There are talks about the FHA (Federal Housing Administration) lowering the minimum FICO score required for a mortgage from 500 to 490. I was asked about the probable impact of such a scenario should it materialize. Below is my opinion.

490 Credit Score

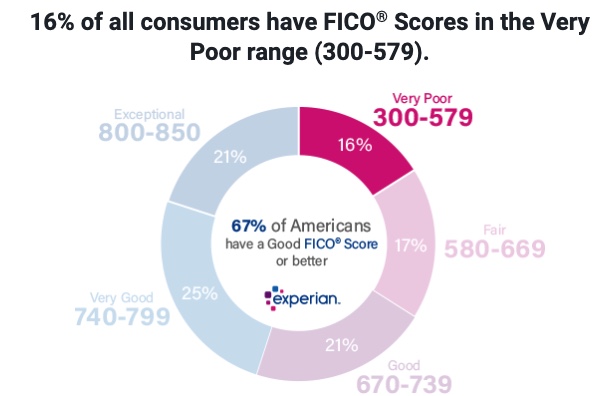

A credit score between 300 and 579 is considered very poor. See the diagram below. [Source] Only about 16% of consumers have scores in this range.

Today, you can get a mortgage with a 500 to 579 FICO score, but the down payment will be 10% and the rate will be 0.5% to 1.5% higher. To qualify for a 3.5% down mortgage, you need a FICO score of at least 580.

Lowering the required minimum credit score from the current 500 (requiring 10% down) to 490 will only benefit about 1% of the population. [Source] I believe it would have little impact on prices because the incremental buyer demand is marginal. In my opinion, what would make a meaningful impact is if the FHA loosens the broader loan requirements. For example, making the 3.5% down payment available to those with a FICO score lower than 580. However, I found no indication in current sources that FHA is discussing or proposing a change to the 10% down‑payment requirement for borrowers with credit scores between 500 and 579.

I researched the probable impact (to Las Vegas SFR investors) of a looser FHA requirement vs a tighter one. See the table below. Note: all the scenarios below assume the current economic and population trends stay the same for Las Vegas.

| Scenario | Acquisition Environment | Rents & Vacancy | Appreciation & Appraisals | Best Use Case for Investors |

|---|---|---|---|---|

| A: Tighter FHA | Lower Competition. Investors have more negotiating power (price cuts, seller credits). | Strong: Vacancy stays low. Rent growth reliably outpaces inflation. | Price growth slows short-term. Long-term: Lower appreciation rate. | Buy-and-Hold for Long-Term Financial Independence. Best scenario to scale. |

| B: Neutral FHA | Current situation. Steady, predictable competition. | Stable: Positive rent growth, slightly above inflation in working-family ZIPs. | Slower, steady appreciation. Appraisals generally support contract prices. | Core Buy-and-Hold with Selective Value-Add. Hitting numbers requires sharp execution. |

| C: Looser FHA | High Competition. FHA buyer pool expands sharply. Multiple offers and bidding wars on correctly priced properties. | In theory: Rent growth slows as more marginal renters can buy. Vacancy may tick up. However, this was not the case during the COVID boom time. | Faster short-term price appreciation in FHA-heavy neighborhoods. | Buy-and-Hold for Long-Term Financial Independence. Best scenario for rapid short-term appreciation. |

More details on the three scenarios.

Scenario A: Tighter FHA FICO

In this environment, stricter FICO score requirements price a segment of first-time buyers out of the market. Investors who can pay cash or secure non-FHA financing suddenly face fewer rivals in the $350k–$475k band.

- LV-Specific Impact: FHA-heavy ZIPs like North Las Vegas or Centennial Hills and Sunrise Manor see more listings sitting on the market longer and more price cuts. Investors can expect better prices and seller credits.

- The Cash Flow Engine: These sidelined homeowners become committed renters. This ensures more households remain tenants longer, pushing up rents and keeping vacancy low in target segments (families earning $60k–$90k).

The result is robust cash flow from day one. - Best Strategy: This is the optimal scenario for investors focused on scaling a long-term buy-and-hold portfolio. The combination of lower entry prices and strong, sustained rent pressure creates the best risk-adjusted returns.

Scenario B: Status Quo

This is the current market. Our strategy has been focusing on identifying and securing selective value-add opportunities to position our clients’ new acquisitions best.

Scenario C: Looser FHA FICO

When credit standards ease, the FHA buyer pool expands sharply.

- LV-Specific Impact: Multiple offers and “highest and best” scenarios become the norm. Most investors will either pay top-of-market prices or pursue less obvious, higher-risk sub-segments. However, our strategy in this kind of market environment has been targeting properties requiring significant renovation, since FHA buyers typically cannot afford such work.

- In theory, as long-term renters buy homes, the rental pool shrinks. Rent growth slows down, and vacancy rates may tick up in fringe locations. However, this is not always the situation. For example, during the COVID boom, when interest rates were unbelievably low, rents rose sharply (alongside prices), and vacancies decreased. My interpretation is that so many people moved to Las Vegas during that time, pushing up both rents and prices, and keeping vacancy low.

- Best Strategy: This environment favors investors looking to build equity rapidly, or to harvest equity and redeploy in better-performing properties.

Conclusion

FHA policy isn’t static—it’s a dynamic market lever. By aligning our acquisition and exit strategy with anticipated shifts, we can turn perceived weakness (tighter credit) into a competitive advantage for your rental portfolio.

If you’re interested in exploring how the current Las Vegas market conditions could align with your goals, please use the link below to schedule a time that works best for you.

Get weekly insights like this and learn how professionals build income safely.