[Image generated with Dall-E]

Last week, I reviewed the unique advantages Las Vegas offers real estate investors and explained why Las Vegas remains one of the best cities for real estate investors seeking lifelong financial independence.

This week, I want to review where to buy high-performance investment properties in Las Vegas.

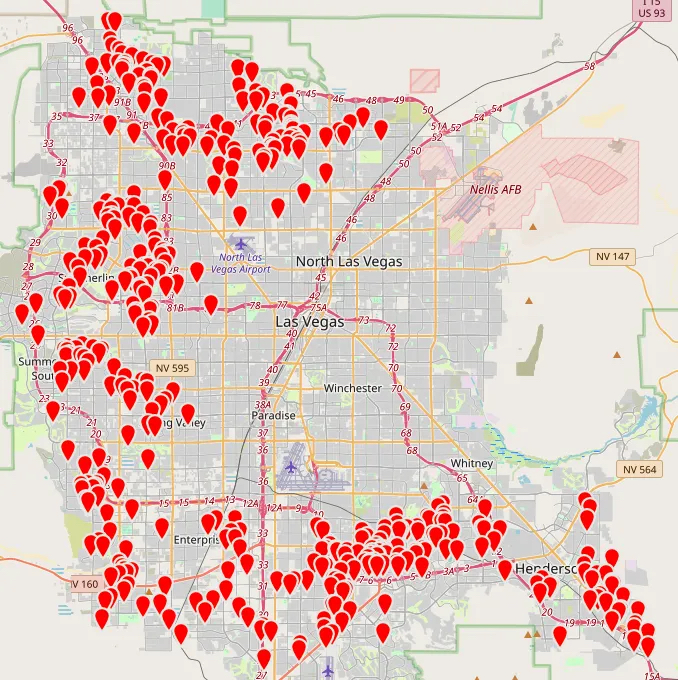

I’ve written about this back in 2023. The concept is simple: buy where a target tenant who stays many years, pays rent on time, and takes good care of the property already lives. Below is a map showing the locations of many of our clients’ properties.

While each property is handpicked, below is a general description of the properties.

- Property type: single-family home or select townhome

- Configuration: 3+ bedrooms, 2+ car garage, 1 or 2 stories, 1,200 to 2,200 SF, 3,000+ SF Lot, no pool, built after 1990.

- Rent range: $1700 to $2400

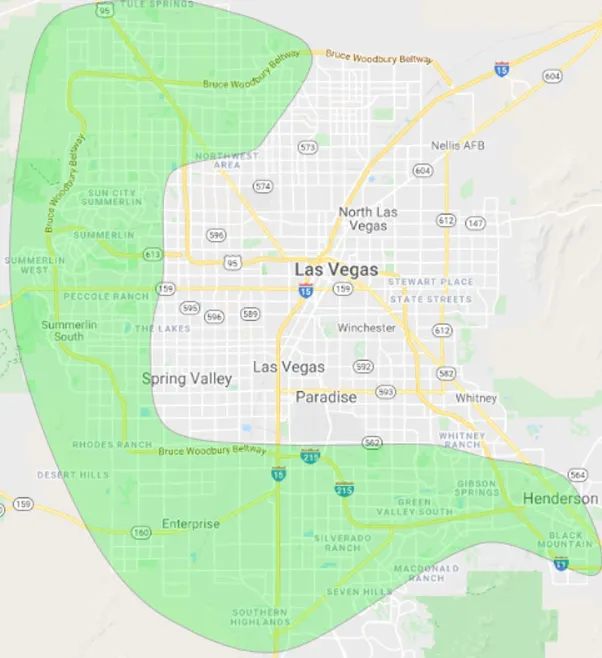

- Location: We find properties using our data mining software. >90% of those that match all of our requirements are within the area shaded in green below.

If I Were Looking for a Rental Property

If I did not have our software, processes, and investment team, I would focus my search on the five areas I marked below. I would only consider single-family properties priced between $350,000 and $475,000. Below $350,000, you start to attract a tenant segment that only stays about 1 year. Properties priced above $475,000 tend to attract a tenant segment that stays less than 2 years.

However, just because a property is located in these areas and falls within this price range, it does not necessarily mean it is a good investment property. We go much further, such as floor plans (for example, no split-level or tri-level homes), specific locations, HOAs, and many, many more. If you want to know more about our property selection process, contact me.

Summary

Our recommendations for Las Vegas investment properties remain unchanged because our target tenant segment’s behaviors haven’t change. The strategy is straightforward—buy properties similar to those that reliable tenants already rent. This approach helps ensure you attract trustworthy renters, leading to steadier rental income, lower vacancy rates, and reduced maintenance costs.

Join the newsletter. Subscribe to receive our latest post in email.

I disagree—there are no simple selection criteria. We evaluate each property against about 40 tenant segment specific behavioral factors. For example, if the driveway is too short or the lot is under 3,000 square feet, the home won’t rent quickly or at market value. Also, there are over 2,600 streets and about 140 floor plans that don’t perform well as rentals. Only someone who worked with rental properties every day for years, we’ll have an understanding of the behavioral characteristics of a segment. We’ve delivered over 560 investment properties and our vacancy rate is less than 2%. We’ve had seven evictions in 17+ years with a tenant population exceeding 1000.

Most realtors focus on selling homes, which are bought based on emotion. Investment properties are selected based on metrics and a team of experts.