[Photo by Julian Hochgesang on Unsplash]

Mid-term rentals remain popular among our clients. In this post, I’ll cover our continued investigation into this opportunity, starting with some background.

Why Mid-Term Rentals

With high-interest rates, it is sometimes difficult to have an adequate initial cash flow with a long-term rental. Mid-term rentals may provide a higher initial cash flow and still not require the intensive management of short-term rentals. Investing in Las Vegas properties, be it short-term rentals, mid-term rentals or long-term rentals, if chosen correctly, will appreciate and rents will increase over time. This is almost guaranteed due to the unique physical limitations of Las Vegas.

The two options other than long-term rentals are short-term rentals and mid-term rentals. Both have limitations and advantages.

- Short-term rentals depend primarily on vacationers, meaning that occupancy is contingent on the state of the economy and local events. Additionally, short-term rentals require consistent and comprehensive management, and their income tends to be sporadic. For instance, short-term rentals may be easily rented during peak travel seasons but hard to rent during other times. However, even though the income is not linear, you may have a higher cash flow with a short-term rental, if you are effective at adjusting the price based on local events. Licensing issues are another problem. Local regulations limit the locations where you can operate a short-term rental.

- Mid-term rentals are primarily occupied by business travelers. For example, traveling nurses. The need for mid-term rentals are usually independent of the economic situation. Additionally, mid-term rentals are unlikely to violate county, city, and most association rules and regulations because they are rented for a minimum of 30 days. An advantage of mid-term rentals is that cost effective property management is available reducing the burden on the owner to a similar level as a long-term rental.

How Much Money Can Mid-Term Rentals Generate?

Obtaining sufficient and reliable mid-term rental comparables has proved to be a challenge. I tried to determine the probable market rent for a mid-term rental using multiple methods, each of which is outlined below.

Extended Stay Hotels with Kitchens

I searched for extended-stay properties with 1 or 2 bedrooms and a kitchen. Properties without a kitchen are less expensive, but based on what I’ve read, extended-stay guests are unlikely to want to eat every meal out. The prices below are for a 30+ day stay.

- Expedia – The majority of prices range from a low of about $100/Night to about $160/Night.

- Staybridge Suites – $140/Night to $170/Night

VRBO

- VRBO – On a 30-day stay, $130/Night and up

- Here is a house in southwest listed for $176/Night. It appears to be rented, but I do not know the amount.

- Also, there is a one-bedroom apartment in the southwest renting for $156/Night

AirBnB

- Airbnb has a confusing site – I did not find any homes for extended lease, only condos and rooms. So, I did not get any useful information from this site.

MLS Listed Properties

- Only 9 (total) closed in the last 120 days. I did not feel any were comparable for mid-term rentals targeting traveling nurses. So, no useful information here.

Meeting with TurnkeyLV.com

We identified a property management company that almost exclusively manages furnished rentals. We met with the broker, Lou Pombo. They have about 100 furnished rentals, which appear to be of all sizes and types. For example, one property they manage has 7 bedrooms. We asked about traveling nurses and this is not a specific focus.

Their primary sources of business includes:

- Corporate: Traveling nurses and others

- Relocations

- Insurance

- Seasonal (snow birds)

We asked questions about furnished rentals in general, and below are some of the bullet points. According to Lou, few, if any, of the properties he manages, target traveling nurses:

- Furnished rentals in general rent for 60% to 80% more than unfurnished long-term rentals.

- Average tenant stay is 3 months.

- Vacancy rate ~15-20% for their portfolio.

- Management fee: 15% of collected rent plus $60/Mo for advertising.

- Owners typically provide a $150 to $200 utility allowance, plus internet (~$70/Mo). So, $270/Mo to $300/Mo towards utilities.

- To furnish a property, he estimates $10,000 to $15,000 for a 2 to 3 bedroom residence. He knows a decorator who charges 10-15% of the cost of the furnishing to handle purchase, set-up and everything else.

We sent a 2 bedroom townhouse to Lou for his opinion.

“… Given a remodel of the upstairs to a reasonable extent and a reasonable furnishing this could quickly move into a low 3s price point. The quality of the existing remodel downstairs seems like it will have a very solid positive effect…”

Later, you will see a model comparing mid-term rentals vs. long-term rentals using this townhome.

Meeting With a Client Who Owns Mid-Term Rentals

There is no substitute for actual experience. Below are bullets from a meeting we had with a client who has mid-term rentals. Thank you BB!

