[Image generated with Dall-E]

Hint: Where you have the biggest odds of attracting dream tenants.

Over the last 15+ years, we’ve worked with investors to acquire highly reliable passive income properties. The properties we select attract a specific, narrow tenant segment. The segment has performed exceptionally well over the years. There was not even any income interruption during the 2008 financial crash.

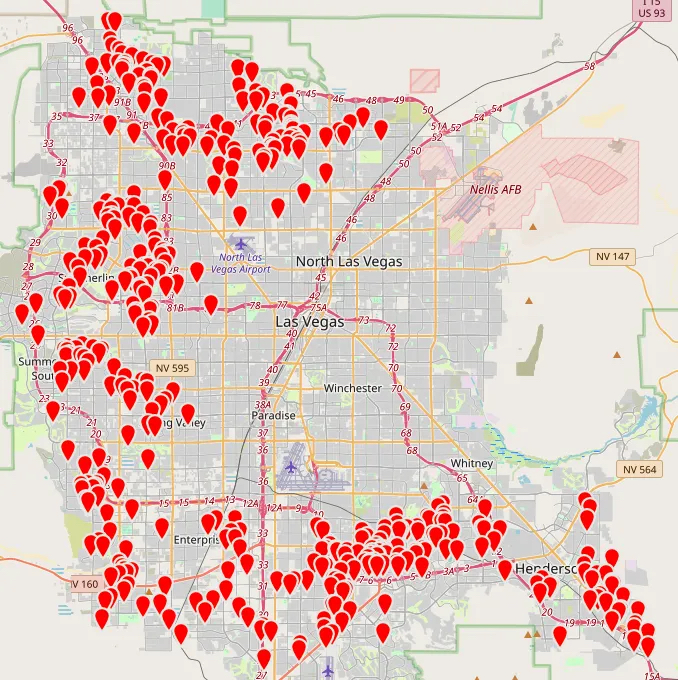

Below is a map showing the locations of many of our clients’ properties.

While each property is handpicked, below is a general description of the properties.

- Property type: single-family home or select townhome

- Configuration: 3+ bedrooms, 2+ car garage, 1 or 2 stories, 1,200 to 2,200 SF, 3,000+ SF Lot, no pool, built after 1990.

- Rent range: $1600 to $2300

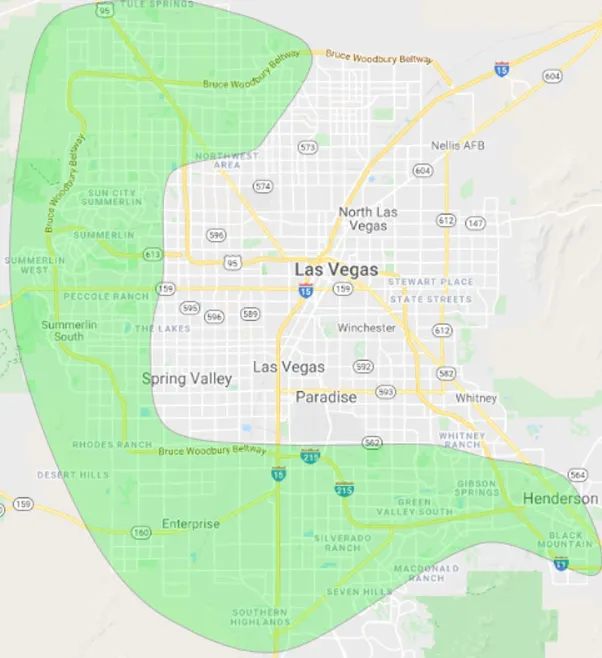

- Location: we find properties using our data mining software. >90% that match all of our requirements are within the area shaded in green below.

To give you a better idea of the properties we select, here is a link to over 100 properties.

As you will notice, all of the properties have a similar appearance and configuration. Why? Because we purchase properties that meet the housing requirements of a specific tenant segment that has a high concentration of reliable tenants. A reliable tenant is someone who stays for many years, always pays rent on time, and takes care of the property. They are the dream tenants.

How have the properties performed?

- From 2013 to 2021, the annual appreciation and rent growth rates were over 15% and over 8%, respectively. Although high interest rates have caused a slowdown, the economic conditions that caused the rapid growth remain unchanged. We consider the current period of high interest rates to be a temporary pause in the rapid price and rent growth.

- Average annual vacancy of less than 2% throughout the years.

- 2008 crash – Zero decline in rent and zero vacancies.

- COVID – Almost no impact

- Eviction moratorium – Almost no impact

- Six evictions in the last 15 years (over 1,000 tenants).

- More than 90% of clients buy more than one property, and over 80% buy more than two.

- More than 90% of clients invest remotely. Some have never visited Las Vegas.

If I Were Looking for a Rental Property

If I did not have our software, processes, and investment team, I would focus my search on the five areas I marked below. I would only consider single-family properties priced between $320,000 and $475,000. Below $320,000, you start to attract a tenant segment that only stays about 1 year, Properties priced above $475,000 tend to attract a tenant segment that stays less than 2 years.

When we search for good properties, we go several steps further than just the areas and price range. If you want to know more about our property selection process, contact me.

Summary

Buy properties similar to the ones reliable tenants currently rent. This strategy will likely ensure you always have trustworthy renters. As a result, you’ll had more reliable rent, lower vacancy rate, and lower maintenance costs.