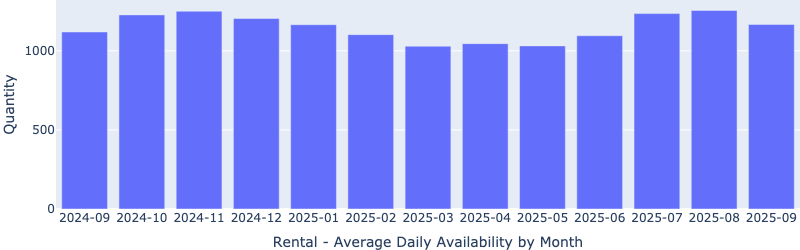

Rentals – Availability by Month

The number of homes for rent decreased MoM in September, again bucking the usual seasonal trend.

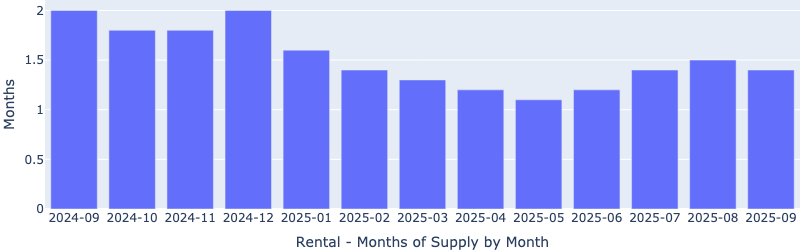

Rentals – Months of Supply

There are only 1.4 months of supply for our target rental property profile. This low inventory will continue to pressure up rents.

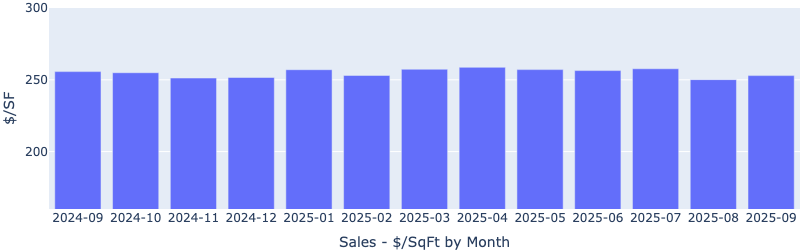

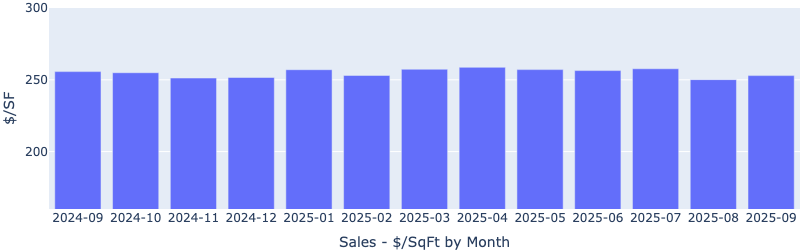

Sales – Median $/SF by Month

The price per square foot recovered some from last month’s unexpected drop, inline with gradually decreasing inventory.

Sales – List to Contract Days by Month

Median days on the market decreased again MoM, indicating that more buyers have decided to buy instead of waiting longer, perhaps taking advantage of last month’s price dip.

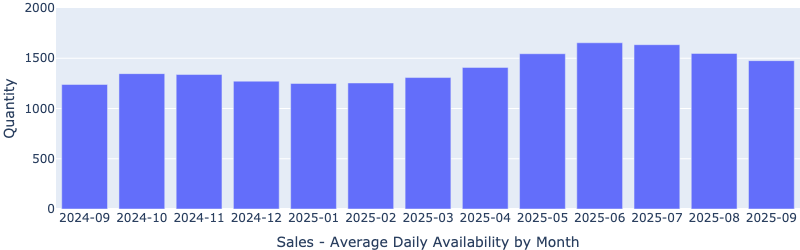

Sales – Availability by Month

The number of properties for sale has been decreasing since June, which again bucks the “usual” seasonal trend.

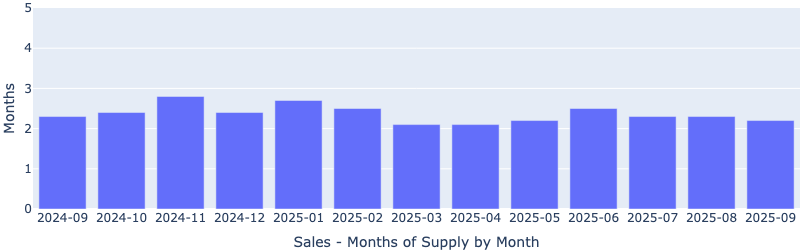

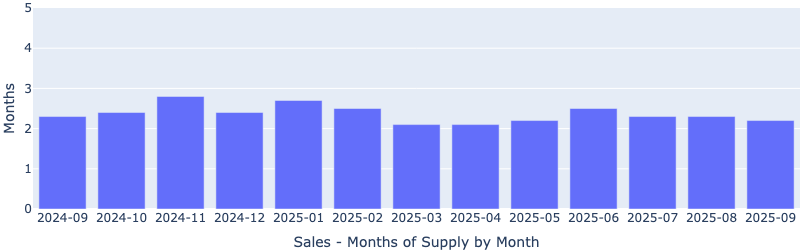

Sales – Months of Supply

Inventory remains at just above two months, indicating our segment is still a seller’s market.

About the FERNWOOD Team

We Help Busy Professionals Build Wealth through Strategic, Data-driven Real Estate Investments in Las Vegas.

Here is what our clients have to say about us:

For the last 17+ years, we’ve helped clients build highly reliable, passive income streams through real estate that they will not outlive. Several are now retired and living entirely on their rental income. Most never invested in real estate before they started working with us, and most live in other states or countries. Below is a two-minute video of the services we provide.

Want to know what we can do for you?

© 2005-2025 Cleo Li and Eric Fernwood, all rights reserved.

Get weekly insights like this and learn how professionals build income safely.