- He focuses on traveling nurses. This works out well for him because he knows various hospitals from work.

- Average tenant stay: 13 weeks

- Utilities included in rent

- HCA-owned hospitals are the best bet: Summerlin and Mountain View hospitals.

- Demographic of traveling nurses: 20 to 30, not married.

- For vacancy, his estimate is 1 to 1.5 months per year. or 8% to 12% vacancy.

- Marketing on FurnishedFinder

- Method of determining rents: Find comparable properties with future availability dates and use their listed price. The logic is that if they are not currently available, they are likely already rented at the price they are advertising.

Furnished Finder

My goal was to find smaller single-family homes or townhouses with future availability. It’s difficult to do so because they provide little information on the property and the location is only approximate. I did find one property that seemed reasonable for our needs.

Property

- Webpage

- Location

- SFR 3/2/2

- $3,600/Mo or about $3,600/1600 = $2.25/SF

- No pool

- The closest comparable properties are below

- Average LTR rent: $1,960 or about $1,960/1600 = $1.23/SF

So, based on the above, the mid-term rental rate is about 83% higher than the long-term rental rate.

Based on our investigation of multiple platforms, a furnished unit with a kitchen appears to be able to generate a minimum of $100/day.

If you know a way to accurately estimate probable mid-term rental rates, I would appreciate learning of it.

Other Considerations

Lantana Property Management

Lantana has limited furnished rental experience but their rates are much better than TurnkeyLV.com. Also, the mid-term rentals are the same properties we normally target as long-term rentals. Plus, we’ve worked with them for many years and have a solid business relationship. Lantana’s rates are 8% of collected rent, a $400 re-rent fee (including the $99 FurnishedFinder fee) and a $250 start up fee (inventory and document everything.)

Lantana will handle utilities, cleaning, repairs, and more with service providers we know and work with every month.

