Photo by Neal Smith on pexels.com

The goal of real estate investing is getting off and staying off the corporate treadmill.

In order to get off and stay off the treadmill, you need a dependable passive income. How does Las Vegas meet this goal?

Supply & Demand

Unlike financial markets, real estate prices and rents are driven by supply and demand. In this article, I will discuss the unique supply and demand situation in Las Vegas.

Supply

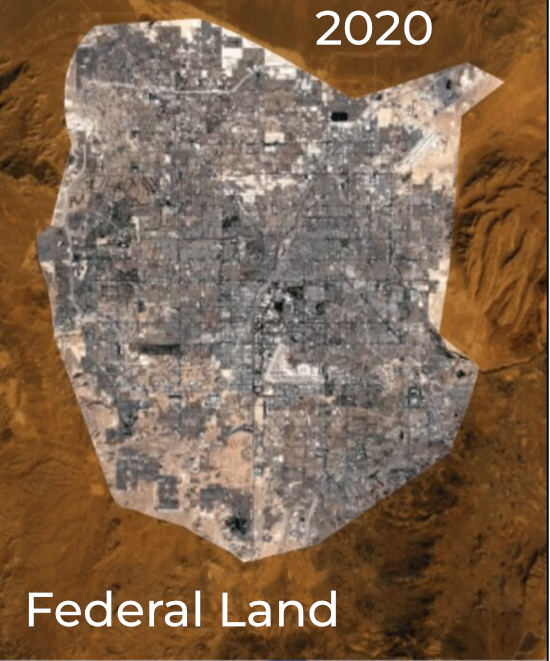

Las Vegas is unique in that it is a tiny island of privately owned land in an ocean of federal land. See the 2020 aerial view below.

There is very little undeveloped private land remaining, and any available land in desirable areas costs more than $1 million per acre. Due to the high cost of land, new homes in our targeted locations start at $550,000. The homes that appeal to our target tenant segment are priced between $320,000 and $475,000. Therefore, no matter how many new homes are built, the housing stock we target remains almost constant. This differs from metropolitan areas with unlimited expansion potential, where the construction of new homes limits the growth of rent and home prices of existing properties.

Demand

The driver for housing demand is population growth. The average Las Vegas annual population growth is between 2% and 3%. When a city’s population grows sustainably and consistenly, a lot of things must be right. Most important is job growth. What attracts most people to Las Vegas (and other metros) is jobs.

In a study I did in January, I looked at two major job sites (Monster and Glass Door) for the number of open jobs in Las Vegas. According to these sites, there are between 26,000 and 31,000 open jobs in Las Vegas.

The number of available jobs will increase in the future. Depending on which study you read, there is between $18B and $26B of new construction under development. As these come online, they will create even more jobs attracting more people to Las Vegas.

Of the people who will move to Las Vegas, a significant portion matches the tenant segment we’ve targeted since 2005. So, the demand for conforming properties priced between $320,000 and $475,000 will increase over time.

Summary

Due to the unique situation of a fixed supply and increasing demand, Las Vegas can provide the dependable passive income you need to achieve financial security.

If you’d like more detail on why Las Vegas will continue to grow, reach out to me.