When investing in real estate, it’s tempting to focus on properties that promise strong initial cash flow. After all, it gives you more satisfaction to see a higher immediate return on your money in the investment. But there’s a major downside to such “instant gratification”, which I will explain in this post.

What Causes Higher Initial Cash Flow

Before I continue: City economics and population migration change very slowly. The conditions you see today are the result of years of momentum and are unlikely to change in the foreseeable future.

Higher initial cash flow comes from low property prices combined with decent rents. These low prices are the result of weak demand over many years, with values failing to keep pace with inflation. That’s why such properties are relatively inexpensive.

There is a relationship between prices and rents. When prices are low, more people can afford to buy, reducing demand for rentals, causing rents to rise slowly or even fall. When prices are high, fewer people can buy and are forced to rent, increasing demand and driving rents higher. Depending on the location, there is a two to five-year lag between price changes and rents.

In lower-priced markets, rents reflect property values from two to five years ago, when those properties were worth more. As a result, rents are relatively high compared to today’s lower prices. In higher-priced markets, rents also reflect values from two to five years ago, when properties were less expensive than they are now.

When you choose low-priced properties for higher initial cash flow, you give up the rent growth needed to keep pace with inflation.

Why is rent growth outpacing inflation so important?

$7,000 Today Will Not Be $7,000 in Ten Years

Suppose you own properties generating $7,000 per month in a city with weak demand. If rents rise by 2% per year while inflation averages 4%, what happens over the next ten years?

- Rent in 10 years: $7,000 × (1 + 2%)^10 ≈ $8,533

- Buying power in today’s dollars: $8,533 ÷ (1 + 4%)^10 ≈ $5,765

So while rent increased to $8,533, its real value is only equal to what $5,765 will buy today.

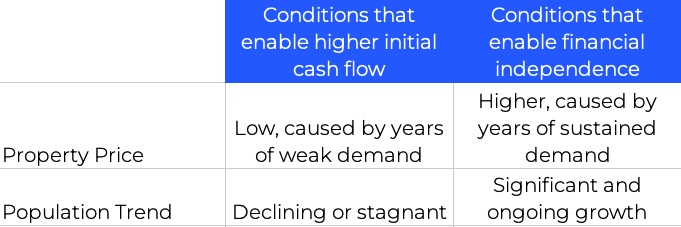

Can you find properties that deliver both strong initial cash flow and rapid appreciation? Not in today’s market. After the 2008 crash, Las Vegas briefly offered that unique combination, but it was a once-in-a-lifetime event. The conditions that create high cash flow are the opposite of those that drive long-term appreciation. See the table below.

Since you’re likely to hold a property for 10 years or more, what happens after the first year matters far more than what happens during the initial year.

