Processes and Fundamentals

Welcome.

The purpose of this guide is to provide a basic understanding of real estate investing. This will enable us to focus on our upcoming Zoom meeting on working together to find and monetize properties.

This guide was written to be as short as I can make it. There is no fluff, just practical content. Below is a brief summary of each section:

- About Us – People choose to work with us due to our analytical and process-oriented approach. This section offers insights into the effectiveness of our methodologies over the past 17+ years.

- Our Process and Investment Fundamentals – Consistent performance doesn’t rely on luck or gurus. Instead, it’s a result of time-tested processes and a team of experts. In this section, I outline the steps we undertake for every property.

- Our Investment Team – A broad set of skills and services are needed to find, vet, inspect, renovate, close, remodel, and manage a property. This section briefly describes our core team and the third parties we often collaborate with.

About Us

Since 2005, we’ve provided a one-stop service for investors. Our 16+ year results.

- We have delivered over 490 investment properties to over 180 clients worldwide.

- More than 90% of clients buy more than one property, and over 80% buy more than two.

How reliable has our client’s income been?

- 2008 crash – Zero decline in rent and zero vacancies.

- COVID – Almost no impact

- Eviction moratorium – Almost no impact

- Our average tenant stays over five years.

- We’ve had six evictions in the last 15 years (over 1,000 tenants).

- From 2013 through 2023, the annual appreciation and rent growth rates were over 10% and over 8%, respectively.

