[Created with Google Gemini]

Welcome to 2026! I hope you are having a great start to the new year.

In This Report

- 2026 Investor Outlook

- Potential Investment Properties

- Market Trends

- About the Fernwood Real Estate Investment Group

2026 Investor Outlook

Executive Summary

Every January, we publish our Las Vegas investment outlook for the upcoming year. Inflation, economic performance, interest rates, geopolitical events, and unexpected developments all affect the market. While accurately predicting the future is impossible, forecasts remain helpful tools for investment planning. At the very least, forecasts help us consider possibilities.

Note: While we did our best to cover relevant topics and provide accurate information, we don’t always get it right. We welcome feedback and corrections—we’ll reissue the outlook with any updates.

A Look Back at 2025

The following information pertains to single-family homes that match our target property profile. See this page for specifics.

Prices

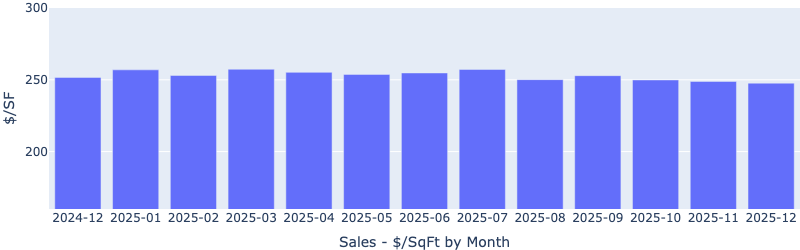

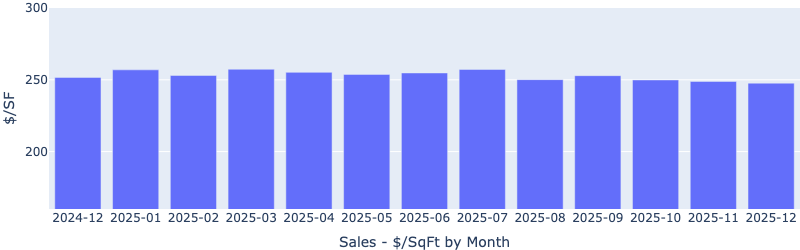

The Las Vegas housing market started 2025 as we expected, heating up in the spring buying season, until May, when it started going sideways. The $/SF for our target segment ended the year marginally down ($249/SF vs $251/SF), rather than up, as we had projected in our 2025 Outlook.

A logical interpretation is that the economic uncertainty caused by tariffs, wars, geopolitical tensions, etc., pushed many buyers to the sidelines, causing motivated sellers to accept lower prices.

