[Image by Dima Shishkov on Unsplash.]

Are condos a good investment property in Las Vegas? In this article, I will cover the pros and cons of condos as investments in Las Vegas.

First, some background.

Background

I frequently hear people recommend buying a specific property type. This is doing things in the wrong order. The reason I say so is because the property does not pay the rent. The tenants who occupy the property pay the rent. And, if you want a reliable income, you need a reliable tenant to always occupy the property. A reliable tenant stays many years, always pays the rent on schedule, and takes good care of the property. What does this have to do with the property?

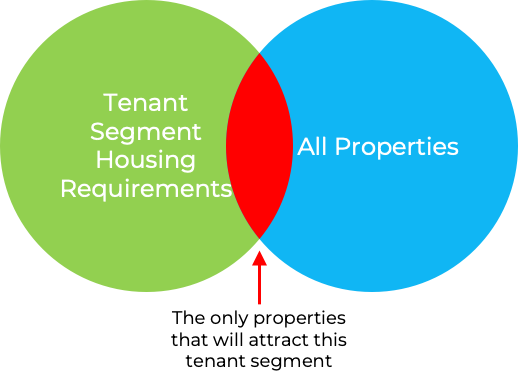

The collective group of renters consists of multiple individual tenant segments, each with unique housing requirements and behaviors. Like tenant segments, each property has specific characteristics. A property attracts only the tenant segment whose housing requirements match the property’s characteristics. See the illustration below.

What does this mean? When you select a property, the tenant segment that will be attracted to that property is fixed and can not be changed.

Las Vegas Condos Characteristics

Now that you know the relationship between a tenant segment’s housing requirements and the properties they are willing and able to rent, what about Las Vegas condos as investments?

- Length of tenant stay: The people who are attracted to condos are typically singles or couples without children, and they stay, on average, less than two years. In contrast, the tenant segment we target is families with elementary school children who remain, on average, over five years. The tenant segment attracted to condos can not be changed, so your vacancy costs will be higher with a condo.

- Rent increase limitations: In Las Vegas, condos compete with apartments for tenants, suppressing condo rent potential. Many condos are older and offer few amenities, while the much newer 400 to 600-unit apartment complexes offer many desirable amenities. The only way condos compete is to offer lower rent than comparable apartments.

- Profitability: High condo association fees make profitability difficult. Condo fees in Las Vegas are typically greater than $300/Mo. Most single-family home association fees are less than $80/Mo.

Additional issues common to most condos.

- Financing issues: Investment financing for condos can be a challenge, especially if the complex’s owner occupancy is below 50%. While you may be able to pay cash for the condo, will your future buyer have this ability?

- Cross-unit maintenance issues: Units in such close proximity can lead to maintenance nightmares. For example, if a water leak is present in an upstairs unit, it may damage the unit below. Addressing the issue and resolving damages can be a lengthy process, especially if the upstairs owner is unresponsive. This delay can exacerbate damages, such as mold growth.

- Neighbors Issues: Noise, cigarette smoke, and other similar issues can cause discomfort for your tenants. Addressing these neighbor-related issues may be beyond your control.

What are the advantages of condos in Las Vegas?

- Lower entry cost: This is a big advantage of condos. You can buy condos for much less than a townhome or single-family.

- Similar appreciation: When I researched how condos appreciate, I was surprised to learn that they appreciate almost as fast as single-family homes.

- Perceived lower maintenance cost: Although condo associations are responsible for maintaining the exterior, you are responsible for the interior and systems like the HVAC and water heater. Surprisingly, the annual upkeep costs for condos are comparable to those of single-family homes and townhomes we target due to the construction materials necessary to survive the Mojave Desert.

Summary

Despite the benefit of a low entry price and appreciation rate similar to single-family homes, condos in Las Vegas are not good investments. This is mainly because they attract a tenant segment that typically stays for only one or two years. Additionally, rent increases are tied to apartment rents. Combined with high association fees, your profitability (income) is much lower than that of single-family homes or townhomes.