Our Process

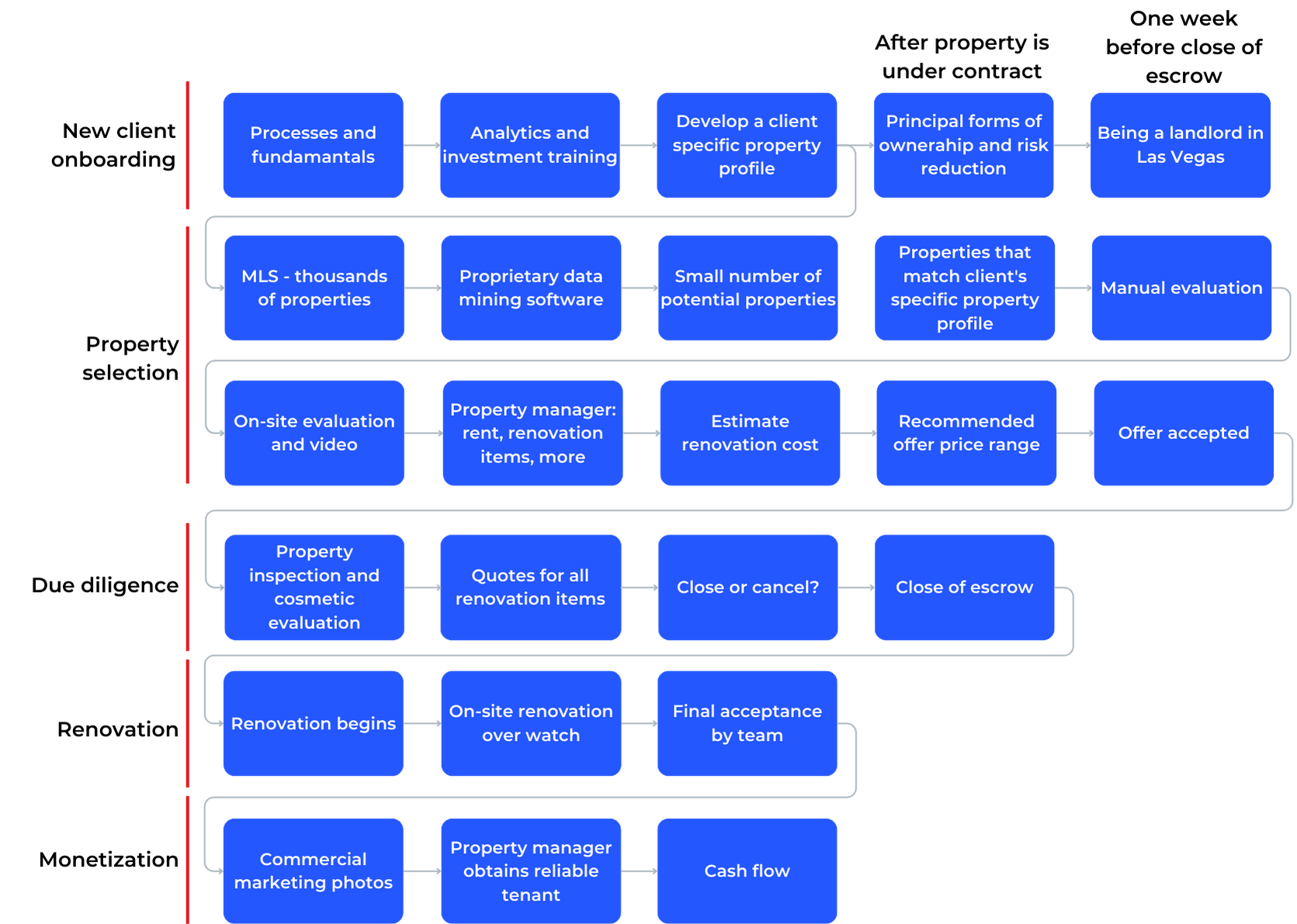

We are able to consistently deliver performing properties due to a combination of data science, a team of experts, and proven processes. Below is a block diagram overview of our process. As you can see, there are many steps between our first meeting and owning a rental property. While the process diagram may seem complex, we manage the vast majority and keep you updated on the progress. You have limited direct involvement in the steps.

- New Client Onboarding – Few clients have prior real estate investing experience. Our training provides a comprehensive understanding of the analytics we offer and our processes. It also covers essential topics, such as strategies for expanding your portfolio with minimal capital.

- Fundamentals of Real Estate Investing – Identifying reliable income properties is straightforward. There are no secrets involved. This section outlines the process we’ve followed to deliver over 490 high-performance investment properties.

- Due Diligence – This agreed-upon time period is for inspections and other investigations to identify potential issues and ensure you have a complete understanding of the property. This section outlines the events that take place during the period.

- Renovation – Renovation refers to the process of enhancing a property with the aim of increasing rent and reducing vacancy costs while keeping costs to a minimum. This section outlines the procedure we follow to decide which items to renovate.

I will expand on each section above later in this guide.