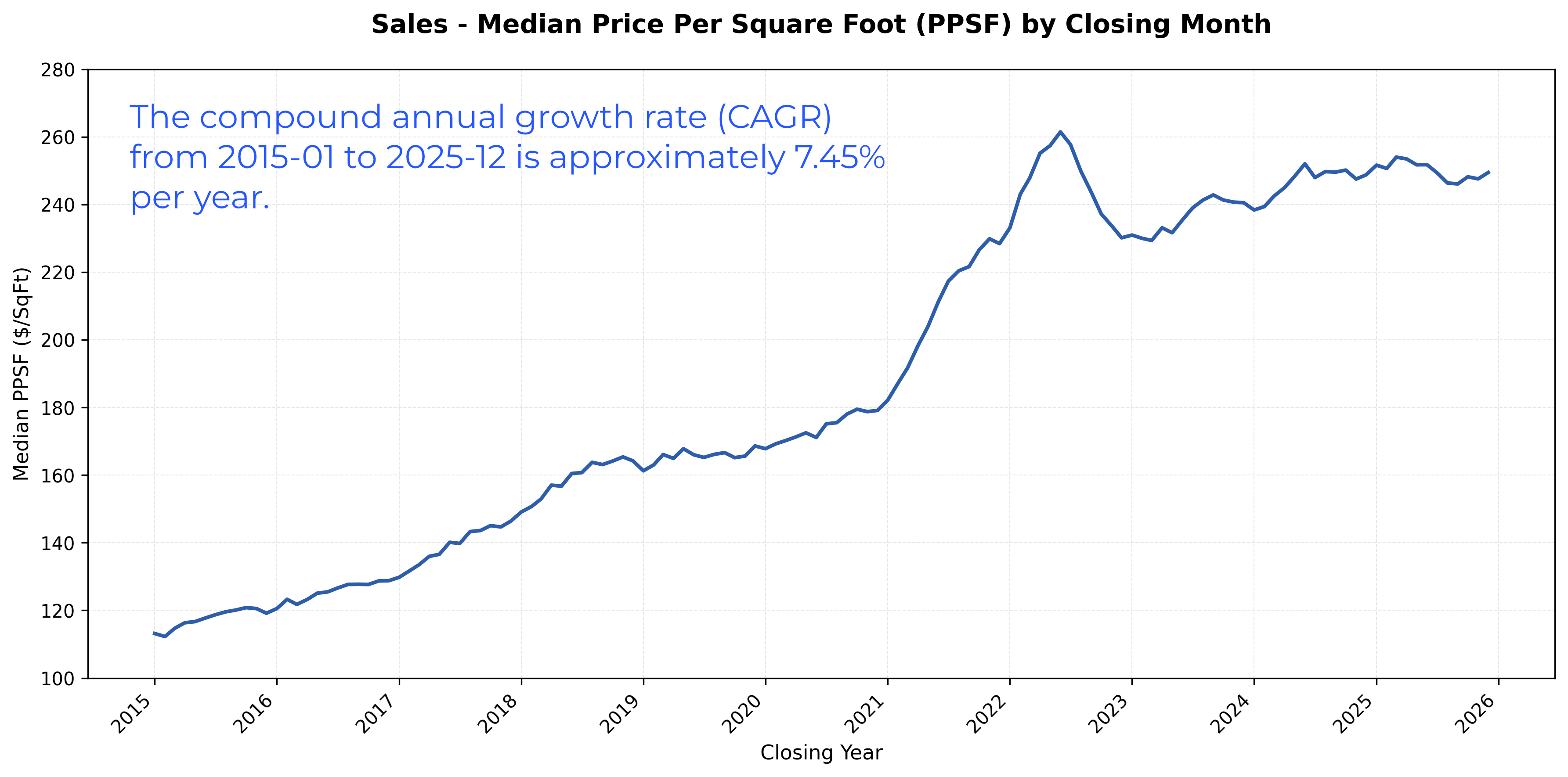

This puts our segment’s 10-year compound annual growth rate (CAGR) at 7.45%, still a remarkable appreciation rate.

[Source: Fernwood Real Estate Investment Group]

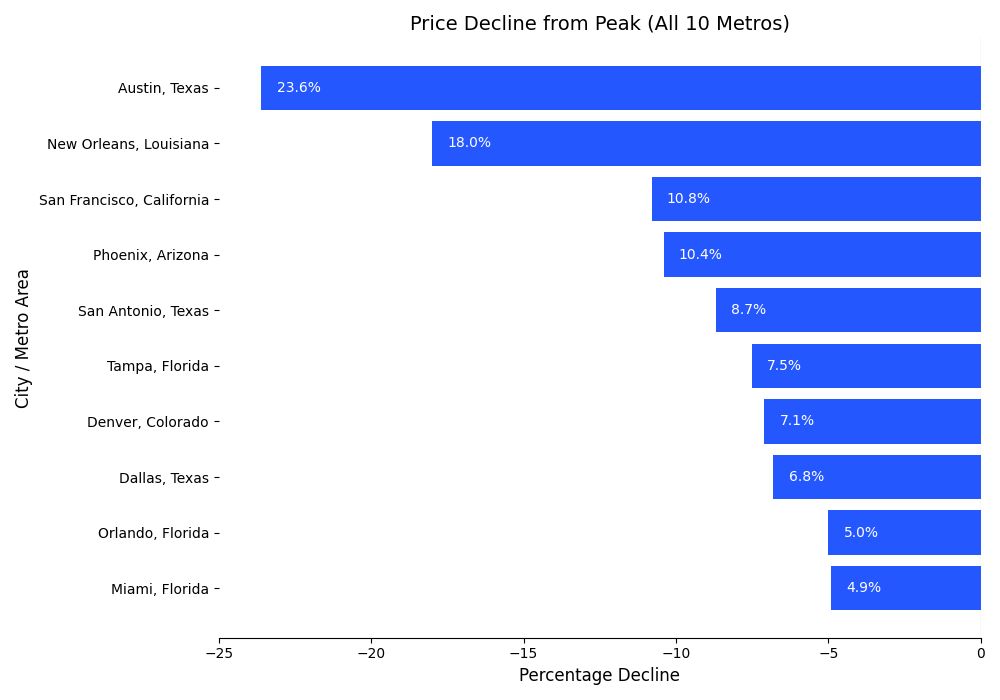

To put things in perspective, many U.S. housing markets saw significant price declines in 2025. [Source]

