There are markets in the US where you can buy properties very inexpensively, and in some cases, the initial ROI is excellent. So, why purchase properties in higher-priced markets when you can buy two or three properties for about the same amount?

Long Term Performance

Initial return and appreciation are opposite ends of a teeter-totter, as shown in the image below.

The reason appreciation and initial return are opposing forces has to do with the relationship between property prices and rent. Depending on the location, rents lag prices by 2 to 10 years. In a declining market, today’s rents reflect higher property prices from 2 to 10 years ago. In an appreciating market, today’s rents reflect lower prices from 2 to 10 years ago. See the image below.

We can also look at appreciation vs. initial return from a demand view. In declining markets, there is little demand, so prices and rents are low. With little demand, rents and prices rise slowly or not at all after adjusting for inflation. However, since rents lag prices, rents are higher when compared to property prices. In appreciating markets, there is strong demand, so prices and rents are higher, and rents and prices will rise. Since rents lag property prices by 2 to 10 years, the initial return is lower.

Whether the market is declining or appreciating, your major operating cost, debt service, is fixed. Fixed operating cost is an advantage in an appreciating market since it results in increasing return. In a declining market, the result is declining return over time. In some cases, rents can fall below your operating cost, and the result is abandoned properties and high crime rates.

I occasionally have people point out that rents are increasing, even in cities perceived as declining markets. It may be true that the rent is increasing, but only if the rate of rent increase is greater than the rate of inflation are rents increasing in terms of buying power. A look at inflation and buying power will explain why rising rents may still be declining in buying power.

Inflation and Buying Power

The value of money is not the dollar bills themselves; the value of money comes from what you can exchange the bills for. Inflation reduces the buying power of money over time, requiring more money to buy the same items. For example, a basket of goods you could purchase in 1990 for $50 costs more than $100 today. See the chart below.

How much would rent have to rise over the same period to maintain the same buying power? See the chart below.

If you rented a property for $500 per month in 1990, the rent today would need to be more than $1,025 to have the same buying power. So, even though the rent rose from $500 to $1,025, the buying power was constant; there was no increase in rent after adjusting for inflation. You have to evaluate markets based on inflation-adjusted dollars, not just the number of dollars. If you would like to experiment with the change in buying power over time, here is a calculator provided by the US Bureau of Labor Statistics.

So, unless rents and prices are increasing at or above the rate of inflation, your actual income (buying power) is decreasing.

I regularly have people point to higher ROI of some areas as proof that it is a good investment location. However, ROI has limitations.

ROI is Only a Snapshot in Time

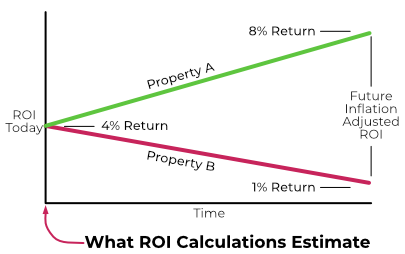

ROI, and other such metrics, estimate how the property is likely to perform on day one of a lifetime hold. ROI tells you nothing about how the property is expected to perform in the future. See the chart below. As an example, today Property A and Property B have the same estimated ROI. However, Property A is returning 8% in the future while Property B is only returning 1%. ROI does not indicate what will happen in the future.

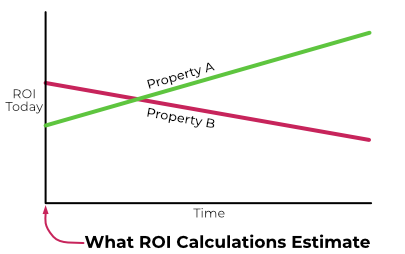

Below is another example. Is property A or Property B a better investment? Even though Property B has a higher initial return, Property A is the clear winner over time. If you only look at ROI, Property B is the clear winner. However, long-term, Property B is a disaster

The point is that what happens over the next 10 to 20 years is more important than the initial return, which is all ROI predicts.

In Conclusion

Declining markets are an alluring trap. The initial ROI may be higher than an appreciating market, but the return will continue to fall over time. Once you buy a property in a declining market, you can do little other than selling the property, no matter the loss. Do not let the allure of low-cost, high initial return properties blind you to the long-term profitability.