[Image generated with Dall-E]

I started my investment career by reading every investing article I could find. I talked to others and wrote software to determine the best property to buy. I decided a C (D?) Class multi-family property was the best option based on my research.

- The cost per door was relatively low.

- The (paper) cash flow was excellent.

- If one unit were empty, I would still have enough rent from the other three to cover my mortgage.

- The property price was within my price range.

- It was close enough to where I lived so I could do most of the work.

- The rent for two units was city-subsidized, so I thought the income from these would be guaranteed.

So, with a friend, I bought my first property.

It was a nightmare. I made the mistake of buying a property assuming the tenants would perform. They did not. I soon learned:

- The city guaranteed a portion of the rent (about 80%), but the tenant never paid their 20%. I talked to an experienced investor, and he told me this was common for most subsidized tenants. He suggested I was better off keeping the non-performing tenants than evicting them because the replacement would likely be the same.

- The tenants live cash-based lives. They were paid every Friday, cashed their checks, and partied. They regularly said they didn’t have the money to pay rent. From talking to experienced investors, I learned this is common with cash-based tenants. Evicting them would take money and time, and the next tenants would likely be no better. So, this was not an option.

- I discovered that the previous owner offered a significant discount if the rent was paid in cash. So, on Saturday mornings, I went door to door, collecting the rent and offering a similar discount. The area was not safe, and I was always concerned about being robbed.

- Almost every other month, a tenant skipped. The condition of these units after they left was bad, and it took significant time and money to make them rentable. The tenants had no concerns about damaging the units because there would be no way to collect even if I got a judgment against them.

I learned that no matter how inexpensive a property is or how good it looks on paper, you depend on the tenant’s performance. So, the property type does not matter; what matters is having reliable tenants: someone who stays many years pays the rent on schedule, and takes good care of the property.

2005+

When I started our investor services business in 2005, I spent most of my time researching tenant segments for the first few months. Based on my research, I located several subdivisions where the average tenant stay was over five years. I then determined the common characteristics of these properties.

However, as an engineer, I needed to validate my research results since my future business would rely on tenant performance. To confirm my findings, I asked several property managers this question: “If your goal was to have tenants who stayed for many years, paid rent on time, and took care of the property, what properties would you buy?” Most property managers directed me to the same properties as my research. I was confident I had the right segment.

The Tenant Defines the Property to Buy

Over the years, we’ve studied our target tenant demographic: families with elementary school children and a gross household income (today) between $60,000 and $85,000 per year.

A general description of the properties that attract this segment is below.

- Type: Single-family

- Configuration: 2+ bedrooms, 2+ baths, 2+ car garage, 1,100 to 2,400 SF, one or two story, lot size 3,000 SF to 6,000 SF.

- Rent range: $1,900/Mo to $2,400/Mo

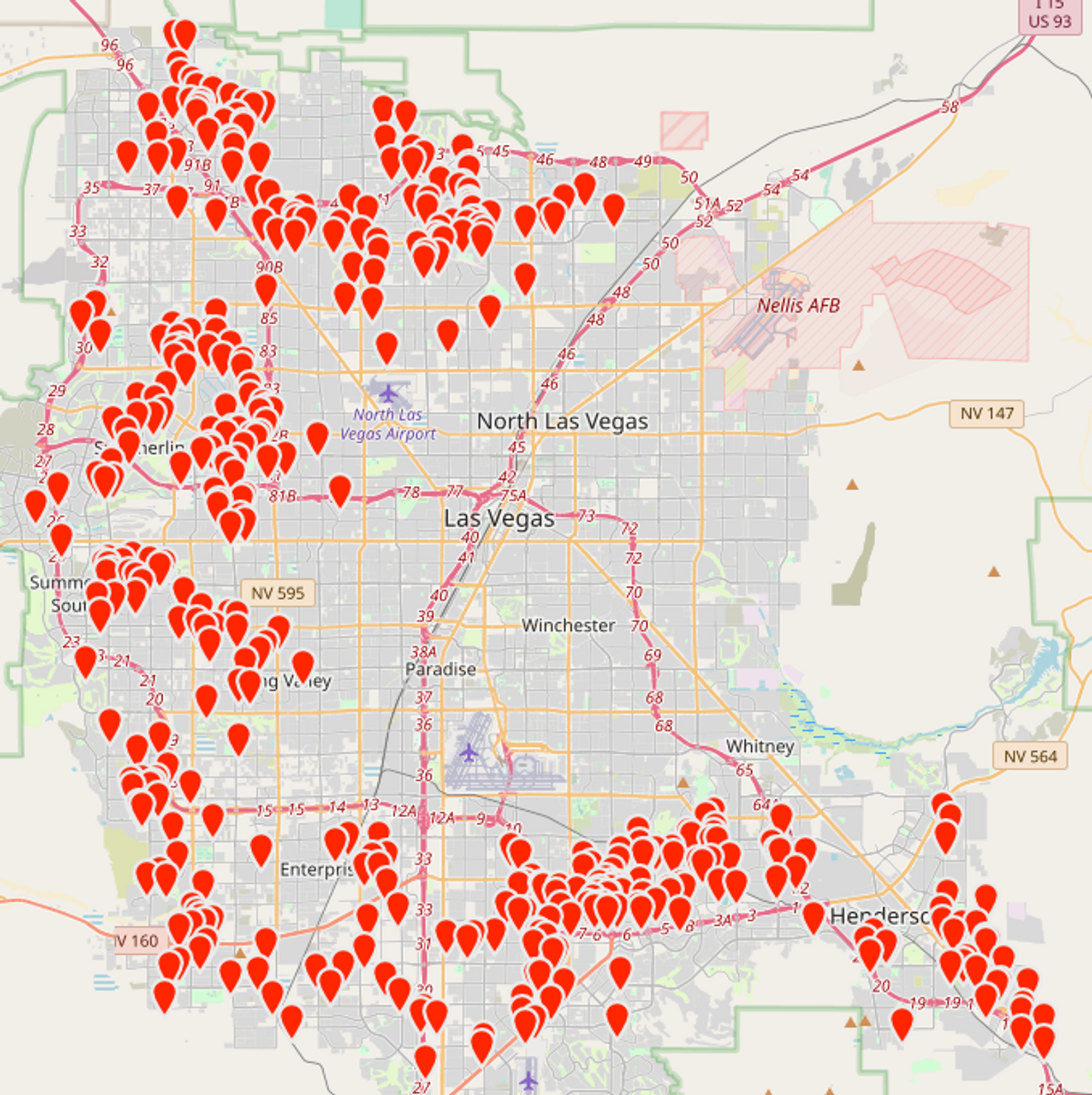

- Location: See the map below for the general areas

Our shift from a property-focused search to searching for properties that match the housing requirements of our target tenant segment has worked extremely well. Our average tenant stay is over 5 years; we’ve had seven evictions in 16+ years.

Lesson Learned

If your goal is financial independence, the property type is not relevant. What matters is the tenant who occupies the property. So, find a tenant segment with a high concentration of reliable people, determine what and where they rent today, and buy similar properties. Forget about guru dogma.