[Photo by Bram Van Oost on Unsplash]

Lessons learned from our 80 or so 1031 Exchange projects

A 1031 Exchange, or Like-Kind Exchange, lets property owners defer capital gains tax by selling an investment property and buying another investment property with the proceeds. This is one of several major tax benefits of real estate investment that I can not find in other types of investment (can you imagine asking the federal government to defer your tax on your big stock wins?)

Before I continue…

This post is for informational purposes only. It should not be considered financial, tax, or legal advice. Before making any major financial decisions, consult a financial professional.

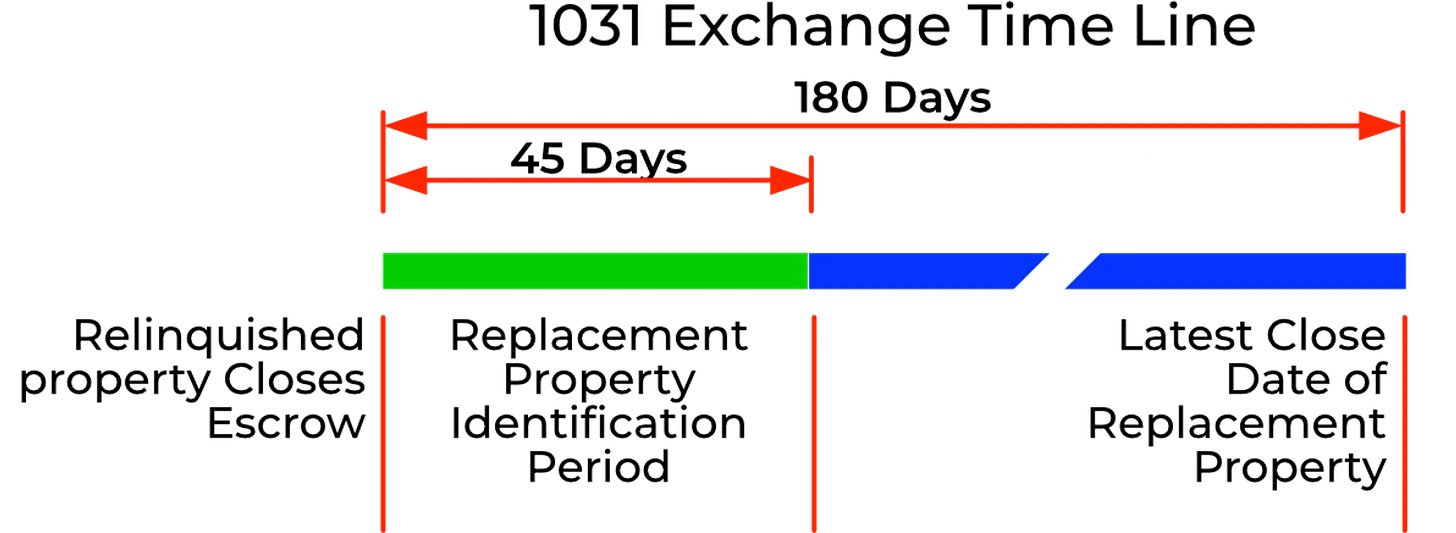

The exchange process is illustrated below:

Though the process seems to be straightforward, there are some pitfalls you must avoid to make sure that you receive the tax benefits from an exchange.

The two biggest ones are: failing to close on the properties identified during the Identification period; and accidentally moving funds into your personal account.

The 45-Day Identification Period

The 45-day replacement property identification period starts when the relinquished property closes. Identifying the replacement properties is the first potential pitfall.

Although you are only required to identify replacement properties during the 45-day window, you may lose your tax deferment if you are unable to or choose not to close on them. This could occur if you are outbid or if a serious issue is identified during the due diligence process, making it not worthwhile to complete the purchase.

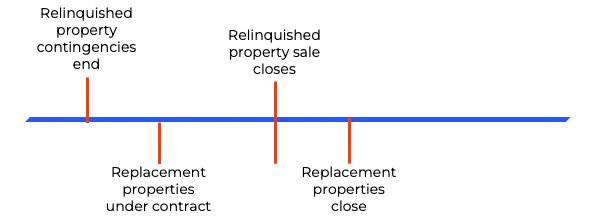

Our Process

Our goal is to put replacement properties under contract immediately after all contingencies are complete on the relinquished property. We then aim to close on the replacement properties as soon as possible after the relinquished property closes. Typically, cash purchases close about two weeks after the relinquished property, while financed purchases close four weeks later. The steps are illustrated below.

By utilizing this method, if something does not pan out with one or more of the replacement properties, we still have ample time to locate, put under contract, and validate (due diligence) another property within the 45-day identification period.