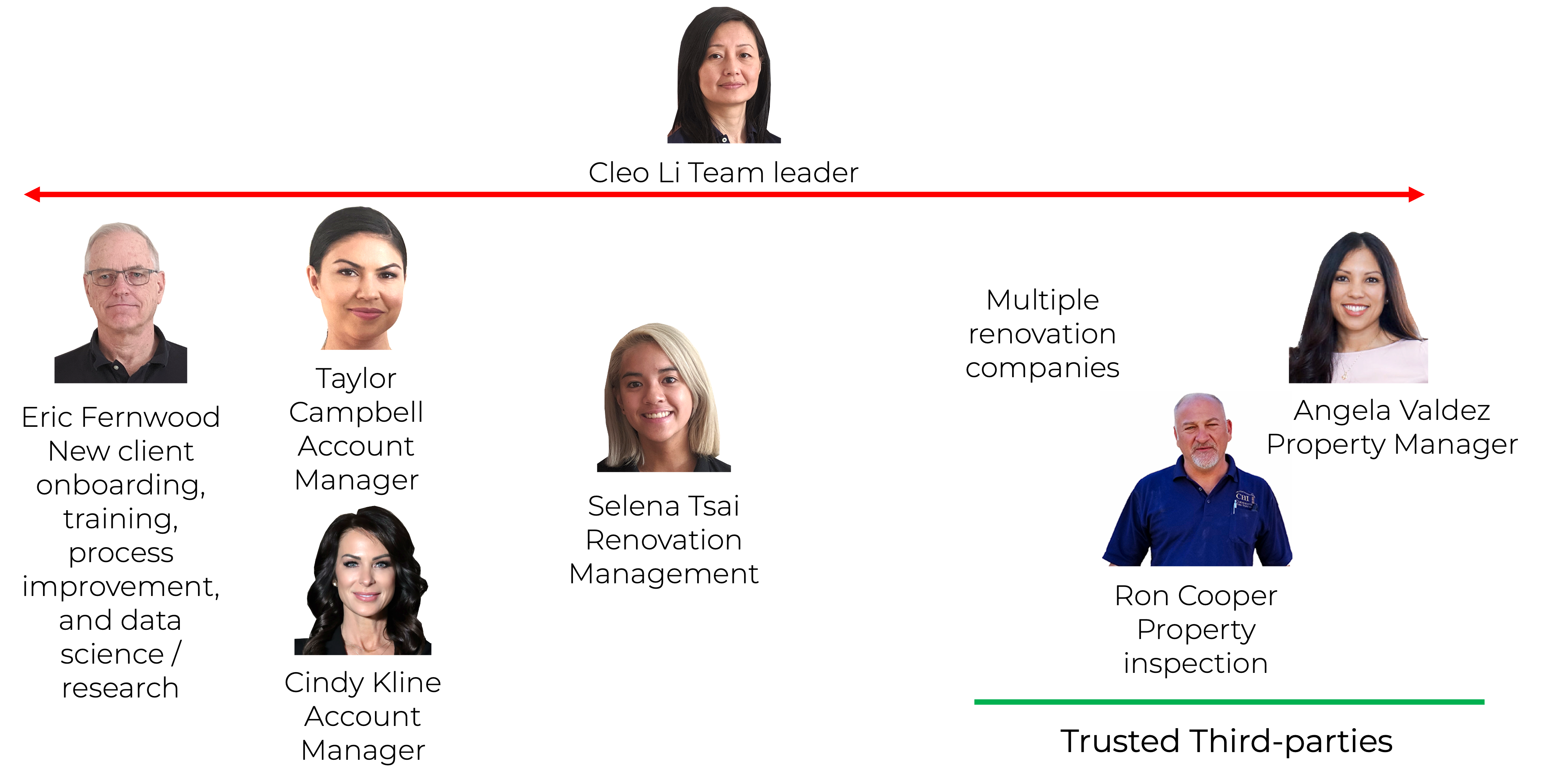

Our Investment Team

We offer services and information usually reserved for institutional investors. This range of services is made possible by our experienced core team and our close collaboration with trusted third parties. Below, you’ll find the core team members, along with a summary of their respective areas of focus and third parties we work with most frequently.

New Client Onboarding

We look forward to a long-term business relationship and, therefore, commit time to educating you about investing and our processes. Our objective is to be fully transparent throughout the process, ensuring you are clear and confident at every step.

Below is a brief overview of each class and the prerequisites. Each class lasts about an hour and is a one-on-one Zoom session with a subject expert. It’s essential to use a computer or tablet during these sessions in order to see the presenter’s screen; a cell phone may be too small.

Fundamentals of Real Estate Investing

The goal of real estate investing is to attain financial freedom. This means not only replacing your current income but also generating an income that outpaces inflation so you can maintain your current standard of living throughout your lifetime. Financial freedom requires an income that meets three criteria:

- Rents must outpace inflation: Inflation consistently erodes the purchasing power of dollars. For instance, if the inflation rate is 5%, what you can buy today for $100 will cost $155 in 10 years. If rents fail to pace with inflation, your financial independence will be short-lived.

- Lifelong: You will not outlive the income.

- Dependable: You will receive the rental income every month, even when the economy is doing badly.

To meet the above requirements, you have to get three things right

- Location

- Tenant segment

- Properties

I will talk briefly about each of these in the following sections.

Location

The location, not the property itself, is the most crucial investment decision you’ll make. This is because the location determines all long-term income characteristics, including:

- Whether rents will keep pace with inflation

- How long your income stream will last

- How reliable your income stream will be

- How much of your rental income is lost to overhead

- Whether you or the government control your property

The following are the requirements of a location likely to provide a reliable, lifelong passive income that outpaces inflation.

- Sustained and significant population growth: Prices and rents are a function of supply and demand. Demand is driven by population growth. Where there is sustained and significant population growth, the current housing supply will not meet demand, so prices will rise until the number of sellers roughly matches the number of buyers. Where population growth is stagnant or falling, the current housing supply is sufficient, so there is little increase in prices. Property prices drive rents. Where prices are low, more people can buy, so there is little demand for rentals, so there is limited or no rent growth. Where prices are higher, more people are forced to rent, so rents increase. In the best locations, rent growth keeps pace with inflation. Never invest in any city with a static or declining population Wikipedia.

- Population >1M: Smaller cities may rely too much on a single business or market segment. Also, larger cities tend to be more stable economically during economic turbulence. Wikipedia

- Low crime: A rental property is no better than the jobs around it. And, it is not just the current jobs. The average lifespan of a company is ten years, and an S&P 500 company only has an average lifespan of 18 years. Every job your tenants have today will disappear in the foreseeable future. Without new companies moving into the city and creating replacement jobs, the only jobs left will be low-paying service sector jobs. Companies wanting to set up new operations will not choose high-crime cities. Never invest in any city on Neighborhood Scout’s list of the 100 most dangerous cities. Note that this is a cashed copy because the 2024 version of the list has not been released.

- No rent control: Some states and metro areas have implemented various kinds of rent control. Rent control may prevent you from increasing the rent fast enough to keep pace with inflation, limit your property manager’s ability to select the best tenant, and make evictions of non-performing tenants difficult or impossible. Never invest in any city with rent control.

Understanding Tenant Segments

There is a belief that all people who rent have common characteristics. This is not true. For example, there are three primary tenant segments in Las Vegas, the characteristics of which are summarized in the diagram below. We are targeting a subsegment of the Permanent segment or the orange segment.

Each segment has sub-segments, as shown below.

