[Image generated with Dall-E]

The key is not the the properties but who occupies the properties.

Since 2005 my team and I have delivered over 480 Las Vegas investment properties (> $125M). While we achieved an annual appreciation of over 15% and annual rent growth of 8% (from 2013 through Q1 2022 before the interest rates exploded), our average vacancy has stayed below 2% throughout the years including two major economic turmoils:

- 2008 housing crash – Zero decline in rent and zero vacancies.

- COVID eviction moratorium – No impact

Why did our client’s properties continue to perform when most others did not?

The Key to Consistently Low Vacancy Rate

The key to consistently low vacancies lies in targeting reliable tenants, not in the properties themselves. A reliable tenant is someone who:

- Has stable employment in a market segment that is very likely to be stable or improve over time

- Pays all the rent on schedule

- Takes care of the property

- Does not cause problems with neighbors

- Does not engage in illegal activities while on the property

- Stays for many years

Not All Tenant Segments Are the Same

There is a common misconception that all tenants are the same, but this is not at all true. The population of renters consists of many different segments, each with its own distinct behavioral characteristics and housing requirements.

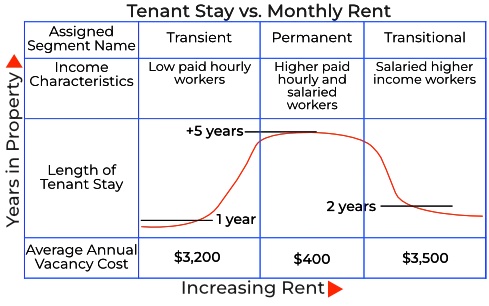

For example, there are three major tenant segments in Las Vegas. Below is a chart comparing how long tenants stay in the property versus the monthly rent.

For convenience, I subdivided the rent range into three segments and named each segment based on the average length of stay.

- The transient tenant segment has an average stay of less than one year, and the estimated annual cash flow loss due to vacancy is about $3,200.

- The permanent segment has an average stay of over 5 years, with an estimated annual cash flow loss of about $400 due to vacancies.

- The transitional segment, on average, has a stay of under 2 years and an estimated annual loss of cash flow due to vacancy of about $3,500.

The takeaway is that if you bought a property that appeals to transient or transitional renters, your vacancy cost will likely be much higher than if your property attracts permanent tenants.

How to Identify a Tenant Segment for Ultra-Low Vacancy

Local property managers work with tenants on a daily basis, and those who manage a significant number of properties similar to what you would like to buy possess a wealth of knowledge. You can access their knowledge by conducting interviews.

Look for property managers who have been in the business full time for many years. One-person operations or those with only a few properties should be avoided. Ideally, you want a list of 5 to 10 full-time property managers who appear to be good candidates.

Before asking questions, it’s important to note that while property managers know how to manage rental properties, very few know how to evaluate investment properties. Don’t expect investment advice from property managers. Additionally, it’s important to ask property managers questions in a way that they understand and is within their expertise. From their answers, you can derive the information you need.

Ask the same questions of multiple property managers and compare their answers. This will enable you to get more reliable information.

Also, property managers are not willing to give away their time, so there has to be something in the meeting for them. I started by telling the property managers that I was looking for a property manager to work with because I plan to purchase multiple properties. (This was true.) I started by asking about their business and moved to questions about tenant segments. (To learn how to select a good property manager, see the guide, “How to select a good property manager.”) Now for the tenant segment questions.

Q: What types of properties would you buy if your goal was tenants who stay for many years?

- The purpose of this question is to understand which properties attract tenants who stay many years. You are also looking for the property type and configuration.

Q: Where are these properties located?

- You were looking for some sort of a geographical box so you know where to look.

Q: What is the rent range that attracts these tenants?

- Once you have determined the rent range, you can estimate the gross monthly income of the renters, which can provide insight into the types of jobs they have. To estimate gross monthly income, multiply the monthly rent by 3. For example, if the rent range is $1,500-$1,800, the gross monthly income is $4,500 to $5,400. In Las Vegas, tenants whose income is closer to the minimum wage are more susceptible to being laid off during times of economic turbulence. Higher-income individuals who can afford to buy a home typically stay in rental properties for two years or less.

Q: Please tell me about the typical tenant who occupies these properties.

- What you were looking for is the demographic. For example, we target young families with elementary school children. This demographic has an average stay of over five years. This also drives the property type and configuration. For example, in Las Vegas, this demographic almost exclusively rents single-family homes with a two-car garage, three bedrooms, and two or more baths.

Q: What kinds of jobs do they have and where do they work?

- By combining the income range information with the industries in which the segment works, you can determine whether those companies are currently thriving and likely to continue to do so in the future. For example, during the cracking boom, people purchased rental properties near large fracking fields, only to find themselves with vacant properties when fracking died down. Similarly, if the majority of the segment works at an auto plant that is scheduled to close in five years, you may want to consider investing in a different city.

Q: As a group, how reliably have they paid the rent? How often do you have evictions with this group?

- It is not how much money you make on paper, what matters is how much you actually net. If evictions are common, you can expect to receive far less rent than what you estimated. For example, with a tenant segment we target, we’ve had six evictions in over 15 years with a tenant population exceeding 1000. For many C Class properties, evictions are common.

This is not an exhaustive list of questions. You will likely need to have a second round of questions with the property managers who seem to be the most market-savvy. The goal of these interviews is to create a property profile that will attract tenants from this segment.

How to Select Properties That Will Attract Your Target Tenant

Every tenant segment has specific housing requirements. People within a segment are unlikely to rent any property that does not match all of their requirements. Also, if someone can afford a monthly rent of $2000, it is unlikely that they will choose a property that rents for $800. Why? The vast majority of people rent the best property they can afford. Are there exceptions? Always. But those exceptions represent a tiny fraction.

After understanding the housing requirements of the tenant segment you want to attract, you can create a property profile. Here is an example:

- Type: Single-family

- Configuration: 3+ bedrooms, 2+ baths, 2+ car garage, 1,200 to 2,100 SF, one or two story, lot size 4,000 SF to 6,000 SF.

- Rent range: $1,900/Mo to $2,300/Mo

- Location: North of 5th Street, east of the river, within 5 miles of the interstate.

What happens if you choose a property that does not meet all of the segment’s housing requirements? You have purposely excluded that segment from considering your property.

The process is to identify the segment of renters that you want to attract to your property (see above), and then purchase properties similar to what they are currently renting. It really is that simple.

This process originates from the commercial world. When a retail chain is seeking a new store location, they search for an area with the highest concentration of their target customers rather than randomly selecting a location.

Property Manager Skills for Low Vacancy Rate

Just because you selected a tenant segment with a high concentration of reliable tenants doesn’t mean every tenant attracted to your property will be a reliable one. Only a property manager who is skilled at selecting reliable tenants can keep your property occupied by reliable tenants. Unfortunately, very few property managers have this skill. I’ve worked with many property managers in Las Vegas over the last 15+ years and I only know of two that have this skill. To learn how to select a good property manager, see the guide titled, “How to Select a Good Property Manager.”

Conclusion

With a property profile, almost any realtor can find conforming properties. However, not every conforming property will be a good investment. It is crucial to evaluate each property yourself.