[Image generated with Dall-E]

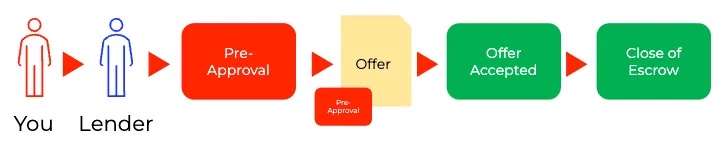

Over the past three or four months, the finance process has undergone significant changes. Below is an illustration of the traditional loan process. The process was simple. You chose a lender, received pre-approval, and closed with that same lender.

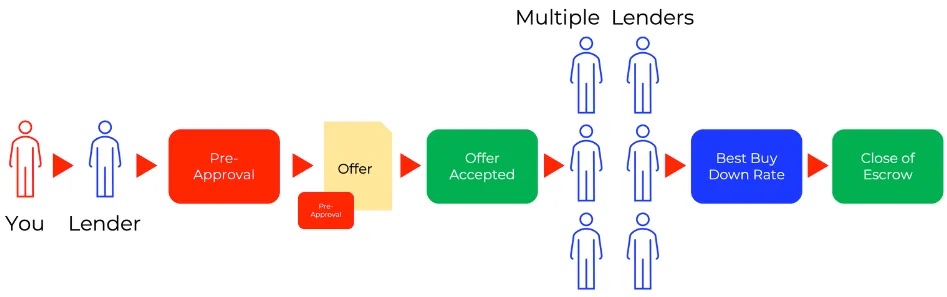

High-interest rates changed this process. See the illustration below.

Today, you still get pre-approval, which we used to make offers. After your offer is accepted, we send your pre-approval and the property details to multiple lenders and ask for their buy-down rates.

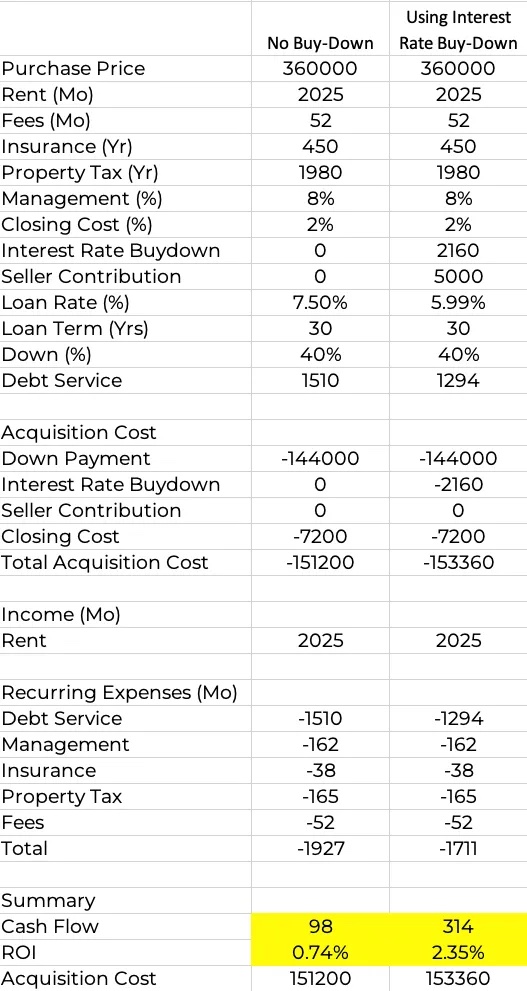

Below is an example of a difference the right interest-rate buy-down can make.

This client used a combination of a 40% payment combined with an interest rate buy down (1% of the loan in this case) to 5.99%. However, we’ve seen Biden raise over 4% of the loan with a down payment of 25%.

We’ve seen buy-down rates for a 25% down payment over 4% of the loan. Also, buy-down rates appear to change almost every day. That is why we do the search immediately after you get a property under contract.

The process may seem confusing, but it’s actually quite simple. Once we receive the rates, we have a Zoom call to review the options and choose the best financing option for you.

This adds an additional step to the overall purchase process, but the increased initial return is worth the effort.