Retirement Accounts Lose Trillions, Now What?

The stock market is now officially in the bear territory and crypto has “collapsed.” For many, this market downturn wiped out years of savings and gains; nest eggs flew out the window. And, the situation is not going to get better any time soon.

During a turbulent financial market, it is more important than ever to deploy your money in an investment that has historically proven to be dependable, during good times or bad. One such investment is real estate. However, not just any real estate will do. Only the right combination of location, tenant pool, and property provide the dependable passive income you need to achieve financial freedom.

“A lot of the wealthiest people on the planet, have either become wealthy from real estate or they later invested in real estate to keep their wealth.” - Mike Wolf

How Is the Las Vegas Real Estate Market Doing

Below are the top 10 cities where prices fell over the last 12 months plus the inflation adjusted change. Note that these are what real estate “gurus” touted as great investment locations.

| City | YoY Price Change | Inflation Adjusted YoY Price Change |

| Toledo | -18.7% | -25.2% |

| Rochester | -17.0% | -23.6% |

| Detroit | -15.4% | -22.2% |

| Pittsburgh | -13.7% | -20.6% |

| Springfield | -5.8% | -13.3% |

| Tulsa | -5.0% | -12.6% |

| Los Angeles | -5.0% | -12.6% |

| Memphis | -4.6% | -12.2% |

| Chicago | -3.7% | -11.4% |

| Richmond | -3.4% | -11.1% |

How did Las Vegas perform over the same period?

- Price change: +39%, inflation adjusted: +27.9%

- Rent change: +16%, inflation adjusted: +6.7%

Is the Las Vegas Market In Decline?

No. In my opinion, “decline” means property prices are falling. The leading indicator of price declines would be a rapid and significant increase in inventory. Below is a chart from the MLS showing months of supply for all single family homes in the metro area over the last 10 years.

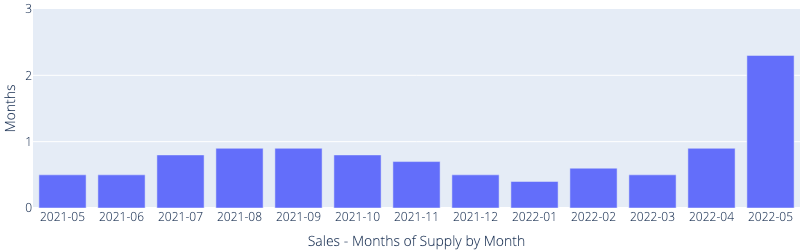

As you can see, inventory levels have almost continuously fallen since 2012. What about the last 12 months? Below is a chart from the MLS showing months of supply for all single family homes. Iventory has increased slightly in the last two months, from 1.1 months to 1.5 months.

A balanced market is 6 months of inventory so Las Vegas inventory has a long way to go to reach a balanced market. Below is the data for the property segment we target.

Sales - Months of Supply

Inventory rose in May. This is likely a combination of the higher interest rate and the normal seasonal uptick. However, a little over 2 months supply is still firmly in the seller’s market. Two months ago we would compete against more than 10 offers on every property. Today, we only compete with about 3 to 10 offers on every property and good properties still go under contract in 3 to 5 days.

Sales - Median $/SF by Month

Prices continue to rise. YoY is +39%!!!

How are rentals performing?

Rentals - Months of Supply

In a “normal” market there should be between two and three months of rental inventory. Today, the inventory is a little over .5 months. Based on the declining inventory level, demand continues to exceed supply.

Rentals - Median $/SF by Month

Due to high demand, rental rates continue to increase. Until rental inventories increase to two or three months, I expect rents to continue to rise.

Based on the above, I see no indication that prices and rent growth for our target segment will stop.

The Market Is Overheated?

No. I recently read that prices are at an all time high and homes and the market is “over heated.” See the chart below. The blue line shows the non-inflation-adjusted price. If you pretend inflation does not exist, you can say that houses are more expensive now than they were in 2006. However, if you correct for inflation, the red line, then we are still $34/SF below 2006 peak prices. I see no indication that the market is overheated.

Single family $/SF since 2006

Does Las Vegas Have A Lot of Foreclosures and Short Sales?

