[Created with Gemini]

Happy New Year, valued clients and subscribers.

We just completed “The Engineer’s Guide to Safe Real Estate Investing.” This is free to our subscribers. Click here to download your copy of the guide. Let me know how I can improve it.

The start of a new year is the time to reflect on the past and plan ahead. In a few weeks, we will release our annual investor outlook. It will review what happened in 2025 and what we expect in 2026 and beyond.

The state of the economy, both national and local, will no doubt play a critical role in any investment planning. The key question is: should you change your investment strategy based on current economic conditions?

To answer that question, let’s first take a step back and review the goal of real estate investing.

The Goal of Real Estate Investing

The goal of real estate investing is lifelong financial independence. To achieve this, you need a reliable rental income that must:

- Continues even during recessions.

- Increase faster than inflation.

- Have minimal vacancies.

- Lasts your entire lifetime.

To get that, you need:

- Tenants who remain employed even during recessions.

- Personal incomes must rise faster than inflation.

- Tenants who stay for many years and pay on time.

Reliable rental income isn’t automatic. It depends on who your tenants are, not which property you buy.

Before discussing tenant segments, I want to clear up a common misunderstanding. Most gurus focus solely on buying a property—ideally a cheap one—and claim you’ll automatically become wealthy. This couldn’t be further from the truth.

Properties don’t pay rent—tenants do. Owning a property does not create income by itself. The property is just a container; the tenant is the revenue source.

How do you achieve a reliable income across economic cycles?

Which Tenant Segment?

My goal was to keep our properties continuously occupied by reliable tenants. Reliable tenants stay for many years and pay rent on time.

I first used traditional data science methods to decide which properties to buy. The results were disappointing. That led me to change the question from “which properties should I buy?” to “which tenants do I want living in our properties?”

Once I realized that data alone would not explain long-term tenant behavior, I shifted my focus to studying tenant behaviors instead. I borrowed this approach from successful retail chains such as Whole Foods, Aldi, Trader Joe’s, and McDonald’s. They all follow a similar process:

- Define the customer demographic that produces the most revenue.

- Identify where that demographic lives.

- Locate stores near large concentrations of the target demographic.

- In addition to their standard offerings, add local products that attract the target customer and lead to repeat visits. For example, McDonald’s sells Poi and Spam in Hawaii and beer in South Korea and France. They added these items to their normal menus to attract their target demographic to their store.

I based our process on the same principles. Their process and ours are illustrated below.

To find properties that attract long-term tenants, I downloaded 10 to 15 years of MLS rental history. I then wrote software to identify subdivisions where tenants stayed more than five years on average.

Next, I analyzed rents in those subdivisions to establish a rent range. From rent, I estimated gross annual income. Most renters spend about 30 percent of gross income on housing, so monthly rent can be converted to income using this formula:

- Approximate Gross Annual Income ≈ Monthly Rent ÷ 0.30 × 12

With the income range defined, I reviewed job boards to understand the types of jobs at each income level.

Note: These income figures reflect current values, not those from 2005.

- Jobs at or below about $50,000 per year were mostly low-skill and easily replaced. These workers are often the first to be laid off during downturns.

- Jobs paying $60,000 to $85,000 were direct revenue-producing, mission-critical, or government workers. These workers directly generate income or play a crucial role in income generation, making them more likely to remain employed.

- Jobs above $90,000 were often more vulnerable during cost cutting.

This is why our target tenant income range is $60,000 to $85,000, which aligns with rents of roughly $1,500 to $2,125 per month. This is our tenant demographic.

The Relationship Between Tenants and Properties

Every tenant segment has specific housing requirements and is unlikely to rent any property that doesn’t meet all their requirements. For example, the illustration below shows housing requirements for a specific segment on the left. On the right are four similar properties. However, only one matches all the segment’s requirements and is the only one that will be considered.

This relationship between tenant segment’s housing requirements and properties with matching characteristics is how you target a specific segment. Below is a subset of the forty property characteristics every property must meet in order to be worth our further evaluation evaluating further.

- Type: Single-family homes and select townhomes

- Configuration: 3+ bedrooms, 2+ baths, 2+ car garages, 1,100 to 2,400 SF, one or two stories, lot size >3,000 SF, the driveway length must be 17′ or greater to the sidewalk, and no private pool or spa.