Mid-Term Long-Term Comparison

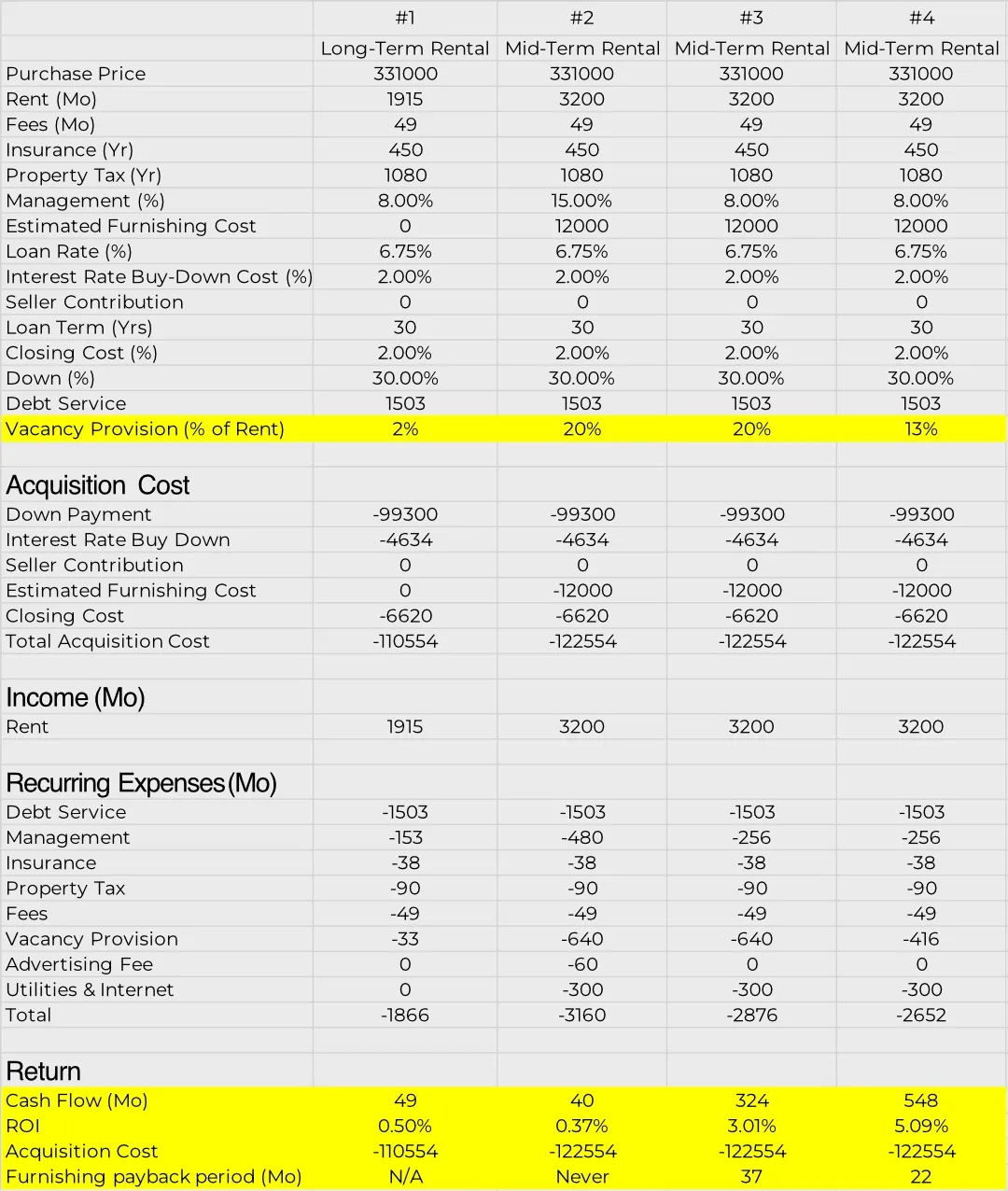

The model below (available here) compares a 2-bedroom townhome when (column number):

- Used as a long-term rental

- Used as a mid-term rental managed at 15% with 20% vacancy

- Used as a mid-term rental managed at 8% with 20% vacancy

- Used as a mid-term rental managed at 8% with 13% vacancy.

Please download the model and try what you think is reasonable. Any feedback to improve the model will be appreciated.

Property Examples

Below are two example properties that appear to match what we know of traveling nurses. The first is a townhouse and the second is a small single-family home.

Townhouse

- 2 bedroom

- 1 car garage

- Dual master

- Community pool and clubhouse

- Excellent long-term rental

Estimated cost:

- Price: $340,000 x 30% down = $102,000

- Typical renovation cost: $20,000

- Guess on furnishing: $12,000

- Estimated total cash: $134,000

Small Single-Family Home

- 3 bedroom

- 2 car garage

- 2 bathrooms

- Excellent long-term rental

Estimated cost:

- Price: $400,000 x 30% down = $120,000

- Typical renovation cost: $20,000

- Guess on furnishing: $15,000

- Estimated total cash: $155,000

Our Conclusions

It is difficult to accurately estimate monthly rent and vacancy costs due to the limited number of comparable properties and the specificity of tenant segments, property types, and locations. However, my research indicates that mid-term rentals have the potential to generate significantly higher cash flow than long-term rentals. As with any rental property, the critical factor is the occupancy rate.

Additional considerations:

- The properties should not only be suitable for mid-term rentals but also effective for long-term rentals, in case the market changes.

- Distance to Summerlin and MountainView hospitals is critical.

- Our opinion is that smaller 3/2/2 single family homes and 2 bedroom (dual master) townhomes are likely the best options.

- Properties with pools are not ideal for long-term rentals because the additional rent generated by the pool does not cover the ongoing maintenance and repair costs. Therefore, properties with community pools may be a better option.

- Most properties within associations require a minimum rental period of 30 days. This should not be a problem for mid-term rentals. However, we will need to evaluate the restrictions of the association for each property.

- Proper marketing of mid-term rentals is important. Most of what I find on sites like Furnished Finder are basic photos of properties with little to differentiate them from others. I think high-quality marketing photos (like the ones we use for long-term rentals) along with a map showing nearby amenities and attractions will set us apart.

- Utility costs should be capped. A monthly utility credit can be offered and the tenant will be billed for any costs that exceed this amount. In addition, internet should be considered a basic utility, like water, and must be provided.

- Our standard renovation approach will need to be changed. Some examples:

- Electronic locks that can be programmed remotely by the property manager.

- Garage door opener that can be controlled remotely by the property manager for receipt of goods and such as needed. Tenants can control the garage door from an app.

- The cost and time to get a property ready for the next tenant is critical so we will need to make some changes to our standard renovation items. For example, instead of carpets in the bedroom, it should be LVP.

Summary

Mid-term rentals, in the right locations and property type, appear to be an excellent way to increase cash flow. We strive to provide the best information possible, so your input regarding this article would be greatly appreciated.