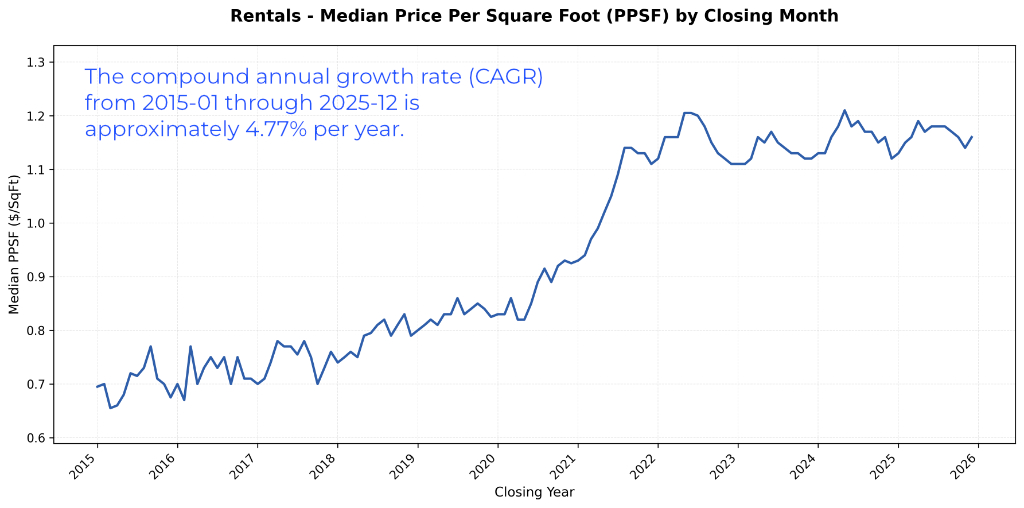

Rents

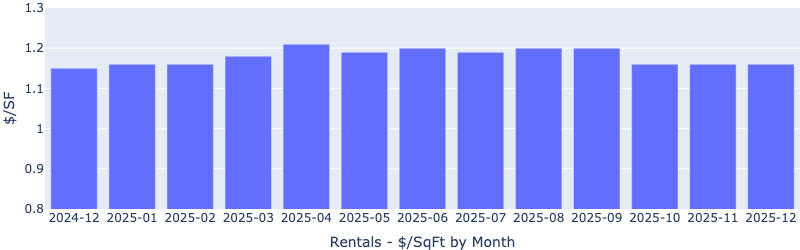

Rents were basically flat for 2025.

Which puts our segment’s 10-year CAGR on rents at 4.77%.

[Source: Fernwood Real Estate Investment Group]

Mortgage rates

30-year fixed mortgage rates remained between 6% and 7%, as we projected in the 2025 Outlook, though the overall trend has been down in 2025.

2026 Outlook

National Economy

We are not economists or financial analysts and do not pretend to be one. We look to the real experts with solid track records of delivering strong results to their clients. According to our research on their analysis, the tailwinds for the economy appear more substantial than the headwinds.

- Fiscal stimulus: The OBBBA tax cuts, which mostly take effect this year, will act as fiscal stimulus. [Source]

- Easier monetary policy: The Fed has been in a rate-cutting cycle since September 2024 and is likely to cut rates further this year. In addition, they stopped QT (Quantitative Tightening) and started reinvesting maturing securities rather than letting them “roll off” their balance sheet, adding liquidity to the financial market. [Source]

- Banking deregulation: Treasury Secretary Scott Bessent is overhauling the US bank regulation apparatus to focus on promoting growth. Alongside monetary easing, bank deregulation—including easier capital standards—is likely to boost growth and inflation.

- Positive fundamentals for business investment: strong corporate profits and a relatively low cost of capital (interest rates) should enable more business investment. The estimated returns on invested capital in the US corporate sector reached a record high of 7%.

