[Image generated with Dall-E]

Investing is a business, not a hobby.

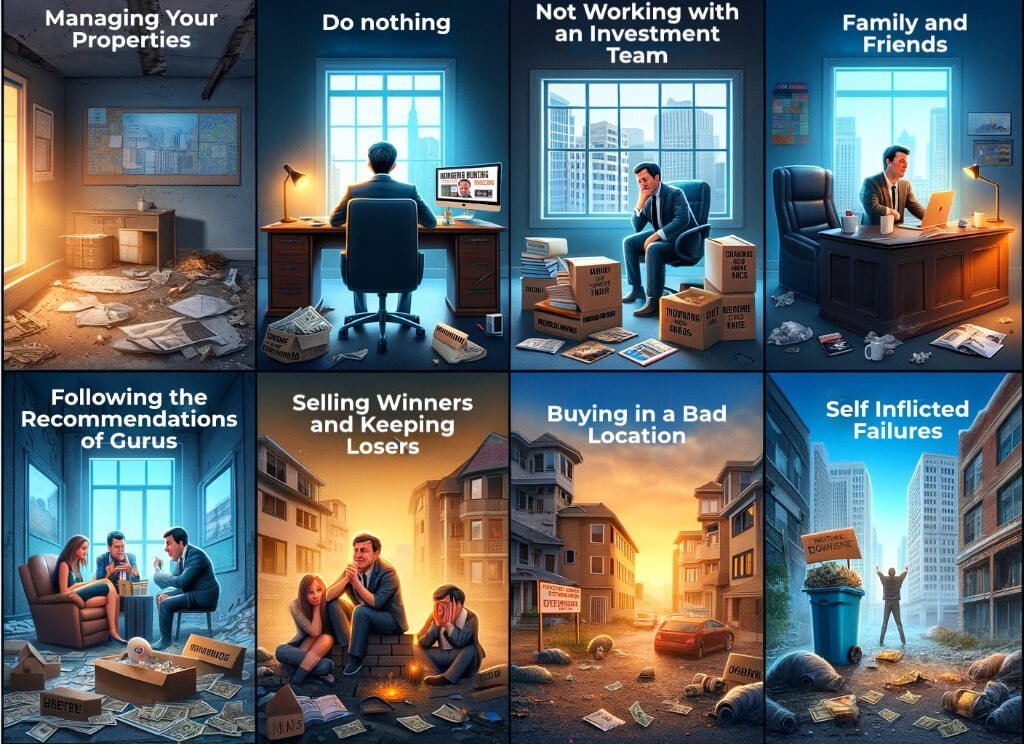

Real estate is the easiest and safest investment, but people still fail. Below are some common ways.

Do nothing

Doing nothing is the most common cause of failure in real estate investing. Some people desire to find the “perfect” property, while others spend years searching for the right book or seminar that promises the “secret” to success. However, there are no secrets to real estate investing. If is a straightforward process. The only people who make real estate investing difficult are those who aim to sell you a class, a book, or a subscription.

Buying in a Bad Location

The location of a property determines its long-term income characteristics. For instance, it determines whether rents will rise at a sufficient rate to keep pace with inflation, as well as the reliability and duration of your income. Also, real estate is forgiving, as long as you buy in a high-appreciation location, inflation, and rent increases will correct all but the worst mistakes. However, if you buy in a low-appreciation location, you can do little to turn things around.

Following the Recommendations of Gurus

People often purchase properties based on the claims of infomercial gurus. However, if these gurus could truly do what they claim, they wouldn’t need to sell seminars. As the saying goes, if it sounds too good to be true, it probably is.

Not Working with an Investment Team

If you needed surgery, you would not start medical school. Instead, you would find a surgeon who specializes in the specific surgery you need. The same principle applies to real estate investing. You cannot replicate the expertise, processes, team members, and connections that come with a skilled investment team.

Family and Friends

Real estate investing is a business, and to be successful, you need an experienced investment team. The chances of your “Uncle Bob” or “best friend” being a star performer are near zero. And if they don’t perform, how will you fire them and still keep the relationship?

Managing Your Properties

I often hear people wanting to manage their own property to save the 8% or 10% they would pay to a property manager. While this might make sense if all property managers did was collect rent, the most critical skill of a property manager is selecting reliable tenants. One bad tenant can cost you more than years of management fees. Compliance with all federal, state, county, and city regulations is also critical. Violating regulations could put you in serious trouble, and legal fees alone could bankrupt you. You can’t afford to not with a property manager.

Selling Winners and Keeping Losers

I recently had a conversation with someone about a 1031 exchange concerning some properties they owned. To my surprise, they wanted to keep the property that was losing money and exchange the performing properties. This behavior is not uncommon and is even given a name: the “Disposition Effect.” Investors tend to sell stocks that have increased in value and hold onto those that have decreased, hoping they will eventually recover. Unfortunately, following this approach often leads to a portfolio of losing properties over time. The better strategy is to sell the losers and keep the winners.

Summary

If you avoid the mistakes listed above, your odds of consistently succeeding in real estate investing are high. However, if you make any of the above mistakes, you could lose a lot of money.