Every subsegment has distinct housing needs and is unlikely to rent a property that does not meet all these requirements. For instance, a family of three is unlikely to rent a one-bedroom condominium.

The reverse is also true. A property typically only matches the housing requirements of a single-tenant subsegment. Only when the housing characteristics match the tenant segment housing requirements will the tenant rent the property. Below is an example in which the property meets the housing requirements of a particular segment.

How do you target a specific tenant segment or subsegment?

By selecting a property that matches that segment’s specific housing requirements.

This is what we did to target a specific tenant segment to meet the requirement for income reliability. A reliable tenant is someone who:

- Has stable employment in a market segment that is very likely to be stable or improve over time

- Pays all the rent on schedule

- Takes care of the property

- Does not cause problems with neighbors

- Does not engage in illegal activities while on the property

- Stays for many years

Characteristics of the segment we target:

- Has higher-skilled jobs and are direct income producers or government employees.

- Earn a wage significantly higher than the minimum wage, but still not enough to afford to buy a home.

- Even in the worst economic times, they are rarely laid off since their skills are not easily replaceable.

- Families with elementary school-aged children. Children anchor families to a specific location for many years.

Our Target Tenant Segment

In 2005, I did extensive demographic research for a segment with a high percentage of reliable people. I started by identifying subdivisions with an average tenant stay of over five years. I then ran a correlation analysis and determined common characteristics. This analysis provided what I call a property profile. Below are the four basic property characteristics that attract our target tenant segment. Our data mining engine evaluates each property against approximately 40 segment housing requirements and behaviors for our target segment.

- Type: Single-family

- Configuration: 3+ bedrooms, 2+ baths, 2+ car garage

- Stories: one or two

- Location: Within any of multiple well-defined areas

- Size: 1,200 to 2,100 SF

However, matching all the segment housing requirements and behaviors for our target segment is not sufficient.

Property Selection

While there may be many properties listed on the MLS, only about 0.4% are worth further consideration. Below is a simplified diagram illustrating how a property is identified as a candidate investment property.

Once a property is identified as a candidate, it enters manual evaluation. It takes about one day from the time a property comes on the market to when it is thoroughly evaluated and sent to you.

If our offer is accepted, the evaluation continues into the due diligence phase.

Due Diligence

During the due diligence phase, which is nominally ten days, there are a minimum of two inspections, as illustrated below.

- Property inspection: The first inspection is by a licensed property inspector. The inspector’s only focus is systems (HVAC, plumbing, electrical, etc.).

- Cosmetic inspection: The second inspection focuses on cosmetics and is performed by a team of people, as illustrated below??.

Deliverables from the due diligence inspections:

- Property inspection report – Here is a sample inspection report.

- Inspection notes. Since the implications of items listed in the inspection report may not be apparent, we provide explanatory notes for each inspection. – Here is an example of inspection notes.

- A 7 to 15-minute video of the property manager evaluating the property – Here is a sample walk-through video. The property inspector was present when the property manager did the walkthrough.

- A quote for all renovation items – Here is a sample quote.

At this time, we know a lot about the property and will re-evaluate it to determine whether to close or cancel the purchase and look for another property. If the cancellation occurs during the due diligence period, your earnest money will be refunded. However, you will lose the inspection cost, which is approximately $375. If you are financing, you will likely also lose the appraisal fee, ranging from $600 to $800.

Renovation

Renovation is the process of transforming a property to:

- Eliminate health and safety issues.

- Attract the right tenant pool.

- Increase rent.

- Decrease time to rent.

- Increase the length of tenant stay.

- Reduce maintenance costs.

The potential list of renovation items is the difference between the market-ready condition and the current condition. A property is considered market-ready when a significant part of the target tenant group is both willing and able to rent the property at its full market value. Market-ready conditions are specific to the tenant segment.

The potential list of renovation items is divided into two categories: Required items and enhancements. Required items include everything necessary to make the property safe and minimize litigation risk.

Enhancements are items that are cost-justifiable based on the payback period. For example, suppose the property has laminate counters in the kitchen. If the property manager predicts that the property will rent for $2,000 per month with laminate counters and $2,200 per month with granite counters, and the cost of granite counters is $3,000, the payback period is calculated as follows:

$3,000 / ($2,200 – $2,000) ≈ 15 months.

In general, I am prone to paying for enhancements with a payback period of less than three years. Over four years, it is difficult for me to justify the cost unless there are additional considerations.

Summary

Thank you for reading this guide. You now have a basic understanding of our processes and fundamentals. In our upcoming Zoom meeting, I will explain our processes in more detail, and we can address any questions you might have.

See you soon,

…Eric

Eric Fernwood

Eric@Fernwood.Team

702-358-8884