- Wealth effects: the wealth effect from (mainly) equity prices (the rise of the stock market) and home values remains positive for consumption. [Source]

Possible headwinds/threats to the GDP growth:

- A burst of the AI capital spending bubble, causing a severe drop in the stock market or even a recession. Although there are contrarian views, citing robust US productivity increases in 2025 (possibly from AI) that may cushion the blow if a burst is to come.

- Inflation resurgence, possibly caused by a spike in energy prices. (My own comment: with the U.S. now being the world’s largest oil producer, doubling the production of the second country in place, the U.S. should have the ability to moderate oil price fluctuations.]

Overall, the analysts are projecting a continued U.S. GDP growth in the 2% to 3% range for 2026.

Mortgage rates

There are several federal efforts to lower the mortgage interest rates, which play a critical role in the housing market (especially for our target segment in Las Vegas).

- Fed rate cuts: lower inflation and higher unemployment rates are expected to prompt the Fed to cut rates further this year. This can help bring the long-term rates down.

- Fed QE, or at least the end of QT, so more demand for Treasury bonds (long-term), therefore lower rates.

- The Treasury is issuing more short-term debt (T-bills), which helps the government avoid locking in higher rates and suppresses the 10-year yield, which acts as an anchor for consumer and business borrowing costs, such as mortgages.

- Banking deregulation: This will make it easier for banks to buy treasury bonds, increasing demand and thereby lowering rates.

- Federal purchase of MBS (Mortgage Backed Securities): Fannie Mae and Freddie Mac are to purchase $200 billion of MBS. This increases demand for MBS, thereby lowering mortgage rates. The initial market response is positive.

Barry Habib, a respected housing and mortgage rates analyst, predicts the 30-year fixed mortgage rate could drop to 5.7% in 2026. My own projection for 2026 mortgage rates is between 5.75% to 6%, which is about a 0.25% improvement over current rates (6.06% as of 1/15/26).

Las Vegas Housing Market

I have stated many times, the housing market is determined by the dynamics between supply and demand.

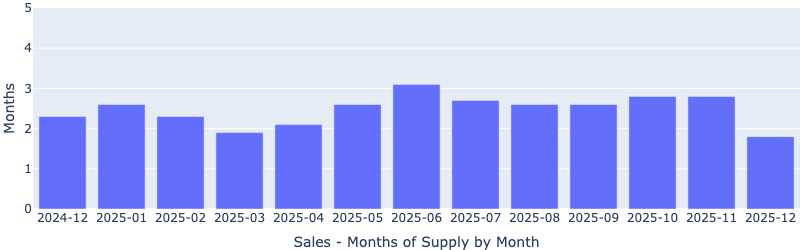

Supply

The inventory for our target segment remained in a tight band between 2 and 3 months throughout 2025, except for December, when it decreased to about 1.8 months. This is a solid seller’s market.

Can the supply increase significantly in 2026? Let’s examine the possible sources.

New builds

New builds may add supply to homes $600k and above, but not to our target segment. The reason is the cost of land.

Below is an aerial map showing the available land in 2024. Historically, Las Vegas has consumed between 4,000 and 5,000 acres per year. According to Applied Analysis, at the current consumption rate, Las Vegas will run out of developable land in about 7 to 8 years. Due to natural barriers and pre-existing uses, there is no way to increase the amount of land available for development.

The cost of the limited remaining land for development is increasing; land in desirable areas sells for more than $1M/acre [Source]. Recent sales to builders include 37 acres for $55.4M ($1.5M/acre), ~29.5 acres for $54.35M ($1.8M/acre), 20.6 acres for $38M ($1.8M/acre) [Source], and $46.4M for 38.6 acres ($1.2M/acre).

As a result of these high land costs, a typical lot in a desirable area costs over $150,000, before construction begins. The result is that new single-family homes now start at $550,000. However, due to income constraints, our target rental segment can only afford to rent properties priced today between $350,000 and $475,000. So, the number of single-family homes in this price range is virtually fixed; there is no way to increase supply.

Population loss

If people started leaving Las Vegas in mass, a lot of the houses would end up on the market. However, the population of Las Vegas is increasing and is projected to continue to increase into the foreseeable future [Source]. So, there will not be an increasing supply from people relocating to other cities.