- Rent range: $1,800/Mo to $2,300/Mo

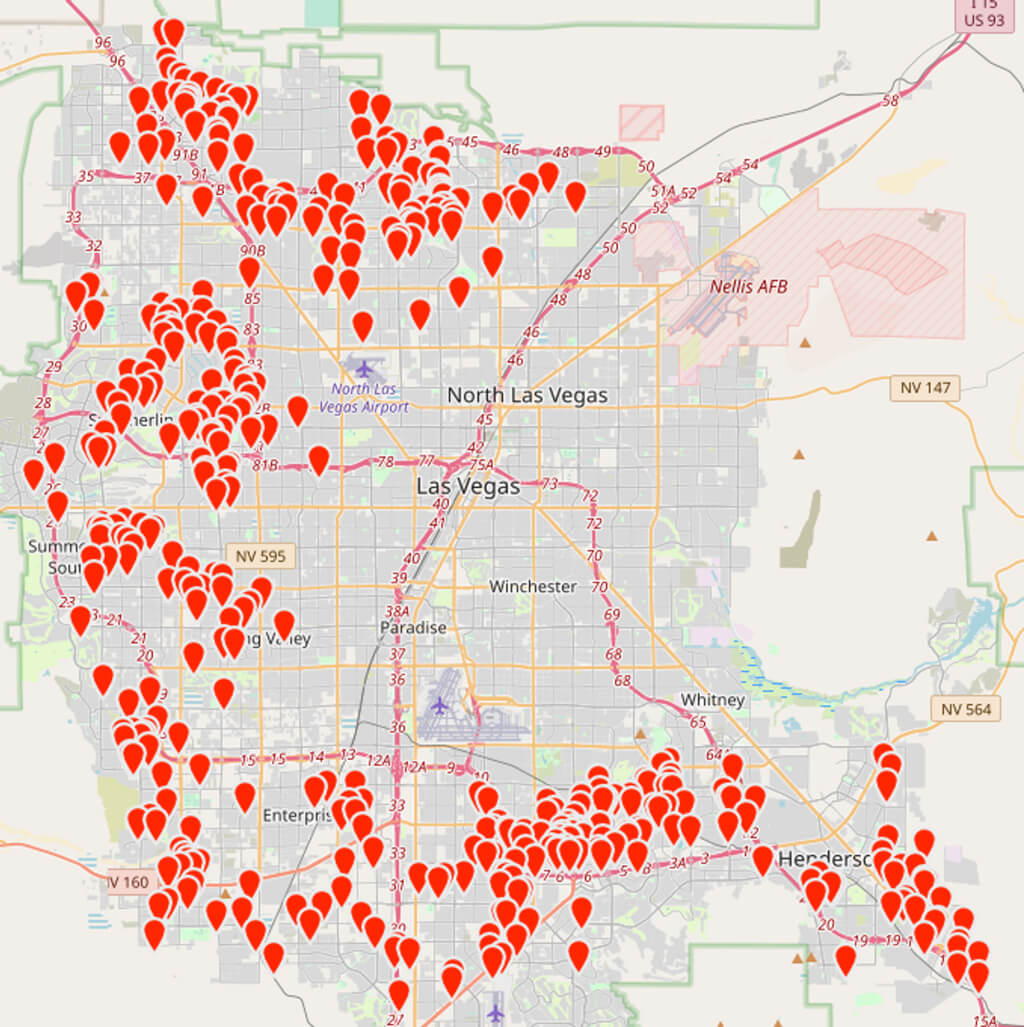

- Location: Very specific locations as shown on the map below.

If you buy a property that doesn’t meet all of a segment’s requirements, you will likely exclude that segment from renting your property.

Did it work?

Based on my research, I believed the jobs of our target tenant segment would likely survive economic downturns. However, you can research something as much as you like, but you never know if you got it right until you stress test it. The 2008 financial crash stress-tested my theories. While property prices across metro Las Vegas fell more than 40%, our clients’ rental incomes were unchanged.

- No rent reductions.

- No vacancies.

A general description of our target tenant segment: Families with children with a gross annual income between $60,000 and $85,000. Children can lock a family into a specific location for an extended period.

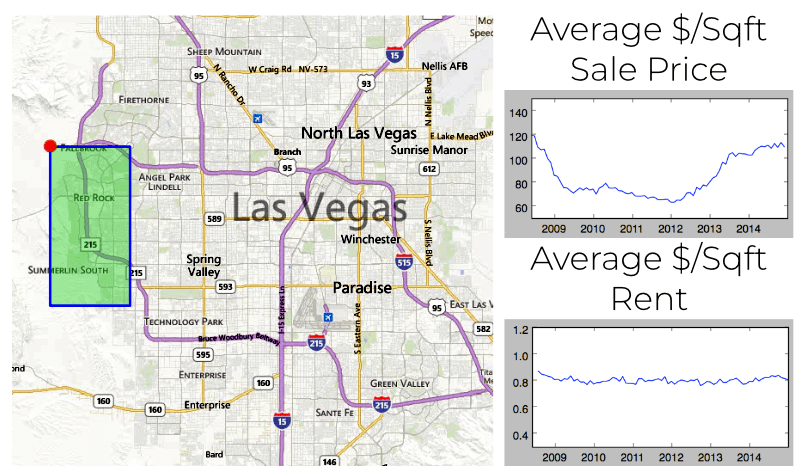

In 2015, we conducted a study to determine the impact of plunging property prices versus rents in an area where clients owned multiple properties. The results are below.

Because our target tenant segment held mission-critical, income-producing, or government jobs, they stayed employed and kept paying rent. Another advantage: everyone needs a place to live, regardless of the economic cycle—housing isn’t optional.

Conclusion

If your goal is a reliable income in all economic conditions, select (and stick to) a tenant segment with jobs most likely to continue even during recessions, and buy properties similar to what they currently rent today. This is the core of our investment philosophy.

Get weekly insights like this and learn how professionals build income safely.