[Image generated with Dall-E]

In my previous blog post, I shared the five major mistakes I made with my first long-term rental investment, hoping you can learn from my experience. This week, I’ll outline the key traits I seek in every long-term rental property I invest in or recommend to my clients.

Buy for Income Reliability

Properties don’t pay rent, so my focus is on identifying the housing requirements of the tenant segment most likely to be reliable. You can do this by interviewing local property managers. Go to this article to see the sample interviewing questions. This approach eliminates guesswork and simplifies the property selection process. Once you have a property profile that will attract your target segment, any realtor can find conforming properties. This greatly reduces your time and effort because you’ll have a smaller, more focused pool of properties to consider.

Below is a sample property profile we developed for Las Vegas long-term rental properties:

- Price range: $350,000 – $475,000

- Size: 1000SqFt – 3000SqFt

- Configuration: 2+ bedrooms, 2+ baths, one or two-story

- Lot size: 3000SqFt – 7000SqFt

- Location: Areas with a proven high-performance track record

Newer Properties

One issue with my first investment property (the Houston property) was its age, which led to constant maintenance problems. I reluctantly became a handyman, addressing various issues—replacing deteriorating siding and windows, and repairing roofs, plumbing, and electrical systems.

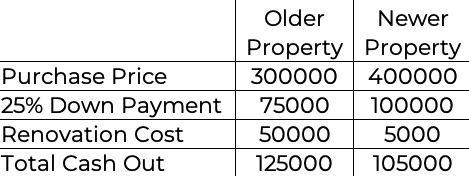

I also discovered that purchasing newer properties in good condition often requires less total cash outlay than buying older properties that need extensive renovation. Here’s a comparison of these two scenarios:

Keep in mind that investing in a newer property typically means higher debt service. Consequently, you may experience lower initial cash flow and ROI.

For Las Vegas long-term rental properties, we typically consider homes built after 1990. However, we make exceptions for select subdivisions where homes built as early as 1985 are acceptable. These exceptions are due to the use of desirable materials and sought-after floor plans in these particular developments.

Property Manager Opinion vs. Online Sources

There’s a significant issue with online rent estimators like Rentometer and Zillow. Such sites simply calculate the average rent per square foot for similar recent rentals, ignoring crucial factors such as specific location and property condition. For instance, Rentometer estimated that the burned-out property shown below would rent for $1,900 to $2,200 per month—a clearly invalid figure.

Another issue with software-generated rental estimates is that they base current property rents on recently rented properties. This approach doesn’t reflect real-world dynamics. Consider this: if you were looking to rent a property, would you spend time evaluating recently rented properties that are no longer available? Or would you focus on properties currently available for rent? Potential renters only consider what is currently available, not what has rented in the past. To address this issue, we include the property manager in our evaluation process. A skilled property manager can provide a rental estimate based on current market competition.

What You Like Does Not Matter

Many investors make a big mistake when buying rental properties. They choose based on what they like, forgetting that they won’t be living there. The only opinion that matters is the tenant’s.

We’ve done a lot of research to figure out what our ideal tenants want in a home. We pick and fix up properties that these tenants will:

- Rent at full market price

- Move into quickly

- Stay in for a long time

Remember, buying a property you like might actually turn away the people you want as tenants. It’s important to focus on what your target renters need and want, not your personal preferences.

Summary

Traits I look for in every Las Vegas long-term rental property:

-

Fits our target property profile (see above). The property profile for your target tenant in your market may be different. There is no one size fits all.

-

Low renovation and maintenance costs: While likely more expensive, newer properties require less initial cash because renovation costs are not financed. Additionally, newer properties typically have lower maintenance costs.

-

Eliminate homes with negative features, even if they would be desirable to you. For example, our demographic is young families with elementary school children who stay, on average, over five years. Based on research, they are unlikely to rent any property with a pool or hot tub. I believe this is due to concerns about drowning. So, even though I would want a pool in the desert climate of Las Vegas, the tenant segment doesn’t—and their opinion is all that matters.

Another example is properties with solar panels but for a different reason.

- There is a minimum monthly payment to the supplier (usually around $120/month). The tenant will enjoy a lower electrical bill thanks to the solar panels, but you cannot increase the rent to cover your increased costs. Additionally, the more the tenant saves on their energy bill, the higher your monthly bill since many solar suppliers charge based on the energy generated.

- Almost all the panels are leased on a 20-year term. Buying the property involves assuming the balance of the 20-year note, which increases your monthly payment and your DTI.

- Even if the panels are owned, you are still responsible for maintenance and repairs.

- There have been significant problems with solar panels and tenants to the point where few property managers will take any properties with solar panels.

-

Property manager approval: Include a skilled property manager in your property selection process. Only choose properties that your property manager approves.