Not all tenant segments exhibit the same behaviors, and not taking this into account can cost you dearly.

A rental property is only as good as the tenant who occupies it. If the tenant doesn’t pay rent or the unit is vacant, you don’t receive any income. So, the only way to have a reliable income is if the property is continuously occupied by a reliable tenant. I define a reliable tenant as someone who stays for many years, pays the rent on schedule, and takes care of the property. Unfortunately, reliable tenants are the exception rather than the norm.

The Renter Population Is Not Uniform

Some people believe that the renter population is uniform and that all tenants have the same behavioral characteristics. However, this is not true. The population of renters is actually a collection of multiple tenant segments, as illustrated below. And each segment has different behavioral characteristics.

For instance, there are three major tenant segments in Las Vegas. The following list shows the average length of stay for each segment. I chose the name of each segment based on how long they stayed in the property.

- Transient: <1 data-preserve-html-node=”true” Year

- Permanent: >5 Years

- Transitional: <2 data-preserve-html-node=”true” Years

Properties occupied by Transient or Transitional tenants will experience more frequent periods of vacancy than those occupied by Permanent tenants.

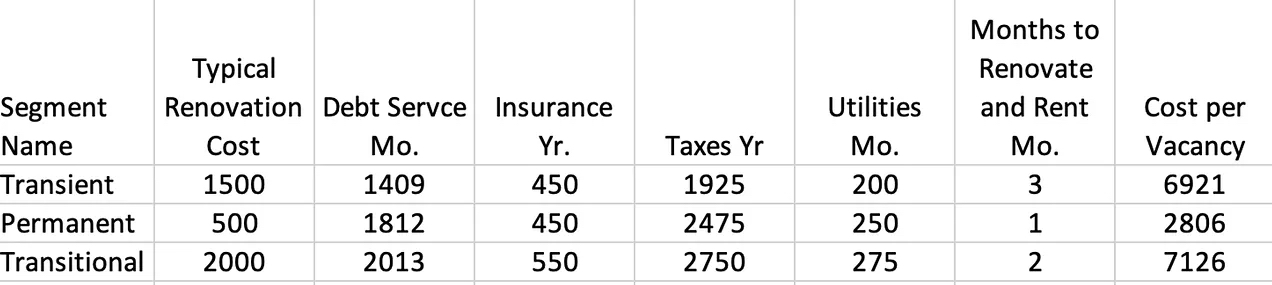

Vacancy Cost

The cost of each vacancy is the sum of all costs incurred from the time a tenant vacates until a paying tenant is back in the property. The primary cost components include:

- Time to rent

- Carrying costs (debt service, insurance, taxes, utilities, etc.)

- Cost to renovate the property between tenants.

Below are typical costs for the three major tenant segments in Las Vegas.

We can calculate the annual vacancy cost based on the per-vacancy cost for each segment and how frequently the property is vacant.

- Transient annual provision: $6,921 / 1 Yr = $6,921/Yr

- Permanent annual provision: $2,806 / 5 Yrs = $561/Yr

- Transient annual provision: $7,126 / 2 Yrs = $3,563/Yr

Most of the time, people make purchasing decisions based on simple cash flow calculations, like the one shown below.

Cash Flow = Rental Income – Recurring Expenses.

The problem with this formula is that it does not account for vacancy costs. Unfortunately, there is no constant or formula that can provide a realistic estimate of vacancy costs. To estimate vacancy costs, you need historical data for the specific tenant segment. The average cost of vacancy is not a good representation of a specific property’s vacancy cost. However, it is the best available estimate.

To estimate the annual cost of vacancies, use the following formula: Annual vacancy cost = cost per vacancy/length of tenant stay. For the three tenant segments:

- Transient: $3,400/1Yr = $3,400/Yr

- Permanent: $1,550/5Yrs = $310/Yr

- Transitional: $7,600/2Yrs = $3,800/Yr

Impact of Tenant Segments of Cash Flow

What is the cash flow difference between a Transient property and a Permanent property?

A Transient property must generate $3,090 ($3,400 – $310) more per year to have the same cash flow as a Permanent property.

This is why the tenant segment impacts your cash flow.