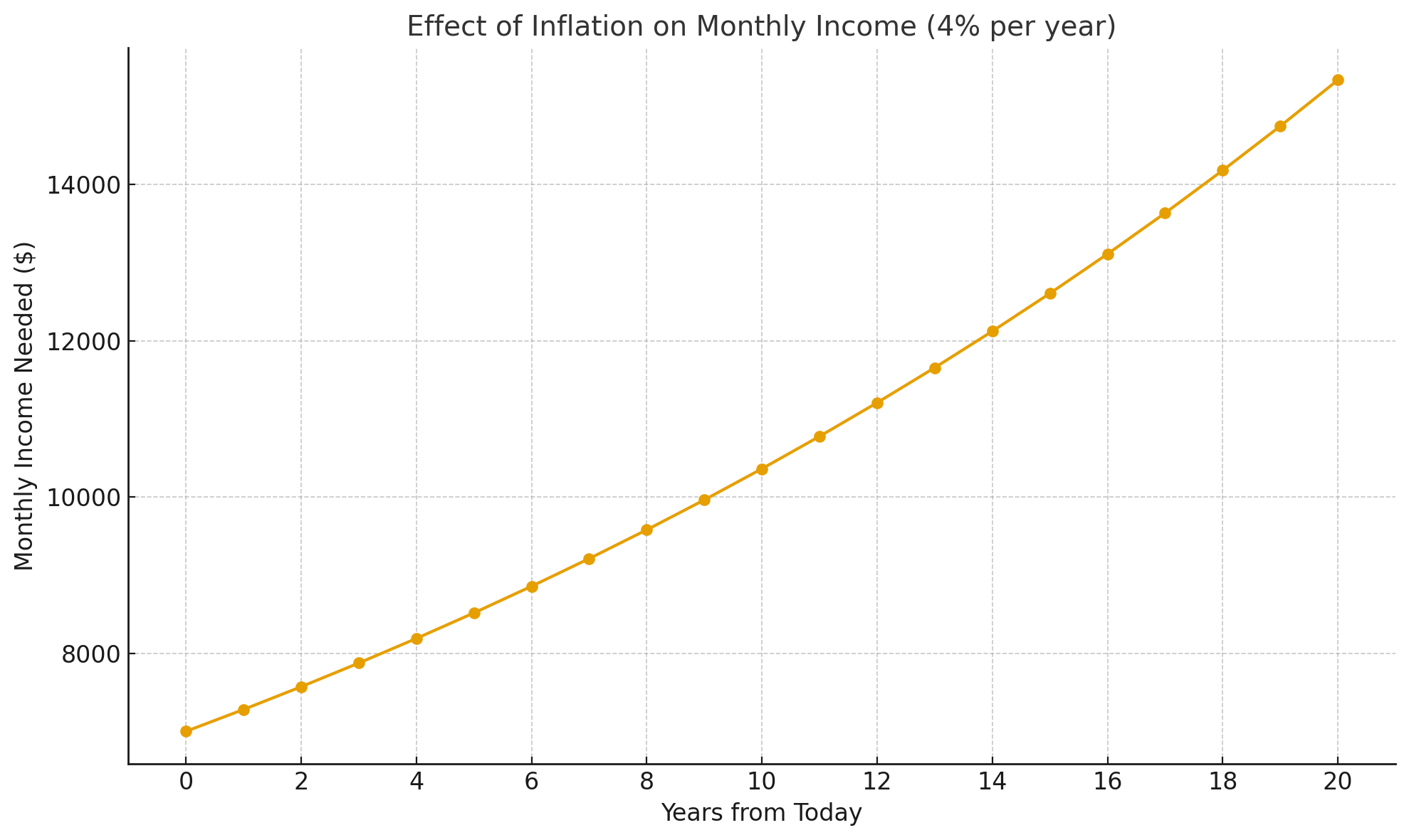

What You Need for Financial Independence

If your goal is lifelong financial independence, your rental income must rise faster than inflation. The chart below shows, by year, how much rental income you will need in the future to match the buying power of $7,000 today.

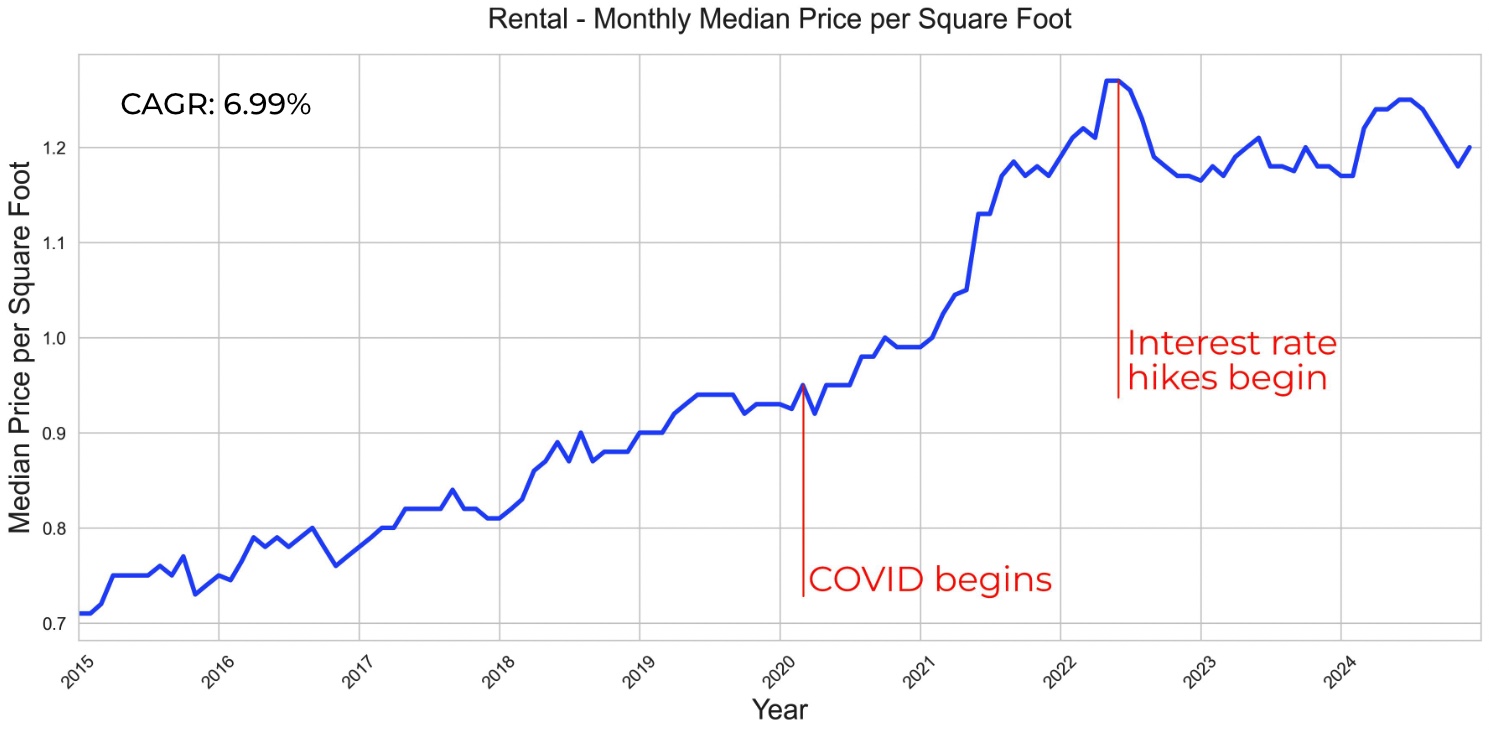

This means that you must invest in a city(s) that can deliver sustained, above-inflation growth. For example, below is a chart showing the rent growth of our target property profile for the last 10 years (2015-2025).

[Source: Fernwood Real Estate Investment Group]

The average annual inflation from 2015 to 2025 was 3.14%/Yr. Over the past decade, rent growth for our target property profile has been more than double the rate of inflation. This means you wouldn’t just maintain your buying power; you would actually increase it.

Summary

Higher initial cash flow and the rental income required for long-term financial independence come from opposite market conditions, so you cannot achieve both in the same property.

Before purchasing, decide on your primary goal:

- Maximize initial cash flow

- Build lasting financial independence

Join the newsletter. Subscribe to receive our latest post in email.