Happy New Year, valued clients and subscribers.

I had my first 2026 weekly blog ready to go. But some important housing policy changes in the last few days compelled me to switch to this policy update piece instead, as I felt these developments may/should cause significant market shifts.

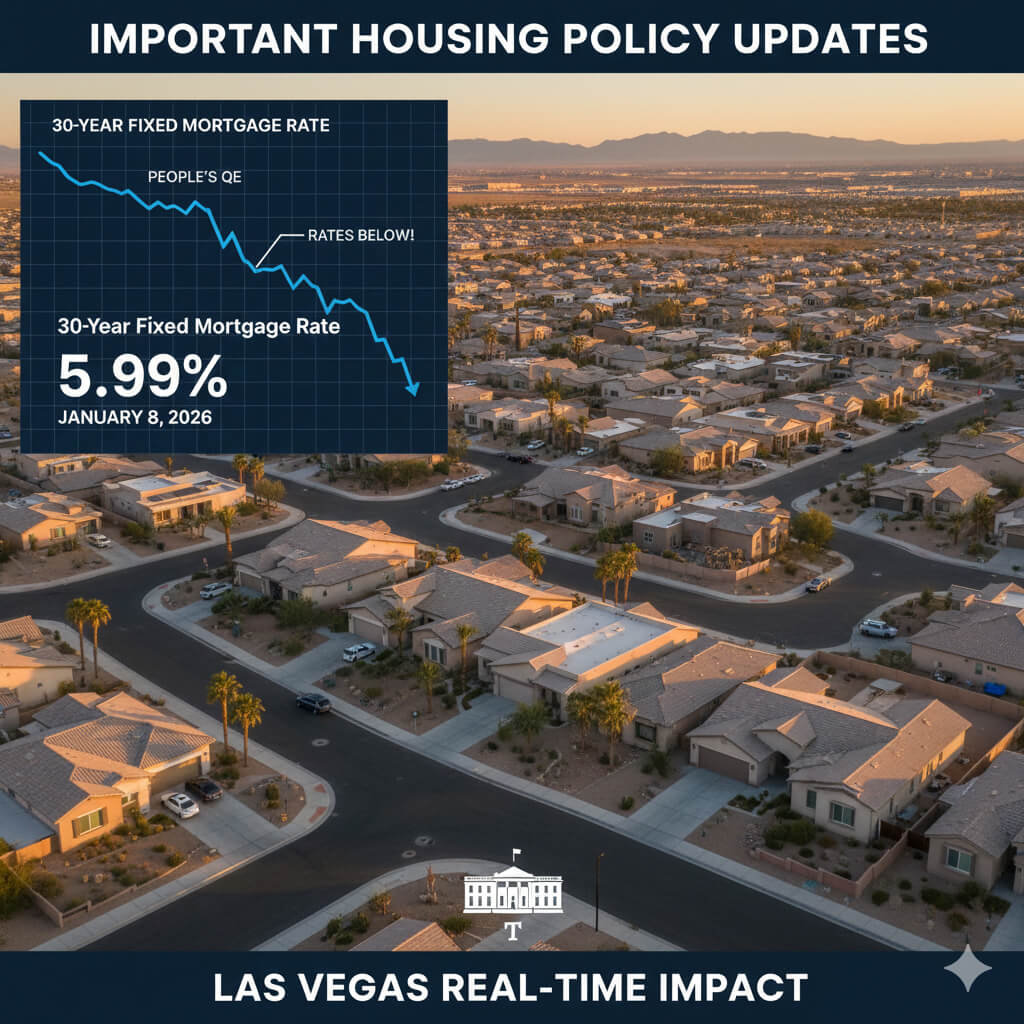

On Thursday afternoon, January 8, 2026, President Trump announced via Truth Social that he is directing the federal government to purchase $200 billion in mortgage bonds—a move already being dubbed the “People’s QE.” [Source]

Unlike traditional Quantitative Easing led by the Federal Reserve, this directive uses the massive cash reserves of Fannie Mae and Freddie Mac to bypass the Fed entirely and inject liquidity directly into the MBS (Mortgage Backed Securities) market, enticing the mortgage rates to move lower and boost the buyer’s purchase power.

Real-Time Impact: Rates Break the 6% Barrier

The market reaction was instantaneous. Within 24 hours of the announcement, mortgage rates dropped below 6% for the first time in nearly three years. By Friday morning, the 30-year fixed rate fell to approximately 5.99%.

FHFA Director Bill Pulte quickly confirmed the move, stating, “We are on it. He later revealed that an initial $3 billion purchase was executed immediately on Friday to kickstart the program. [Source] This confirms the administration is serious and has the “ample liquidity” (nearly $100B at each entity) to follow through.

What It Means for Las Vegas

This policy doesn’t exist in a vacuum. It follows Wednesday’s proposal to ban large institutional investors from purchasing single-family homes. For our investors targeting properties in the $350,000–$475,000 price range, this creates a nice tailwind.

- The Rate Subsidy: Lower rates give individual investors more purchasing power to buy investment properties.

- The Institutional Investor Ban: This move is designed to reduce your competition, theoretically leaving more inventory for families—but there’s a catch (for Las Vegas).

The Fixed Inventory Squeeze

With land costs exceeding $1M per acre, new single-family homes in desirable areas start at $550,000. Because it is physically impossible to build new single-family homes in the sub-$500k range, the supply of our segment is fixed.

Lower rates combined with a fixed inventory, the government is essentially funneling a newly-empowered group of investors (to Las Vegas). When demand rises against a fixed supply, prices don’t just stabilize—they often jump.

The “Cobra Effect” Warning

While the government’s stated goal is “affordability,” we must watch for the Cobra Effect—where a solution inadvertently worsens the problem.

In 1890s New Delhi, the British offered a bounty for dead cobras. Locals began breeding cobras to collect the cash. When the bounty ended, breeders released the worthless snakes, leaving the city with more cobras than when they started.

Similarly, if this rate subsidy drives home prices up by 5% or 10% this spring, the “affordability” gained from a lower interest rate will be completely erased by the higher purchase price.

However, this does create a window of opportunity for buyers to take advantage of lower rates and lock in the lower prices hangover from the holiday season. We have observed well priced properties starting to sell quickly in the last week. This trend/shift may already have begun in our segment.

If you’re interested in exploring how the current Las Vegas market conditions could align with your goals, please use the link below to schedule a time that works best for you.

Get weekly insights like this and learn how professionals build income safely.