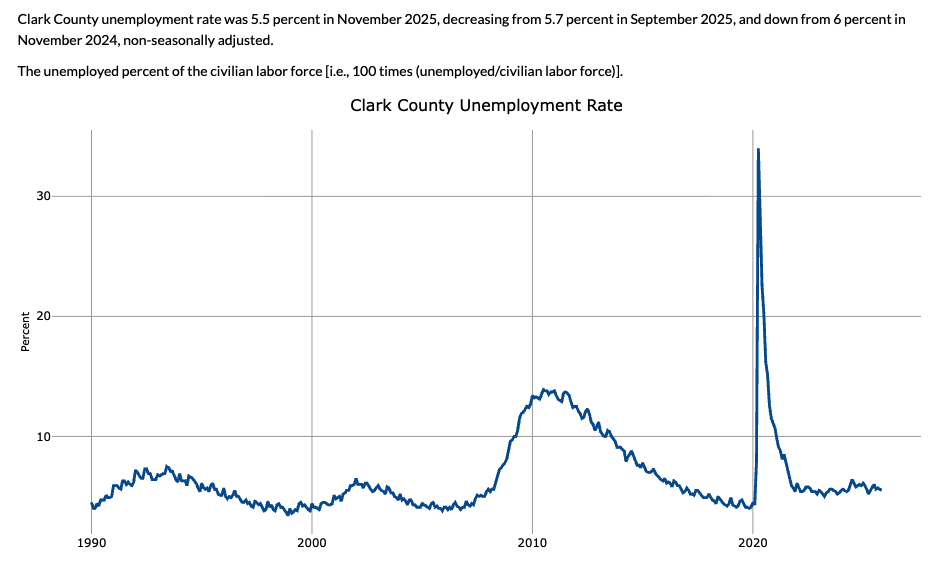

Job loss

If Las Vegas suffers a local recession and unemployment spikes, we may see more homes on the market due to financial distress. What is the current single-family distressed home sales situation?

- REO: 38 or about 0.0084% of all single-family homes

- Short sale: 44 or about 0.0097% of all single-family homes

- Foreclosure started: 30 or about 0.0066% of all single-family homes

There are very few distressed property sales in Las Vegas.

The unemployment rate has been stable and trending down despite a turbulent 2025.

Based on our outlook for the 2026 national economy, we do not see why Las Vegas would suffer a major unemployment wave in 2026.

In summary, we do not see any forces that will increase the supply of our target segment in 2026.

Demand

On the contrary, we expect the demand for Las Vegas housing to grow in 2026.

Population growth is what drives up prices and rent increases. What is the primary reason people move to Las Vegas? Jobs. What is the current job situation in Las Vegas?

A recent job fair had over 15,000 openings with an average starting wage of $52,200 [Source], an income level where most people will be forced to rent rather than buy. Las Vegas’s population grew by about 33,000 in 2025 and is expected to grow by 50,000 in 2026. [Source]

What about future jobs?

As of early 2026, the total investment for major construction projects in Clark County and Las Vegas is dominated by a $20 billion wave of mega-projects, with an additional $12 billion planned [source]. This includes both massive developments currently under construction and those set to break ground this year (Vegas Loop, A’s Stadium, Sony Studios, Brightline West, Switch “AI Factories”, etc.). These continuous massive investments will create thousands more jobs.

Another source of population inflow is the Exodus from California.

As of early 2026, California continues to lose residents to other states, with net losses of roughly 216,000 in 2024–2025. Though natural increase (births minus deaths) provides marginal growth, net migration remains negative and is projected to worsen in 2026. [Source]

Some of this exodus will come to Las Vegas. Nevada DMV data indicate that around 40–43% of surrendered out‑of‑state driver’s licenses come from California; this is not broken out separately just for Clark County, but Clark accounts for most new arrivals. [Source]

The continued exodus of companies from California will bring even more jobs and people to Nevada and Las Vegas.

