[Image generated with Dall-E]

The location (city) where you invest is your most important investment decision, not the properties themselves.

Why?

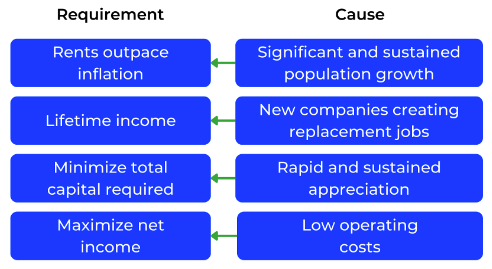

The goal of real estate investing is financial independence. But financial independence isn’t just replacing your current income. It’s about having the necessary funds to maintain your present lifestyle throughout your lifetime. This requires a rental income that meets the following requirements:

- Rent outpaces inflation: No matter how many properties you own, if their rents do not outpace inflation, your actual income will decline every month.

- You will not outlive the income: The income must continue throughout your life.

- Minimize total capital required: Generating sufficient monthly income will require multiple properties. You need to be able to grow your portfolio with the least capital.

- Maximize Net Income: Every dollar you lose to taxes and insurance is a dollar less for you to live on, so low operating costs are essential.

So, what is necessary to achieve each of the above?

Spoiler alert: meeting the above depends on the city where you invest.

Rent Outpaces Inflation

Rents and prices are driven by supply and demand. Population growth increases the demand for housing. The city must have significant and sustained population growth for rents to rise fast enough to outpace inflation.

Income You Will Not Outlive

For your properties to continue generating rent throughout your life, your tenants must remain employed.

The problem is that non-government jobs are not permanent. The average company lasts about ten years. Even an S&P 500 company only has an average life of 18 years and falling. Every non-government job your tenants have today will likely be gone in 10 to 15 years. The only way for your tenants to continue paying the rent is if companies set up new operations in the city, creating similar-paying replacement jobs requiring similar skills.

However, companies can set up operations anywhere. And some locations are more desirable than others. In general, companies will not set up operations in cities with:

- High level of crime: Companies are unlikely to choose any location with a high level of crime for new operations.

- High operating costs: It isn’t easy to be competitive with high operating costs. So, if taxes or insurance are high, they will choose another city.

- Declining population: A declining or static population indicates a city’s decline. Few companies will consider investing in a declining city when there are so many better alternatives.

- Too small to be economically viable: Companies need access to a national airport and major highways, which are only available in larger cities. They also often need a sizeable local labor/talent pool. Generally, companies will choose metros with a population >1M.

So, choose a city that attracts businesses to ensure that there will always be jobs for your tenants (so you can continue to collect rent).

Minimize Total Capital Required

Owning multiple properties is necessary to earn a sufficient income. The total capital needed to buy multiple properties depends on the appreciation rate, not the property prices.

In cities with low property prices, housing demand has remained stagnant for a prolonged period. This is typically due to a declining or static population. In such cities, you can not use the most cost-effective strategy for expanding your portfolio: cash-out refinancing. With consistent, rapid appreciation, you can refinance your existing properties every few years, obtaining the funds to purchase additional properties and minimizing the need for additional capital from your savings.

Without rapid appreciation, every investment dollar must come from your savings. Buying low-cost properties is the most expensive way to achieve financial freedom.

Maximize Net Income

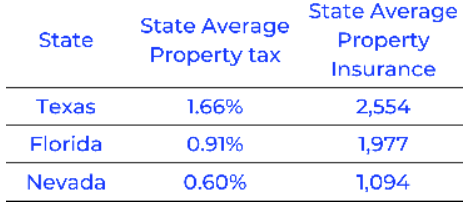

It’s not about how much you gross but how much you keep. When choosing an investment city, consider all significant recurring costs. Property taxes and insurance are typically the two biggest recurring costs. Below is an overhead cost comparison of three states with no state income tax.

Sources for insurance and property taxes: Insurance – ValuePenguin, State Property Tax Rates – Rocket Mortgage.

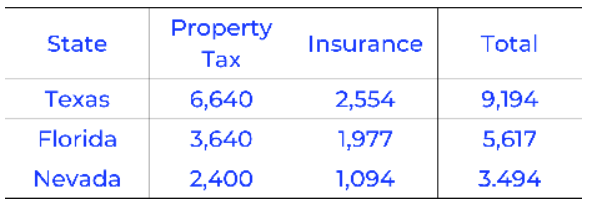

To demonstrate the impact of taxes and insurance on net income, I compared the overhead costs of a $400,000 property in the three states. (These averages represent state-level data, and individual cities may levy additional taxes.)

To achieve the same level of cash flow as a property in Nevada, you would need to generate a higher cash flow in Texas and Florida to offset the higher operating costs.

- Texas: The property must generate $5,700 ($9,194 – $3,494) more cash flow annually to compensate for the higher operating costs in Texas.

- Florida: The property must generate $2,123 ($5,617 – $3,494) more cash annually to compensate for the higher operating costs in Florida.

⠀Overhead costs can have a significant impact on cash flow.

Summary

Location determines all the long-term characteristics of your rental income. So, to achieve and maintain financial independence, the most important decision you will make is to choose a city where all the following requirements are met:

If you choose to invest in a city that meets all the above criteria, you maximize your chances of achieving and maintaining financial independence throughout your life with minimal capital.