[Image generated with Dall-E]

My first investment property was a 4-plex in a C-class area in Houston. With all four units rented, the ROI and cash flow looked excellent, over 12%. I naively thought that even with just three units rented, I could cover all my expenses and still make a small profit.

Here’s the reality:

- The average tenant lasted only six to nine months. After this brief period, tenants stopped paying the rent or abandoned the property.

- I learned that I had to follow a legal process to retake possession of the property because they had a lease, even though they had abandoned the property. This was slow and expensive.

- I got good at the eviction process – something I never expected to need to know.

- Once I regained possession of the unit, I had to restore it to rentable condition, which proved expensive. The damage wasn’t due to normal wear and tear; it was mostly vandalism, such as smashed toilets, ripped-off cabinet tops, holes punched in the walls, etc.

In summary, I offered clean, well-maintained rental units, only to have tenants cause extensive damage. The person who advised me not to buy properties that targeted low-income tenants was correct.

The best day in my early investment career was when I sold the property.

My mistakes:

- I bought a “below market priced” property to “make money upfront.” There is a reason why some properties are sold at a discount—they are not worth more.

- I assumed that all tenants would pay rent, take reasonable care of the property, and honor leases. However, none of this was true for the tenants who occupied my four-plex.

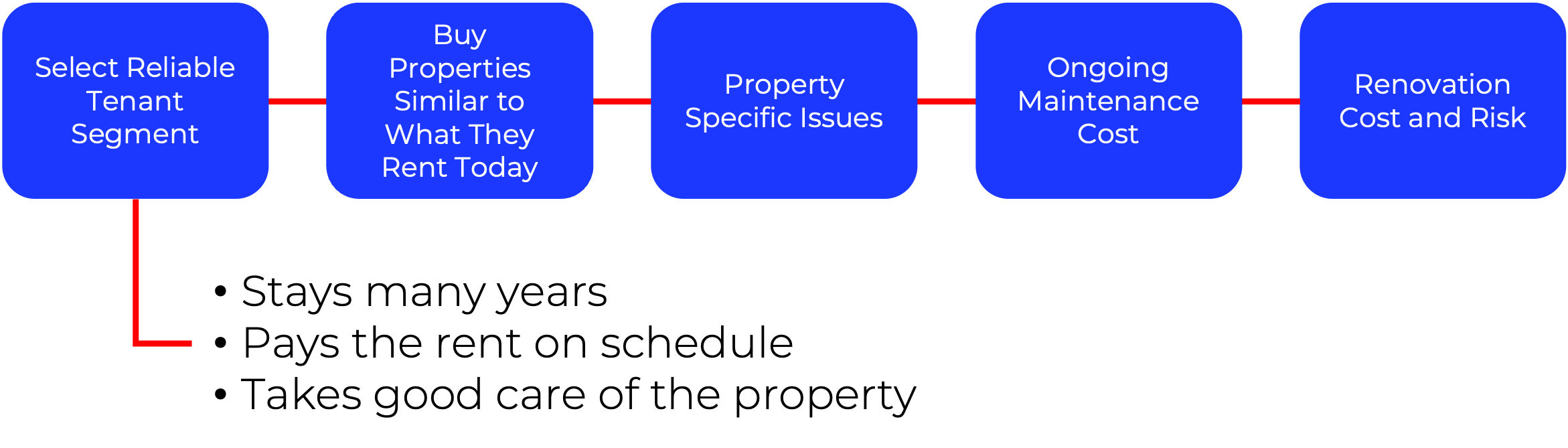

- I failed to understand that properties don’t pay rent—tenants do. Instead of chasing “deals,” I should have focused on selecting a desirable tenant segment and purchasing properties they’d be willing and able to rent.

- I mistakenly tried to save money by not hiring a property manager. My inexperience left me vulnerable, and the tenants took advantage of this. A professional property manager would have never selected such problematic tenants. In hindsight, even the most expensive property management fee would have been far less costly than the losses I incurred due to the tenants’ behavior and vandalism.

- Older properties tend to be less expensive (to buy). However, they have significantly higher renovation and maintenance costs. You must carefully balance the property’s purchase price against potential renovation and ongoing maintenance expenses.

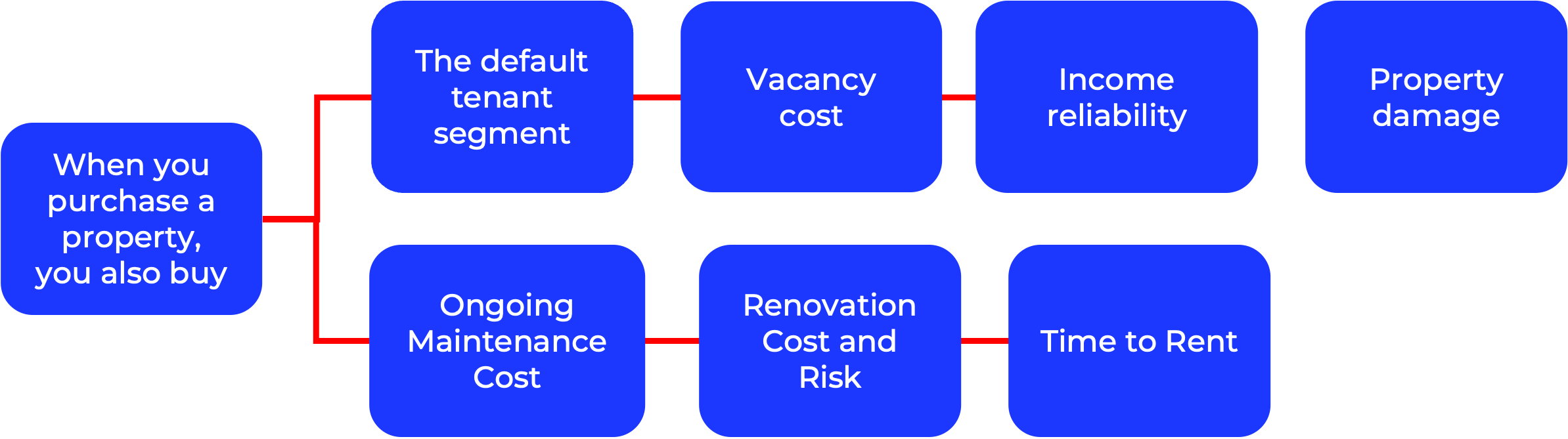

The mistakes I made are illustrated below.

What I learned.

Choose the tenant segment and buy what they are currently renting. You will still need to do your due diligence on the property, but you will start with the right tenant segment.

In next week’s post, I will discuss the traits I look for in every long-term rental I invest in or recommend my clients invest in.