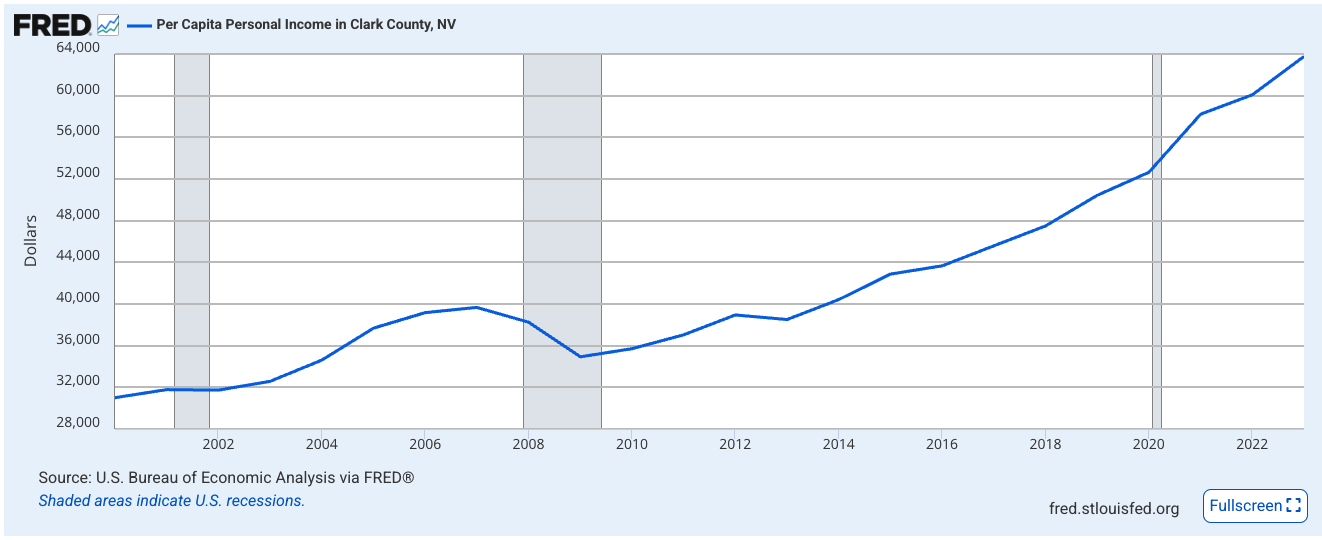

Growing Personal Income

Population growth alone, without income growth, may not be able to lift home prices and rents. Below is a chart from the St. Louis Federal Reserve showing personal income growth in Clark County, Nevada.

[Source: Federal Reserve Bank of St. Louis]

From 2013 – 2023 (the latest data available), the per capita personal income in Clark County grew 65.59%, or a CAGR of 5.17%, well above the inflation rate (approximately 2.72% CAGR from 2013 to 2023).

Our 2026 Predictions

Positive:

- We expect 2026 to be a growth year.

- We expect rents to increase by 5% to 6%. This is because of a chronic housing supply shortage and rapidly rising personal incomes.

- We expect prices to increase by 7% to 10% due to a strong influx of people moving into Clark County.

- We expect mortgage rates to be in the 5.75% to 6% range by the end of 2026.

- We expect the exodus from California to accelerate, driving up home prices.

Concerns:

- Nevada and Arizona get most of their fuel from California refiners. By the end of 2026, California is projected to have only 9 to 11 operating petroleum refineries left, down from over 40 in the mid-1980s. This will result in higher fuel prices in Las Vegas until pipelines from Texas come online. [Source]

- The Las Vegas tourism sector must rebalance entertainment value versus cost to tourists. While our target tenant segment is unlikely to be impacted by reduced international tourism (e.g., the ongoing economic strife in Canada), it does drag down the metro economy growth.

Summary

Overall, we expect prices and rents for our target segment to resume growth in 2026. This outlook is driven by a positive national economy, massive ongoing business investments locally, a growing population with rising personal incomes, lower mortgage rates, and a constrained housing supply.

If you’re interested in exploring how the current Las Vegas market conditions could align with your goals, please use the link below to schedule a time that works best for you. Schedule a Zoom meeting with Eric Fernwood

Potential Investment Properties

Below is a link to this month’s list of candidate investment properties. Our proprietary data mining software selected these candidate properties from thousands of available properties, and this is just the first step in our multi-step validation process, as shown below.

This Month’s List of Candidate Properties

Market Trend

Below are charts from our latest trailing 13-month market report, which includes December data. Remember that this data is only for our target property profile, not the entire metro area. To see all the charts, please click here.

