[Image generated with Dall-E]

You’ve found what appears to be a great property, and you just received the inspection report. The report listed many defects, most of which are typical, and the cost to correct them is well-defined. However, a few items are disconcerting because the report listed symptoms rather than a specific defect. For example, mold, Kitec plumbing, China drywall, aluminum wiring, roof leaks, settlement, etc.

These ill-defined problems are red flags because there is no “fixed” cost to remediate them. For example, suppose mold was detected. What will it cost to correct the mold? I met someone who learned of mold during the inspection and decided $1,000 would be enough to fix the problem. $25,000 later, the problem still was not fully corrected. You simply cannot afford to skip having an experienced and licensed property inspector inspect the property, especially the red flags.

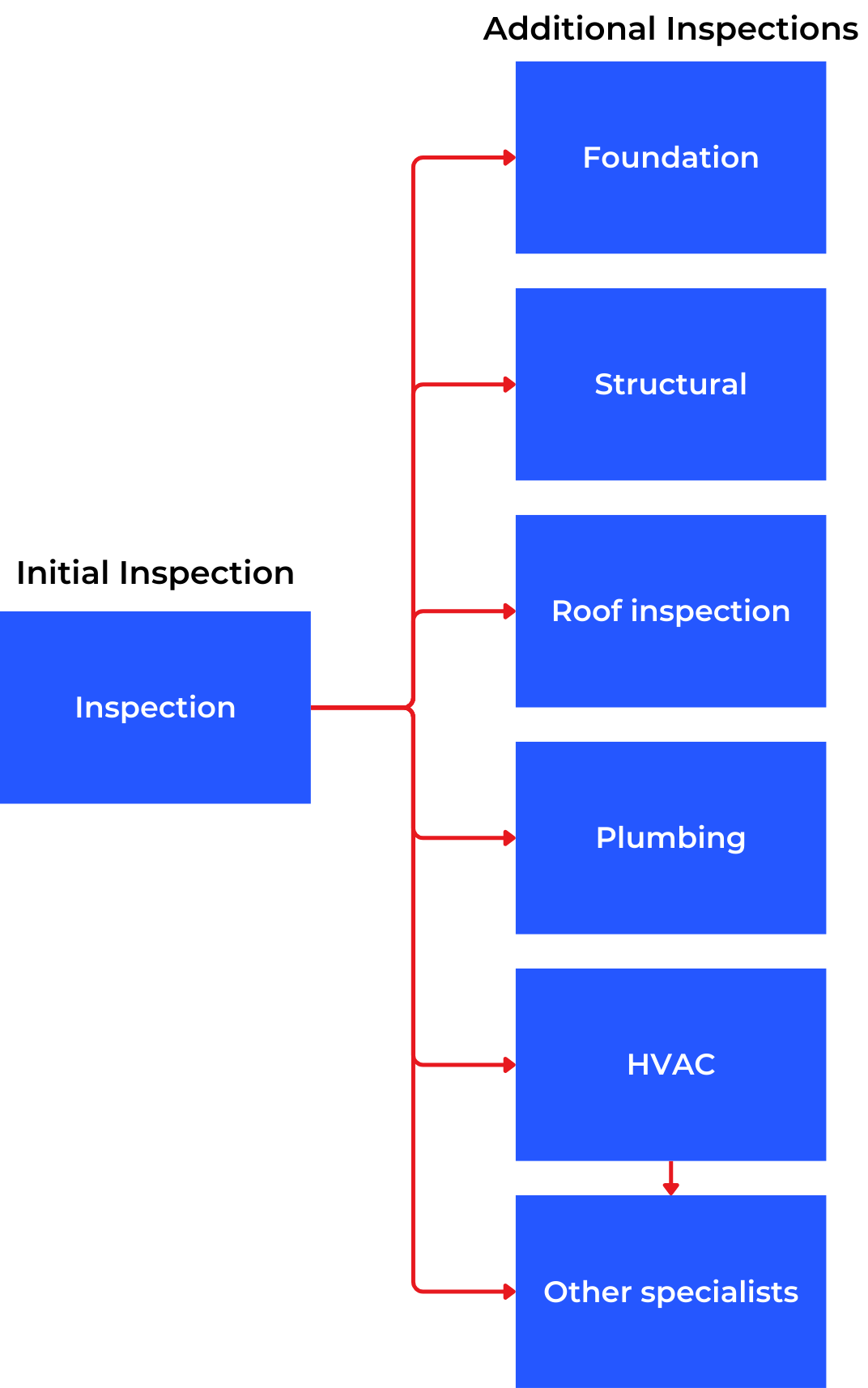

It does not matter how low the price is or whether you are in love with the property. You cannot afford to buy a property with high-risk items. However, you can frequently get a fixed cost to resolve some problems with secondary inspections. See the illustration below.

For example, if the property inspector calls out a roof issue, we have a secondary inspection by a roofing contractor.

One issue with secondary inspections is time. In Las Vegas, the customary due diligence period is 10 calendar days. If the initial inspection occurs on day five of the due diligence, you will have little time for secondary inspections.

High-Risk vs. Low-Risk

Below are examples of high and low-risk renovation items.

Low-risk renovation items – You can obtain fixed bids for the following:

- Appliances

- Paint

- Window treatments

- Flooring

- Landscaping

- Light fixtures

High-risk renovation items—The cost of correcting these items is unknown. A vendor usually gives an initial estimate, but until the work is started, they cannot provide a fixed cost.

- Foundation issues

- High water

- Structural issues

- Mold

- Improper wiring

- Fire damage

- Roof leaks or damage

- Dry rot

- Termites

- Un-permitted additions

- Significant plumbing issues

- Water damage

- China drywall

- Pool water leak

As I stated, a secondary inspection can provide a fixed cost for some issues.

Dealing With High-Risk Items

We usually ask the seller to repair high-risk items before closing escrow. Is the seller obligated to make the repairs? In Nevada, no. However, a document named Duties Owed by a Nevada Real Estate Licensee is part of every real estate transaction. One clause of this document states the realtor’s duty to disclose material facts about the property. The text is, “Disclose to each party to the real estate transaction as soon as practicable: Any material and relevant facts, data or information which licensee knows, or with reasonable care and diligence the licensee should know, about the property.”

When we ask the seller to make repairs, we also send the inspection report with the defect called out. In this situation, both the seller and the realtor now have actual knowledge of the defect and, by law, must disclose it to any future buyer should the seller refuse to make the repair. The seller may choose to hide it, but the realtor is equally responsible for the disclosure.

Cash in Lieu of Repairs

It is not uncommon for sellers to offer cash instead of making repairs. If the cost is well defined, this is often acceptable because if you make the repairs, you know the work was done correctly. However, where the total cost is not well defined, accepting a fixed amount of cash in lieu of repairs is not advisable.

For example, one property inspection revealed several damaged roof tiles. The seller offered $500 instead of making the repair. We rejected this offer, and the seller made the repair. If the seller makes the repair, we require the invoice for the completed work. In this case, 140 tiles had to be replaced, costing the seller over $2,500.

Avoid the Nightmare

Always have the property inspected by an experienced and knowledgeable inspector. If there are high-risk items, either resolve the risk with secondary inspections or cancel the purchase. You cannot afford to buy a property with high-risk repairs.