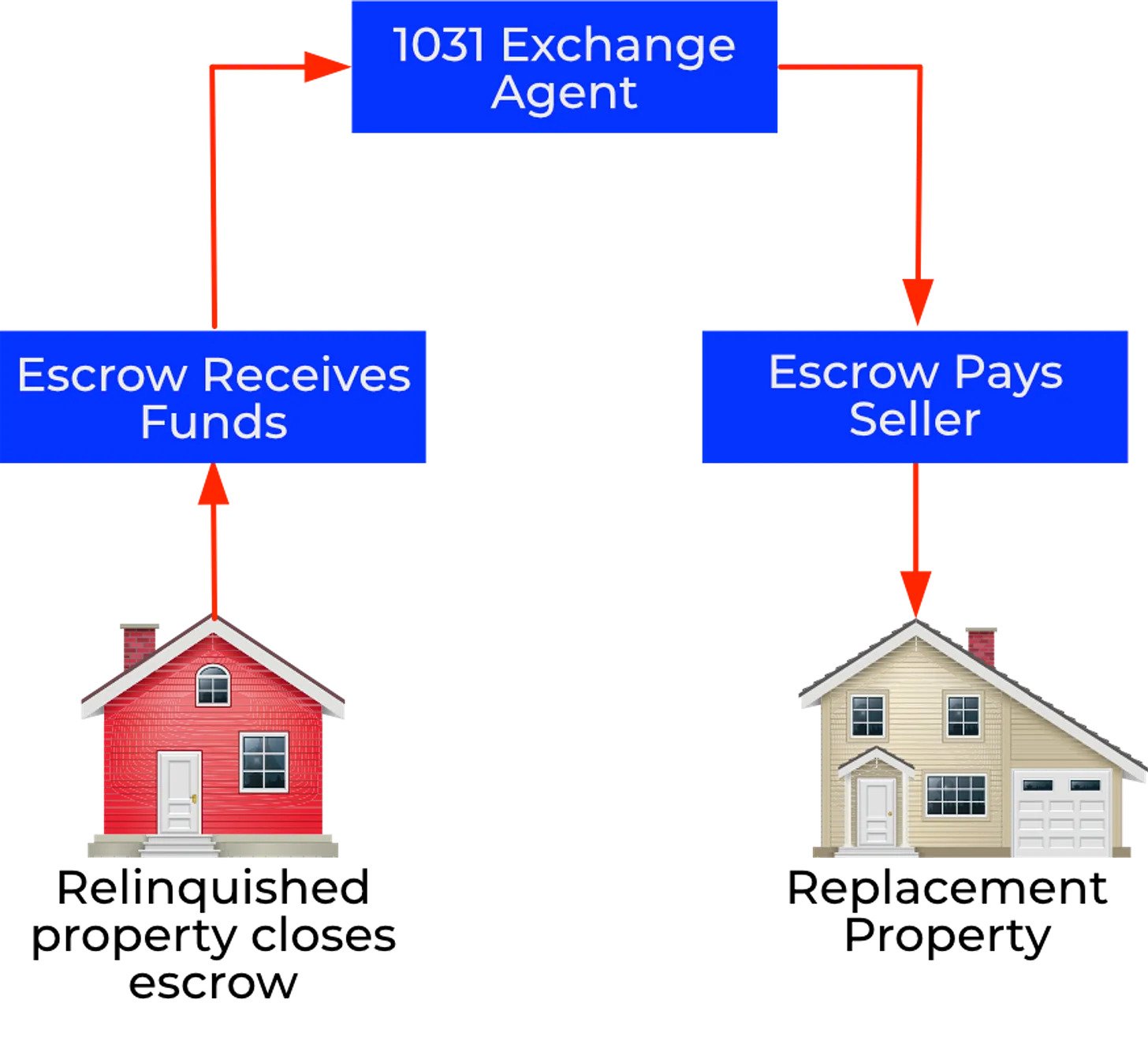

Movement of Funds

A regular question I receive is if a 1031 exchange agent is required. The simple answer is yes. If the funds touch your accounts, you lose your tax deferment.

Below is an illustration of the flow of funds during a 1031 exchange. The funds must move from the closing escrow agent to the 1031 exchange agent. When you close on the replacement property, the funds go from the 1031 exchange agent to the escrow company handling the closing. The funds must never be in your hands, or the 1031 exchange may be void.

Other Potential Pitfalls

- You are not allowed to use the proceeds from the relinquished property to pay for renovations. Some of our clients have opted to pay capital gains tax on a portion of the proceeds and use that money for the renovation.

- Not all purchase contracts include the 1031 exchange language. Make sure to have your listing agent obtain the correct language from your exchange agent for your state. The agent should include it in the agent-to-agent remarks, specifying that the 1031 text must be included in offers. If this does not happen, you can counteroffer specifying the required 1031 language.

- To fully defer the capital gains tax, you must reinvest all the proceeds from the sale into the replacement property. Any cash or other non-like-kind property received during the exchange will be subject to capital gains tax.

- To accurately determine the cost of the replacement property for tax purposes, it is important not to make any assumptions. Instead, obtain the required replacement cost from a 1031 exchange agent. We once had a client who assumed that their replacement property had to cost $300,000 or more, only to discover through the exchange agent that they actually had to spend over $500,000. There is no room for error in this process, so it is crucial to work closely with an exchange agent. If anyone would like a referral to a good 1031 exchange agent, DM me. We can provide you with the contact information for three exchange agents who are known for being easy to work with and highly knowledgeable.

- If there is an existing mortgage debt on the relinquished property, it’s important to consider how it will be handled during the exchange. Any reduction in debt or cash received may be treated as taxable boot, resulting in potential tax liabilities. Do not assume, ask your 1031 exchange agent.

- Qualified Use Requirement – Both the relinquished and replacement properties must meet the requirement of being held for investment or used in a trade or business. Personal residences or properties primarily held for personal use do not qualify for a 1031 exchange.

- State Tax Considerations – While 1031 exchange tax deferments are allowed under federal tax law, not all states conform to these rules. It’s crucial to understand the state-specific regulations regarding like-kind exchanges, as some states may not recognize or fully conform to the federal provisions. Consult with a tax professional familiar with your state’s laws.

- The Biden Administration’s proposed FY 2024 budget includes the creation of “capped deferral” for 1031 exchanges. In this proposed change to 1031 exchange laws, taxpayers in FY2024 would only be able to defer capital gains up to an aggregated amount of $500,000 for each taxpayer ($1 million for joint filers). Source. If you are considering a 1031 Exchange, 2023 may be the last year to do it.