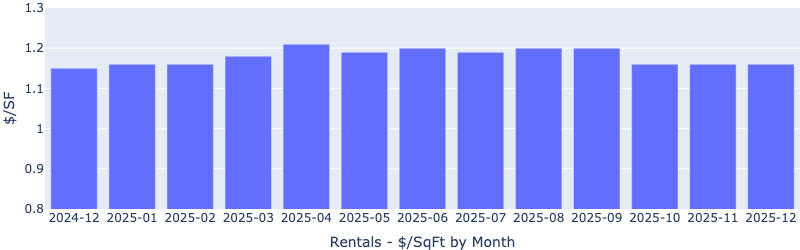

Rentals – Median $/SF by Month

Rents were flat MoM again, and practically flat YoY. The median $/SF has remained in a tight band of $1.16/SF and $1.20/SF throughout 2025.

Rentals – Median Time to Rent by Month

Median days to rent decreased MoM, a bit unusual for December.

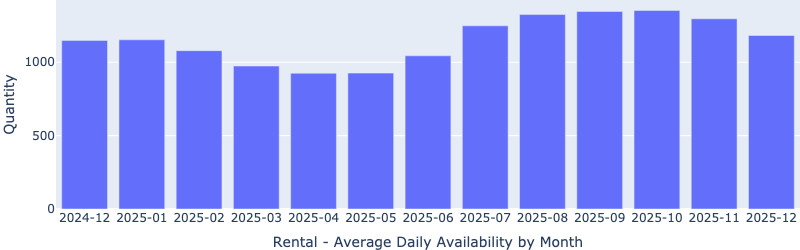

Rentals – Availability by Month

The number of homes for rent continued to decrease MoM, which is unusual for the time of year (it usually rises towards the end of the year).

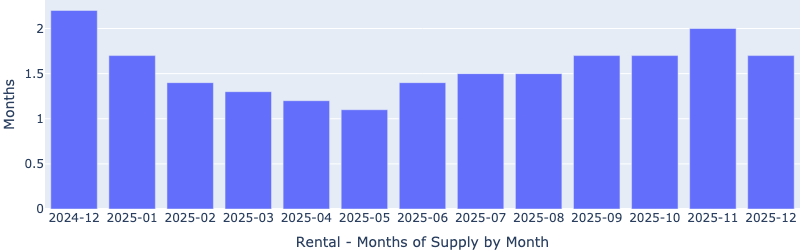

Rentals – Months of Supply

Inventory decreased MoM to about 1.7 months, indicating a firm landlord’s market.

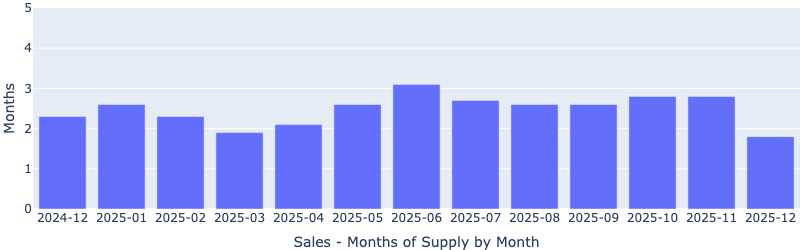

Sales – Months of Supply

As discussed earlier, sales inventory has remained in a tight band of between 2 and 3 months throughout 2025, except for December, when it dropped to 1.8 months. This is a solid seller’s market.

Sales – Median $/SF by Month

Prices were essentially flat ($250/SqFt) for the last 5 months, very unusual.

Sales – List to Contract Days by Month

Median days on the market increased again MoM, typical for the holiday season.

About the Fernwood Real Estate Investment Group

We Help Clients Acquire Highly Reliable Passive Income Streams

Here is what our clients have to say about us:

For the last 17+ years, we’ve helped more than 170 clients build highly reliable, passive income streams through real estate that they will not outlive. Several are now retired and living entirely on their rental income. Most never invested in real estate before they started working with us, and most live in other states or countries. Below is a two-minute video of the services we provide.

Want to know what we can do for you?

© 2005 to 2026 Cleo Li and Eric Fernwood, all rights reserved.

Get weekly insights like this and learn how professionals build income safely.