[Image generated with Dall-E]

The title isn’t clickbait; it’s a fact, and it’s easy to demonstrate. Consider this: Has there ever been a time in human history when a property paid rent? No, because it’s the tenants who pay rent, not the properties. Therefore, instead of focusing solely on purchasing a property, focus on who will be paying the rent—the tenant.

About Tenant Segments

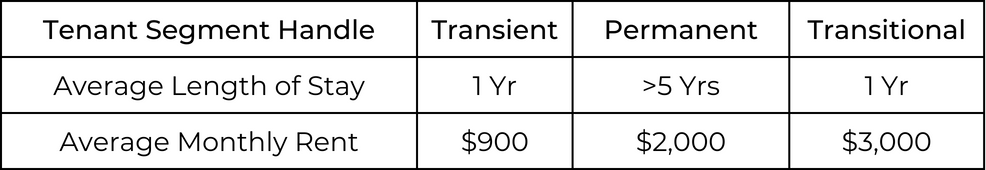

Many people believe everyone who rents is homogeneous; they all have the same behaviors. This is not true. The renting population comprises many segments, each with different housing requirements and behaviors. For example, Las Vegas has three major tenant segments, as illustrated below.

As you can see, the average length of stay and the average rent vary among different segments. Each segment also has distinct housing requirements and behaviors. Fortunately, there is a way you can target a specific tenant pool with the behavioral characteristics you need for income reliability.

Income Reliability

To live on your rental income, you must be able to rely on it coming in every month. This requires that your property be occupied by a reliable tenant. A reliable tenant stays for many years, always pays the rent on schedule, and takes good care of the property. Reliable tenants are the exception, not the norm. How do you maximize the odds of always having a reliable tenant? Buy properties that attract people from a segment with a high percentage of reliable individuals.

How do you find a segment with a high percentage of reliable people? Through property manager interviews. Essentially, ask multiple property managers: “If you were purchasing a property where the tenant stayed many years, always paid the rent on schedule, and took good care of the property, what properties would you buy?” I did this in 2005 when I started my investor services business. The majority of the property managers gave the same answer.

Once you know the type and location of properties most likely to attract reliable people, the next step is to purchase similar properties. We’ve done this for over 16 years, and the results have been outstanding.

Let me be clear. I did not select the property type, configuration, location, or the rent range. I identified the segment of tenants I wanted to occupy my properties and bought similar properties. It really is this simple.

Summary

When you start with the goal of income reliability and make property decisions based on that goal, your odds of success are high because it is location—and tenant segment-specific. In one location, the property type might be multi-family. In another, it might be student housing or single-family homes. You do not care what property type you choose because your goal is income reliability.

The alternative is choosing a property based on the opinions of others (who may be across the country) and hoping everything works out, which is no more than gambling.