No. Below are the actual numbers for single family homes in the Las Vegas metro area on 06/14/2022:

- Bank owned (REO): 13

- Short sales: 9

- Pre-foreclosures: 10

This is not 2008 when over 90% of the properties were underwater. Today, only a tiny fraction are underwater. So, if people get behind on their mortgages, they will sell the property in days, bank the profit and rent. We do not expect any significant amount of foreclosures. Foreclosures only occur when the property cannot be sold for at least the mortgage balance.

How Are High Interest Rates Impacting the Las Vegas Market?

In a classic market, as prices and interest rates rise, inventories rise and prices decline. This is not the situation in Las Vegas.

So far, properties that conform to our property profile, continue to perform exceptionally well, and we expect this to continue for the foreseeable future. Demand is still far greater than supply and new homes (for whatever small numbers there are) will not add to our target segment.

The majority of properties our client’s purchase range between $400,000 and $500,000. In these same areas, new homes prices start at $550,000 and rapidly climb from there. Also, there is little land available for expansion. 80% of the entire state of Nevada is federal land. Clark County (metro Las Vegas) is 87.5% federally owned. Below is a time lapse showing land consumption between 1984 and 2020. As you can see, there is not a lot of developable land available.

Higher interest rates will however, push more buyers to become renters so I expect rental demand will increase, which drives rents higher.

How Did Your Properties Perform in Bad Times?

15 years ago we selected a specific tenant pool to target. Part of the reason we selected this tenant pool was their history of staying employed in good times and bad, paying all the rent on schedule, and staying for several years. How has this tenant pool performed during the down times?

- 2008 market crash - Zero (no) decrease in rent, no vacancies. Property prices plunged by over 50% but this was not an issue for our clients. Our clients buy properties for dependable passive income streams, and all the properties continued to generate the income our clients depended upon.

- COVID - Almost no impact. Rents and prices continued to rise rapidly.

- Eviction moratorium - No impact.

- Evictions - 5 in the last 15 years

- Average tenant stay - 5 years.

What If There Is A Recession?

Many are predicting a recession; time will tell if they are right. Based on the last 15 years, I believe our clients’ rental income will not be impacted by a recession. The tenant pool we target remained employed in good times and bad. And, people always have to have a place to live.

Is Today a Good Time to Invest in Las Vegas?

It depends on your goal. If your goal is to buy inexpensive properties, it is not a good time. If your goal is a dependable passive income stream you will not outlive, then this is a great time.

Today there are a combination of issues that will impact our ability to reach financial freedom or retire without the fear of outliving our savings. We are living longer, inflation is through the roof, stocks are declining, crypto has collapsed, and most dependable investments are not keeping pace with inflation. Many have lost a significant portion of their savings and the only option will be to reduce their standard of living, move to a low cost of living locations and hope that inflation drops back to 2% or 3%. Here is an article listing the lowest cost places to live. Below are the 10 lowest cost locations from this article:

- Kalamazoo, Michigan

- Harlingen, Texas

- McAllen, Texas

- Jackson, Mississippi

- Amarillo, Texas

- Anniston, Alabama

- Knoxville, Tennessee

- Joplin, Missouri

- Augusta-Aiken, Georgia/South Carolina

- Kokomo, Indiana

If none of the above locations are on your bucket list, it is time to do something.

After all, insanity is doing the same thing, over and over again, but expecting different results.

How to Buy Dependable Passive Income Properties

The process is simple, but it takes time and money. Below is an illustration of our process that we developed and followed to deliver over 400 passive income properties (>$100M investment).

Below are some frequent questions we receive from new clients:

Q: How much do the properties you recommend cost? A: 90% cost between $380,000 and $500,000.

Q: How much cash do I need? A: About $150,000 in cash and the balance is financed.

Summary

Based on all the data we see about Las Vegas and our tenant pool segment, we believe Las Vegas will continue to do well for the foreseeable future.

Thanks for your time. As always, I welcome your feedback and suggestions for future articles.

…Eric

Eric Fernwood Eric@Fernwood.Team 702-358-8884 www.Fernwood.Team